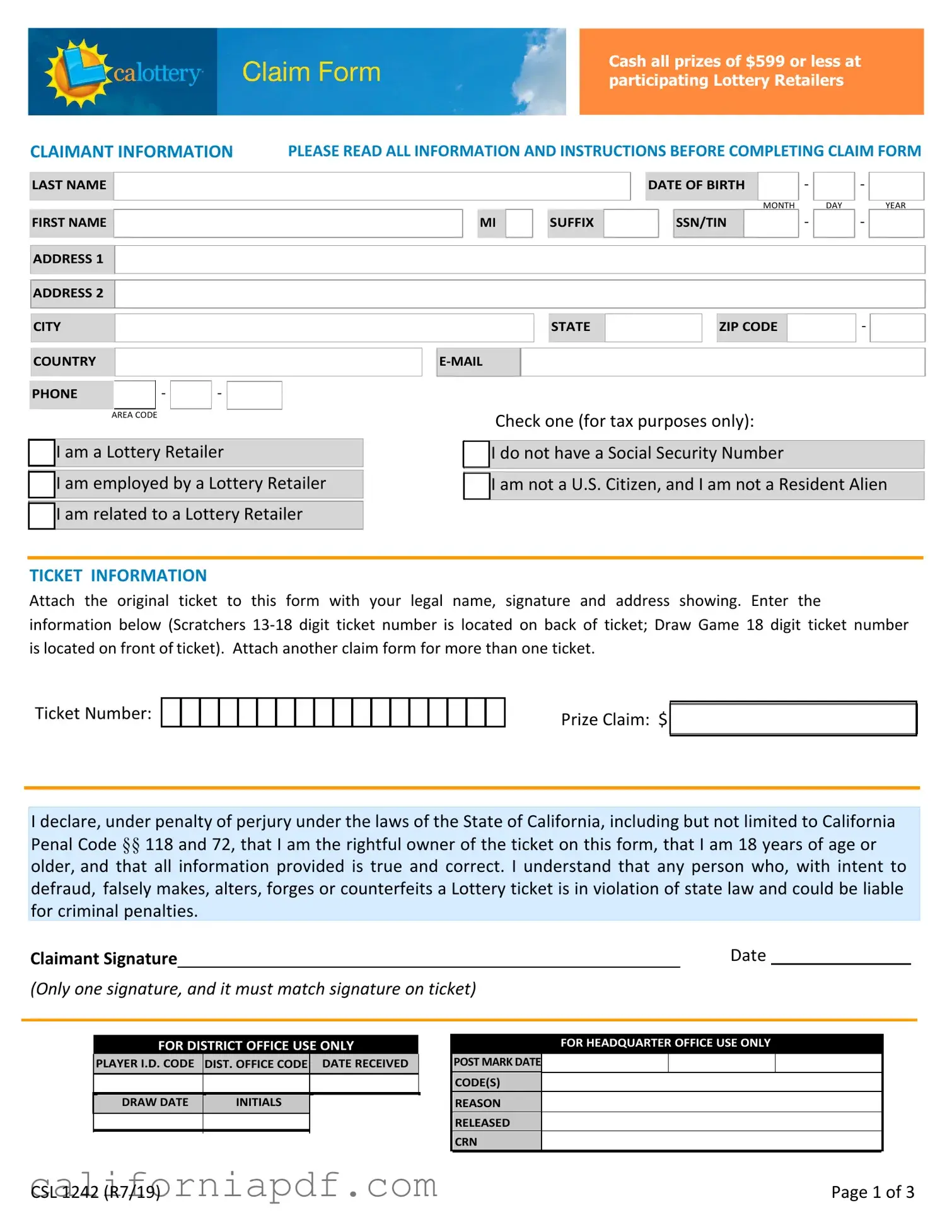

Fill a Valid California Scratchers Form

Winning a California Scratcher can be an exciting moment, filled with the thrill of potential financial reward. However, claiming your prize involves navigating the California Scratchers form, a necessary step to ensure your winnings are properly awarded. For cash prizes of $599 or less, winners can easily claim their rewards at participating Lottery Retailers. The form itself requires claimants to provide comprehensive personal information, including last name, first name, address, date of birth, social security number or tax identification number (SSN/TIN), and contact details, ensuring that the claim process adheres to state regulations. Additionally, for tickets exceeding the $599 threshold, winners must attach the original ticket to the form, with all necessary information clearly indicated, and submit it for processing, which may take up to eight weeks. The California Lottery emphasizes the confidentiality of claimant information, diligently protecting it in compliance with state and federal laws, while also reserving the right to utilize this information for sales, marketing, and legal purposes under specified conditions. Moreover, the form encompasses sections for ticket information and a declaration of truthfulness under penalty of perjury, illustrating the legal seriousness and implications of the claim process. Understanding the intricacies of this form and the accompanying legal obligations ensures a smooth transition from the moment of victory to the moment you receive your well-deserved prize.

Document Example

Cash all prizes of $599 or less at participating Lottery Retailers

CLAIMANT INFORMATION PLEASE READ ALL INFORMATION AND INSTRUCTIONS BEFORE COMPLETING CLAIM FORM

LAST NAME

FIRST NAME

ADDRESS 1 |

ADDRESS 2

CITY

COUNTRY

|

|

|

|

|

|

DATE OF BIRTH |

|

- |

|

- |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTH |

|

DAY |

|

YEAR |

MI |

|

|

SUFFIX |

|

|

|

|

SSN/TIN |

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

- |

PHONE |

|

- |

|

- |

|

|

|

|

|

|

AREA CODE |

|

|

|

I am a Lottery Retailer

I am a Lottery Retailer

I am employed by a Lottery Retailer

I am employed by a Lottery Retailer

I am related to a Lottery Retailer

I am related to a Lottery Retailer

Check one (for tax purposes only):

I do not have a Social Security Number

I do not have a Social Security Number

I am not a U.S. Citizen, and I am not a Resident Alien

I am not a U.S. Citizen, and I am not a Resident Alien

TICKET INFORMATION

Attach the original ticket to this form with your legal name, signature and address showing. Enter the

information below (Scratchers

Ticket Number:

Prize Claim: $

I declare, under penalty of perjury under the laws of the State of California, including but not limited to California Penal Code §§ 118 and 72, that I am the rightful owner of the ticket on this form, that I am 18 years of age or older, and that all information provided is true and correct. I understand that any person who, with intent to defraud, falsely makes, alters, forges or counterfeits a Lottery ticket is in violation of state law and could be liable for criminal penalties.

Claimant Signature |

|

Date |

(Only one signature, and it must match signature on ticket)

FOR DISTRICT OFFICE USE ONLY

PLAYER I.D. CODE |

DIST. OFFICE CODE |

|

DATE RECEIVED |

|

|

|

|

|

|

DRAW DATE |

|

INITIALS |

|

|

|

|

|

|

|

|

|

|

|

|

FOR HEADQUARTER OFFICE USE ONLY

POST MARK DATE

CODE(S)

REASON

RELEASED

CRN

CSL 1242 (R7/19) |

Page 1 of 3 |

PRIZE PAYMENT INFORMATION

Failure to provide your original signed ticket with date of birth, legal name, complete address (including apartment or space number, city, state, zip code), email and phone number may delay or prevent the California State Lottery (Lottery) from processing your prize claim. Claims submitted to Lottery Headquarters for processing are paid by check and mailed from the California State Controller's Office. Processing time, once claim is received and verified, is approximately 8 weeks. If you have questions, contact the Lottery at

Lottery prizes are not subject to California state income tax. The Lottery is required by federal tax law to withhold federal taxes of 24% for U.S. citizens and resident aliens.

Tickets, transactions, purchases, claims and prize payments are subject to federal and state law and California Lottery regulations, policies and procedures. Copies of regulations are available at Lottery District Offices and on our website at www.calottery.com. Tickets failing validation are void.

INSTRUCTIONS

1.Print your legal name, street address, city, state, and zip code on the back of the ticket.

2.Sign your name on the back of the original ticket.

3.Complete the Claimant Information and Ticket Information sections on the first page of thisform.

4.Sign the first page of this form with ink. (ONLY ONE SIGNATURE IS PERMITTED)

5.Staple your original ticket to the front of this form.

KEEP A COPY OF THIS FORM AND A COPY OF THE FRONT AND BACK OF THE TICKET.

Deliver the completed claim form with original ticket to any Lottery District Office. Location and directions can be found at www.calottery.com.

OR, MAIL THIS CLAIM FORM, AT YOUR OWN RISK, WITH THE ORIGINAL TICKET STAPLED ON THE FRONT, TO: California Lottery, 730 North 10th Street, Sacramento, CA

Call

PRIVACY NOTICE

The Information Practices Act of 1977 (Cal. Civ. Code

The Claimant Information requested on this form will be used to validate and process your claim in accordance with the California State Lottery Act of 1984 (Gov. Code §8880 et seq.). The Lottery requests a player's social security or

tax identification number (SSN/TIN) for tax withholding and reporting purposes, pursuant to Internal Revenue Code

§§6011, 6041, 6109, 3402, and the regulations enacted thereunder.

The Claimant Information you provide may be disclosed to various state and federal government agencies, including but not limited to: the State Controller's Office, Franchise Tax Board, Health and Welfare Agency, and the Internal Revenue Service. It will not be disclosed to members of the public.

You have the right to access your personal information maintained by the Lottery by contacting the California Lottery, 700 North 10th Street, Sacramento, CA

Purpose and Relevancy of Information Collected: Information is collected to validate and process a claim and for purposes of sales, marketing, research, security investigation, legal review, surveys, and strategic planning as related to the operations of the Lottery. By submitting this claim, you consent and agree to such use, and waive any and all legal claims, known or unknown, related to the specified uses set forth herein. The California Lottery is subject to public disclosure laws that allow access to certain governmental records. Your full name, the name and location of the retailer who sold you the winning ticket, the date you won, and the amount of your winnings, including your gross and net installment payments, are matters of public record and are subject to disclosure. The Lottery will not disclose any other personal or identifying information without your permission unless legally required to do so. No information will be collected or accepted from known minors. You may be asked to participate in a press conference.

CSL 1242 (R7/19) |

Page 2 of 3 |

VOLUNTARY DEMOGRAPHIC INFORMATION

By volunteering to answer the following questions, you will help the Lottery know more about its players. The voluntary information that you provide regarding your ethnicity, household income, gender, and household composition will be used only by the Lottery to conduct internal demographic analyses (which may be completed by agents and contractors).

Which of the following do you consider yourself to be?

(Check all that apply)

African American

African American

Asian

Asian

Hispanic

Hispanic

White

White

Other (Specify)

Other (Specify)

Annual Household Income

Under $30,000

Under $30,000

$30,000 TO $49,999

$30,000 TO $49,999  $50,000 TO $99,999

$50,000 TO $99,999

$100,000 TO $149,999

$100,000 TO $149,999

$150,000 or more

$150,000 or more

Number of People in Household

(including yourself):

Gender

Female

Female

Male

Male

Nonbinary

Nonbinary

CSL 1242 (R7/19) |

Page 3 of 3 |

Form Breakdown

| Fact Number | Description |

|---|---|

| 1 | California Scratchers prize claims for amounts of $599 or less can be processed at participating Lottery Retailers. |

| 2 | Claimants must provide personal information including their Social Security Number or Tax Identification Number for tax withholding and reporting purposes, as mandated by the Internal Revenue Code and relevant regulations. |

| 3 | The original ticket, signed with the claimant's legal name and address, is required to be attached to the claim form. |

| 4 | Claimants must declare, under penalty of perjury under California state law, that the information provided is true and correct, and that they are the rightful owners of the ticket. |

| 5 | The claim form processing time, once received and verified by the California Lottery, is approximately 8 weeks. |

| 6 | Lottery prizes are exempt from California state income tax but are subject to federal tax withholdings at rates of 24% for U.S. citizens and resident aliens, and 30% for non-U.S. citizens. |

| 7 | All tickets, transactions, and claims are subject to California state law, and the policies and procedures of the California Lottery. |

| 8 | The provided personal information may be disclosed to various state and federal agencies for validation and processing of the claim in accordance with the California State Lottery Act of 1984. |

| 9 | Claimants have the right to access their personal information maintained by the Lottery by contacting the designated Privacy Coordinator. |

| 10 | Voluntary demographic information provided by claimants is used exclusively for internal demographic analyses by the California Lottery. |

How to Write California Scratchers

To ensure a smooth process when claiming your California Scratchers prizes, it's essential to follow the correct steps for filling out the claim form. This document is your key to officially claiming your prize, whether big or small. Attention to detail and accuracy when completing this form protects your rights and helps expedite the validation and payment of your prize. Below are the step-by-step instructions to ensure your claim is processed effectively and efficiently.

- Sign your name on the back of the original Scratchers ticket.

- Fill out the Claimant Information section on the form, which includes:

- Your last and first name, along with any middle initials or suffixes.

- The addresses (including Address 1 and Address 2, if applicable), city, state, and zip code where you reside.

- Your date of birth, along with your social security number or tax identification number.

- Country, email address, and phone number with area code.

- Indicate if you are a Lottery Retailer, employed by a Lottery Retailer, or related to a Lottery Retailer, alongside your citizenship status for tax purposes.

- Complete the Ticket Information section with your Scratchers ticket number and prize claim amount. Remember, the Scratchers 13-18 digit ticket number is located on the back of your ticket.

- Sign the declaration on the first page of the form, confirming that you are the rightful owner of the ticket and all information provided is true and correct. Only one signature is permitted, and it should match the signature on your ticket.

- Staple the original ticket to the front of this form. Ensure your legal name, signature, and address are visible on the ticket.

- Keep a copy of this form and a copy of the front and back of your ticket for your records.

- Submit the completed claim form and original ticket by delivering it to any Lottery District Office or mailing it, at your own risk, to: California Lottery, 730 North 10th Street, Sacramento, CA 95811-0336.

After submitting your claim form and ticket, the California State Lottery will proceed with the validation and processing of your prize. Claims are paid by check and mailed from the California State Controller's Office. Remember, the processing time might take up to 8 weeks once your claim is received and verified. Should you have queries or require further assistance during this period, the California Lottery provides support through their helpline and website. Your patience during this process ensures a secure and proper handling of your prize claim.

Listed Questions and Answers

What is the California Scratchers form?

The California Scratchers form is a document that must be filled out to claim prizes for California Lottery games, including Scratchers tickets. This form collects claimant information and ticket information, ensuring that the prize is awarded to the rightful owner.

How do I claim prizes of $599 or less?

Prizes of $599 or less can be cashed at participating Lottery Retailers. This allows for an easy and quick process to claim your winnings without the need to fill out the claim form for these smaller amounts.

What information do I need to provide on the claim form?

When completing the California Scratchers claim form, you'll need to provide several pieces of information, including:

- Your full legal name

- Address including any apartment or space number (city, state, zip code)

- Date of birth

- Social Security Number or Tax Identification Number

- Email and phone number

- Ticket information, such as the ticket number and claimed prize amount

Where is the ticket number located?

For Scratchers tickets, the 13-18 digit ticket number is located on the back of the ticket. Make sure to enter this number correctly on the claim form.

What if I have more than one ticket to claim?

If you have more than one ticket to claim, you need to attach another claim form for each additional ticket. One form per ticket helps streamline the validation and processing of each claim.

How do I submit my claim form?

After completing the claim form and attaching your ticket, you have two options to submit it:

- Deliver the completed form and original ticket to any California Lottery District Office. Locations and directions are available on the California Lottery website.

- Mail the claim form with the original ticket attached to the front, to the California Lottery's designated postal address. It's important to note that mailing is at your own risk.

How long does it take to process a claim?

Once your claim is received and verified, the processing time is approximately 8 weeks. Claims are paid by check and mailed from the California State Controller's Office.

Is my lottery prize subject to taxes?

Lottery prizes are not subject to California state income tax. However, the California Lottery is required by federal tax law to withhold taxes for U.S. citizens and resident aliens at a rate of 24%. Non-US citizens will have 30% withheld from all prizes.

What is the privacy policy related to the information I provide on the claim form?

The information you provide on the claim form is used to validate and process your claim as per the California State Lottery Act of 1984. It may be disclosed to state and federal government agencies for tax withholding and reporting purposes. However, your personal information will not be disclosed to the public. You have the right to access your information maintained by the Lottery by contacting the Privacy Coordinator at the California Lottery.

Common mistakes

Filling out the California Scratchers claim form, while straightforward, presents opportunities for mistakes that can delay or invalidate a claim. Here are ten common errors to avoid:

- Not including the original ticket with the claim form, or failing to attach it properly. Remember, the original ticket is crucial for the claim.

- Filling out the form with incorrect information, especially in the Claimant Information section. Double-check everything, from your name to your address.

- Forgetting to sign the back of the ticket and the claim form. Only one signature is allowed and they must match.

- Leaving the Ticket Information section blank or incomplete. Ensure the ticket number and the prize claim amount are clearly stated.

- Using multiple claim forms for multiple tickets when, in fact, each ticket requires its own claim form.

- Providing incomplete or inaccurate contact details. The form requires a full address, email, and phone number.

- Choosing the wrong category regarding the relationship with a lottery retailer or unclear tax status. This information is crucial for tax purposes.

- Failure to keep a copy of the claim form and the ticket. It's recommended to keep records of your claim.

- Incorrectly mailing the claim form and the ticket, or not using a secure method to send these important documents. The form provides specific mailing instructions for this purpose.

- Not reading the privacy notice and comprehensive instructions thoroughly, which can lead to overlooking important details required for successful claim processing.

By avoiding these common errors, claimants can ensure a smoother process in claiming their Scratchers prizes.

Documents used along the form

When engaging in the California Lottery system, particularly with the Scratchers portion, individuals commonly encounter several essential forms and documents alongside the main claim form. These documents are vital for a seamless process, whether for claiming prizes, complying with tax requirements, or understanding the legal implications of lottery participation. Described below are key documents often utilized in conjunction with the California Scratchers form.

- Multiple Ownership Claim Form: This form is specifically designed for groups of players, less than 100, who need to claim shared prizes of $1,000,000 or more. It ensures that prize distribution among the members is documented and processed correctly by the California Lottery.

- Winner Claim Form: Used for claiming individual lottery prizes over $599, the Winner Claim Form requires detailed personal information and a valid signature, similar to the Scratchers form. It's crucial for processing large winnings through the Lottery system.

- IRS Form W-9 (Request for Taxpayer Identification Number and Certification): This form is necessary for tax reporting purposes, specifically for winners who claim prizes that necessitate federal tax withholdings. Winners provide their Taxpayer Identification Number (TIN) or Social Security Number (SSN) to ensure compliance with federal tax regulations.

- Group Play Form: While not an official document of the California Lottery, many players use a Group Play Form to clarify the terms of participation, including the division of winnings among group members. This informal agreement can help prevent disputes among participants of lottery pools or group plays.

Together, these documents provide a comprehensive framework to navigate the complexities of lottery prize claims in California. From individual claims to group participations and tax compliance, each form plays a critical role in ensuring a transparent, fair, and lawful process for all parties involved. Players are encouraged to familiarize themselves with these forms to guarantee a thorough understanding of their rights and responsibilities within the California Lottery system.

Similar forms

The California Scratchers form bears similarity to an IRS W-9 form, which requests taxpayer identification and certification. Just as the W-9 form collects necessary information like name, address, and Social Security Number (SSN) or Taxpayer Identification Number (TIN) for tax purposes, the California Scratchers form collects similar personal information to validate the identity of the claimant and ensure compliance with tax withholding regulations. Both forms are essential for financial transactions involving reporting to the Internal Revenue Service (IRS) and require the claimant's signature to certify the accuracy of the information provided.

Another document that mirrors the California Scratchers form is a standard employment application. Employment applications require detailed personal information, including legal name, contact information, and employment history, comparable to how the Scratchers form gathers claimant information and employment status related to the lottery. Additionally, both documents include declarations or acknowledgements that the information provided is true and accurate, with similar legal implications for falsification.

The California Scratchers form also has similarities to a bank account opening form. These forms typically require comprehensive personal information, including name, date of birth, contact details, and Social Security Number, for the purpose of identity verification. Likewise, the Scratchers form requests detailed personal information for the purpose of validating the prize claim. Moreover, both forms have sections that regard the processing of financial transactions, with the bank form pertaining to account setup and transactions, and the Scratchers form relating to prize claims and payment processing.

Lastly, this form shares common features with a governmental records request form under the Freedom of Information Act (FOIA) or state equivalents. Both kinds of documents require the requester to provide specific personal information and details about the request. While FOIA forms are used to request access to public records, the Scratchers form is used to claim lottery winnings, yet both involve a formal request process overseen by a government body. Each has procedural instructions and stipulations regarding the handling and use of personal information, including privacy notices and the rights of the individuals providing that information.

Dos and Don'ts

Filling out the California Scratchers form is a crucial step towards claiming your winnings. To ensure a smooth process, here are five dos and don'ts to keep in mind:

- Do print your legal name, street address, city, state, and zip code on the back of the ticket as instructed. This information is fundamental for the validation of your claim.

- Do sign your name on the back of the original ticket. This step is crucial as it helps in verifying the ticket's rightful owner.

- Do fill out the Claimant Information and Ticket Information sections on the first page of the form accurately. Ensuring all your details are correct and up-to-date is key to processing your claim.

- Do keep a copy of the completed form and a copy of the front and back of your ticket. It is always a good practice to have a personal record of your claim submission.

- Do deliver the completed claim form with the original ticket to any Lottery District Office, or mail at your own risk to the provided California Lottery address. Choosing a secure delivery method is essential.

- Don't leave any sections incomplete on your claim form. Failing to provide all required details might delay or even prevent your prize claim from being processed.

- Don't sign the form with anything other than ink. Using any other medium could lead to the rejection of your claim.

- Don't submit photocopies of your ticket. The original ticket is required for validation and processing, and photocopies will not be accepted.

- Don't ignore the privacy notice. Understanding how your personal information will be used is important for your own privacy protection.

- Don't attempt to submit claims for tickets that do not belong to you. The declaration section under penalty of perjury ensures the legality and rightful ownership of claims.

Misconceptions

Misconception 1: Lottery winnings are taxed by the state of California. Many people believe they will have to pay state taxes on their lottery winnings in California. However, the truth is that lottery prizes are not subject to California state income tax. Thus, winners of California Scratchers do not have to worry about state tax deductions from their prizes.

Misconception 2: Only U.S. citizens or residents can claim prizes. While it's a common belief that only U.S. citizens or resident aliens can claim California Scratchers prizes, this is not entirely accurate. Non-U.S. citizens can also claim prizes, but a different tax rate applies. The California State Lottery withholds 30% from non-U.S. citizens, compared to the 24% federal tax withholding for U.S. citizens and resident aliens.

Misconception 3: You do not need to sign your ticket to claim a prize. A significant misunderstanding is that winners can claim prizes without a signature on their tickets. The truth is, ensuring that your ticket is signed is crucial. The signature on the back of the ticket helps verify your identity as the rightful owner, and without it, claiming your prize could be delayed or even denied.

Misconception 4: Minors can play and win California Scratchers. Although some might think otherwise, the California State Lottery strictly prohibits the sale of lottery tickets to minors. Furthermore, no prize can be claimed by anyone under the age of 18. This rule emphasizes the importance of responsible gambling and ensures that only eligible individuals participate in lottery games.

Key takeaways

Filling out the California Scratchers form correctly is crucial for the successful claim of lottery prizes. Here are key takeaways to ensure a smooth process:

- Any prize of $599 or less can be claimed at participating Lottery Retailers without needing to complete the form, simplifying the process for smaller wins.

- Complete personal and ticket information accurately. The form requires details such as your legal name, address, date of birth, and Social Security or Tax Identification Number (SSN/TIN) for tax purposes and to verify your identity.

- For the claim to be processed, the original ticket must be attached to the form. Ensure your legal name, signature, and address are visible on the ticket.

- Sign the form with ink, and remember that only one signature is permitted. This matches the signature requirement on the ticket, ensuring consistency and security.

- Keep a copy of the form and the front and back of the ticket for your records. This precaution is advised to keep evidence of your claim submission.

- Information provided on the form may be disclosed to state and federal government agencies for validation, tax withholding, and reporting purposes. However, personal information collected is protected from public disclosure, respecting your privacy.

Follow these guidelines carefully to ensure your California Scratchers form is correctly filled out, helping avoid delays or issues in claiming your lottery prize.

Different PDF Templates

Death of Joint Tenant California - Crucial for maintaining the legal integrity of a trust after a trustee's death.

California Jv 445 - Summarizes compliance with legal requirements for notifying and involving the child's Indian tribe in the permanency planning process.