Attorney-Approved California Deed Document

In California, transferring ownership of real estate is a legal process that requires the proper documentation to ensure the transaction is valid and binding. The California Deed form is a critical document in this process, serving as the official record that the property's ownership has changed hands. Whether you're buying or selling property, understanding this form is paramount. It outlines the parties involved, describes the property in detail, and specifies the type of deed being used, each type offering different levels of protection and guarantees to the buyer. Not only does the California Deed form solidify the transfer of ownership, but it also needs to be properly recorded with the local government to be considered fully effective. This form, and the process surrounding it, involves careful attention to detail to ensure that all legal requirements are met, avoiding potential disputes and complications down the line. Knowing the nuances and legalities of the California Deed form can greatly benefit anyone going through the process of real estate transactions in the state.

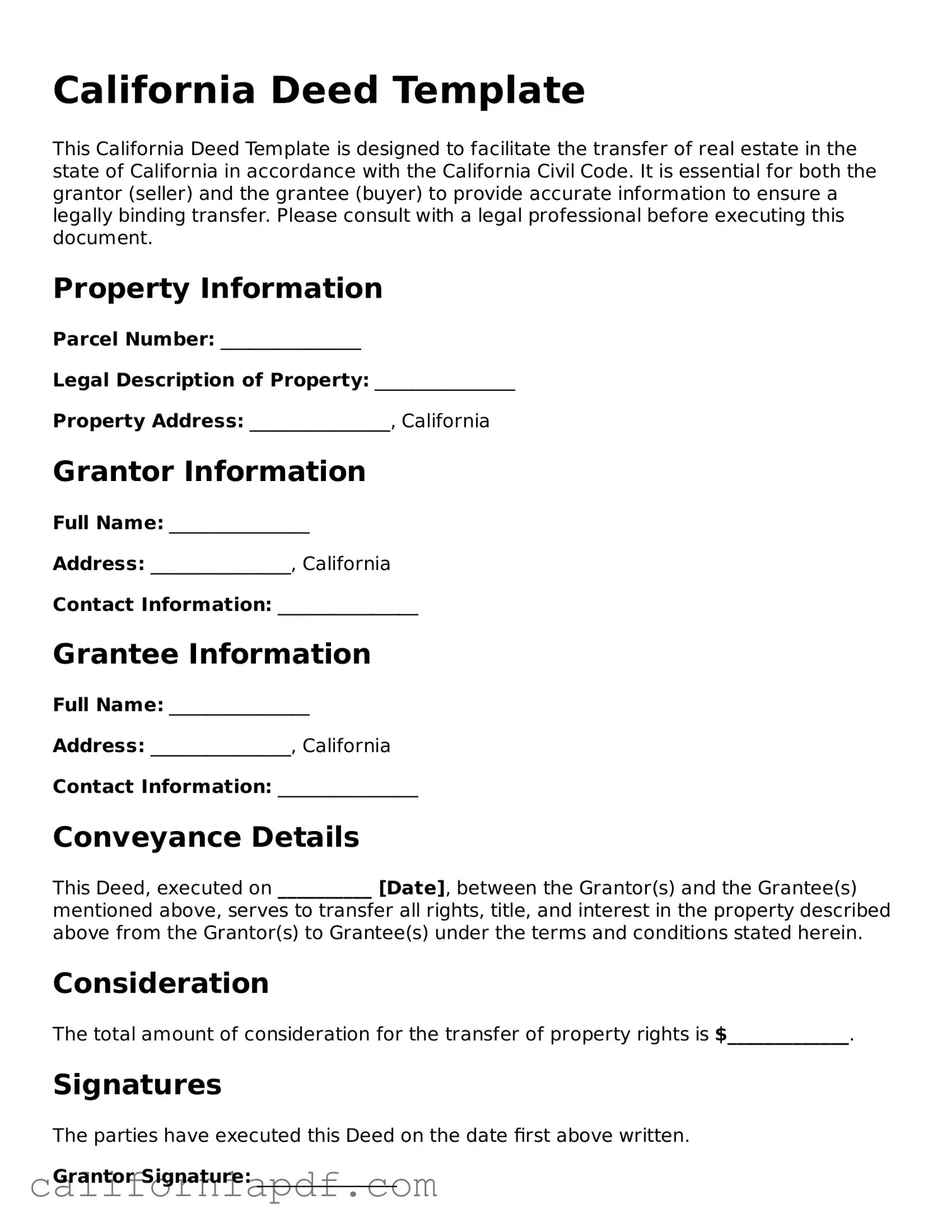

Document Example

California Deed Template

This California Deed Template is designed to facilitate the transfer of real estate in the state of California in accordance with the California Civil Code. It is essential for both the grantor (seller) and the grantee (buyer) to provide accurate information to ensure a legally binding transfer. Please consult with a legal professional before executing this document.

Property Information

Parcel Number: _______________

Legal Description of Property: _______________

Property Address: _______________, California

Grantor Information

Full Name: _______________

Address: _______________, California

Contact Information: _______________

Grantee Information

Full Name: _______________

Address: _______________, California

Contact Information: _______________

Conveyance Details

This Deed, executed on __________ [Date], between the Grantor(s) and the Grantee(s) mentioned above, serves to transfer all rights, title, and interest in the property described above from the Grantor(s) to Grantee(s) under the terms and conditions stated herein.

Consideration

The total amount of consideration for the transfer of property rights is $_____________.

Signatures

The parties have executed this Deed on the date first above written.

Grantor Signature: _______________

Grantee Signature: _______________

Notary Acknowledgment

This document was acknowledged before me on __________ [Date] by _______________ [Name(s) of Grantor(s)/Grantee(s)].

Notary Public Signature: _______________

Commission Number: _______________

Instructions for Use

- Complete all blank spaces with the appropriate information.

- Review the document carefully to ensure all information is accurate and complete.

- Both the Grantor(s) and Grantee(s) must sign the deed in the presence of a Notary Public.

- Record the deed with the county recorder's office in the county where the property is located to make the transfer public record.

This template provides a basic structure for a California Deed but does not encompass all variables and legal requirements for property transfer. Seek legal advice to ensure compliance with state laws and regulations.

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Definition | A California Deed is a legal document used to transfer property from one person to another within the state of California. |

| Governing Law | The primary laws governing California Deeds are found in the California Civil Code, specifically sections related to the transfer of real property. |

| Types | Common types include General Warranty, Grant, and Quitclaim Deeds, each offering different levels of protection for the buyer. |

| Recording | In California, deeds must be recorded with the county recorder's office in the county where the property is located to be effective against third parties. |

| Requirements | To be valid, a California Deed must include the grantor's and grantee's names, a legal description of the property, and the grantor's signature, which must also be notarized. |

How to Write California Deed

After determining the type of deed required for a property transaction in California, the next step involves the precise completion of the deed form. This legal document, crucial for the transfer of property from the current owner (grantor) to the new owner (grantee), must be filled out with accuracy and attention to detail. The following instructions are designed to guide you through the process, ensuring that all necessary information is provided and the document is correctly prepared for the subsequent steps in the property transfer process.

- Identify the correct deed form relevant to your transaction. California offers several forms such as the General Warranty Deed, Quitclaim Deed, and Grant Deed. Each serves different purposes and choosing the correct one is crucial to the transaction’s success.

- Start by entering the date of the deed transfer at the top of the document.

- Fill in the grantor's full legal name, address, and state of residence. Be sure to use the grantor's name as it appears on the current deed or property title.

- Specify the grantee's full legal name, address, and state of residence. As with the grantor, it’s important that the grantee's name is accurate according to legal documents.

- Provide a detailed legal description of the property being transferred. This information can typically be found on the current deed or property title and may include the lot number, parcel number, and exact address.

- List any monetary considerations involved in the transfer, specifying the amount in U.S. dollars if the property is sold.

- Include any additional terms and conditions related to the property transfer as necessary. This section can cover items like transfer rights, obligations, or specific reservations.

- The grantor must sign and date the deed in the presence of a notary public. The notarization process is important as it legally acknowledges the grantor's signature.

- Verify if witness signatures are required for your document; if so, ensure it is witnessed accordingly. Requirements can vary depending on local laws and regulations.

- Submit the completed and notarized deed to the local county recorder’s office. There may be a filing fee, which varies by county. It’s essential to check with the local office for the correct amount and acceptable forms of payment.

These instructions are designed to guide you through the comprehensive process of filling out a deed form in California. Accuracy and thoroughness are key to ensuring the legality of the property transfer and avoiding potential issues in the future. Ensuring all steps are carefully followed will facilitate a smoother transaction and legal process.

Listed Questions and Answers

What is a California Deed Form?

A California Deed Form is a legal document used to transfer ownership of real estate in California from one person to another. It must be completed, signed, and then recorded with the county recorder in the county where the property is located to be effective.

What types of Deed Forms are available in California?

In California, there are mainly three types of deed forms used for different purposes:

- Grant Deed: Commonly used in sales transactions to transfer property with implied warranties about the title.

- Quitclaim Deed: Used to transfer ownership without any warranties, often between family members or to clear title defects.

- Warranty Deed: Less common in California, provides the strongest warranties about the title to the buyer.

How can I obtain a California Deed Form?

California Deed Forms can be obtained through several means:

- Online from a reputable legal documents provider.

- From a local real estate attorney or a legal aid office.

- At the county recorder's office where the property is located.

What information is needed to complete a California Deed Form?

To complete a California Deed Form, you will need the following information:

- The legal names and addresses of the grantor (seller) and grantee (buyer).

- A legal description of the property being transferred.

- The parcel number of the property (often found on property tax statements).

- Any conditions or warranties associated with the transfer.

- The signature of the grantor, acknowledged by a notary public.

Is a lawyer required to complete a Deed in California?

While a lawyer is not strictly required to complete a Deed in California, consulting one is highly recommended, especially for complex transactions. A real estate lawyer can provide advice on the type of deed most appropriate for your situation, ensure the deed complies with California law, and help navigate the recording process.

How do I file a California Deed Form with the county recorder?

After completing the California Deed Form, it must be filed with the county recorder's office in the county where the property is located. The process generally involves:

- Ensuring the deed is properly signed and notarized.

- Paying any required recording fees.

- Submitting the deed to the county recorder, either in person, by mail, or electronically, if available.

What are the consequences of not recording a Deed in California?

Failing to record a Deed in California can have significant legal implications, including:

- The transfer might not be recognized legally, affecting the grantee's ability to demonstrate ownership.

- Difficulty in selling or mortgaging the property in the future.

- Possible disputes with heirs or future claims against the property.

Can I change or revoke a Deed once it's been recorded in California?

Once a Deed has been recorded in California, it cannot be changed or revoked unless a new Deed is executed and recorded. This new Deed must follow the same legal requirements as the original and clearly state the intention to revoke or amend the previous Deed. Because of the complexity and legal implications, consulting a real estate attorney for such actions is advisable.

Common mistakes

When it comes to transferring property in California, the deed form plays a vital role. However, it's fairly common for people to stumble over some critical steps while filling it out. Let's zoom in on the top eight mistakes to watch out for:

Not Checking the Correct Type of Deed: California offers several deed forms, each serving different purposes, like the grant deed, quitclaim deed, or warranty deed. Picking the wrong form can impact your legal rights and the transfer’s effectiveness.

Incorrectly Identifying the Grantee or Grantor: The person transferring the property is the grantor, and the receiver is the grantee. Mixing up these names or spelling them incorrectly can invalidate the transfer.

Omitting Legal Description of Property: The deed form requires a detailed legal description of the property, not just the address. Skipping this or providing incomplete information can lead to significant legal issues.

Failing to Sign in the Presence of a Notary: California law mandates that the grantor’s signature on a deed must be notarized. Signing outside of a notary’s presence is a common slip-up that can render the document legally void.

Leaving Out Required Declarations: Certain declarations, such as the Preliminary Change of Ownership Report (PCOR), are necessary for processing the deed. Overlooking these can delay or disrupt the recording process.

Incorrectly Stating the Transfer Tax: Based on the property's sale price or value, a transfer tax may apply. Misstating or neglecting this tax can result in penalties or future disputes.

Not Including the Assessor’s Parcel Number (APN): The APN uniquely identifies the property for tax purposes. Excluding this number can complicate or delay the deed recording process.

Failing to Record the Document Promptly: After completion, the deed must be submitted to the county recorder's office for official recording. Delaying this step can risk disputes regarding property ownership or create issues with clear title in the future.

Avoiding these pitfalls requires careful attention to detail. Below are a few actionable tips to get it right:

Always verify the deed type required for your specific transaction.

Double-check the spellings of all names and ensure every detail matches the legal documents.

Obtain the complete legal description of the property from a reliable source, such as a previous deed or the county recorder's office.

Arrange for a notary public to witness the signing of the document.

Include all necessary forms and declarations required by local laws and regulations.

Consult with a professional to accurately assess and state applicable transfer taxes.

Tackling these steps with diligence ensures a smoother, legally compliant transfer of property. Whether you're navigating this process for the first time or you've been through it before, it's always wise to consult with a legal professional. This can help avoid any unintended consequences and maintain the integrity of the transaction.

Documents used along the form

When handling real estate transactions in California, the Deed form plays a critical role in the transfer of property ownership. However, this document does not stand alone in the process. Several other forms and documents are utilized to ensure a smooth, legally compliant transaction. Understanding these additional documents can help participants navigate the complexities of real estate transfers more efficiently.

- Preliminary Change of Ownership Report (PCOR): This document is required by the county assessor's office and provides details about the sale or transfer, including the nature of the transfer, sales price, and buyer and seller information. It helps the assessor determine if the property should be reassessed for tax purposes.

- Transfer Tax Declarations: Transfer taxes must be paid when the deed is recorded, and this document declares the amount of taxes due. The tax rate and the specific requirements can vary significantly between different counties and cities within California.

- Title Search Report/Title Abstract: Before the transfer of property, a title search is conducted to ensure that the title is clear—meaning there are no liens, encumbrances, or legal questions regarding the ownership of the property. This report provides a history of the title and highlights any issues that need to be addressed before the sale can proceed.

- Grant Deed: While this is a type of deed form, it deserves specific mention. The Grant Deed is commonly used in California to transfer property ownership. It includes warranties from the seller that the property has not been sold to someone else and is free from undisclosed encumbrances.

- Escrow Instructions: These are detailed instructions, agreed upon by both the buyer and seller, provided to an escrow officer. The instructions outline the conditions that must be met for the transaction to close, such as payment of the purchase price, distribution of funds, and transfer of the deed.

In the world of California real estate, being well-informed about the necessary documentation is crucial for a successful transaction. Each of these documents plays a pivotal role in ensuring that property ownership is transferred correctly and legally. By understanding and properly managing these forms, all parties can navigate the complexities of real estate transactions with confidence.

Similar forms

The California Deed form shares similarities with a Warranty Deed. Both documents are integral in real estate transactions, offering an official means to transfer property ownership. However, where the Warranty Deed specifically guarantees the buyer that the property is free of any liens or claims, the California Deed form, depending on its type (e.g., grant deed, quitclaim deed), might not always offer such comprehensive assurances. Essentially, both documents serve the foundational purpose of documenting the transfer of property rights.

Comparable to the California Deed form is the Bill of Sale. This document is traditionally used to document the sale and transfer of ownership of personal property, like vehicles or household items, as opposed to real estate. Both documents function as legal evidence of a transfer of ownership, yet they cater to different types of properties. The format and specific protections each offers might differ, but their core purpose of formalizing ownership transition aligns them closely.

The Quitclaim Deed is another document with notable resemblances to the California Deed form. Primarily used for transferring ownership rights in real estate without any warranty regarding the title's quality, the Quitclaim Deed, much like certain types of California Deeds (e.g., California Quitclaim Deed), is a fast and efficient way to relinquish or acquire interest in property. While both documents serve to transfer property rights, the level of protection and guarantee they offer can vary significantly.

The Trust Deed, often confused with the traditional deed forms, shares a connection with the California Deed form. Its primary function is to secure a real estate transaction involving a loan, where the property is held as collateral. Unlike a simple property transfer between buyer and seller, a Trust Deed involves a lender, making it more complex. Despite their differences, both documents are pivotal in real estate transactions, each playing a distinct role in the conveyance and financing of property.

The Grant Deed, specifically used in California, bears a resemblance to the broader category of California Deed forms. While a Grant Deed specifically guarantees that the property has not been sold to someone else and is free from undisclosed encumbrances, it is, in essence, a subset of the various types of deeds available in California. Both aim to transfer ownership rights, providing certain assurances to the buyer about the property status.

Similarly, the Easement Agreement parallels the California Deed form in its capacity to dictate rights over a property. Whereas deeds transfer the title or ownership of property, an Easement Agreement grants a right to use the property for a specific purpose without transferring ownership. Both documents are integral to defining and modifying legal rights associated with real estate, affecting how properties are used or accessed.

The Power of Attorney for Property is akin to the California Deed form because both empower individuals to act concerning real estate matters. However, while a Power of Attorney for Property authorizes someone to manage or transact real estate on another's behalf, a Deed directly transfers property rights. Each plays a crucial role in legal procedures involving property, facilitating transactions and management.

The Land Contract is somewhat similar to the California Deed form as another vehicle for real estate transactions. This agreement allows the buyer to pay the seller for the property over time, with the deed transferred only after all payments are made. While both documents are crucial in the conveyance of real estate, their approaches to ownership transfer and the timing of that transfer significantly differ.

Last but not least, the Mortgage Agreement and the California Deed form are connected through their roles in real estate financing. A Mortgage Agreement involves a borrower agreeing to use their property as security for a loan, while various Deeds, including those used in California, can signify the transfer of property that might be subjected to such agreements. Both are essential in the buying and selling process, often working hand in hand to secure financing and transfer ownership.

Dos and Don'ts

When navigating the process of filling out a California Deak form, attention to detail is crucial. To ensure that the document is completed accurately and efficiently, adhering to a set of do's and don'ts can guide individuals through the procedure seamlessly. Below are critical points to consider.

- Do verify the type of deed required. It's essential to understand whether a Grant Deed, Quitclaim Deed, or another form of deed best suits your needs based on the transfer you are making.

- Don't overlook the legal description of the property. This isn't just the address; it includes the lot number, tract number, and any other details that legally identify the property. Incorrect or incomplete descriptions can void the document.

- Do ensure all parties are correctly named. Double-check the spelling of names and the capacity in which they hold title. For example, if a trustee is signing, the signature must reflect their capacity as a trustee.

- Don't forget to sign in the presence of a notary. The deed must be notarized to be valid. Ensure that all required parties are present to sign the document in front of a notary public.

- Do retain a lawyer or real estate professional's advice if unsure. Deeds are legally binding documents with significant consequences. Professional advice can help navigate the complexities.

- Don't neglect to record the deed with the county recorder’s office. After the deed is notarized, it must be officially recorded to be valid. Recording fees will apply, and the document becomes public record.

- Do keep a copy of the recorded deed for your records. Once the deed is recorded, ensure you have a copy for your personal records. This documents the property transfer and can be crucial for future transactions or claims.

By following these guidelines, individuals can avoid common pitfalls and ensure the process is conducted properly. Remember, the accuracy and legality of the deed form are paramount in transferring property rights effectively and protecting all parties involved.

Misconceptions

Many homeowners and buyers in California have misconceptions about the California Deed form. It's crucial to get these facts straight to avoid any legal pitfalls or misunderstandings in real estate transactions. Here are ten common misconceptions, clarified for better understanding:

All deeds are the same. This isn’t true. In California, there are several types of deeds, including grant deeds, warranty deeds, and quitclaim deeds, each serving different purposes and offering varying levels of protection to the buyer.

Filling out a deed form is simple and requires no legal help. While filling out the form may seem straightforward, understanding the legal implications of the words on the form is crucial. Mistakes can lead to significant legal and financial consequences. Consulting with a legal professional is advised.

A deed and a title are the same things. This is incorrect. The deed is the physical document that transfers ownership of the property from one person to another. The title is a concept that represents the legal right to own and use the property.

You only need a deed to claim ownership. Simply holding onto a deed doesn’t give you clear ownership. The deed must be properly executed, delivered to the buyer, and, most importantly, recorded with the county recorder’s office.

Once signed, deeds cannot be changed. Deeds can be corrected or amended if both parties agree to the changes, and a new deed is executed and recorded. Errors or necessary adjustments can be rectified with proper legal procedures.

Electronic signatures aren’t valid on deed forms in California. Contrary to this belief, California has embraced electronic signatures on many legal documents, including deeds, as long as they comply with state laws and regulations regarding electronic transactions.

A quitclaim deed guarantees that the property is free of liens. Unlike warranty deeds, quitclaim deeds do not offer any guarantees or warranties about the property’s title. They simply transfer whatever interest the grantor has in the property, if any.

Recording a deed is optional. While technically you could own property without recording your deed, failing to do so can lead to significant risks. Unrecorded deeds do not provide public notice of ownership and leave the owner vulnerable to claims and disputes.

Deeds must be publicly witnessed to be valid. California law does not require a deed to be witnessed by the public. However, the signature of the grantor must be notarized for the deed to be recorded and valid.

Handwritten modifications on a printed deed form are acceptable. Any handwritten changes on a deed form, after notarization, can lead to disputes about the document’s validity. All modifications should be properly made before the document is notarized and recorded.

Understanding the specifics of California Deed forms is essential for anyone involved in real estate transactions in the state. Making assumptions or relying on common misconceptions can lead to costly errors. Always seek professional legal advice when dealing with real property transfers.

Key takeaways

When dealing with a California Deed form, understanding its essential elements and the legal requirements for its completion is crucial. Here are the key takeaways you should be aware of:

- Before filling out the California Deed form, it's important to determine the type of deed required. California primarily uses two kinds of deeds: Grant Deeds and Quitclaim Deeds. A Grant Deed transfers ownership with certain guarantees, while a Quitclaim Deed transfers any interest the grantor may have without any guarantees of clear title.

- The Deed must include accurate information about the grantor (the person selling or transferring the property) and the grantee (the person receiving the property). Mistakes in names or incorrect details can lead to complications in establishing clear ownership of the property.

- Legal description of the property on the Deed must be precise. This description goes beyond the street address and often includes lot numbers, block numbers, tract name, or a section, township, and range description. This information can generally be found on the current Deed or by contacting the county recorder’s office.

- After completing the Deed form, it needs to be signed by the grantor in the presence of a Notary Public before being filed with the county recorder's office. Some counties may have additional filing requirements, so checking with the local recorder’s office is advisable. Filing the Deed is a critical step in making the transfer of ownership public record, thereby protecting the grantee’s legal rights.

Understanding these key elements helps ensure that the process of transferring property in California is done correctly and efficiently, reducing the risk of future disputes over property ownership.

Create Some Other Templates for California

Car Bill of Sale Form Free - The presence of a Bill of Sale can expedite the resolution process in disputes, offering a clear point of reference for authorities or mediators.

Template for a Will - For those with extensive art, jewelry, or collectible items, a Last Will can detail how these valuable assets are to be distributed, ensuring they go to appreciative and deserving heirs.