Attorney-Approved California Deed in Lieu of Foreclosure Document

In the vast landscape of financial distress and property management, individuals and financial institutions often find themselves navigating complex pathways to resolve mortgage defaults. Among these paths, the California Deed in Lieu of Foreclosure form emerges as a significant instrument, designed to offer a mutually beneficial solution to borrowers and lenders alike. This formal agreement allows a homeowner to transfer ownership of their property to the lender, thereby avoiding the conventional and often protracted process of foreclosure. Such a transaction not only aids borrowers in sidestepping the dire credit repercussions associated with foreclosure but also permits lenders to expedite the recovery of the loaned sum by directly acquiring property rights. Critical to understanding this form are its legal stipulations, which outline the precise terms of the property transfer, including but not limited to, the release of the borrower’s mortgage obligations and the conditions under which the transfer is deemed acceptable. Moreover, the implications of accepting a Deed in Lieu of Foreclosure for both parties cannot be overstated, as it involves thorough consideration of potential tax consequences, the possibility of a deficiency judgment, and the immediate and long-term impacts on the borrower’s credit report. Notwithstanding, the use of this form as a resolution strategy epitomizes the legal system's flexibility in facilitating agreements that serve the interests of both borrower and lender in the face of financial adversity.

Document Example

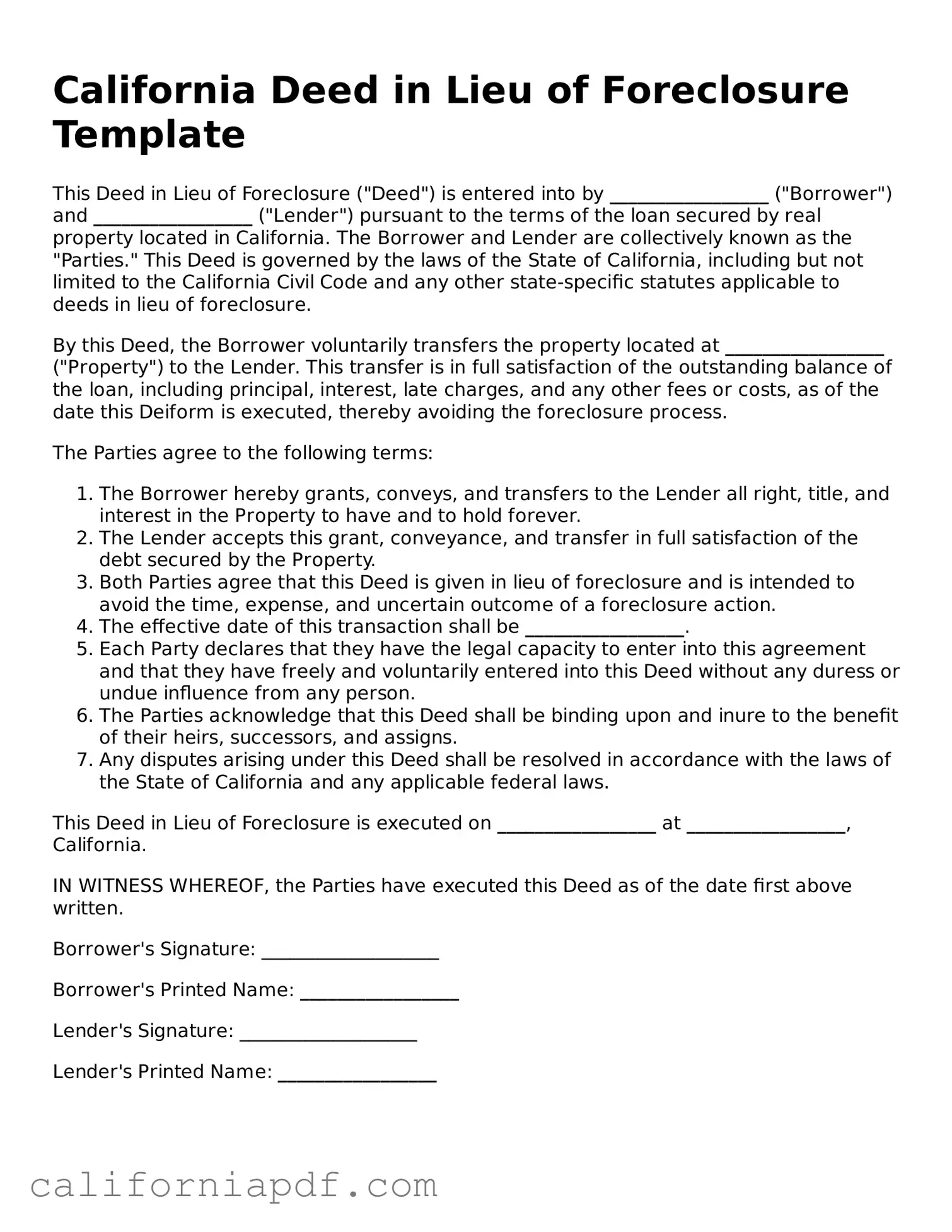

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is entered into by _________________ ("Borrower") and _________________ ("Lender") pursuant to the terms of the loan secured by real property located in California. The Borrower and Lender are collectively known as the "Parties." This Deed is governed by the laws of the State of California, including but not limited to the California Civil Code and any other state-specific statutes applicable to deeds in lieu of foreclosure.

By this Deed, the Borrower voluntarily transfers the property located at _________________ ("Property") to the Lender. This transfer is in full satisfaction of the outstanding balance of the loan, including principal, interest, late charges, and any other fees or costs, as of the date this Deiform is executed, thereby avoiding the foreclosure process.

The Parties agree to the following terms:

- The Borrower hereby grants, conveys, and transfers to the Lender all right, title, and interest in the Property to have and to hold forever.

- The Lender accepts this grant, conveyance, and transfer in full satisfaction of the debt secured by the Property.

- Both Parties agree that this Deed is given in lieu of foreclosure and is intended to avoid the time, expense, and uncertain outcome of a foreclosure action.

- The effective date of this transaction shall be _________________.

- Each Party declares that they have the legal capacity to enter into this agreement and that they have freely and voluntarily entered into this Deed without any duress or undue influence from any person.

- The Parties acknowledge that this Deed shall be binding upon and inure to the benefit of their heirs, successors, and assigns.

- Any disputes arising under this Deed shall be resolved in accordance with the laws of the State of California and any applicable federal laws.

This Deed in Lieu of Foreclosure is executed on _________________ at _________________, California.

IN WITNESS WHEREOF, the Parties have executed this Deed as of the date first above written.

Borrower's Signature: ___________________

Borrower's Printed Name: _________________

Lender's Signature: ___________________

Lender's Printed Name: _________________

PDF Form Characteristics

| Fact Name | Description |

|---|

How to Write California Deed in Lieu of Foreclosure

Filling out the California Deed in Lieu of Foreclosure form is a crucial step for homeowners aiming to avoid the traditional foreclosure process. By completing this form, individuals can transfer the ownership of their property back to the lender, under agreed terms, to satisfy a loan that is in default. It is essential that the document is filled out correctly to ensure that the process goes smoothly and without any unnecessary delays. The following steps will guide you through the necessary details that need to be provided on the form.

- Gather all the required information including the full legal names of all parties involved, the property address, and the legal description of the property. This can usually be found on your original deed or mortgage agreement.

- Enter the name(s) of the borrower(s) as it appears on the original mortgage along with their mailing address.

- Specify the name of the lender (beneficiary) along with the contact information for the representative handling the deed in lieu transaction.

- Provide a complete and accurate legal description of the property. This should match the description used in the original deed or mortgage documentation. It might include lot numbers, tract number, or the physical address.

- State the date when the agreement is made. Make sure the date is current and correctly entered.

- Ensure that all parties involved sign the form. This includes the borrower(s) and an authorized representative of the lender. Signatures must be witnessed by a notary public to verify the identities of the signatories.

- After completing the form and having it notarized, file the document with the County Recorder's office in the county where the property is located. Note that there might be a filing fee, which varies by county.

Once the form has been filed, the process of transferring the property title back to the lender will begin. It is important to maintain communication with the lender throughout the entire process and to keep copies of all documents submitted for your records. Proper completion and filing of this document are steps toward resolving the default situation and moving forward.

Listed Questions and Answers

What is a Deed in Lieu of Foreclosure form in California?

A Deed in Lieu of Foreclosure form is a legal document in California that allows a homeowner to transfer ownership of their property to the lender. This action is taken to avoid the foreclosure process. It's a voluntary agreement where both parties— the borrower and the lender—agree it's in their best interest to transfer the property's title to avoid foreclosure proceedings.

How does the process of Deed in Lieu of Foreclosure work in California?

The process involves the homeowner and the lender agreeing that the homeowner will surrender the title of the property to the lender. It starts with the homeowner approaching the lender with the proposition or, in some cases, the lender may suggest it as an option to the homeowner. Once agreed upon, the borrower will sign the Deed in Lieu of Foreclosure, thereby transferring ownership of the property to the lender. The lender, in return, agrees not to proceed with foreclosure. This process also involves the preparation and submission of several documents, including the agreement detailing the transfer and any additional terms.

Who benefits from a Deed in Liee of Foreclosure in California, and how?

Both the homeowner and the lender can benefit from a Deed in Lieu of Foreclosure:

- The homeowner can avoid the negative consequences of a foreclosure on their credit report, potentially facing a less severe financial setback.

- The lender can save on the time and expenses associated with the foreclosure process.

What are the potential risks or drawbacks of a Deed in Lieu of Foreclosure for California homeowners?

While a Deed in Lieu of Foreclosure can offer relief, there are potential drawbacks, including:

- It may not release the homeowner from all financial obligations. Some lenders may require homeowners to pay the difference between the sale price and the mortgage owed.

- There could be tax implications. The forgiven debt may be considered taxable income.

- It may still negatively impact the homeowner's credit score, though typically less than a foreclosure would.

Are all California homeowners eligible for a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure varies by lender and situation. Homeowners must generally be experiencing financial hardship that makes it impossible to continue making mortgage payments. Additionally, the property should not have any other liens or second mortgages, as this can complicate the process. Lenders will also consider the current market value of the property and how it compares to the outstanding mortgage balance.

What steps should a California homeowner take to pursue a Deed in Lieu of Foreclosure?

Homeowners interested in a Deed in Lieu of Foreclosure should take the following steps:

- Contact their lender to discuss the possibility and to understand if they qualify.

- Gather and prepare necessary documentation, including proof of income, financial statements, and a hardship letter detailing the reasons for their inability to continue making payments.

- Work with a legal professional to ensure the process is handled correctly and that all legal documents are properly completed.

- Review and sign the Deed in Lieu of Foreclosure agreement, officially transferring the property to the lender.

Common mistakes

When handling a California Deed in Lieu of Foreclosure form, it's important for property owners to proceed with care. This approach can be a strategic move to avoid the consequences of foreclosure, but certain missteps can create complications. Here are six common errors to avoid:

-

Not consulting with a legal professional: Before proceeding, getting legal advice can clarify the implications of a deed in lieu of foreclosure and ensure that it aligns with the homeowner's best interests.

-

Ignoring tax consequences: Many people don't realize that a deed in lieu of foreclosure can have significant tax implications. It's essential to understand how this action might affect your tax liabilities.

-

Failing to negotiate the terms: Simply accepting the lender's first offer without negotiation can result in unfavorable terms. Homeowners have the right to negotiate the conditions of the agreement, potentially leading to a better outcome.

-

Overlooking junior liens: When transferring property via a deed in lieu of foreclosure, all liens or claims against the property must be addressed. Overlooking junior liens can lead to issues with the property title down the line.

-

Not obtaining a release of liability: Without a formal release of liability, lenders might still pursue deficiency judgments for the difference between the mortgage balance and the property's value. Securing a release protects the homeowner from future claims.

-

Inaccurate or incomplete documentation: Filling out the deed in lieu of foreclosure form inaccurately or leaving sections incomplete can invalidate the process or delay it considerably. Every detail on the form should be carefully reviewed and correctly provided.

In summary, navigating the deed in lieu of foreclosure process requires attention to detail, an understanding of the legal and tax implications, and, ideally, guidance from experienced professionals. Steering clear of these common pitfalls can help homeowners manage their situation more effectively.

Documents used along the form

When addressing the complexities involved in averting foreclosure, individuals often turn to a Deed in Lieu of Foreclosure as a viable alternative. This agreement allows the homeowner to transfer their property voluntarily to the lender, thus avoiding the conventional foreclosure process. While the Deed in Lieu of Foreclosure form serves as the cornerstone document in these situations, several other forms and documents are frequently required to effectively navigate the process and ensure legal compliance and protection for all parties involved.

- Hardship Letter: This document is a personal statement from the homeowner explaining the financial difficulties they are experiencing that prevent them from continuing mortgage payments. The Hardship Letter offers context to the lender, detailing the reasons behind the borrower’s inability to fulfill their financial obligations and the rationale for requesting a deed in lieu of foreclosure.

- Financial Statement: Accompanying the Hardship Letter, the Financial Statement provides a comprehensive overview of the borrower’s current financial status. This document includes detailed information regarding income, expenses, assets, and liabilities. It serves to validate the claim of financial hardship made in the Hardship Letter.

- Estoppel Affidavit: An Estoppel Affidavit is a legal document wherein the borrower confirms certain facts and conditions related to the deed in lieu agreement. This affidavit may include acknowledgments about not being pressured into the agreement, the voluntary nature of the transfer, and the full satisfaction of the debt owed to the lender, barring any further claims.

- Agreement Not to Pursue a Deficiency Judgment: This form is crucial in cases where the lender agrees not to pursue the balance owed on the mortgage that exceeds the property’s value. By signing this agreement, the lender waives the right to seek a deficiency judgment against the borrower, offering a significant relief and a clear financial break from the property for the homeowner.

Together, these documents form a comprehensive packet that supports the Deed in Lieu of Foreclosure form, providing clarity, legal safety, and documented agreement between the borrower and lender. Each document plays a critical role in ensuring that the process is conducted fairly, transparently, and with a mutual understanding of the terms and consequences. It's imperative for homeowners considering this route to familiarize themselves with these documents and seek professional advice to navigate the process effectively.

Similar forms

The California Deed in Lieu of Foreclosure form shares some similarities with a Mortgage Release or Satisfaction of Mortgage document. Both serve to release a borrower from the obligations under a mortgage, but they do so at different stages of the process. While the Deed in Lieu of Foreclosure is used as an alternative to foreclosure, allowing a borrower to transfer the title of the property back to the lender, the Mortgage Release or Satisfaction of Mortgage document is typically used after a borrower has paid off their mortgage in full, to officially remove the lien from the property records.

Another similar document is the Short Sale Agreement, which, like the Deed in Lieu of Foreclosure, is also a measure to avoid foreclosure. The primary difference is that in a short sale, the property is sold to a third party for less than the amount owed on the mortgage, with the lender's approval. The lender agrees to accept the proceeds from the sale as full settlement of the debt, unlike in a deed in lieu of foreclosure, where the property is directly transferred back to the lender without going through a sale process.

The Loan Modification Agreement can also be compared to the Deed in Liea of Foreclosure. Both are options for homeowners struggling to keep up with mortgage payments, yet they differ significantly in approach and outcome. The Loan Modification Agreement involves changing the terms of the mortgage to make payments more manageable for the borrower, potentially by extending the loan term, reducing the interest rate, or even forgiving a portion of the loan principal. In contrast, a deed in lieu transfers property ownership back to the lender as a final measure to avoid foreclosure.

The Quitclaim Deed is another document that, much like the Deed in Liea of Foreclosure, involves the transfer of property ownership. However, the key distinction lies in the lack of guarantees or warranties regarding the property's title. A Quitclaim Deed transfers the owner's interests in the property to another party without confirming that the property title is clear of liens or encumbrances. This contrasts with a Deed in Lieu of Foreclosure, which is used specifically to transfer the property back to the lender to satisfy a debt and typically involves a more formal process with assurances regarding the property title.

The Foreclosure Notice is closely related to the Deed in Lieu of Foreclosure process. This document informs a borrower that they are at risk of losing their home due to non-payment of the mortgage. It is a preliminary step in the foreclosure process, serving as a legal warning to the borrower. While both the Foreclosure Notice and the Deed in Lieu of Foreclosure stem from the same issue of mortgage default, they represent different stages and solutions. The Foreclosure Notice signals the beginning of the legal process that may lead to the lender taking ownership of the property, whereas the Deed in Lieu of Foreclosure is a voluntary agreement to transfer the property before the foreclosure is finalized.

Lastly, the Grant Deed is somewhat similar to the Deed in Lieu of Foreclosure form in that it is used to transfer property ownership. The Grant Deed, however, is used in voluntary and typically sale-related transactions, where the seller guarantees they have not sold the property to someone else and that the property is not burdened by undisclosed encumbrances. This contrasts with the Deed in Lieu of Foreclosure, where the transfer is specifically made to settle an unpaid mortgage under the threat of foreclosure, and not as part of a sale to a new owner.

Dos and Don'ts

Facing foreclosure can be challenging and stressful. Opting for a Deed in Lieu of Foreclosure in California is a strategic decision that might help homeowners avoid the full impact of a foreclosure. Proper completion of the form is crucial for this process to be effective. Here are some recommendations on what to do and what not to do when filling out the California Deed in Lieu of Foreclosure form.

Things You Should Do

- Verify all property information is accurate, including the legal description of the property and any identifying numbers or codes.

- Ensure that all parties with an interest in the property, such as co-owners or lienholders, are aware of and agree to the deed in lieu transaction.

- Provide complete and truthful financial information, as this will be used to assess your situation and eligibility for a deed in lieu of foreclosure.

- Consult with a legal advisor who has experience in real estate or foreclosure law in California to review the form before submission. This helps in identifying any potential legal issues that might arise.

- Keep copies of all documents related to the deed in lieu of foreclosure, including any correspondence with the lender and the completed form itself, for your records.

Things You Shouldn't Do

- Do not leave any sections of the form blank. If a section does not apply, write “N/A” (not applicable) to indicate this.

- Avoid rushing through the form without understanding each part. If there's a section you do not understand, seek clarification.

- Do not omit financial information or misrepresent your financial situation, as this could be construed as fraud.

- Resist the urge to sign the form without having all the agreeing parties present or without the guidance of a legal advisor, as this might void the document.

- Do not hesitate to contact your lender for any clarifications or additional information required in filling out the form. Communication with your lender can often facilitate a smoother process.

Properly handling a Deed in Lieu of Foreclosure can provide a dignified exit from a difficult situation while minimizing the negative impact on one’s credit. Being thorough and cautious during the process ensures that the interests of all parties are respected and protected.

Misconceptions

The California Deed in Lieu of Foreclosure form is surrounded by various misconceptions that can complicate the understanding of homeowners facing the prospect of losing their home. It's critical to dispel these misunderstandings to navigate this difficult time with accurate information. Here’s a closer look at some of these misconceptions:

- It completely absolves the borrower of all financial responsibilities: Many people believe that once they've opted for a deed in lieu of foreclosure, they're entirely free from any mortgage debt or other financial obligations related to the defaulted property. However, this isn't always the case. Lenders may include a deficiency judgment clause, attempting to recover any shortfall between the sale price of the property and the balance owed on the mortgage.

- It's available to all homeowners facing foreclosure: Not all homeowners can choose a deed in lieu of foreclosure. Lenders typically require certain conditions to be met before agreeing to this arrangement, such as exhausting all other loss mitigation options like loan modifications or short sales. Additionally, if there are any secondary liens on the property, it might not be eligible for a deed in lieu of foreclosure.

- The process is fast and simple: While it might seem like an easy way out of a mortgage default, the process for obtaining a deed in lieu of foreclosure can be complex and time-consuming. Homeowners must negotiate with their lender, who will conduct a thorough review of the homeowner's financial situation, the property's value, and other factors before making a decision.

- It severely damages one's credit score just like a foreclosure: A common misconception is that a deed in lieu of foreclosure has the same impact on a homeowner's credit score as a foreclosure. While it's true that both actions negatively affect credit scores, a deed in lieu of foreclosure might have a slightly less detrimental impact depending on how the lender reports it to the credit bureaus.

- It’s the homeowner's only option to avoid foreclosure: Many homeowners believe that once they're facing foreclosure, a deed in lieu of foreclosure is their only alternative. However, there are several options available to those struggling to make their mortgage payments, including loan modification programs, refinancing, or even filing for bankruptcy as a last resort to halt foreclosure proceedings.

Understanding the complexities of a deed in lieu of foreclosure in California is essential for homeowners considering this option. By demystifying these misconceptions, individuals can make more informed decisions about their financial and housing situations.

Key takeaways

When dealing with a Deed in Lieu of Foreclosure in California, individuals find themselves navigating a process that can offer a less harrowing exit from mortgage difficulties. Here are some key takeaways to guide you through filling out and using the California Deed in Lieu of Foreclosure form:

- Understand what it is: A Deed in Lieu of Foreclosure is a legal document transferring ownership of property from the borrower to the lender to avoid the foreclosure process.

- Eligibility considerations: Not all borrowers will qualify for a Deed in Lieu of Foreclosure. Lenders often require that all other loss mitigation options have been exhausted.

- Communicate with your lender: Early and open communication with your lender is crucial. Discussing your financial difficulties and potential options can pave the way for an agreement.

- Accuracy is key: When completing the form, ensure all information is accurate and complete. Mistakes can delay or derail the process.

- Seek professional advice: Consulting with a legal or financial advisor can provide valuable insights into whether this option best suits your situation.

- Understand the implications: Transferring property through this method may have tax consequences and can impact your credit score. Fully understanding these implications is essential.

- Document preparation: The form requires detailed information about the property and the loan. Having all relevant documents on hand can simplify the process.

Review and sign: Carefully review the completed form for accuracy. It must be signed by all parties with an interest in the property, which may include co-owners or co-borrowers. - Notarization is required: The document must be notarized to be considered legally valid. This step verifies the identity of the signatories and their understanding of the document's contents.

- Record the deed: Once completed and notarized, the Deed in Lieu of Foreclosure must be recorded with the county recorder’s office. This official recording is necessary for the transfer of ownership to be recognized by law.

- Seek a deficiency judgment waiver: Negotiate with your lender to obtain a waiver for any deficiency judgment, which would prevent the lender from pursuing you for any remaining debt after the property is transferred.

- Consider the impact on co-signers: If the loan has co-signers, a Deed in Lieu of Foreclosure will also affect their credit. Their agreement and understanding are critical.

Successfully navigating the completion and use of the California Deed in Lieu of Foreclosure form requires careful attention to detail and a clear understanding of the legal and financial ramifications. This pathway can offer a dignified alternative to the often stressful and drawn-out foreclosure process, but it comes with its own set of considerations and responsibilities.

Create Some Other Templates for California

How Long Does a Quit Claim Deed Take to Process - Despite its conveniences, it’s important to consider the implications of receiving property through a Quitclaim Deed, as it comes with no title guarantee.

Sample Promissory Note California - Includes specific details like the principal amount, interest rate, and repayment schedule.