Attorney-Approved California Durable Power of Attorney Document

Imagine being in a situation where, for any reason, you can't make decisions for yourself. This thought often brings worry about who would handle your affairs and how. Here comes the role of the California Durable Power of Attorney form, a legal document designed to grant someone you trust the authority to make decisions in your place. This form particularly stands out because it retains its effectiveness even if you become incapacitated. It covers a wide array of decisions, including financial ones, ensuring that your affairs are managed according to your wishes. Through it, you can appoint a trusted individual to look after your financial matters, providing peace of mind to you and your loved ones. It’s crucial, however, to understand how this form works, the importance of choosing the right person for this role, and the scope of power you're transferring. With this understanding, you can ensure your affairs are in safe hands, even when you're unable to oversee them yourself.

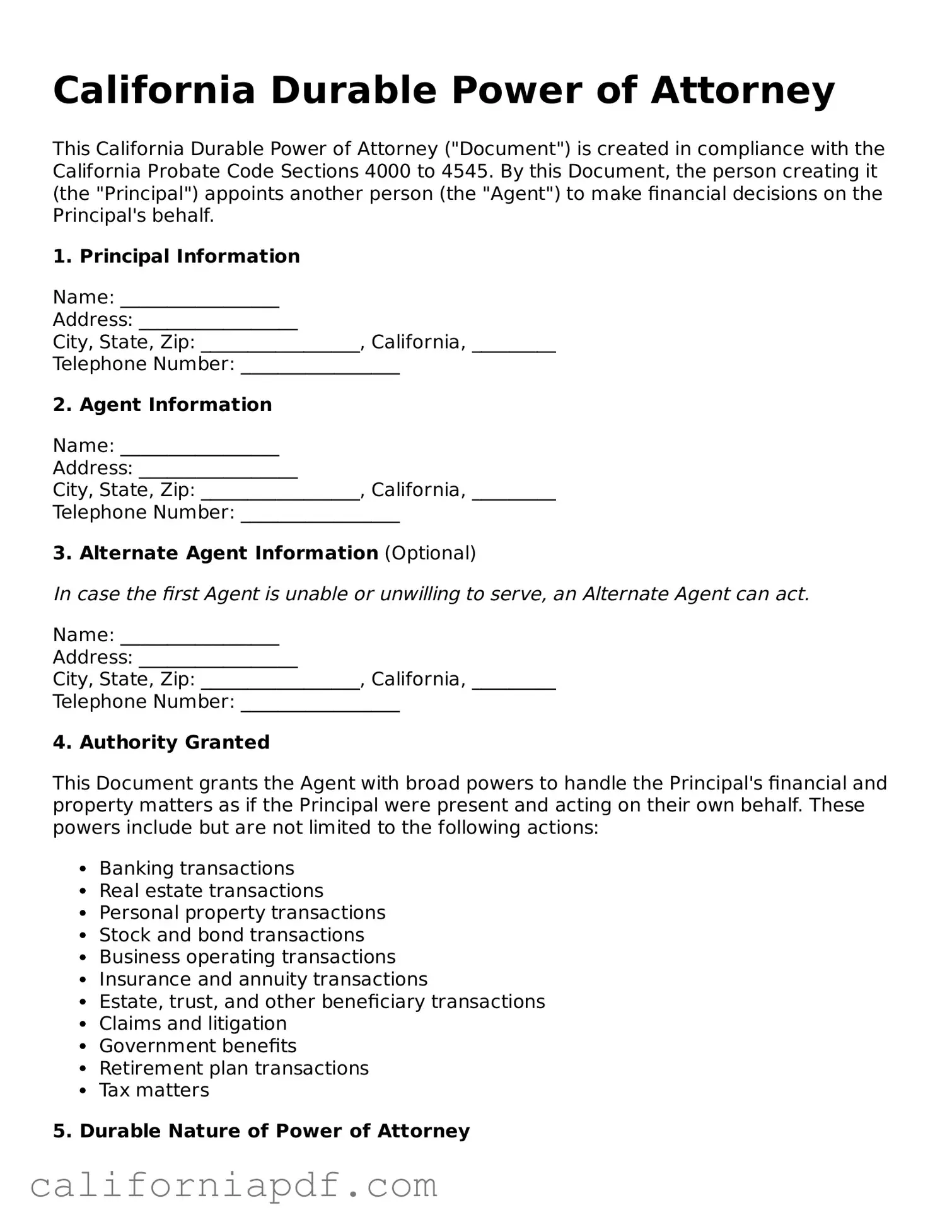

Document Example

California Durable Power of Attorney

This California Durable Power of Attorney ("Document") is created in compliance with the California Probate Code Sections 4000 to 4545. By this Document, the person creating it (the "Principal") appoints another person (the "Agent") to make financial decisions on the Principal's behalf.

1. Principal Information

Name: _________________

Address: _________________

City, State, Zip: _________________, California, _________

Telephone Number: _________________

2. Agent Information

Name: _________________

Address: _________________

City, State, Zip: _________________, California, _________

Telephone Number: _________________

3. Alternate Agent Information (Optional)

In case the first Agent is unable or unwilling to serve, an Alternate Agent can act.

Name: _________________

Address: _________________

City, State, Zip: _________________, California, _________

Telephone Number: _________________

4. Authority Granted

This Document grants the Agent with broad powers to handle the Principal's financial and property matters as if the Principal were present and acting on their own behalf. These powers include but are not limited to the following actions:

- Banking transactions

- Real estate transactions

- Personal property transactions

- Stock and bond transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Government benefits

- Retirement plan transactions

- Tax matters

5. Durable Nature of Power of Attorney

This Document is durable in nature, meaning the Agent's power shall continue even if the Principal becomes incapacitated. This durability ensures that the Principal's financial matters can be taken care of without interruption.

6. Execution

The effectiveness of this Document is contingent upon proper execution in accordance with California law. The Principal and the Agent must sign this Document in the presence of a notary public.

Principal's Signature: ___________________________ Date: ________________

Agent's Signature: _____________________________ Date: ________________

Alternate Agent's Signature: _____________________ Date: ________________ (if applicable)

Notary Acknowledgment

State of California

County of _______________

On __________________ (date), before me, ____________________ (name and title of the officer), personally appeared _________________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

Witness my hand and official seal.

Signature _________________________________

(Seal)

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Allows an individual, known as the principal, to give another person, known as the agent, the authority to make financial decisions on their behalf. |

| Governing Law | Regulated under the California Probate Code, sections 4000 to 4465. |

| Durability | It remains in effect even if the principal becomes incapacitated, ensuring that the agent can still act on the principal's behalf. |

| Requirements | Must be signed by the principal and either witnessed by two adults or notarized to be legally binding in California. |

| Scope of Authority | The principal can grant broad or limited powers to the agent, including handling financial and real estate transactions. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent. |

| Form Availability | Standard forms are available, but it's advisable to consult with a lawyer to ensure that the form meets the principal's specific needs and is filled out correctly. |

How to Write California Durable Power of Attorney

Filling out a California Durable Power of Attorney form is an important task that grants another person the authority to make decisions on your behalf regarding financial matters. This person, known as an agent, will have the power to manage your finances if you're unable to do so. It's crucial to choose someone you trust and to be clear about the powers you are granting. The process can seem complex, but with careful attention, you can complete the form accurately and ensure your financial matters are handled according to your wishes.

Steps for Filling Out the California Durable Power of Attorney Form:

- Start by reading the form thoroughly. Understand each section to ensure that you know the implications of what you're filling out.

- In the "Designation of Agent" section, clearly print the name, home address, and telephone number of the person you're appointing as your agent.

- If you wish to appoint an alternate agent in case the primary agent is unable or unwilling to act, provide their information in the "Alternate Agents" section. This is similar to step 2.

- Under "Grant of General Authority," check the boxes next to the powers you're granting to your agent. Be thoughtful about the powers you give, as they will have access to manage your financial affairs.

- In the "Special Instructions" area, provide any specific directions you have. This section allows you to limit or expand the powers granted to your agent.

- Look for the "Durable" section of the form and ensure it reflects your intent for the power of attorney to remain in effect even if you become incapacitated. This is the "durability" provision.

- Date and sign the form in the presence of a notary public or two witnesses, as required by California law. Witnesses should not be your agent or alternate agent. Notarization may not be required but is recommended for added legal strength.

- If notarized, have the notary complete their section of the form, acknowledging your signature.

Once you've completed these steps, your California Durable Power of Attorney form is legally binding. Safely store the original document and provide copies to your agent and any financial institutions that may need it. Keep in mind that you can revoke this document at any time as long as you are mentally competent. It's a good practice to review and possibly update your power of attorney periodically or when your circumstances change.

Listed Questions and Answers

What is a California Durable Power of Attorney?

A California Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint someone else, called an agent or attorney-in-fact, to manage their financial affairs. This authority continues to be effective even if the principal becomes incapacitated.

How does one create a California Durable Power of Attorney?

To create a California Durable Power of Attorney, the principal must complete and sign a power of attorney form that complies with California laws. The document must be signed in the presence of a notary public or two witnesses, as required by state law. It's advisable to consult with a legal professional to ensure the form meets all legal requirements and accurately reflects the principal's wishes.

Who can be designated as an agent in a California Durable Power of Attorney?

Any competent adult can be designated as an agent in a California Durable Power of Attorney. This includes, but is not limited to, a trusted family member, friend, or professional advisor. It's important to choose someone who is trustworthy, understands the principal's desires, and is capable of managing financial affairs effectively.

What powers can be granted in a California Durable Power of Attorney?

The powers granted in a California Durable Power of Attorney can be broad or specific, depending on the principal's preferences. They may include, but are not limited to, the following:

- Buying or selling real estate

- Managing bank accounts and investments

- Handling tax matters

- Claiming benefits

Can a California Durable Power of Attorney be revoked?

Yes, a California Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. To revoke the document, the principal should notify the agent and any financial institutions involved in writing. Additionally, destroying the document and creating a new one can also effectively revoke the power of attorney.

What happens if there is no California Durable Power of Attorney in place and the principal becomes incapacitated?

If there is no California Durable Power of Attorney in place and the principal becomes incapacitated, a court may need to appoint a conservator or guardian to make financial decisions on behalf of the incapacitated individual. This process can be time-consuming, expensive, and stressful for family members. Having a durable power of attorney in place helps to avoid this situation and ensures that the individual's financial matters are handled according to their wishes.

Common mistakes

When it comes to completing the California Durable Power of Attorney form, a number of common mistakes often arise. These errors can significantly affect the document's validity and functionality. Understanding these pitfalls can help individuals navigate the process more smoothly and ensure their wishes are accurately represented and legally sound.

-

Not Specifying Powers Clearly: One significant mistake is not being specific enough about the powers granted. This document requires clarity to ensure that the agent knows exactly what they can and cannot do on behalf of the principal.

-

Choosing the Wrong Agent: Another common error is choosing an agent without considering their ability to act responsibly in the principal's best interest. Trustworthiness and reliability are paramount qualities the agent must possess.

-

Failing to Include Alternate Agents: Life is unpredictable. The initially chosen agent might become unable or unwilling to serve. Failing to name an alternate can leave affairs in limbo and necessitate court intervention.

-

Omitting the Sign and Date: A surprisingly common oversight is forgetting to sign and date the form. This simple misstep can invalidate the document, rendering it useless when needed most.

-

Not Having It Witnessed or Notarized: Depending on the state’s requirements, some durable power of attorney forms must be either witnessed or notarized to be legally effective. In California, while notarization isn’t a statutory requirement, it can add a layer of validity and is highly recommended.

Incorrectly filled out forms can lead to misunderstandings, legal battles, and the principal's wishes not being followed. It's crucial for individuals to approach this task thoughtfully, seeking guidance when necessary, to ensure that the document accurately reflects their intentions and meets all legal standards.

Documents used along the form

When managing personal affairs, particularly in preparing for future incapacities, it is vital to have a comprehensive legal framework in place. A Durable Power of Attorney (POA) form in California is one key document that allows an individual to appoint someone else to make decisions on their behalf. However, to ensure all aspects of one's personal and medical affairs are covered, several other documents are often used in conjunction with a Durable POA. Each document serves a unique purpose and complements the Durable POA, creating a more comprehensive approach to personal and estate planning.

- Advance Health Care Directive (AHCD): This allows individuals to outline their preferences for medical care if they become incapable of making decisions themselves. It includes choices about end-of-life care and appoints a health care agent.

- Living Will: Often included within an AHCD, a living will specifically outlines wishes regarding life-sustaining treatment in the event of a terminal condition or persistent vegetative state.

- HIPAA Authorization Form: Authorizes the release of an individual's health information to designated persons. This is crucial for the appointed health care agent to make informed decisions.

- Last Will and Testament: Specifies how an individual's property and assets are distributed after death. This document works alongside a Durable POA by addressing post-death matters.

- Revocable Living Trust: Helps manage an individual's assets during their lifetime and distribute them after death, often allowing the estate to avoid probate. The maker can serve as trustee and manage their trust as long as they are capable.

- Financial Information Sheet: While not a formal legal document, it is highly useful for the appointed agent under a Durable POA. It lists all important financial information, including accounts, assets, and liabilities, enabling the agent to manage financial affairs effectively.

Together, these documents form a robust protective shield for individuals, allowing them to dictate the management of their affairs in health and incapacity. It is vital for those drafting a Durable POA to consider including these complementary documents in their estate planning to ensure comprehensive coverage of both their personal and financial matters. Consulting with a legal professional can provide clarity and guidance in preparing these essential documents, ensuring they are correctly executed and reflect the individual's wishes accurately.

Similar forms

The California Healthcare Directive, often juxtaposed with the Durable Power of Attorney (POA), shares a common purpose in allowing an individual to designate another person to make decisions on their behalf. While the Durable POA encompasses financial and legal decision-making, the Healthcare Directive is specifically tailored towards health-related decisions. This essential document comes into play when an individual is unable to make their own medical choices due to incapacitation, ensuring their medical treatment aligns with their wishes.

Similar to the Durable POA, a General Power of Attorney is a legal mechanism that grants an agent broad powers. However, unlike its durable counterpart, this authority usually ceases if the principal becomes mentally incapacitated. This type of POA grants an agent the capacity to handle affairs across a wide spectrum, not limited to financial matters, but lacking the enduring nature to withstand the principal's incapacity.

The Limited or Special Power of Attorney is akin to the Durable Power of Attorney in allowing an individual to appoint another person to act on their behalf. However, it is distinct in its scope. While the Durable POA typically grants broad powers, a Limited POA is characterized by its specificity to certain acts or situations, such as selling a property or managing specific transactions, and often has a set duration.

The Advance Healthcare Directive bears resemblance to a Durable Power of Attorney for healthcare decisions. It allows individuals to lay out their wishes concerning end-of-life care and appoint an advocate to enforce these preferences. This proactive approach ensures that, should the individual be unable to communicate their healthcare decisions, their predetermined wishes are followed, providing peace of mind and guidance to family members during difficult times.

Trust documents, much like the Durable Power of Attorney, serve the purpose of managing an individual’s assets, but in a distinctly different manner. A trust is a legal entity one creates to hold property, managed by a trustee for the benefit of designated beneficiaries. The trustee’s powers can be as broad or as specific as the document outlines, making it a versatile tool for estate planning and asset protection beyond the scope of a POA, which ceases to be effective upon the principal’s death.

A Living Will, while different, shares common ground with the elements of a Durable Power of Attorney focused on healthcare. It specifies an individual’s preferences regarding certain medical treatments and life-sustaining measures in the event they are unable to communicate their wishes. Unlike a Healthcare Directive, which appoints another person to make decisions, a Living Will provides direct instructions to healthcare providers.

The Conservatorship is a court-appointed process that, like a Durable Power of Attorney, deals with the appointment of another individual to manage one's affairs due to incapacity. However, unlike a POA, which is arranged before incapacity and can be designated by the individual, a conservatorship comes into effect only after a court deems an individual unable to manage their affairs, offering a more restrictive and supervised form of management.

The Springing Power of Attorney is closely related to the Durable Power of Attorney but with a key distinction – it only comes into effect upon the occurrence of a specific event, typically the incapacity of the principal. This feature contrasts with a typical Durable POA, which is usually effective immediately upon execution. The Springing POA offers an extra layer of control, ensuring that the agent only obtains authority under predetermined circumstances.

The Financial Power of Attorney, a variant of the broader Power of Attorney category, specifically delegates someone to handle your financial affairs. Similar to a Durable POA, it allows for the management of one’s financial matters but doesn’t inherently include the durability feature to remain effective upon the principal's incapacity unless explicitly stated. This focus on financial affairs only distinguishes it from broader POAs that may include healthcare decisions.

Lastly, the Guardianship, akin to Conservatorship and Durable Power of Attorney, involves appointing someone to manage an individual’s personal, healthcare, and financial affairs. Typically determined through a court process, unlike a Durable POA which is organized privately, a Guardianship is designed for those who cannot make decisions for themselves, including minors or individuals with severe disabilities, offering a comprehensive solution for their well-being and financial security.

Dos and Don'ts

Filling out a Durable Power of Attorney (DPOA) form in California is a crucial step in planning for your future. It allows you to choose someone you trust to manage your finances and make decisions on your behalf should you become unable to do so yourself. To ensure the process is done correctly, here are some do's and don'ts to consider:

- Do: Choose an agent you trust implicitly. This person will have significant power over your financial affairs, so it's crucial they have your best interests at heart.

- Do: Be specific about the powers you are granting. California law allows you to tailor the authority you give your agent very specifically, so take advantage of this to ensure your wishes are clearly outlined.

- Do: Consult with a lawyer. Legal advice can help you understand all implications and ensure the form complies with California law.

- Do: Sign the document in the presence of a notary public. This step is critical for the DPOA to be legally binding in California.

- Do: Inform your chosen agent about their appointment and discuss your expectations with them. They need to be prepared and willing to take on this responsibility.

- Don't: Wait until it's too late. It's best to take care of this well before the authority is needed. An unforeseen event can occur at any time, leaving your affairs in limbo if you haven't prepared.

- Don't: Fill out the form in haste. Take your time to consider all your options and the extent of powers you're comfortable granting.

- Don't: Use a generic form without checking that it complies with California's specific requirements. State laws vary, and using the wrong form could render your DPOA ineffective.

By following these guidelines, you can help ensure that your California Durable Power of Attorney effectively protects your interests and provides peace of mind for both you and your loved ones.

Misconceptions

When it comes to drafting a Durable Power of Attorney (POA) in California, several misconceptions can lead to confusion and complications. It's important to dispel these myths to ensure individuals are fully informed about the implications and processes involved in creating a Durable POA.

- Myth 1: A Durable Power of Attorney grants control over all aspects of your life.

Many believe that by granting someone a Durable POA, they relinquish control over all personal decisions. In reality, this document specifically allows the person you choose to handle your financial affairs and legal decisions, especially when you're unable to do so yourself. It does not grant them control over personal aspects like healthcare decisions unless it explicitly states so.

- Myth 2: You can only appoint a family member as your attorney-in-fact.

This is a common misconception. The truth is, you can appoint anyone you trust to be your attorney-in-fact (the person designated to make decisions on your behalf). This can include friends, professional advisors, or even organizations, provided they are of legal age and capable of making informed decisions.

- Myth 3: A Durable Power of Attorney is effective immediately after signing.

While many assume that a Durable POA becomes effective as soon as it is signed, this is not always the case. Some POAs are drafted to become effective only upon the occurrence of a specific event, often the grantor's incapacity, which must be verified by a medical professional. This is known as a "springing" power of attorney.

- Myth 4: Once granted, a Durable Power of Attorney is irrevocable.

A common misconception is that once you have granted someone a Durable POA, the decision is final and cannot be changed. In fact, as long as you, the principal, are mentally competent, you can revoke or modify the POA at any time. It's vital to keep the document updated to reflect your current wishes and circumstances.

Key takeaways

The California Durable Power of Attorney (POA) form is a legal document that allows someone to act on your behalf in financial matters if you become unable or unwilling to manage them yourself. Here are key takeaways for filling out and using this essential form:

Filling out the form correctly is crucial. It requires accurate information about the person granting the power (the principal) and the person receiving the power (the agent).

Choosing a trustworthy agent is vital, as this person will have control over important financial decisions and transactions.

The form must be signed in the presence of a notary public or two witnesses, depending on California state laws, to be legally binding.

Clearly specifying the powers granted to the agent helps in preventing misuse of the authority. These can range from handling bank accounts to selling property.

A Durable Power of Attorney remains effective even if the principal becomes incapacitated, differentiating it from a general POA, which becomes invalid under such circumstances.

The principal has the right to revoke the power of attorney at any time, provided they are mentally competent.

It’s advisable to specify a start date and, if desired, an end date for the POA’s validity to avoid any confusion.

Holding a copy of the document is important for the agent, as financial institutions and other entities will require seeing it before allowing the agent to act on the principal’s behalf.

Reviewing and updating the POA periodically ensures that it reflects the principal’s current wishes and that the chosen agent is still willing and able to serve.

Properly executing a Durable Power of Attorney in California ensures that financial matters are managed according to the principal’s wishes, providing peace of mind to all parties involved.

Create Some Other Templates for California

How to Write a Cease and Desist - If ignored, the Cease and Desist Letter can be presented in court as evidence of an attempt to resolve the issue peacefully.

Avoid Probate in California - It offers an empowering option for individuals to ensure their real estate is transferred according to their wishes, with minimal legal complexity.