Attorney-Approved California Employment Verification Document

In the bustling world of employment within the Golden State, stakeholders from various sectors find the California Employment Verification form a critical document, bridging the gap between potential employment opportunities and regulatory compliance. As a cornerstone of the hiring process, this form serves not only as a testament to an individual's eligibility to work within the United States but also plays a pivotal role in ensuring employers adhere to state and federal mandates. Highlighting a multifaceted approach to employment verification, this document encompasses detailed information pertaining to an employee's work authorization, thus mitigating potential legal hurdles for companies. Moreover, its significance extends beyond mere compliance; it underscores a commitment to fostering a legally sound and inclusive workforce. Tailored to meet stringent regulatory requirements, the California Employment Verification form embodies the nuanced intersection of employment law, immigrant rights, and corporate responsibility, making its thorough understanding and proper execution indispensable for businesses operating within California's dynamic economic landscape.

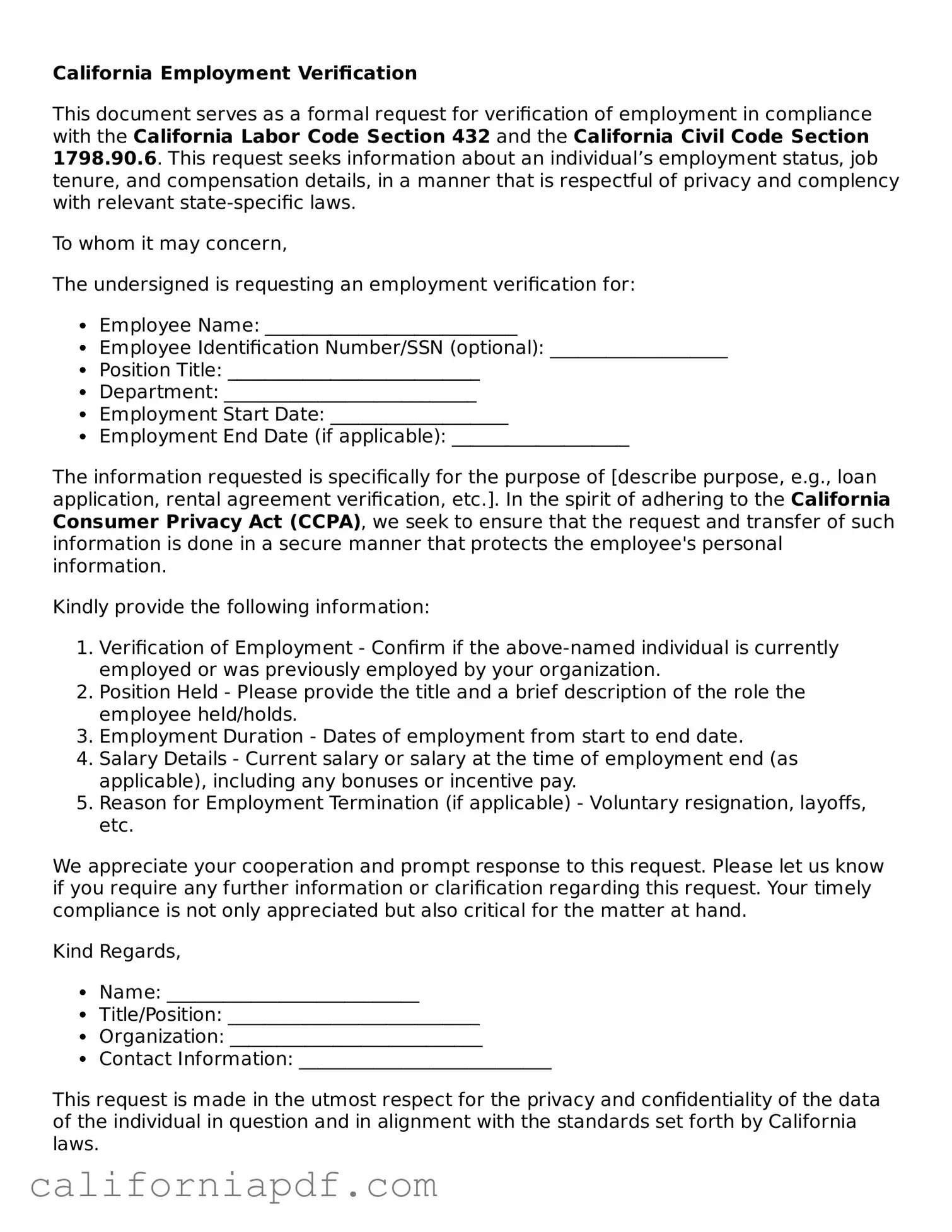

Document Example

California Employment Verification

This document serves as a formal request for verification of employment in compliance with the California Labor Code Section 432 and the California Civil Code Section 1798.90.6. This request seeks information about an individual’s employment status, job tenure, and compensation details, in a manner that is respectful of privacy and complency with relevant state-specific laws.

To whom it may concern,

The undersigned is requesting an employment verification for:

- Employee Name: ___________________________

- Employee Identification Number/SSN (optional): ___________________

- Position Title: ___________________________

- Department: ___________________________

- Employment Start Date: ___________________

- Employment End Date (if applicable): ___________________

The information requested is specifically for the purpose of [describe purpose, e.g., loan application, rental agreement verification, etc.]. In the spirit of adhering to the California Consumer Privacy Act (CCPA), we seek to ensure that the request and transfer of such information is done in a secure manner that protects the employee's personal information.

Kindly provide the following information:

- Verification of Employment - Confirm if the above-named individual is currently employed or was previously employed by your organization.

- Position Held - Please provide the title and a brief description of the role the employee held/holds.

- Employment Duration - Dates of employment from start to end date.

- Salary Details - Current salary or salary at the time of employment end (as applicable), including any bonuses or incentive pay.

- Reason for Employment Termination (if applicable) - Voluntary resignation, layoffs, etc.

We appreciate your cooperation and prompt response to this request. Please let us know if you require any further information or clarification regarding this request. Your timely compliance is not only appreciated but also critical for the matter at hand.

Kind Regards,

- Name: ___________________________

- Title/Position: ___________________________

- Organization: ___________________________

- Contact Information: ___________________________

This request is made in the utmost respect for the privacy and confidentiality of the data of the individual in question and in alignment with the standards set forth by California laws.

PDF Form Characteristics

| Fact Number | Description |

|---|---|

| 1 | The California Employment Verification form is required for verifying the eligibility of individuals for employment in the state. |

| 2 | This form must be completed by employers for each individual they hire. |

| 3 | The governing law for the employment verification process in California is the Immigration Reform and Control Act (IRCA). |

| 4 | Employers are required to retain completed forms for a specified period, typically three years after the date of hire or one year after employment ends, whichever is later. |

| 5 | The form requires information about the employee's identity and their eligibility to work in the United States. |

| 6 | Employers must verify the documentation provided by the employee to prove their identity and work eligibility. |

| 7 | The form is part of the federal form I-9 process, but California employers might have additional state-specific requirements or forms to complete. |

| 8 | Failure to properly complete, retain, and/or present these forms for inspection can result in legal penalties against the employer. |

| 9 | Although electronic completion and storage of the form are permissible, they must adhere to specific regulations to be considered valid. |

How to Write California Employment Verification

Once you've decided to hire someone in California, you're required to verify their employment eligibility. This is an essential step that not only complicates with federal and state laws but also ensures your workforce is authorized to work in the United States. This process involves filling out the California Employment Verification form correctly. The procedure is straightforward if you follow these steps. Remember, this document must be completed for each employee to verify their eligibility for employment.

- Start by collecting the necessary information from your new employee, including their legal name, address, date of birth, and Social Security number.

- On the form, enter the employee's full name (last name, first name, and middle initial) in the designated section.

- Fill in the employee's address, including the street number, city, state, and ZIP code.

- Enter the employee's date of birth in the format MM/DD/YYYY.

- Record the employee's Social Security number in the appropriate field.

- Check the box that corresponds to the employee's citizenship or immigration status. This section is crucial as it determines their work eligibility.

- If the employee is not a U.S. citizen but is authorized to work in the country, enter their Alien Registration Number or USCIS Number.

- For employees who present a document or documents for Section 2, complete the document information fields, including the document title, issuing authority, number, and expiration date, if applicable.

- The employer or authorized representative must fill out the certification area, including their name, title, and the date the form was completed. This section also requires the business's name and address.

- Ensure the employee and the employer (or authorized representative) have signed and dated the form.

After completing the form, it's essential to keep a copy for your records. This document does not need to be filed with any state or federal agency, but it must be available for inspection by authorized U.S. Government officials. Staying organized and ensuring all forms are correctly filled out and retained will help facilitate a smooth verification process for every new hire.

Listed Questions and Answers

What is the purpose of the California Employment Verification form?

The California Employment Verification form serves a crucial role in the hiring process, providing a standardized way for employers to confirm the eligibility of prospective employees to work in the United States. Its design is to ensure compliance with the federal regulations that mandate the verification of an individual's legal authorization to engage in employment within the country. This process safeguards both employers and employees by establishing legal work status from the outset of employment.

Who needs to fill out the California Employment Verification form?

Every employee working in California is required to complete the Employment Verification form, commonly referred to as Form I-9. This requirement encompasses both citizens and non-citizens. The form is a dual-responsibility document:

- The employee must provide truthful information about their identity and eligibility to work.

- The employer must review the documents provided by the employee to ensure they meet the criteria set by the federal government.

What documents are needed to complete the form?

Completing the California Employment Verification form requires specific documents that prove the employee's identity and their authorization to work in the U.S. These documents are categorized into three groups:

- List A documents verify both identity and employment authorization (e.g., U.S. Passport, Permanent Resident Card).

- List B documents verify identity only (e.g., Driver's License, state-issued ID card).

- List C documents verify employment authorization only (e.g., Social Security Card, birth certificate).

How long must employers retain the completed California Employment Verification form?

Employers are required to retain the completed California Employment Verification form for either three years after the date of hire or one year after the date employment ends, whichever is later. This retention requirement is crucial for demonstrating compliance with federal laws, should the employer need to present these forms for inspection by authorized federal officials. The storage of these forms must be in a manner that ensures their confidentiality and accessibility for the required retention period.

Are there penalties for failing to complete or retain the Employment Verification form correctly?

Yes, employers face significant risks for non-compliance with the requirements of the Employment Verification form. Penalties can range from fines to criminal penalties for knowingly hiring or continuing to employ unauthorized workers. Moreover, failing to properly complete, retain, or make available the forms for inspection as required by law can lead to administrative fines. These penalties underscore the importance of adhering to all relevant federal guidelines regarding employment eligibility verification.

Common mistakes

Filling out the California Employment Verification form is a crucial step in many processes like applying for loans or government benefits. While it might seem straightforward, people often make mistakes that can delay or complicate matters. Here are six common errors to watch out for:

- Skipping sections - Every field is important. Even if you think a section doesn’t apply, review it carefully. Leaving parts blank can result in processing delays.

- Incorrect employer information - Double-check the accuracy of your employer’s details. Mistakes here can lead to verification issues.

- Mismatched employment dates - Ensure that the start and end dates of employment are correct. Discrepancies might raise questions about your employment history.

- Using informal names - Always use the full legal name of your employer. Nicknames or abbreviations might not be recognized.

- Forgetting to sign and date - Your signature and the date certify that the information you provided is true and accurate. Missing these can invalidate the form.

- Ignoring instructions - Detailed instructions are provided for a reason. They guide you on how to properly fill out the form, including which parts to complete and what documentation might be needed to support your submission.

By avoiding these common errors, you can ensure that your California Employment Verification form is completed accurately and processed smoothly.

Documents used along the form

When verifying employment in California, the Employment Verification form is a key document. It confirms an individual's employment status, position, salary, and employment dates with a company. However, this form is often used in conjunction with several other documents, depending on the context of verification, such as for loan applications, government benefits application, or rental agreements. Below is a list of other forms and documents that might be used alongside the California Employment Verification form.

- W-2 Forms: These provide detailed information on an employee's annual earnings and tax deductions. Employers issue them annually in compliance with federal tax requirements.

- Pay Stubs: Pay stubs serve as proof of current income and verify the details provided on the Employment Verification form. They include information on earnings, deductions, and net pay for each pay period.

- I-9 Employment Eligibility Verification: Required by federal law, the I-9 form validates an employee's legal right to work in the United States. It is completed by both employer and employee.

- Offer Letters: These letters can support employment verification by providing details on the terms of employment, including position, salary, and start date, as agreed upon by the employer and the employee.

- Employee Identification Badges: While not a document, an employee identification badge can serve as a form of employment verification by confirming the individual's current employment status with the organization.

- Loan Application Forms: When applying for loans, the employment verification form may be used in conjunction with specific loan application forms which detail the loan amount, purpose, and terms requested by the borrower.

- Rental Application Forms: For renting property, landlords might require an Employment Verification form alongside rental application forms that collect information on the applicant's income, employment, and rental history.

Together, these documents comprehensively support the verification of an individual's employment and income. They are essential for various processes that require proof of employment and financial stability, reinforcing the importance of accurate and thorough employment verification.

Similar forms

The Form I-9, Employment Eligibility Verification, shares fundamental similarities with the California Employment Verification form, primarily in its objective to validate an individual's eligibility to work in the United States. Both documents require employees to present identification and work authorization documents. The Form I-9 is a federal requirement, emphasizing its widespread use across the country, whereas the California version is more state-specific yet complements the broader goal of ensuring a legal workforce.

The W-4 Form, or Employee's Withholding Certificate, although primarily concerned with tax withholding preferences, parallels the California Employment Verification form in its significance at the onset of employment. Both are integral to the hiring process, ensuring compliance with federal and state regulations. The W-4 helps determine the amount of taxes to withhold from an employee's paycheck, indirectly supporting the legal employment framework by ensuring tax compliance.

Similar to the California Employment Verification form, State Disability Insurance (SDI) forms are pivotal for employees in California, enabling workers to claim disability benefits. While the Employment Verification form authenticates employment eligibility, the SDI forms ensure that employees who become disabled can receive short-term benefits, highlighting the state's provision for worker support and legal employment benefits.

Another parallel document is the California New Hire Reporting Form. This form, like the Employment Verification form, is submitted for every new employee. Its purpose is to inform state agencies about new hires for the enforcement of child support obligations. Both forms are vital for compliance with state regulations and aid in the maintenance of legal employment practices and support obligations enforcement.

The Equal Employment Opportunity (EEO) Self-Identification Form also shares similarities with the California Employment Verification form. While the EEO form focuses on collecting demographic information for compliance with federal equal employment opportunity laws, it complements the Employment Verification form in ensuring a diverse and discrimination-free workplace, reinforcing the legal and ethical standards of employment practices.

Direct Deposit Authorization forms, commonly used by employers to deposit employees' wages directly into their bank accounts, pair with the California Employment Verification form by necessitating accurate employee information for financial transactions. Though one pertains to financial logistics and the other to legal employment verification, both require precision and truthfulness to ensure lawful and efficient employment operations.

Finally, the Emergency Contact Information Form bears resemblance to the California Employment Verification form in its function as a standard document collected at the time of hire. While serving different purposes – one for legal work eligibility and the other for safety protocols – they collectively ensure that an employer maintains a comprehensive and compliant dossier on each employee, reinforcing the structured and regulated nature of the employment relationship.

Dos and Don'ts

When filling out the California Employment Verification form, it's crucial to follow specific guidelines to ensure accuracy and compliance with state laws. Here are key dos and don'ts to keep in mind:

Do:

Double-check all the information you provide for accuracy. Mistakes can lead to delays or problems in the verification process.

Use black or blue ink if filling out the form by hand. These colors are standard and ensure readability.

Complete every required field. Skipping sections can result in an incomplete submission, which may not be processed.

Provide clear, legible writing if not filling it out electronically. Poor handwriting can lead to misunderstandings or incorrect data entry.

Consult the instructions for any unclear sections. It’s better to seek clarification than to guess and make an error.

Include all necessary supporting documents. Certain verifications may require additional paperwork to substantiate the employment claim.

Verify the submission deadline and method. Submit the form accordingly to avoid any compliance issues.

Don't:

Fabricate any details within the form. False information can lead to legal consequences and undermine the verification process.

Use correction fluid or tape on the form. If you make a mistake, it's best to start over on a new form to maintain cleanliness and legibility.

Submit the form without double-checking it for errors. A quick review can catch and correct any mistakes before submission.

Ignore the specific requirements or instructions related to the form. Each part of the form has a purpose and should be correctly filled out.

Leave required fields empty. If a section does not apply, indicate with a "N/A” (not applicable) instead of leaving it blank.

Forget to sign and date the form. An unsigned or undated form is often considered invalid and will not be processed.

Delay submitting the form. Timeliness is critical in many employment verification processes, and delays can impact employment opportunities.

Misconceptions

Many misconceptions surround the Employment Verification form in California, often leading to confusion among employers and employees alike. Here are some of the common misunderstandings clarified:

- It’s only needed for foreign workers: A prevalent misconception is that employment verification forms are necessary solely for individuals who are not U.S. citizens. In reality, this form is required for all employees, regardless of their nationality, to verify their eligibility to work in the United States.

- It's interchangeable with tax forms: Some people mistakenly believe that employment verification and tax forms serve the same purpose and can be used interchangeably. However, employment verification forms specifically confirm an individual’s eligibility to work, whereas tax forms relate to an employee's tax obligations.

- Employers can fill it out before the employee is hired: There's a common misconception that employers can complete and submit the employment verification form before officially hiring an employee. This is incorrect. The employee must be hired, as the form requires information that the employee must provide.

- Digital copies are not acceptable: In today’s digital age, this is a significant misunderstanding. While original signatures were once necessary, current regulations allow for digital completion, signatures, and storage of the form, provided they adhere to specific requirements.

- It’s a one-time verification: Another misunderstood aspect is the belief that once the employment verification form is completed, it never needs to be revisited. The truth is, re-verification may be necessary, for example, if an employee’s work authorization documentation expires, necessitating an update to their employment eligibility status.

- Small businesses are exempt: A common myth is that small businesses, because of their size, do not need to comply with the employment verification requirements. This is inaccurate as all employers, regardless of size, are obligated to complete and retain an Employment Verification form for every person they hire.

Key takeaways

When dealing with the California Employment Verification form, understanding its key aspects can greatly smooth the process for both employers and employees. Here are five important takeaways to keep in mind:

- Accuracy is critical: Every piece of information you provide on the form needs to be accurate. Misinformation, whether intentional or accidental, can lead to complications, ranging from delays in processing to legal issues.

- Privacy matters: The information you share is personal and sensitive. The California Employment Verification form features measures to protect your privacy, but it's also essential for you and your employer to handle the form and the information it contains responsibly.

- Time frames are important: There are specific time frames within which the Employment Verification form must be completed and submitted. Adhering to these timelines is essential for compliance with state laws and regulations.

- Understand the purpose: The primary reason for the Employment Verification form is to confirm that an individual is legally authorized to work in the United States. It's a crucial step in the employment process, ensuring that both employer and employee meet federal and state employment eligibility requirements.

- Seek clarification when needed: If there's anything on the form that's unclear, it's important to ask for clarification from a human resources representative or consult legal resources. Misunderstandings can lead to errors, so it's much better to ask questions up front.

Adhering to these guidelines can facilitate a smoother verification process, ensuring that all legal requirements are met while protecting the rights and privacy of employees.

Create Some Other Templates for California

Bill of Sale for a Car - This document serves as proof of purchase and includes details such as the boat's make, model, year, and hull identification number.

Bill of Sale for Trailers - Vital for maintaining a clear record of the ownership lineage of an RV for future reference or sale.

What Does a Durable Power of Attorney Allow You to Do - The General Power of Attorney ceases to be effective if you become incapacitated, highlighting its role in non-health related decisions.