Attorney-Approved California General Power of Attorney Document

In the state of California, individuals have the opportunity to make arrangements for the management of their financial affairs through the use of a General Power of Attorney form. This particular legal document plays a vital role by granting another person, known as the agent or attorney-in-fact, the authority to handle financial transactions on behalf of the principal. The breadth of powers included can cover a wide range of activities, from buying and selling property to managing bank accounts and investments. It is imperative for those considering this form of delegation to understand its full scope, including the conditions under which the power can be activated and any limitations that may apply. The process of establishing a General Power of Attorney requires adherence to specific legal requirements, aiming to ensure that the document is valid and enforceable. Additionally, it is essential to carefully select a trustworthy agent since the powers granted involve significant responsibility and control over the principal's financial well-being.

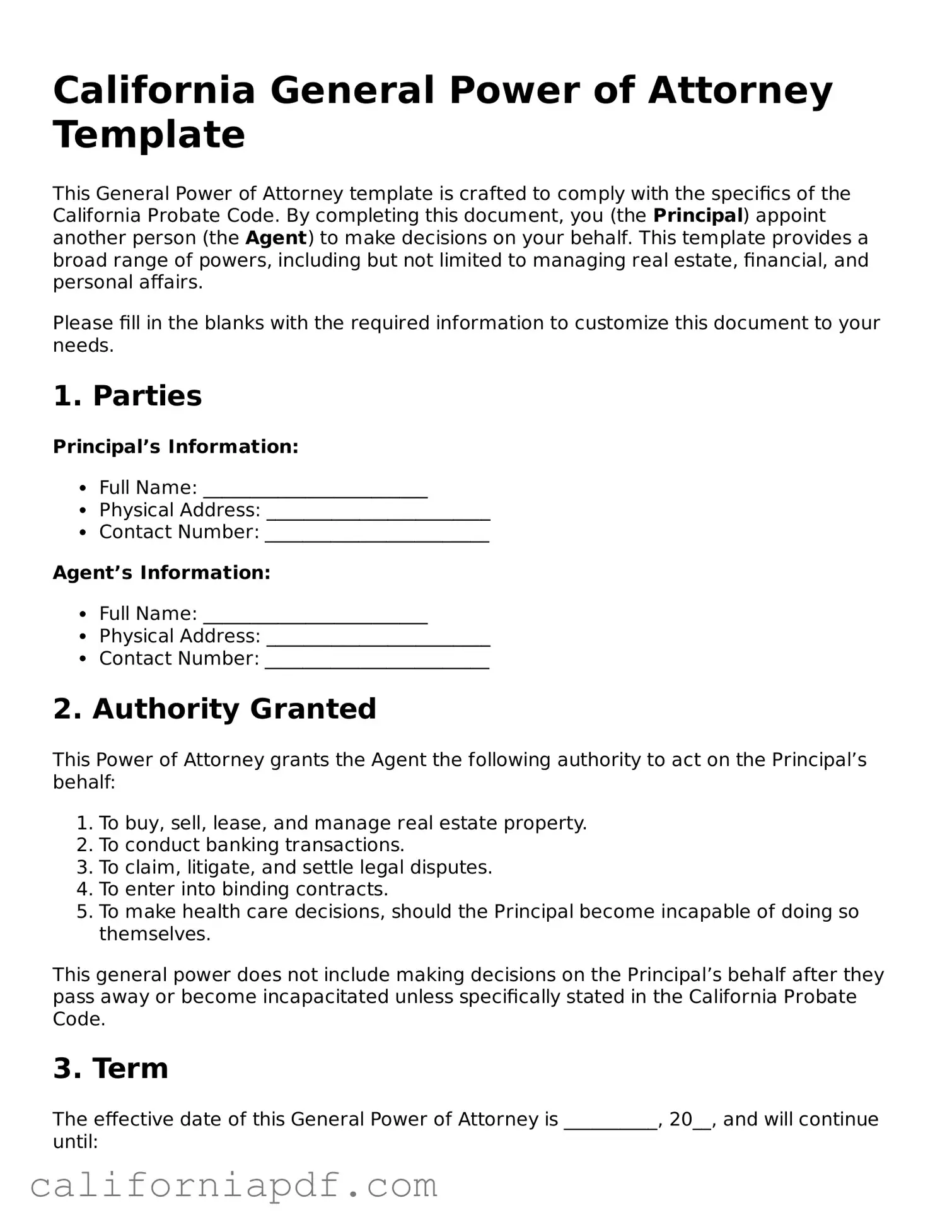

Document Example

California General Power of Attorney Template

This General Power of Attorney template is crafted to comply with the specifics of the California Probate Code. By completing this document, you (the Principal) appoint another person (the Agent) to make decisions on your behalf. This template provides a broad range of powers, including but not limited to managing real estate, financial, and personal affairs.

Please fill in the blanks with the required information to customize this document to your needs.

1. Parties

Principal’s Information:

- Full Name: ________________________

- Physical Address: ________________________

- Contact Number: ________________________

Agent’s Information:

- Full Name: ________________________

- Physical Address: ________________________

- Contact Number: ________________________

2. Authority Granted

This Power of Attorney grants the Agent the following authority to act on the Principal’s behalf:

- To buy, sell, lease, and manage real estate property.

- To conduct banking transactions.

- To claim, litigate, and settle legal disputes.

- To enter into binding contracts.

- To make health care decisions, should the Principal become incapable of doing so themselves.

This general power does not include making decisions on the Principal’s behalf after they pass away or become incapacitated unless specifically stated in the California Probate Code.

3. Term

The effective date of this General Power of Attorney is __________, 20__, and will continue until:

- The Principal revokes it in writing.

- The Principal passes away.

- A court decides that the Principal is fully incapacitated (if not already specified).

4. Signature

To make this document legally binding, both the Principal and the Agent must sign below:

Principal’s Signature: ________________________ Date: __________, 20__

Agent’s Signature: ________________________ Date: __________, 20__

This document was prepared on the basis of information provided and is intended for use only in the State of California. It is recommended to review this document with a legal professional to ensure it meets your specific needs and complies with current California law.

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Definition | A California General Power of Attorney form grants broad powers to an individual to make legal decisions and conduct transactions on behalf of another person. |

| Governing Law | It is governed by the California Probate Code, specifically sections 4000 to 4545. |

| Eligibility | The person giving power must be mentally competent at the time of signing the form. |

| Agent Requirements | The appointed agent must be a trustworthy individual, ideally familiar with the principal's affairs and capable of acting in their best interest. |

| Powers Granted | The form enables the agent to manage financial, real estate, and personal matters for the principal. |

| Duration | Unless stated otherwise, it remains effective until the principal dies or revokes the power granted. |

| Revocation | The principal can revoke the power of attorney at any time as long as they are mentally competent. |

| Signing Requirements | It must be signed in the presence of a notary public or two adult witnesses, according to California law. |

| Limitations | It does not grant the agent the authority to make healthcare decisions for the principal. |

How to Write California General Power of Attorney

Filling out a General Power of Attorney form in California is an important process that allows you to appoint someone else to manage your affairs, should you become unable to do so yourself. This could be due to a variety of reasons such as travel, illness, or incapacity. The person you choose will have the power to make decisions on your behalf, so it's crucial to choose someone you trust implicitly. Below are steps to help you accurately complete the form, ensuring your affairs will be handled according to your wishes.

- Begin by locating the most current version of the General Power of Attorney form for California. This can usually be found online through legal resources or at a local attorney's office.

- Next, you'll need to fill in your full name and address at the top of the form. This identifies you as the principal, the person granting power to another.

- In the section provided, write the full name and address of the person you're appointing as your agent. This is the individual you're giving authority to act on your behalf.

- Specify the powers you are granting your agent. Be as detailed as possible to avoid any ambiguity. This might include powers to handle financial transactions, make decisions about real estate, or manage your business affairs.

- If there are any powers you do not wish to grant your agent, make sure you clearly indicate these exceptions on the form. It's important to be precise to ensure your intentions are fully understood.

- Some forms have a section where you can designate an alternate agent. Fill in this part if you want to appoint a secondary agent to act in case your primary agent is unable or unwilling to serve.

- Review the durability provisions carefully. In California, a General Power of Attorney can be made "durable," meaning it remains in effect even if you become incapacitated. If this is your intent, ensure the appropriate box is checked or section is filled out.

- Sign and date the form in the presence of a notary public. California law requires your General Power of Attorney to be notarized to be legally valid.

- Finally, give the original signed form to your agent and keep a copy for your records. It's also a good idea to provide copies to institutions like your bank or healthcare provider, where your agent may need to act on your behalf.

After you've completed these steps, your agent will have the legal authority to make decisions and act in your place regarding the powers you've designated. Remember, you can revoke or change your General Power of Attorney at any time, as long as you are mentally competent. Always keep a record of who has copies of your documents, and don't hesitate to seek legal advice if you have questions or concerns about the process.

Listed Questions and Answers

What is a California General Power of Attorney?

A California General Power of Attorney (GPA) is a legal document that lets you (the principal) appoint someone you trust (the agent) to manage your affairs. This appointment can include handling financial transactions, buying or selling property, and managing other personal and business matters. The authority you give in a General Power of Attorney is broad and typically ends if you become incapacitated or upon your death unless specified otherwise.

Who can serve as an agent under a California General Power of Attorney?

In California, nearly any adult can serve as an agent, also known as an attorney-in-fact, under a General Power of Attorney. The chosen agent should be someone trustworthy and capable of handling the responsibilities you are entrusting to them. It could be a family member, a friend, or a professional. The law requires the agent to act in your best interests, maintain accurate records, keep your property separate from theirs, and avoid conflicts of interest.

How can I revoke a California General Power of Attorney?

You have several options for revoking a General Power of Attorney in California:

- Writing a formal revocation document that states your intention to revoke the power of attorney and delivering it to your current agent.

- Creating a new power of attorney that explicitly revokes the previous one.

- Physically destroying the original power of attorney document, thereby rendering it invalid.

Does a California General Power of Attorney need to be notarized?

Yes, for a California General Power of Attorney to be legally effective, it needs to be notarized. This means you and any witnesses must sign the document in the presence of a notary public. The notary public will verify everyone's identity and ensure that all parties are signing the document willingly and under no duress. Notarization helps protect against forgery and fraud, ensuring that the document is legally binding.

Common mistakes

Filling out a California General Power of Attorney form involves a great amount of responsibility and attention to detail. Common pitfalls often undermine the form's effectiveness, affecting the principal's future and the agent's ability to act on their behalf. From overlooking crucial legal requirements to misunderstanding the power being granted, these mistakes can have far-reaching consequences. It's important to approach this task with the necessary due diligence and perhaps legal guidance to ensure the document truly reflects the principal's intentions and complies with California law.

Not specifying the powers granted – A vague or overly broad description of the agent’s authority can lead to confusion and misuse of power. It's crucial to clearly outline what the agent can and cannot do.

Forgetting to designate an alternate agent – Life is unpredictable. If the primary agent is unable to perform their duties, having a successor agent listed can keep affairs moving smoothly without court intervention.

Failing to consider the form’s durability – A general power of attorney in California can be either durable or non-durable. Not making a clear declaration means the document automatically becomes non-durable, ceasing its power if the principal becomes incapacitated.

Improper or incomplete signing procedures – California law has specific requirements for signing a power of attorney, including witness and notarization requirements. Neglecting these formalities can invalidate the entire document.

Not specifying an effective date or duration – Without clear instructions on when the power of attorney begins and ends, it might not be effective when needed or could grant power for longer than intended.

Overlooking financial institution policies – Some banks and financial institutions have their own forms and requirements. Failure to comply with these can lead to refusal in honoring the power of attorney.

Misunderstanding the authority being granted – It’s important that both the principal and the agent fully understand the extent of authority being given. Misinterpretations can lead to actions beyond what the principal intended.

Forgetting to revoke previous powers of attorney – If a new power of attorney is being established, any existing ones should be formally revoked to avoid conflicting authorities.

Lack of specificity in healthcare decisions – Although a general power of attorney doesn’t cover healthcare decisions, if it’s meant to include any such authority, it must be specified clearly to avoid any ambiguity.

Ignoring state-specific requirements – Each state has its own rules for powers of attorney. Not adhering to California’s specific statutes and assuming one form fits all can result in an unenforceable document.

To navigate these pitfalls, detailed attention to the document’s contents and the advice from professionals familiar with California law can make a significant difference. Taking these steps not only ensures the power of attorney serves its intended purpose but also protects the rights and wishes of all parties involved.

Documents used along the form

When embarking on the journey of establishing a General Power of Attorney in California, it's crucial to be well-informed about the additional forms and documents that may play a pivotal role in the process. These documents not only complement the General Power of Attorney but also enhance its effectiveness, ensuring that all your legal and financial affairs are comprehensively managed. Below is a curated selection of forms and documents often used alongside the California General Power of Attorney form, each serving a specific function to provide thorough legal coverage and peace of mind.

- Advance Health Care Directive: This vital document allows individuals to outline their preferences for medical care in the event they are no longer capable of making decisions due to illness or incapacity. It complements a General Power of Attorney by covering health care decisions that fall outside the scope of financial matters.

- Durable Power of Attorney for Health Care: Similar to the Advance Health Care Directive, the Durable Power of Attorney for Health Care designates someone to make health-related decisions on behalf of the individual, should they become incapacitated. It often includes specific guidance on the person’s health care wishes.

- Living Will: Focused exclusively on end-of-life care, a Living Will delineates what medical actions should be taken if the person is unable to communicate their desires, working in tandem with the Advance Health Care Directive to provide clear instructions for such situations.

- Financial Records Release: This form authorizes the release of financial records to the person holding the Power of Attorney, ensuring that they have access to all necessary information for managing the individual's financial affairs effectively.

- Real Estate Deeds: When transferring or managing real property, Real Estate Deeds are often required. These legal documents formally document the change of ownership or clarify the powers related to the handling of real estate under the General Power of Attorney.

- Vehicle Power of Attorney: This document grants authority to another individual to handle matters related to the ownership or sale of a vehicle. It is particularly useful when the principal cannot be present to sign necessary paperwork themselves.

- Statement of Authority: Often used in business contexts, this document outlines the specific powers granted to the agent, including any limitations. It provides third parties, such as financial institutions or companies, with clarity regarding the agent’s role and extent of their authority.

Employing these documents alongside a General Power of Attorney in California ensures a comprehensive legal strategy, safeguarding not only financial assets but also personal wishes regarding health care and end-of-life decisions. The deliberate use of these complementary forms creates a robust framework for managing an individual's affairs, reflecting their wishes accurately and ensuring their well-being and peace of mind. Knowing about and utilizing these additional documents provides an added layer of security and preparedness in navigating the complexities of legal and health care planning.

Similar forms

The California General Power of Attorney form shares similarities with the Durable Power of Attorney document. Both authorize a person, known as the agent, to make decisions on behalf of another person, the principal. The key distinction lies in their durability: while a General Power of Attorney ceases to be effective if the principal becomes incapacitated, a Durable Power of Attorney remains in effect, ensuring that the agent can continue making decisions even if the principal cannot.

Similar to the Medical Power of Attorney, the General Power of Attorney form permits someone to act on another's behalf. However, while the General Power of Attorney encompasses a wide range of actions, including financial and business decisions, a Medical Power of Attorney is specifically focused on healthcare decisions, empowering the agent to make medical choices for the principal when they are unable to do so themselves.

The Limited Power of Attorney is akin to the General Power of Attorney, with the fundamental difference being in scope. A Limited Power of Attorney grants the agent authority to act in specific situations or for particular tasks, such as closing a home sale. In contrast, a General Power of Attorney offers broader powers, allowing the agent to conduct a wide range of activities on the principal’s behalf.

The California General Power of Attorney form and the Springing Power of Attorney have a similar purpose but differ in their activation criteria. A Springing Power of Attorney becomes effective only under conditions specified in the document, typically the principal's incapacitation. This feature contrasts with a General Power of Attorney, which is usually effective immediately upon signing and does not depend on the principal's physical or mental state.

The Financial Power of Attorney shares similarities with the California General Power of Attorney form by authorizing an agent to handle the principal's financial affairs. Nonetheless, a Financial Power of Attorney can be either general, giving broad authority over financial decisions, or limited, focusing on specific transactions, allowing for a narrower or broader scope similar to General Power of Attorney, based on how it's structured.

Regarding estate planning, the California General Power of Attorney form aligns in purpose with the Trust. Both instruments are used to manage assets; a General Power of Attorney allows an agent to manage the principal's affairs broadly while they are alive, whereas a Trust is a legal arrangement that dictates how assets are to be handled both during the grantor’s life and after their passing, potentially offering more specificity in asset distribution.

The Advance Healthcare Directive, like the Medical Power of Attorney, has a specific function somewhat related to the General Power of Attorney. It allows individuals to outline their healthcare preferences in advance and appoint someone to make healthcare decisions on their behalf. The General Power of Attorney might encompass authority to make some healthcare decisions unless limited, but an Advance Healthcare Directive provides more nuanced directives regarding medical care.

The Guardianship or Conservatorship arrangements bear resemblance to the functions a General Power of Attorney might cover, especially concerning decision-making powers for someone who is unable to make decisions themselves. While these legal arrangements are court-ordered and typically come into play when the individual has not designated someone to act on their behalf, a General Power of the Attorney serves as a voluntary designation of an agent to manage a wide array of the principal's needs.

Lastly, the Business Power of Attorney is closely related to the General Power of Attorney in the sense that it grants an agent authority to handle business-related matters on behalf of the principal. This form tends to be more specific, focusing on business transactions and operations, whereas a General Power of Attorney may allow for both personal and business affairs management but is not limited solely to business activities.

Dos and Don'ts

When dealing with the California General Power of Attorney form, it's essential to approach the process with precision and a clear understanding. This form grants significant authority to another person, known as your agent, to make decisions and act on your behalf. Here are some crucial dos and don'ts to keep in mind:

Do:- Review the form thoroughly before you start filling it out. Familiarize yourself with each section to ensure you understand the implications of the decisions you are about to make.

- Choose your agent wisely. This person will have considerable control over your affairs, so select someone you trust implicitly.

- Be specific about the powers you are granting. Clarify what your agent can and cannot do on your behalf to prevent any misuse of the power.

- Sign the document in the presence of a notary public. This step is crucial for the document to be legally valid in California.

- Provide clear instructions for how your agent should carry out their duties. This guidance can help them make decisions that align with your wishes.

- Keep the original document in a safe place, but accessible to your agent when it's needed. You might also want to give copies to financial institutions or anyone else who might need to recognize the authority of your agent.

- Review and update the document as necessary. Your circumstances or preferences may change, and your General Power of Attorney should reflect those changes.

- Delay in completing the form. It's a critical tool for managing your affairs, especially in unexpected situations.

- Forget to specify a termination date, if you only want the power to be temporary. Without a specified end date, the document remains effective until you revoke it or pass away.

- Fail to discuss your decision with close family members or loved ones. While the choice of agent is yours alone, discussing it can prevent potential conflicts or hurt feelings.

- Overlook the importance of a successor agent. If your first choice is unable or unwilling to act, having a backup is crucial.

- Assume the form doesn't need a witness or notarization. In California, notarization is typically required for the document to have legal force.

- Rely solely on generic forms without reviewing state-specific requirements. Although general forms can provide a good starting point, ensure that any form you use complies with California law.

- Ignore the need for periodic reviews. Life changes such as marriage, divorce, or the death of a chosen agent can affect the relevance of your document.

Misconceptions

Understanding the California General Power of Attorney (POA) is crucial for anyone considering this legal tool for their affairs. However, misconceptions abound, often leading to confusion and missteps. Here, we clarify some of the most persistent myths.

It grants unlimited power. Many believe a General Power of Attorney grants an agent absolute authority. In reality, it only allows the agent to perform specific acts outlined in the document, such as managing finances, real estate, and other assets.

It remains valid after the principal's death. Contrary to this belief, a General Power of Attorney automatically terminates upon the principal's death. The appropriate tool for handling affairs after death is a will or trust.

It's effective when the principal becomes incapacitated. This is incorrect; a General POA ceases to be effective if the principal becomes incapacitated unless it is specifically stated to be a durable power of attorney.

Only seniors need it. While it’s often associated with older adults, a General POA is a prudent measure for anyone, providing a safety net in case of sudden illness or incapacity.

It supersedes a will. A will and a General Power of Attorney operate in different legal domains and times; a POA is effective during the principal's lifetime, whereas a will takes effect after death. They cannot override each other.

Creating one requires a lawyer. While legal advice is recommended, it’s not a requirement. One can create a General POA using standardized forms or online resources, but it must comply with California law.

All POAs are the same. There are different types of POAs, such as durable, medical, or specific-purpose. Each serves different needs and comes into effect under different circumstances.

The agent can make decisions after the POA is revoked. Once a POA is legally revoked and relevant parties are notified, the agent's authority to make decisions on behalf of the principal ends immediately.

It allows the agent to benefit personally from their position. Agents under a POA are bound by a fiduciary duty to act in the best interest of the principal, not for their personal gain.

Any form of written consent can be considered a POA. For a document to be recognized as a General POA in California, it must meet specific legal requirements and formalities, such as being notarized, to be valid.

Dispelling these misconceptions is vital for effectively using a General Power of Attorney in California. Whether managing your affairs or assisting a loved one, clear understanding and adherence to legal guidelines ensure that the POA serves its intended purpose without complications.

Key takeaways

The California General Power of Attorney form is a legal document that enables you to appoint someone you trust to manage your affairs in case you're unable to do so yourself. Understanding how to correctly fill out and use this form is crucial to ensuring that your financial and legal affairs are handled according to your wishes. Here are seven key takeaways to consider:

- Ensure that the person you choose as your agent is someone you trust completely. This individual will have broad authority to manage your economic and legal matters.

- Despite the title "General" Power of Attorney, be specific about the powers you grant. California law requires clarity on what your agent can and cannot do on your behalf.

- Consider specifying a duration for the Power of Attorney. If no duration is mentioned, it remains effective until you revoke it or upon your death.

- Take the time to understand the difference between a "General" Power of Attorney and a "Durable" Power of Attorney. The latter remains in effect even if you become incapacitated.

- Remember, signing a General Power of Attorney does not strip you of your power to act for yourself. You can still manage all aspects of your affairs as long as you are capable.

- Ensure the form gets notarized. In California, notarization is a legal requirement for the General Power of Attorney to be recognized and enforceable.

- After completing the form, inform the relevant parties—such as your financial institutions—of the Power of Attorney to avoid any confusion about your agent’s authority to act on your behalf.

Proper execution of a General Power of Attorney form can safeguard your interests and provide peace of mind. It’s a responsible step to take for anyone looking to ensure their affairs are managed according to their wishes, but always consult with a legal professional to ensure it is done correctly.

Create Some Other Templates for California

Horse Bill of Sale Template - Helps in maintaining accurate records for breeding, competition, and health histories of the horse.

Room Rental Basic Rental Agreement Fillable - Equips both landlords and tenants with a thorough understanding of their rights and responsibilities.

Avoid Probate in California - For those seeking to avoid the potential delays and expenses associated with probate, it offers an effective alternative for real estate inheritance.