Attorney-Approved California Gift Deed Document

In the sunny state of California, the process of gifting property is made straightforward with the use of a California Gift Deed form. This legal document is vital for anyone looking to transfer ownership of property to another person without any expectation of payment or compensation. Essentially a no-cost transaction, it's a generous way of handing over real estate, vehicles, or other valuable assets to family members, friends, or charities. The form ensures that the transfer is recognized legally, protecting both the giver and the recipient. It also addresses important considerations such as the tax implications of gifting, which can vary depending on the value of the gift. Moreover, the completion of this form plays a crucial role in the documentation and registration process, making it an essential step for anyone intending to make a significant, no-strings-attached contribution to someone's life.

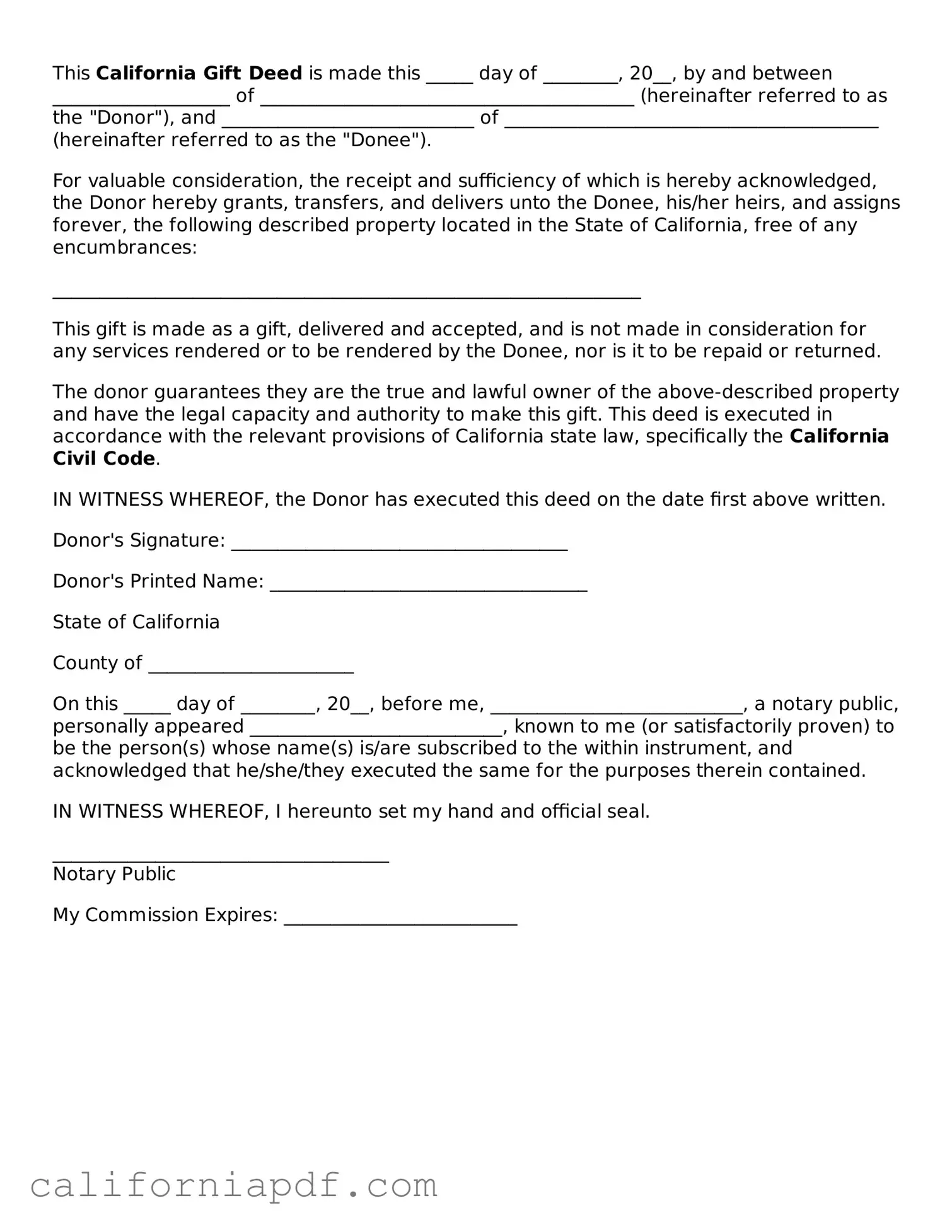

Document Example

This California Gift Deed is made this _____ day of ________, 20__, by and between ___________________ of ________________________________________ (hereinafter referred to as the "Donor"), and ___________________________ of ________________________________________ (hereinafter referred to as the "Donee").

For valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Donor hereby grants, transfers, and delivers unto the Donee, his/her heirs, and assigns forever, the following described property located in the State of California, free of any encumbrances:

_______________________________________________________________

This gift is made as a gift, delivered and accepted, and is not made in consideration for any services rendered or to be rendered by the Donee, nor is it to be repaid or returned.

The donor guarantees they are the true and lawful owner of the above-described property and have the legal capacity and authority to make this gift. This deed is executed in accordance with the relevant provisions of California state law, specifically the California Civil Code.

IN WITNESS WHEREOF, the Donor has executed this deed on the date first above written.

Donor's Signature: ____________________________________

Donor's Printed Name: __________________________________

State of California

County of ______________________

On this _____ day of ________, 20__, before me, ___________________________, a notary public, personally appeared ___________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

____________________________________

Notary Public

My Commission Expires: _________________________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The California Gift Deed form is used to transfer property from one person (the donor) to another (the donee) without any consideration or payment. |

| Governing Law | In California, the gift deed is governed by the California Civil Code Sections that pertain to the voluntary transfer of property. |

| Delivery and Acceptance | For a gift deed to be valid, it must be properly delivered to, and accepted by, the donee during the lifetime of the donor. |

| Revocability | A gift deed, once delivered and accepted, is irrevocable unless specific conditions allow for revocation, making the transfer a permanent one. |

| Recording Requirement | To protect against future disputes, the completed and executed gift deed should be recorded with the county recorder in the county where the property is located. |

| Considerations for Tax Purposes | While transferring property via a gift deed can be exempt from some forms of taxation, it may still be subject to federal gift tax laws and should be reported to the IRS. |

How to Write California Gift Deed

When someone decides to give a piece of property in California as a gift, they must complete a Gift Deed form. This document officially transfers ownership of the property from the giver (donor) to the recipient (donee) without any exchange of money. Filling out this form requires attention to detail to ensure the transfer is legally binding and recognized by the state. Follow these straightforward steps to complete the California Gift Deed form accurately.

- Begin by identifying the donor. Include the full legal name, address, and contact information of the person giving the gift.

- Next, specify the donee's full legal name, address, and contact information. It's vital to ensure this information is accurate for the deed to be valid.

- Describe the gifted property. This should include a detailed description of the property being transferred. If it's real estate, include the legal description found in the property's current deed.

- State the relationship between the donor and donee. While not always mandatory, this can clarify the intent behind the gift, especially if it's between family members.

- Include the date of the gift. Indicate when the property was officially transferred from the donor to the donee.

- Signatures are crucial. The donor must sign the deed in the presence of a notary public. Some states also require the donee's signature, so it's wise to check specific state requirements.

- File the completed deed with the county recorder's office where the property is located. This step is essential for the deed to be acknowledged legally and for the property records to be updated.

After completing these steps, the Gift Deed is finalized, and the property ownership has officially changed hands. It's recommended to keep copies of the notarized deed for personal records. Transferring property is a significant decision, and properly completing the Gift Deed form is a critical part of this process. If there are any doubts or questions during this process, consulting with a legal professional can provide clarity and ensure that every step is completed according to California law.

Listed Questions and Answers

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property from one person, the donor, to another, the donee, without any exchange of money. The deed indicates that the transfer is made freely and without consideration, purely as a gift. It is primarily used between family members or close friends and must be recorded in the county where the property is located to be effective.

Is a Gift Deed in California revocable?

Once a Gift Deed is executed, delivered to the donee, and accepted, it is generally irrevocable, meaning it cannot be taken back by the donor. To ensure clarity and avoid potential disputes, it is crucial that the deed clearly states the intent to gift the property and is properly recorded.

Are there tax implications for using a Gift Deed?

Yes, there can be tax implications for both the donor and the donee. The donor may be subject to federal gift tax if the value of the property exceeds the annual gift tax exclusion amount. It is important for the donor to file a gift tax return with the Internal Revenue Service (IRS) if required. Meanwhile, the donee might have tax implications concerning the property's future sale, specifically regarding capital gains tax based on the property's basis at the time of the gift.

What are the requirements for a Gift Deed to be valid in California?

To be valid, a Gift Deed in California must include several key elements:

- The deed must clearly state that the property transfer is a gift.

- It must contain the legal description of the property.

- The deed needs to be in writing and signed by the donor.

- It must be delivered to and accepted by the donee.

- Lastly, it needs to be notarized and recorded with the county recorder’s office where the property is located.

Does a Gift Deed require consideration to be valid?

No, a Gift Deed does not require consideration to be valid. Consideration is a legal term that refers to something of value, such as money, being exchanged. A Gift Deed operates on the premise that the property is transferred without any payment or exchange of value, emphasizing the gift's nature.

How is a Gift Deed recorded in California?

To record a Gift Deed in California, the deed must first be completed, signed by the donor, notarized, and then taken to the county recorder’s office where the property is located. A recording fee will need to be paid. The office will copy the deed into public records, making it part of the property’s legal history and officially transferring ownership to the donee.

Can property with a mortgage be transferred via a Gift Deed in California?

Yes, property with a mortgage can be transferred using a Gift Deed. However, the presence of a mortgage complicates the transfer as the mortgage remains against the property, and the lender's permission might be required. The donee becomes responsible for the mortgage unless otherwise agreed. It's essential to consult with a legal professional to understand the implications fully.

What happens if a Gift Deed is not recorded?

If a Gift Deed is not recorded, it can lead to several issues. The main problem is that the transfer might not be recognized legally, which could result in disputes about the property's true ownership. Additionally, without being recorded, future transactions involving the property could be complicated since the deed would not appear in the public record.

Can a Gift Deed be contested?

Yes, like any legal document, a Gift Deed can be contested, particularly if there are questions about the donor's mental capacity, the presence of undue influence, or if the deed was not properly executed, delivered, and accepted. It’s crucial that all legal requirements are carefully followed and documented to minimize the risk of disputes.

Common mistakes

Filling out the California Gift Deed form is a legal action that transfers ownership of property from one person to another without any exchange of money. While it might seem straightforward, there are common errors that can significantly affect the deed's validity or even cause legal disputes in the future. Here are nine mistakes to watch out for:

- Not including full and accurate information of the parties involved: It's crucial to use the complete legal names and correct addresses of both the grantor (the person giving the gift) and the grantee (the person receiving the gift). Errors or omissions can create confusion and legal issues.

- Omitting a detailed legal description of the property: Generic or incomplete descriptions of the property being gifted can invalidate the deed. The legal description usually includes the parcel number and detailed boundaries, not just the address.

- Ignoring the requirement to have the deed signed in the presence of a notary public: For the gift deed to be legally binding in California, it must be notarized. A failure to follow this step can lead to the deed being considered invalid.

- Failing to file the deed with the county recorder’s office: After the gift deed is signed and notarized, it must be filed with the county recorder in the county where the property is located. Not doing so can delay the legal transfer of ownership.

- Forgetting to check for any restrictions on the property: Some properties may have restrictions or covenants that forbid the transfer of property without certain conditions being met. Not investigating these can lead to legal challenges.

- Including incorrect or misleading information: Any false information on the deed, whether intentional or accidental, can cause the document to be voided and lead to potential legal action against the grantor.

- Assuming that a gift deed covers all property types: The California Gift Deed form is typically used for real property (like land or buildings) and might not be suitable for transferring other types of property, like personal or intellectual property.

- Overlooking tax implications: Both the grantor and grantee should be aware of any federal or state tax responsibilities that come with the gift deed. For example, the grantor might need to file a federal gift tax return.

- Not seeking legal advice: The biggest mistake is not consulting with a legal professional, especially in complex situations. A lawyer can help navigate the legal requirements and ensure the deed is completed correctly.

By paying attention to these details and seeking the appropriate guidance, individuals can execute a gift deed correctly, ensuring a smooth and legally sound transfer of property.

Documents used along the form

In the realm of transferable property rights, California, like many other jurisdictions, often requires more than a mere Gift Deed form to complete the legal transfer of property. Such documents play a considerable role in ensuring compliance with laws and regulations, offering clarity and legal efficacy to property transactions. It is essential to understand these supplementary forms, each designed to smooth the passage of property from one party to another, without financial consideration, further elucidating the intentions and legal standing of all parties involved.

- Preliminary Change of Ownership Report (PCOR): This form serves as a notification to the local County Assessor's office, detailing the change in ownership. It aids in the assessment for property tax purposes, helping to determine if the property transfer is subject to reassessment under current tax laws.

- Notary Acknowledgment: While technically part of the Gift Deed form, the notarization is crucial. A Notary Acknowledgment verifies the identity of the parties involved and confirms that they signed the document willingly and under no duress, providing a layer of legal protection and legitimacy.

- Quitclaim Deed: Occasionally used in conjunction with a Gift Deed, a Quitclaim Deed relinquishes any claim, interest, or title the grantor has in the property, without stating that such a claim exists. It's particularly useful in situations where the property's title might be unclear, providing peace of mind to all parties involved.

- Grant Deed: Similar to a Gift Deed in that it transfers property rights, a Grant Deed goes a step further by guaranteeing that the property has not been sold to someone else and is free from undisclosed encumbrances. This document is often used to reinforce the intentions and assurances behind the property transfer.

Understanding these documents within the context of a Gift Deed can provide insights into the complexities of property transfer in California. Individuals planning to navigate this space must acquaint themselves with these documents, as they play pivotal roles in legitimizing the transaction, ensuring that all legal bases are covered. Whether it's through guaranteeing the absence of encumbrances or detailing the change for tax assessment purposes, each document complements the Gift Deed, culminating in a smooth and transparent transfer of property. Recognizing the purpose and importance of each can greatly demystify the process, paving the way for a successful transfer.

Similar forms

The California Gift Deed form shares similarities with a Quitclaim Deed in that both are used to transfer property without exchanging money. A Quitclaim Deed, like a Gift Deed, is often used among family members and requires minimal guarantees about the property's title, meaning the donor makes no warranty regarding the property's lien status.

Alike the California Gift Deed, the Grant Deed is another form used for property transfer in California. However, while a Gift Deed transfers property as a gift without consideration, a Grant Deed may involve a sale and comes with certain guarantees. These guarantees include the promise that the property has not been sold to someone else and is free of undisclosed encumbrances.

A Warranty Deed, although not commonly used in California, presents another form of real estate transfer document akin to the Gift Deed. The core similarity is the transfer of property ownership; however, unlike a Gift Deed, a Warranty Deed provides the strongest guarantees to the buyer about the clear title and freedom from liens, which is not necessarily a component of the Gift Deed process.

The Life Estate Deed is related to the concept of a Gift Deed, as it involves transferring property while retaining certain rights for the original owner. Under a Life Estate Deed, the donor (or the original owner) retains the right to use the property for their lifetime after which it automatically passes to the remainderman, similar to how a Gift Deed might transfer property rights.

Similarly, a Beneficiary Deed, also known as a Transfer-on-Death Deed, parallels the Gift Deed in the sense that both allow property to be transferred upon the donor’s death without going through probate. However, a significant difference is that a Beneficiary Deed can be revoked or changed as long as the donor is alive, unlike a Gift Deed which is effective immediately.

The Revocable Living Trust document also shares a similar purpose with the Gift Deed by allowing the transfer of property. However, while a Gift Deed is a one-time transfer, a Revocable Living Trust involves placing the property into a trust, which can be altered or revoked while the grantor is alive, providing more flexibility and control over the asset during the grantor's lifetime.

Another comparable document is the Promissory Note, which is often associated with the transfer of property, particularly in private financing deals. Unlike a Gift Deed that transfers property ownership without financial consideration, a Promissory Note is a debt instrument that outlines the borrower's promise to pay back a sum to the lender, reflecting a financial transaction rather than a gift.

Last but not least, a Power of Attorney document can be related to the process of transferring property via a Gift Deed in essence. A Power of Attorney allows an individual to grant someone else the authority to make legal decisions on their behalf, which could include the power to gift or transfer property, thereby indirectly enabling a property transfer through the appointed agent's actions.

Dos and Don'ts

When filling out the California Gift Deed form, it is essential to pay close attention to detail and follow best practices. Below are lists of things you should and shouldn't do to ensure the process is completed correctly and efficiently.

Do:

- Verify that the property can legally be transferred via a gift deed.

- Include the full legal description of the property.

- Make sure the donor's and recipient's full names and addresses are accurately entered.

- Ensure the deed is signed in the presence of a notary public.

- Keep a copy of the signed deed for personal records.

- Check for any county-specific requirements or forms that might be needed in addition to the gift deed.

- File the deed with the county recorder's office where the property is located.

- Consult with a legal professional if there are any questions or uncertainties.

- Clearly state that no monetary compensation is being exchanged for the property.

- Review the form thoroughly before submitting it to ensure all information is complete and accurate.

Don't:

- Leave any sections of the form blank.

- Forget to specify the relationship between the donor and recipient, if applicable.

- Mistake the form for other types of deeds without understanding the differences.

- Ignore local or state-specific filing fees or requirements.

- Attempt to use the gift deed to transfer property that is not clearly owned by the donor.

- Overlook the tax implications of gifting property.

- Use the deed to transfer property with unresolved encumbrances without professional advice.

- Submit the form without a notarized signature.

- Assume the transfer is instant without recording the deed.

- Neglect to inform the beneficiary about the maintenance or taxes associated with the property.

Misconceptions

Understanding the California Gift Deed form can often be confusing and leads to several misconceptions. Below are eight common myths, demystified to give you a clearer understanding of how these deeds work:

Gift Deeds are complicated documents that always require a lawyer. While professional legal advice can be beneficial, the California Gift Deed form is designed to be straightforward. Simple transfers between family members or friends often don't necessitate a lawyer's intervention.

A Gift Deed is just a letter or verbal agreement. Actually, a Gift Deed must be a formal, written document that meets specific state requirements, including being filed with the appropriate county. Verbal promises or informal letters aren't legally binding as Gift Deeds.

You can retract a Gift Deed anytime you change your mind. Once a Gift Deed is executed and delivered, the giver cannot revoke the deed or take back the property without the recipient's consent. It's a completed transfer of ownership.

Gift Deeds transfer property immediately upon signing. While the execution of a Gift Deed does indicate the intent to transfer the property, the actual transfer isn't complete until the deed is delivered to, and accepted by, the recipient.

Gift Deeds are only for real estate transactions. Though commonly used for transferring real estate without financial consideration, Gift Deeds can also be used for transferring personal property or vehicles, depending on the laws and requirements in California.

Filing a Gift Deed with the county is optional. For real estate transactions, filing the deed with the county recorder’s office is essential for it to be effective. This public recordation confirms the transfer and protects the new owner's interests.

Gift Deeds eliminate the need for a will. While a Gift Deed can transfer property prior to death, it doesn't replace a will. A comprehensive estate plan should include a will to cover assets not addressed by Gift Deeds or other transfer mechanisms.

Taxes aren't necessary on property given through a Gift Deed. Although there’s no immediate sale price or traditional financial consideration, the giver may still be responsible for federal gift taxes if the value exceeds the annual exclusion amount set by the IRS. Additionally, the recipient could face property tax reassessment under certain circumstances in California.

These points help clarify the common misconceptions surrounding the California Gift Deed form, ensuring you're better informed about the document's potential impact and requirements.

Key takeaways

When dealing with the process of transferring property in California through a gift deed, it's crucial to understand the essential aspects of completing and using the Gift Deed form. A gift deed is a legal document that facilitates the process of giving property from one person to another without any payment. Here are five key takeaways that can help guide individuals through this procedure:

- Understand the Importance of a Complete and Accurate Form: Ensuring that the California Gift Deed form is filled out correctly and entirely is crucial. A properly completed form is essential for the deed to be legally effective. This includes accurately identifying the donor (the person giving the property), the donee (the person receiving the property), and a detailed description of the property being transferred.

- Notarization Is Mandatory: For a Gift Deed to be valid in California, it must be notarized. This means that once the form is filled out, the donor needs to sign the deed in the presence of a Notary Public. Notarization is a fraud-prevention measure that ensures the document is legally binding.

- Recording the Deed: After the Gift Deed is notarized, it should be recorded with the county recorder’s office in the county where the property is located. Recording the deed is a critical step as it makes the transfer public record, which helps protect the donee's interest in the property.

- No Consideration Required: A characteristic feature of a gift deed is that it transfers property without any payment or consideration from the donee. It's essential to state clearly in the document that the transfer is a gift. This differentiates it from a sale and has implications for taxes and legal responsibilities.

- Understand Tax Implications: While a gift deed transfers property without consideration, there could still be tax implications for both the donor and the donee. Gift taxes may apply depending on the value of the property transferred. It is advisable for both parties to consult with a tax professional to understand any potential tax liabilities or exemptions.

Properly executing a California Gift Deed requires attention to detail and an understanding of the legal requirements and implications. Taking the time to correctly complete the form, having it notarized, and ensuring it is recorded can provide peace of mind to both the donor and the donee by clearly establishing the transfer of property.

Create Some Other Templates for California

Divorce Agreement Sample - Offers a way for couples to end their marriage with dignity and respect, by mutually agreeing on the terms of their separation.

Free Promissory Note Template California - Late payment policies described in the document deter delays and ensure timely repayment.

Bill of Sale for Trailers - Helps in ensuring that all legal liabilities regarding the RV are transferred to the new owner upon sale.