Attorney-Approved California Independent Contractor Agreement Document

In California, navigating the intricacies of employment law requires a meticulous approach, especially when it involves delineating the roles between employees and independent contractors. The California Independent Contractor Agreement form is a critical tool in this endeavor, serving to clearly define the working relationship, scope of work, compensation, duration, and the respective rights and obligations of the parties involved. This document, tailored specifically to comply with California's unique employment standards, including the stringent ABC test established by the Dynamex decision and further codified by Assembly Bill 5 (AB5), helps in setting the groundwork for a transparent, fair, and legally sound working arrangement. By ensuring both parties are on the same page, it not only minimizes potential legal disputes but also aligns with the state's labor laws, offering a shield against misclassification challenges and the associated liabilities. Hence, for anyone engaging in or hiring for freelance, consultancy, or contract work in California, understanding and properly executing this form is not just advisable; it's essential for safeguarding interests and ensuring compliance.

Document Example

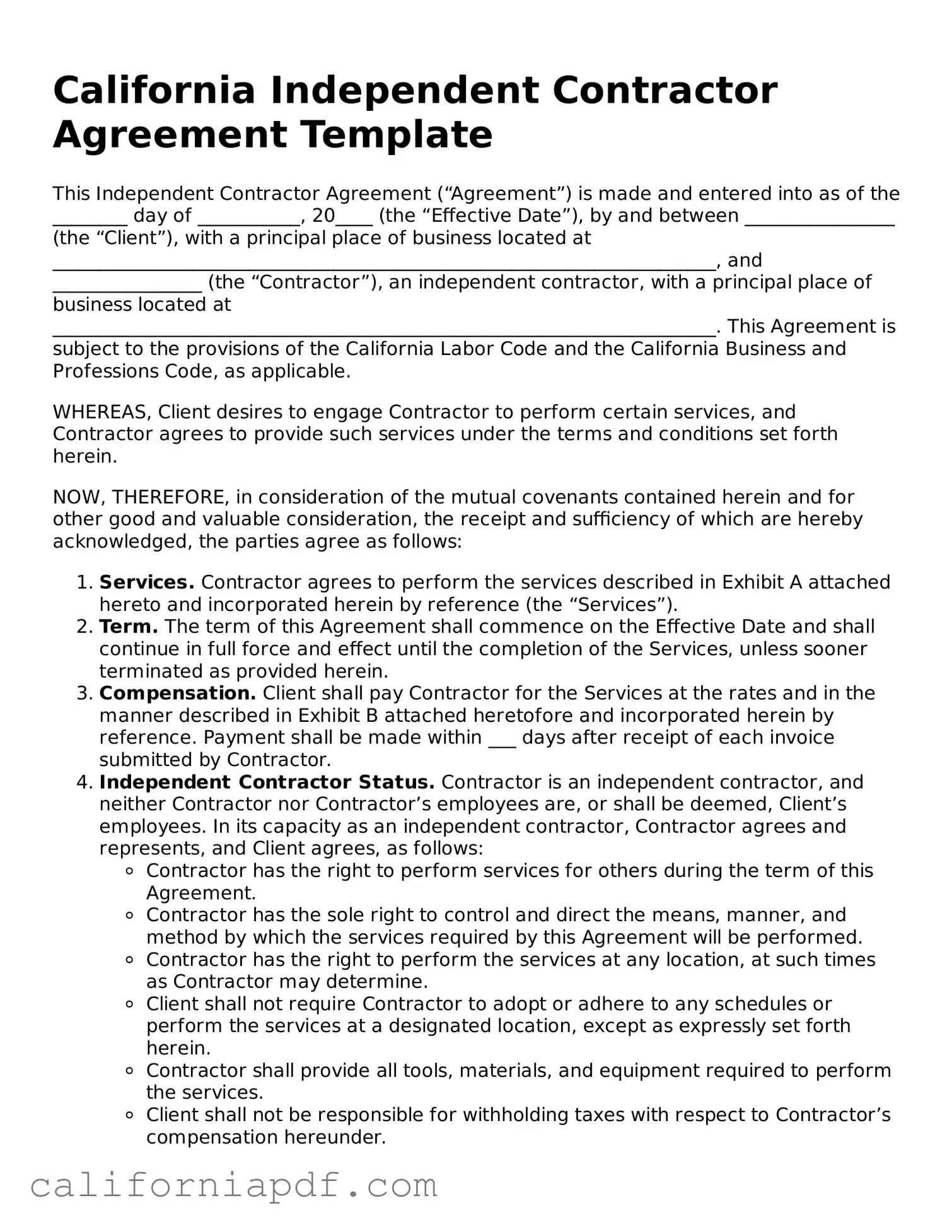

California Independent Contractor Agreement Template

This Independent Contractor Agreement (“Agreement”) is made and entered into as of the ________ day of ___________, 20____ (the “Effective Date”), by and between ________________ (the “Client”), with a principal place of business located at _______________________________________________________________________, and ________________ (the “Contractor”), an independent contractor, with a principal place of business located at _______________________________________________________________________. This Agreement is subject to the provisions of the California Labor Code and the California Business and Professions Code, as applicable.

WHEREAS, Client desires to engage Contractor to perform certain services, and Contractor agrees to provide such services under the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Services. Contractor agrees to perform the services described in Exhibit A attached hereto and incorporated herein by reference (the “Services”).

- Term. The term of this Agreement shall commence on the Effective Date and shall continue in full force and effect until the completion of the Services, unless sooner terminated as provided herein.

- Compensation. Client shall pay Contractor for the Services at the rates and in the manner described in Exhibit B attached heretofore and incorporated herein by reference. Payment shall be made within ___ days after receipt of each invoice submitted by Contractor.

- Independent Contractor Status. Contractor is an independent contractor, and neither Contractor nor Contractor’s employees are, or shall be deemed, Client’s employees. In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows:

- Contractor has the right to perform services for others during the term of this Agreement.

- Contractor has the sole right to control and direct the means, manner, and method by which the services required by this Agreement will be performed.

- Contractor has the right to perform the services at any location, at such times as Contractor may determine.

- Client shall not require Contractor to adopt or adhere to any schedules or perform the services at a designated location, except as expressly set forth herein.

- Contractor shall provide all tools, materials, and equipment required to perform the services.

- Client shall not be responsible for withholding taxes with respect to Contractor’s compensation hereunder.

- Confidentiality. During the term of this Agreement and thereafter, Contractor agrees to take all reasonable steps to maintain the confidentiality of Client’s proprietary information and not to disclose such information to any third party without the prior written consent of Client, except as may be necessary to perform the Services under this Agreement.

- Termination. Either party may terminate this Agreement at any time upon ___________ days’ written notice to the other party.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of California, without regard to its conflict of laws principles.

- Entire Agreement. This Agreement contains the entire understanding and agreement between the parties and supersedes any and all prior or contemporaneous oral or written communications regarding the subject matter hereof. Any changes to this Agreement must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date.

Client: ___________________________________

Contractor: _______________________________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The California Independent Contractor Agreement is governed by the laws of the State of California, particularly by the California Labor Code and relevant court decisions. |

| Assembly Bill 5 (AB-5) Compliance | This agreement must comply with AB-5, which uses the "ABC" test to determine if a worker is an employee or an independent contractor. |

| Written Agreement Requirement | Though not always legally required, having a written agreement clarifies the relationship, scope of work, compensation, and obligations, providing protection for both parties. |

| Dispute Resolution | The agreement should specify how disputes between the parties will be resolved, often through mediation, arbitration, or court action, under California jurisdiction. |

| Amendment Procedure | The agreement should outline the procedure for any amendments, ensuring that any changes are documented in writing and agreed upon by both parties. |

How to Write California Independent Contractor Agreement

Filling out a California Independent Contractor Agreement form correctly is crucial for defining the scope of work, payment terms, and the legal obligations of both parties. This document ensures that everyone involved understands their roles and responsibilities, paving the way for a successful partnership. Let's dive into the steps required to fill this form out, ensuring that all the necessary details are covered comprehensively.

- Begin with the basics: Start by entering the date on which the agreement is made. This should be at the top of the form.

- Identify the parties: Clearly write the full legal name of the contractor and the client. Include addresses and contact information to ensure both parties are easily identifiable.

- Describe the services: Detail the specific services that the independent contractor will provide. Be clear and concise to avoid any ambiguity.

- Set the duration: Specify the start date and, if applicable, the end date of the services. If the duration is not fixed, provide details on how the agreement can be terminated by either party.

- Discuss compensation: Outline the payment terms including the rate, schedule, and method of payment. Also, include any necessary details about expenses, invoices, and taxes.

- Address confidentiality: If the independent contractor will have access to sensitive or proprietary information, include a confidentiality clause that specifies the expectations and responsibilities.

- Clarify ownership rights: Include a clause that specifies who will own the rights to any work product. This is especially important for creative or intellectual property.

- Indemnification and liability: State the agreements regarding indemnification and limit the liability of both parties. This protects both the contractor and the client in the event of unforeseen circumstances.

- Include additional clauses: Depending on the nature of the work and the preferences of both parties, additional clauses such as non-compete, non-solicitation, or arbitration agreements may be included.

- Signature and date: Finally, ensure that both the independent contractor and the client sign and date the agreement. This formalizes the document, making it legally binding.

After completing these steps, it's important to review the document thoroughly to ensure all the information is accurate and reflects the agreement between the parties. Each party should keep a copy for their records. This not only solidifies the agreement but also serves as a reference in case any questions or disputes arise during the course of the work. Remember, the goal is to create a clear, mutual understanding that supports a productive and positive working relationship.

Listed Questions and Answers

What is a California Independent Contractor Agreement?

An Independent Contractor Agreement in California outlines the terms between a contractor and the entity or person hiring them for services. This legally binding document specifies the nature of the work, compensation, duration of the project, and responsibilities of both parties. California has specific requirements under AB5 bill, making it crucial for the agreement to clearly define the contractor's status to comply with state laws regarding employment and independent contractors.

Why is it important to use a California-specific Independent Contractor Agreement?

Since California has unique laws, particularly the AB5 bill that sets strict criteria (the "ABC test") for classifying workers as independent contractors, using a state-specific agreement is crucial. This ensures that the terms and definitions used in the contract are in line with local requirements, providing clarity and legal protection for both parties involved. It helps avoid misclassification of employees as contractors, which can lead to significant legal ramifications and penalties.

What key elements should be included in this agreement?

Essential elements of a California Independent Contractor Agreement include:

- Description of services to be provided

- Details of compensation and payment terms

- Duration of the contract

- Termination conditions

- Confidentiality, non-disclosure, and non-compete clauses, if applicable

- Indemnification clause

- Ownership of work product

- Clear distinction that the worker is an independent contractor, not an employee

- Signatures from both parties involved

How does a worker qualify as an independent contractor under California law?

Under California law, specifically the AB5 bill, a worker is considered an independent contractor if they meet the three criteria outlined in the "ABC test":

- The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

- The worker performs work that is outside the usual course of the hiring entity's business.

If a worker does not meet all three criteria, they must be classified as an employee, not an independent contractor, under California law.

Can an independent contractor agreement be modified or terminated early in California?

Yes, an independent contractor agreement can be modified or terminated early if both parties agree to the changes. The agreement should contain provisions outlining the process for modifications, including how to give notice and any requirements for the changes to be in writing. Early termination clauses should also be clearly stated, specifying any notice period required and terms for early termination, including any compensation or penalty.

What are the consequences of misclassifying an employee as an independent contractor in California?

Misclassifying an employee as an independent contractor carries significant legal and financial consequences. Employers can face penalties, back payment of wages, overtime compensation, and benefits that should have been provided, along with contributions to unemployment insurance and workers' compensation funds. Additionally, there could be tax implications and the possibility of lawsuits for wrongful employment practices. Ensuring proper classification according to the specifics of the California AB5 bill is crucial to avoid such issues.

Common mistakes

In the bustling economy of California, the use of independent contractors has become a prevailing modality for many businesses seeking flexibility and talent across various sectors. However, the pathway to establishing a legally sound and mutually beneficial independent contractor relationship is often fraught with potential missteps, especially when filling out the Independent Contractor Agreement form. Let’s explore the common mistakes to avoid:

Overlooking the importance of a detailed description of services: Many people fail to specify the scope of services to be performed. This should be detailed to avoid ambiguity and future disagreements about the contractor's obligations.

Forgetting to set clear payment terms: It's essential to precisely outline how and when the contractor will be paid. This includes rates, deadlines, and conditions for payment to ensure clarity on financial matters.

Neglecting to define the relationship: The agreement must clearly state that the worker is being hired as an independent contractor, not an employee. This distinction impacts tax obligations, benefits, and liability.

Overlooking termination clauses: Both parties should understand under what circumstances the contract can be terminated. Without a clearly defined termination clause, ending the contract amicably and legally can become complicated.

Failing to address confidentiality: If the work involves access to sensitive or proprietary information, the agreement should include a confidentiality clause to protect your business interests.

Not including a dispute resolution method: Disputes may arise, so it’s wise to have a predetermined method for resolution. This might include arbitration or mediation as alternatives to litigation.

Sidestepping state-specific legal requirements: California has unique laws governing independent contractors, notably the ABC test to determine worker status. Ignoring these could lead to legal issues and penalties.

Skipping the signatures and dates: The agreement isn’t legally binding until all parties have signed and dated the document. This seemingly simple step is surprisingly often overlooked.

Avoiding these pitfalls not only smoothens the path towards a fruitful working relationship but also minimizes legal risks associated with independent contractor engagements. Careful attention to detail and adherence to federal and state laws ensure a robust foundation for these agreements.

Documents used along the form

When engaging with independent contractors in California, several forms and documents often complement the Independent Contractor Agreement. These documents play a critical role in clarifying the terms of engagement, ensuring compliance with state laws, and safeguarding the interests of both parties. Below is a carefully compiled list of forms and documents that are frequently used alongside the California Independent Contractor Agreement form to provide a comprehensive framework for these professional relationships.

- W-9 Form – This form is used to collect information about the contractor for tax purposes. It is essential for the business to report payments made to the contractor to the Internal Revenue Service (IRS).

- Confidentiality Agreement – Often used to protect sensitive information. This agreement ensures that the contractor will not disclose proprietary information gained during their contract period.

- Intellectual Property (IP) Assignment Agreement – This agreement is crucial when the contractor is expected to create or innovate as part of their services. It outlines the ownership rights of all creations or inventions made during the contract term.

- Service Level Agreement (SLA) – Details the standards and quality of service expected from the contractor. It includes metrics by which the contractor’s performance will be measured and can help prevent disputes over expectations.

- Non-Compete Agreement – Although enforceability varies by jurisdiction and specific circumstances, this agreement may be used to prevent a contractor from entering into competition with the business within a certain period and geographic region after the contract ends.

- Indemnification Agreement – This document helps safeguard the business against losses resulting from the contractor’s actions. It is an agreement where the contractor agrees to indemnify the business for any liabilities arising out of their work.

- Termination Clause – While typically encompassed within the Independent Contractor Agreement, a separate document detailing the conditions and process for contract termination may be used for clarity. This includes notice periods and any applicable termination fees.

Together, these documents form a robust legal framework that supports clear communication, aligns expectations, and addresses potential legal concerns upfront. By thoroughly understanding and utilizing these documents, both parties can engage in a productive and legally sound working relationship, minimizing misunderstandings and disputes. It’s advisable for businesses to consult with legal counsel when drafting these documents to ensure compliance with current laws and to tailor the agreements to their specific needs.

Similar forms

The California Independent Contractor Agreement shares similarities with an Employment Agreement. Both documents outline the terms of a working relationship, including job responsibilities, compensation, and termination procedures. However, an Employment Agreement is used for hiring employees, not independent contractors, establishing an ongoing relationship where the employer has more control over how and when the work is completed.

Similar to a Consultant Agreement, the Independent Contractor Agreement specifies the nature of the work to be done, the compensation, and the duration of the contract. However, Consultant Agreements are often used for professional or expert advisory services and focus more on providing advice and expertise rather than completing specific projects or tasks.

The Non-Disclosure Agreement (NDA) bears resemblances to the Independent Contractor Agreement in that it can include confidentiality clauses to protect sensitive information. While an NDA is specifically designed to prevent the sharing of proprietary information, Independent Contractor Agreements may incorporate similar provisions to safeguard a company's intellectual property and trade secrets involved in the contractor's work.

A Service Agreement, much like the Independent Contractor Agreement, outlines a service provider’s duties, payment details, and terms of service. Service Agreements are broader and can apply to either independent contractors or businesses providing services, whereas Independent Contractor Agreements are tailored specifically to the individual contractor's relationship with their client.

The Work For Hire Agreement shares common ground with the Independent Contractor Agreement in that it typically includes terms for compensation, deadlines, and delivery expectations. However, Work For Hire Agreements specifically relate to creative works, indicating that the hiring party owns any work produced, distinguishing them in terms of intellectual property rights transfer.

Finally, a Subcontractor Agreement is similar to an Independent Contractor Agreement because it also involves hiring an individual or business to perform tasks as part of a larger project. The difference lies in the relationship chain; Subcontractor Agreements are used when an independent contractor outsources part of the work they’ve been hired to complete, whereas Independent Contractor Agreements are between the contractor and their direct client.

Dos and Don'ts

Filling out the California Independent Contractor Agreement form is a crucial process that ensures the legality and clarity of the working relationship between an independent contractor and their client. To help guide you through this process, here is a list of things you should and shouldn't do.

What You Should Do:- Provide accurate and complete information about both parties involved, including full legal names, addresses, and contact details. This ensures that the agreement is legally binding and enforceable.

- Clearly define the scope of work to be performed, including project deadlines, deliverables, and any specific expectations. This helps prevent misunderstandings and conflicts during the course of the work.

- Outline the payment terms in detail, including rates, schedules, and methods of payment. This is critical for maintaining a smooth financial relationship between the contractor and the client.

- Review state laws concerning independent contractors to ensure the agreement complies with all legal requirements. California has specific regulations that must be adhered to in order to maintain an independent contractor status.

- Leave sections of the agreement blank. This can lead to ambiguity and potential disputes. Ensure every section is filled out comprehensively.

- Sign the agreement without reading and understanding every part of it. It's important that both parties are fully aware of their rights and obligations as laid out in the document.

- Forget to specify the duration of the agreement or terms for termination. Both parties should have clarity on how long the arrangement is expected to last and under what circumstances it can be ended.

- Ignore the need for a written agreement. Verbal agreements are harder to enforce and can lead to legal issues. A written and signed document provides a clear record of the agreement and its terms.

Misconceptions

When it comes to navigating the complexities of the California Independent Contractor Agreement, misconceptions abound. Understanding the truth behind these common misunderstandings can help both employers and independent contractors ensure their agreements are both compliant and fair. Here are nine misconceptions unpacked for clearer insight.

- Misconception #1: The label determines the relationship. It's a common belief that simply calling someone an independent contractor in an agreement instantly makes them one. However, the reality is that behavior and the nature of the work performed, not just the title, determine the relationship.

- Misconception #2: A signed agreement guarantees protection from misclassification. While having a signed Independent Contractor Agreement is crucial, it's not a foolproof defense against misclassification. The actual working relationship must reflect the independent contractor status.

- Misconception #3: Independent contractors don't have rights. Though different from employees, independent contractors still have rights under contract law and California's specific regulations, including protection against discrimination.

- Misconception #4: The details of the job don't need to be exhaustively specified. A thorough description of the services to be provided, deadlines, and payment details ensures clarity and helps prevent disputes. Vagueness is not advisable.

- Misconception #5: Independent contractors can be treated like employees. Treating independent contractors as if they were employees, such as requiring set hours or providing extensive supervision, can jeopardize their status and lead to legal complications.

- Misconception #6: Non-compete clauses are always enforceable. In California, non-compete clauses are generally unenforceable against independent contractors, highlighting the need for precise and legally compliant contract drafting.

- Misconception #7: A single agreement works for all independent contractors. The diversity of services and relationships means a one-size-fits-all approach can miss important specifics, potentially leading to misunderstandings and legal vulnerabilities.

- Misconception #8: Oral agreements are sufficient. While oral contracts can be legally binding, the lack of a written agreement complicates proving the terms of the arrangement. A written agreement provides clarity and security for both parties.

- Misconception #9: The agreement is only about compliance. Beyond meeting legal requirements, a well-crafted Independent Contractor Agreement sets clear expectations, helps manage risk, and fosters a positive and productive working relationship.

Dispelling these misconceptions is the first step towards ensuring a fair and compliant working arrangement. Remember, every independent contractor and employer relationship is unique, necessitating careful consideration and often, tailored legal advice to navigate successfully.

Key takeaways

In California, the use of an Independent Contractor Agreement form is critical when engaging independent contractors for services. This document defines the relationship between the contractor and the client, ensuring clarity and legal compliance. Here are nine key takeaways to consider:

- Understanding the classification criteria is vital. California employs strict standards to determine if an individual is an independent contractor or an employee. The distinction affects tax implications, benefits, and legal responsibilities.

- Clearly outline the scope of work. The agreement should specify the services being provided, deadlines, and any other expectations for the project. This prevents misunderstandings and sets clear objectives.

- Payment terms must be defined. It's essential to detail payment amounts, schedules, and methods. This includes how and when the contractor will be compensated for their work.

- Discuss intellectual property rights. The agreement should address who will own the work product upon completion. Often, intellectual property created by the contractor transfers to the client, but this must be explicitly stated.

- Include confidentiality clauses. Protect sensitive information by incorporating non-disclosure provisions. These clauses ensure that confidential information shared during the course of work remains private.

- Clarify the relationship. Emphasize that the agreement establishes an independent contractor relationship, not an employer-employee relationship. This has significant legal and tax implications for both parties.

- Address termination conditions. The agreement should specify under what circumstances it can be terminated by either party. This includes notice periods and any obligations upon termination.

- Indemnify each party. Including indemnification clauses can protect both the client and the contractor from legal claims arising from the other's actions.

- Understand legal compliance. The agreement must comply with California laws governing independent contractors. This includes adhering to the California Labor Code and relevant IRS guidelines.

Completing and using the California Independent Contractor Agreement form with these considerations in mind can help establish a clear, legally sound relationship between the contractor and the client, avoiding potential legal issues down the line.

Create Some Other Templates for California

Simple Lease Agreement Template - A formal legal document that clearly outlines the expectations and responsibilities of renting a property to ensure clarity and avoid disputes.

Mobile Home Title California - A properly executed Mobile Home Bill of Sale can expedite the change of ownership process, making it easier for the buyer to obtain insurance and registration.