Attorney-Approved California Last Will and Testament Document

In the state of California, a Last Will and Testament plays a critical role in ensuring an individual's desires regarding their estate are honored upon their passing. This legal document allows a person to outline precisely how they wish their assets to be distributed to heirs, appoint an executor who will oversee this distribution, and, if necessary, designate guardians for minor children. The California Last Will and Testament form must adhere to specific state laws to be considered valid. These include requirements related to the testator's (person creating the will) capacity, the signing and witnessing of the document, and stipulations regarding what can and cannot be included. Understanding and fulfilling these legal prerequisites are paramount for the document to serve its intended purpose without being contested or deemed invalid, thus ensuring a smoother transition of assets to the designated beneficiaries.

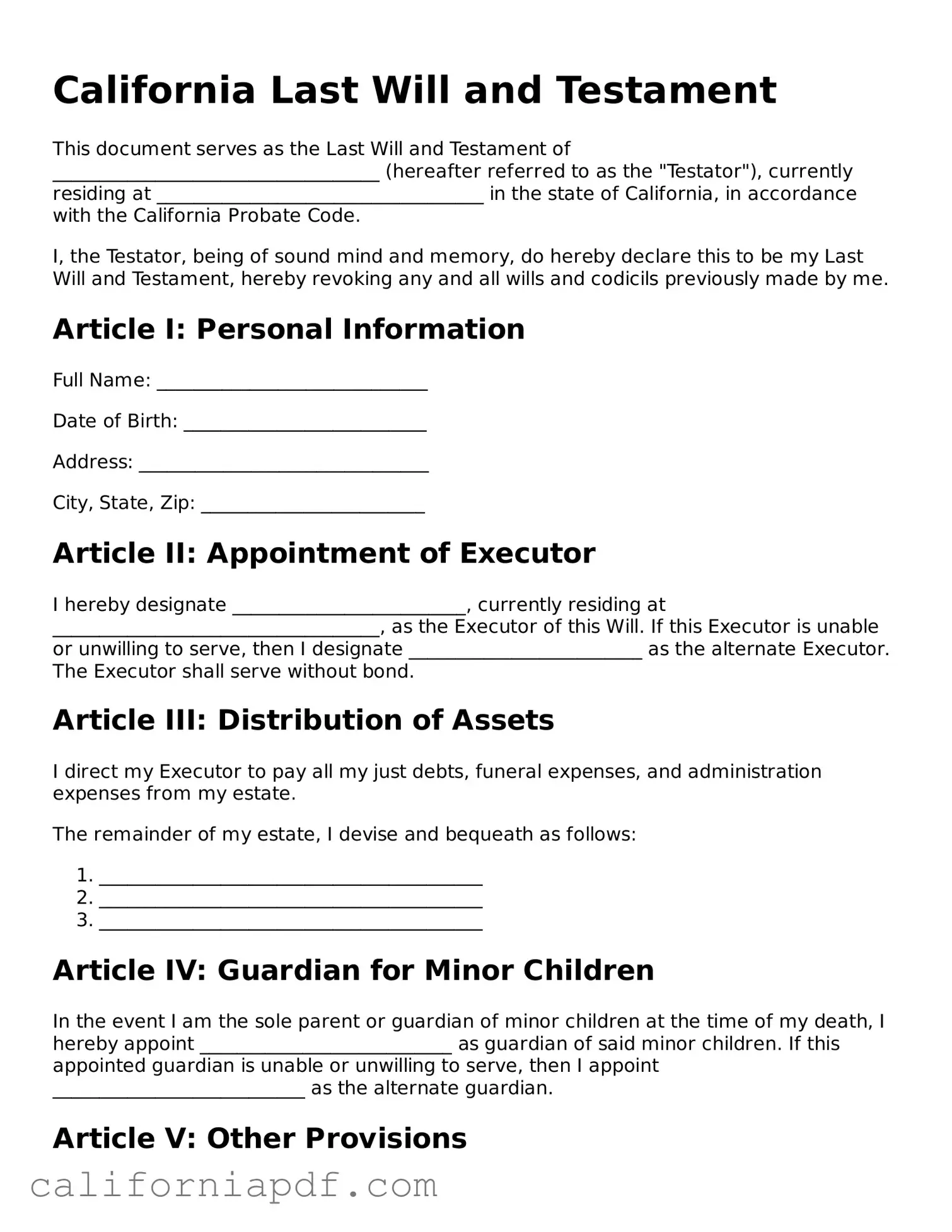

Document Example

California Last Will and Testament

This document serves as the Last Will and Testament of ___________________________________ (hereafter referred to as the "Testator"), currently residing at ___________________________________ in the state of California, in accordance with the California Probate Code.

I, the Testator, being of sound mind and memory, do hereby declare this to be my Last Will and Testament, hereby revoking any and all wills and codicils previously made by me.

Article I: Personal Information

Full Name: _____________________________

Date of Birth: __________________________

Address: _______________________________

City, State, Zip: ________________________

Article II: Appointment of Executor

I hereby designate _________________________, currently residing at ___________________________________, as the Executor of this Will. If this Executor is unable or unwilling to serve, then I designate _________________________ as the alternate Executor. The Executor shall serve without bond.

Article III: Distribution of Assets

I direct my Executor to pay all my just debts, funeral expenses, and administration expenses from my estate.

The remainder of my estate, I devise and bequeath as follows:

- _________________________________________

- _________________________________________

- _________________________________________

Article IV: Guardian for Minor Children

In the event I am the sole parent or guardian of minor children at the time of my death, I hereby appoint ___________________________ as guardian of said minor children. If this appointed guardian is unable or unwilling to serve, then I appoint ___________________________ as the alternate guardian.

Article V: Other Provisions

All provisions of this Will shall be construed in accordance with the laws of the State of California.

Article VI: Attestation

This Will was signed in the city of ____________________, state of California, on the __________ day of _______________, 20____. The Testator has signed this Will in our presence, declaring it to be their final Will. We, in the Testator's presence and at the Testator's request, and in the presence of each other, have hereunto subscribed our names and addresses as witnesses, believing the Testator to be of sound mind and memory.

Testator's Signature

Signature: _______________________________

Date: ___________________________

Witnesses

Witness #1 Signature: _______________________________

Address: ____________________________________________

Date: ___________________________

Witness #2 Signature: _______________________________

Address: ____________________________________________

Date: ___________________________

PDF Form Characteristics

| Fact Name | Detail |

|---|---|

| Legal Age Requirement | In California, an individual must be at least 18 years old to create a Last Will and Testament. |

| Witness Requirement | A California Last Will and Testament must be signed in the presence of at least two witnesses who also need to sign the will. |

| Writing Requirement | The document must be written to be considered valid under California law. |

| Governing Law | California Probate Code governs the creation and validation of Last Wills and Testaments within the state. |

How to Write California Last Will and Testament

When filling out the California Last Will and Testament form, individuals take a significant step toward ensuring their wishes are honored regarding the distribution of their assets and personal property upon their passing. This document allows individuals to specify beneficiaries, guardians for minor children, and an executor who will manage the estate. Careful completion of this form helps to avoid potential disputes among survivors and ensures that the decedent's preferences are clear and legally documented.

- Start by entering your full legal name and address, establishing you as the testator of the will.

- Appoint an executor by providing the name and details of the person you trust to manage your estate. Include an alternative executor as a backup.

- Specify guardians for any minor children, if applicable, to ensure they are cared for by someone you trust in your absence. Again, an alternate guardian's details can be added for added security.

- Detail your assets and precisely whom you wish to inherit each one. This section can include monetary assets, real estate, and personal items.

- Indicate any specific funeral or burial wishes you may have. This step is optional but helpful in guiding your loved ones.

- If you wish to make any charitable donations, list the organization(s) and the amount or percentage of your estate you're donating.

- Ensure all beneficiaries are clearly named and their shares of the estate are specified, preventing potential confusion or disputes.

- Review your will carefully, ensuring all details are accurate and reflect your wishes.

- Sign the will in front of two witnesses, who should not be beneficiaries of the will. The witnesses must also sign, attesting to your capacity to understand and your voluntary act of signing the will.

- Date the will to establish when it was executed, making it a valid legal document.

After completing the California Last Will and Testament form, it should be stored in a safe, accessible place. Informing the executor and a trusted family member or friend about its location is wise. Consider consulting with an attorney to ensure the will complies with California laws and truly reflects your wishes. Regularly reviewing and updating the will in response to life changes (such as marriage, divorce, births, and deaths) is essential to maintain its relevance and effectiveness.

Listed Questions and Answers

What is a Last Will and Testament form in California?

A Last Will and Testament form in California is a legal document that lets individuals, known as testators, specify how they want their property distributed upon their death. This document can outline the distribution of assets, name guardians for minor children, and appoint an executor to manage the estate's affairs. In California, for the document to be valid, it must adhere to the state's laws, such as being signed by the testator in the presence of two witnesses who are not beneficiaries.

Who can create a Last Will and Testament in California?

In California, any individual over the age of 18 who is of sound mind can create a Last Will and Testament. Being of "sound mind" typically means the individual understands the nature of the will, knows the nature and extent of their property, and recognizes the identities of those who are the natural beneficiaries of their estate. This ensures that the person fully comprehends the implications of the will they are creating and the decisions they are making regarding their estate.

How can one change or revoke a Last Will and Testament in California?

There are several methods by which someone can change or revoke a Last Will and Testament in California, including:

- Creating a new will that states previous wills are revoked.

- Physically destroying the document with the intention of revoking it, such as by tearing, burning, or otherwise destroying the will so it cannot be used.

- Making a legal document called a codicil, which amends parts of the existing will without creating a new one. However, the codicil must be executed with the same formality as the original will.

It's important to note that getting married, divorced, or having children after the creation of a will can also affect its terms, depending on the circumstances.

What happens if someone dies without a Last Will and Testament in California?

If a person dies without a Last Will and Testament in California, they are said to have died "intestate." In such cases, California's intestacy laws determine how the person's assets will be distributed. Generally, the property is divided among the surviving spouse, children, or nearest relatives according to a set legal formula. This process can be complex and may not reflect the deceased person's wishes, emphasizing the importance of having a Last Will and Testament.

Common mistakes

When filling out a California Last Will and Testament form, people often overlook crucial details or make mistakes that can significantly impact the validity and execution of their will. Being aware of these common errors can ensure your final wishes are honored accurately and without unnecessary delay. Here are six common mistakes:

Not adhering to California's legal requirements: Each state has its own laws regarding how a will must be signed and witnessed. In California, the will must be signed by two witnesses who are present at the same time and understand that the document is your will.

Failing to designate an executor or naming an inappropriate one: The executor plays a vital role in managing and distributing your estate as per your wishes. Choosing someone who is unwilling or unable to perform these duties can lead to complications.

Ignoring the details of beneficiary designations: Not being clear about who gets what can lead to disputes among heirs and potentially result in parts of the estate not being distributed as you had intended.

Omitting alternate beneficiaries: It’s important to appoint alternate beneficiaries in case your primary beneficiaries predecease you or are unable to inherit. Failure to do so could leave part of your estate subject to probate, defeating the purpose of having a will.

Not regularly updating the will: Life changes such as marriage, divorce, the birth of children, or the death of a beneficiary can affect your will. Not updating your will to reflect these changes might mean your assets won’t be distributed according to your current wishes.

Attempting to dispose of property not allowed under the will: Certain types of property, such as jointly owned assets or those in a trust, typically cannot be distributed through a will. Including these can create confusion and potential legal issues.

Being mindful of these mistakes and how to avoid them can help ensure that your will is a true reflection of your wishes and that those wishes will be carried out smoothly.

Documents used along the form

When preparing for the future, it's essential to consider how your affairs will be managed, not just in terms of distributing assets but also in terms of personal care and financial decisions. In California, alongside the Last Will and Testament, there are other critical legal documents that help in comprehensive estate planning. A Last Will and Testament primarily focuses on the distribution of a person's estate upon their death. However, other documents play vital roles in managing one's personal, health, and financial affairs, especially in circumstances where they may not be able to make those decisions themselves.

- Power of Attorney for Finance: This legal document allows an individual, the principal, to designate another person, known as an agent or attorney-in-fact, to make financial decisions on their behalf. It can be structured to take effect immediately or upon the occurrence of a future event, usually the incapacity of the principal.

- Advance Health Care Directive: Also known as a living will, this document outlines an individual's preferences for medical treatment and care in situations where they are unable to communicate their decisions. It often includes the appointment of a health care proxy to make decisions on the individual’s behalf.

- Durable Power of Attorney for Health Care: This document is similar to the Advance Health Care Directive but focuses specifically on appointRCTG someone to make all healthcare decisions, from routine to end-of-life considerations, in case the principal cannot do so themselves.

- Revocable Living Trust: Often used in conjunction with a Last Will and Testament, a Revocable Living Trust allows an individual to set terms for managing their assets both during their lifetime and after their death, avoiding the potentially long and costly probate process. The person who creates the trust can change or revoke it at any time during their lifetime.

Each of these documents plays a role in a well-rounded estate plan, ensuring that personal and financial affairs are handled according to the individual's wishes. While the Last Will and Testament is essential for detailing how assets should be distributed after death, these additional forms provide comprehensive coverage for various scenarios that might arise during the individual's lifetime. Together, they ensure that one's wishes are respected and followed, minimizing the burden on loved ones during challenging times.

Similar forms

The California Last Will and Testament shares similarities with the Revocable Living Trust in that both allow the individual to outline how their assets should be managed and distributed upon their death. While a Last Will becomes active posthumously and must go through probate, a Revocable Living Trust becomes effective immediately upon creation and can help bypass the probate process, thus offering a swifter distribution of assets to beneficiaries.

Like the Advance Healthcare Directive, a Last Will gives individuals control over personal decisions, albeit in different contexts. An Advance Healthcare Directive outlines preferred medical treatments and end-of-life care, ensuring one’s health care wishes are honored if they become incapacitated. Conversely, a Last Will and Testament focuses on financial and property matters, detailing how one's estate should be handled after death.

Financial Power of Attorney forms also bear resemblance to a Last Will, though they serve distinct purposes and are active at different times. A Financial Power of Attorney grants someone authority to manage your financial affairs while you are alive but possibly incapacitated. On the other hand, a Last Will outlines how your assets are to be distributed after your passing, with no power granted to individuals while you are alive.

The Pour-Over Will is closely linked to a Last Will and Testament but is designed to work in conjunction with a Living Trust. Essentially, it ensures that any assets not already included in a Trust are "poured over" into it upon the individual’s death, thereby requiring probate only for those specific assets. This setup provides a safety net, ensuring all of one’s assets are eventually managed as per the instructions in their Living Trust.

The Living Will, another pivotal document, parallels the Last Will by empowering individuals to make critical decisions about their personal affairs. However, a Living Will specifically focuses on health care decisions, such as life support and other medical interventions, in the event that one cannot communicate their wishes due to a severe health condition. This ensures that their health care preferences are respected, similar to how a Last Will ensures financial wishes are honored.

A Durable Power of Attorney for Health Care is akin to a Last Will in that it deals with personal choice and autonomy. This legal instrument allows someone to appoint a healthcare agent who can make medical decisions on their behalf if they become unable to do so. While operational during the individual's lifetime, it complements a Last Will's posthumous directions by ensuring decisions align with the individual's healthcare preferences and estate plans.

The Codicil to a Last Will mirrors the original Last Will in function by allowing modifications to be made without drafting a completely new document. Reflecting the testator's changing wishes or circumstances, it amends previously stipulated directions in the existing Will. Just like the original Last Will permits the allocation of one's estate, a Codicil adjusts those allocations or terms to ensure the document remains aligned with the testator's current wishes.

Lastly, the Deed of Gift is somewhat similar to a Last Will as it permits the transfer of property. However, it does so during the grantor's lifetime, without the need for probate or the event of death to activate the transfer. Unlike a Last Will that specifies the distribution of assets after death, a Deed of Gift is an immediate transfer, showing an immediate expression of generosity, yet both documents demonstrate the individual's intent to distribute their property to chosen beneficiaries.

Dos and Don'ts

When it comes to preparing a Last Will and Testament in California, understanding what to do and what not to do is crucial. This form is an essential document that ensures your wishes are respected regarding the distribution of your assets after your death. To help guide you through this process, here are five do's and don'ts to keep in mind:

Do's:Review California's legal requirements: Make sure you understand and comply with the state's legal demands for drafting a will, including the need for witnesses and the testator's signature.

Clearly identify your assets: Provide a detailed list of your assets, including real estate, bank accounts, and personal property, to prevent any confusion or disputes among heirs.

Appoint a reliable executor: Choose someone you trust implicitly to serve as the executor of your will, as this person will be responsible for managing your estate and ensuring your wishes are fulfilled.

Be explicit about your beneficiaries: Clearly name who you want to inherit each asset, which helps to prevent misunderstandings and ensure that your wishes are carried out as you intend.

Sign and witness the document correctly: Ensure the will is properly signed in the presence of witnesses who meet California's requirements, as failing to do so could render the document invalid.

Don't leave any ambiguity: Vague language or unclear instructions can lead to conflicts among your heirs, potentially resulting in legal battles that could have been avoided with clearer drafting.

Don't forget to update your will: Life changes, such as marriage, divorce, the birth of children, or the acquisition of significant assets, should prompt a review and, if necessary, a revision of your will.

Don't neglect to name a guardian for minor children: If you have minor children, it's crucial to appoint a guardian in your will; failing to do so leaves the decision up to the courts.

Don't overlook digital assets: In today's digital age, ensuring your digital assets are included in your will is essential; these can include social media accounts, online banking, and digital files.

Don't attempt to handle complex situations without legal advice: If your estate involves complex assets, business interests, or other sophisticated matters, seek legal advice to ensure your will accurately reflects your wishes.

Following these guidelines when filling out the California Last Will and Testament form can help ensure that your assets are distributed according to your wishes and can prevent unnecessary stress for your loved ones after you're gone.

Misconceptions

When it comes to preparing a Last Will and Testament in California, there are several misconceptions that can lead to confusion and, potentially, to not having your final wishes carried out as you intended. Here, we aim to clarify four common misunderstandings to help ensure your estate planning is on solid ground.

All your assets pass through your will. Many people assume that a will is a one-stop document that dictates how all of their possessions and assets will be distributed upon their death. However, certain assets, such as life insurance policies, retirement accounts, and some types of jointly held properties, typically pass to the named beneficiary or co-owner directly, outside of the will's provisions. It’s important to review these assets separately to ensure they align with your overall estate plan.

If you die without a will, the state takes everything. This is a common fear, but it's largely unfounded. If you pass away without a will (intestate), your assets will be distributed according to California's intestacy laws. While these laws dictate a hierarchy of heirs, starting with your closest relatives, the state only inherits your assets if no lawful heirs can be found, which is rare.

A will eliminates the need for probate. Many assume that having a will in place means their estate will not have to go through the California probate process. Unfortunately, this isn't the case. The will must be validated by the probate court, and the estate settled through this process, unless the estate qualifies for a simpler procedure available for small estates or assets were transferred via other means (like a living trust).

You can leave anything to anyone. While wills do provide a great deal of freedom in terms of designating who receives what, there are restrictions. For example, you cannot completely disinherit your spouse without their agreement, due to California's community property laws. Additionally, there are special considerations and restrictions if you wish to leave assets to a minor.

Key takeaways

The California Last Will and Testament is a vital document for ensuring your wishes are honored after your passing. Here are key takeaways to consider when filling out and using the form:

- Legal Age: You must be at least 18 years old to create a Last Will and Testament in California.

- Mental Capacity: The law requires that you are of sound mind when you make your Will. This means understanding the nature of the Will, knowing the extent of your assets, and recognizing the heirs to whom you are leaving your assets.

- Witness Requirements: Your Will must be signed by at least two witnesses who are not beneficiaries in the Will. Witnesses should be present at the same time and observe you signing the document.

- Writing Requirement: While oral Wills are not recognized, a typewritten or computer-printed Will is valid in California, provided it meets all other legal requirements.

- Executor Appointment: Designating an executor in your Will is crucial. This person will manage your estate and distribute your assets according to your wishes.

- Be Specific: Clearly identify your beneficiaries and specify what each will receive. Ambiguities can lead to disputes and potential legal challenges.

- Guardianship: If you have minor children, you can and should name a guardian in your Will to ensure their care in the event of your and the other parent’s death.

- Regular Updates: Update your Will following significant life events such as marriage, divorce, the birth of a child, or the acquisition of substantial assets. This keeps your Will relevant to your current situation.

- Keep It Secure: Store your Will in a safe place where your executor and beneficiaries can access it when needed. Avoid safety deposit boxes that can be sealed upon death.

- Seek Professional Advice: Consider consulting with a legal professional to ensure your Will complies with California law and accurately reflects your wishes. This can help prevent potential legal issues for your beneficiaries.

Create Some Other Templates for California

Esign Lease Agreement - It specifies the number of individuals who may reside in the property, ensuring the residence is not overcrowded and is used as intended.

Bill of Sale Dmv - Acts as a record of the dog's official sale price, which can be useful for insurance or taxation purposes.

Non Disclosure - Offers businesses the legal backing needed to confidently navigate negotiations and discussions where sensitive data is shared.