Attorney-Approved California Loan Agreement Document

In the diverse landscape of financial transactions within California, the role of a well-constructed loan agreement form cannot be overstated. This document serves as a crucial bridge between lenders and borrowers, outlining the terms and obligations that bind both parties throughout the tenure of a loan. Major aspects covered by such a form include, but are not limited to, the loan amount, interest rates, repayment schedule, and any collateral involved. Equally important are the provisions for default and remedies, ensuring a clear path is laid out for addressing any discrepancies or failures in meeting the agreement’s terms. Moreover, the form is tailored to comply with California’s specific legal requirements, protecting the interests of all involved entities and minimizing the risk of unenforceable terms. By meticulously detailing each party's rights and responsibilities, the California Loan Agreement Form embodies a pivotal resource in securing financial agreements, thereby fostering a climate of trust and predictability in monetary exchanges.

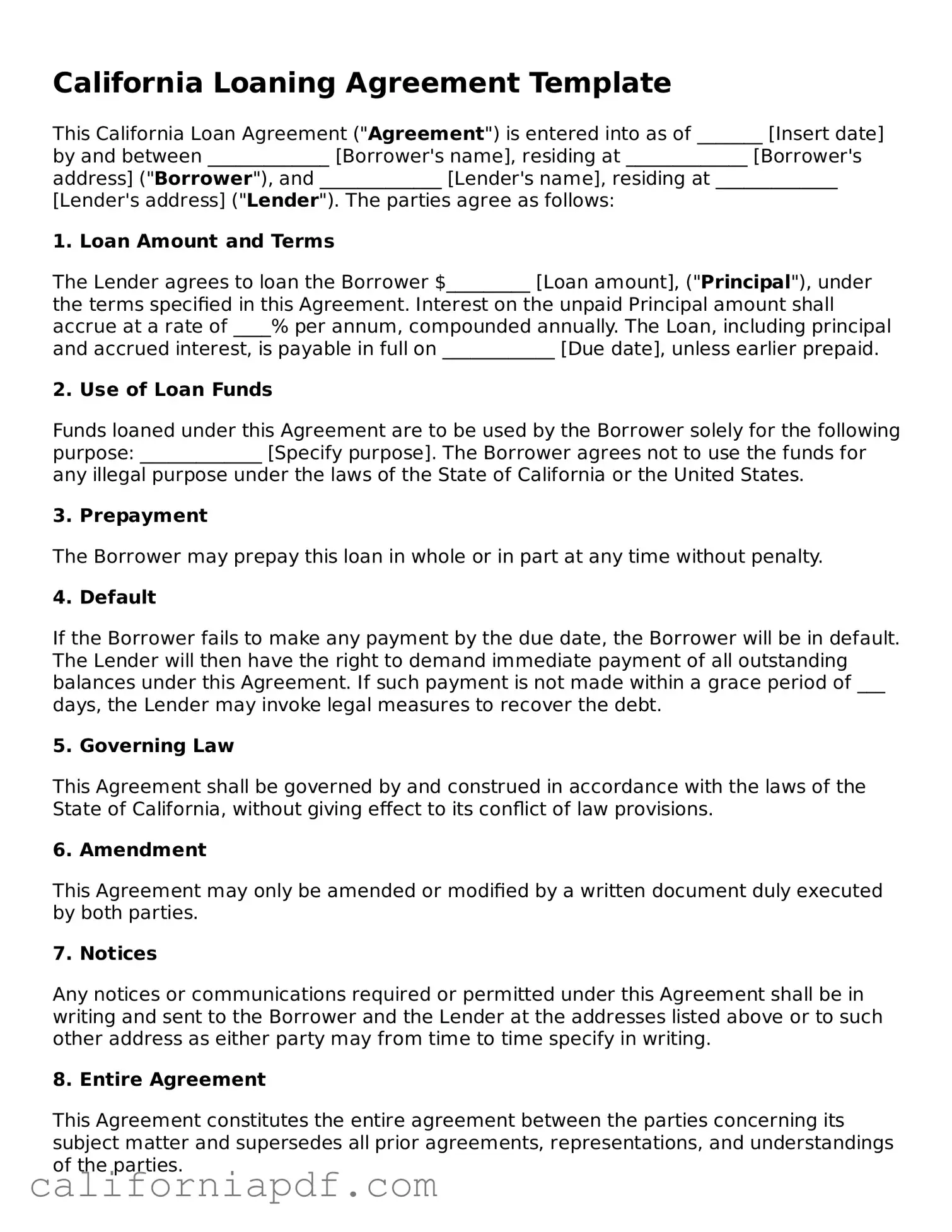

Document Example

California Loaning Agreement Template

This California Loan Agreement ("Agreement") is entered into as of _______ [Insert date] by and between _____________ [Borrower's name], residing at _____________ [Borrower's address] ("Borrower"), and _____________ [Lender's name], residing at _____________ [Lender's address] ("Lender"). The parties agree as follows:

1. Loan Amount and Terms

The Lender agrees to loan the Borrower $_________ [Loan amount], ("Principal"), under the terms specified in this Agreement. Interest on the unpaid Principal amount shall accrue at a rate of ____% per annum, compounded annually. The Loan, including principal and accrued interest, is payable in full on ____________ [Due date], unless earlier prepaid.

2. Use of Loan Funds

Funds loaned under this Agreement are to be used by the Borrower solely for the following purpose: _____________ [Specify purpose]. The Borrower agrees not to use the funds for any illegal purpose under the laws of the State of California or the United States.

3. Prepayment

The Borrower may prepay this loan in whole or in part at any time without penalty.

4. Default

If the Borrower fails to make any payment by the due date, the Borrower will be in default. The Lender will then have the right to demand immediate payment of all outstanding balances under this Agreement. If such payment is not made within a grace period of ___ days, the Lender may invoke legal measures to recover the debt.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California, without giving effect to its conflict of law provisions.

6. Amendment

This Agreement may only be amended or modified by a written document duly executed by both parties.

7. Notices

Any notices or communications required or permitted under this Agreement shall be in writing and sent to the Borrower and the Lender at the addresses listed above or to such other address as either party may from time to time specify in writing.

8. Entire Agreement

This Agreement constitutes the entire agreement between the parties concerning its subject matter and supersedes all prior agreements, representations, and understandings of the parties.

9. Signatures

Both parties agree to the terms and conditions set forth in this Agreement:

Borrower's Signature: ______________________ Date: _______

Lender's Signature: ______________________ Date: _______

PDF Form Characteristics

| Fact Number | Description |

|---|---|

| 1 | The California Loan Agreement form is used to document the terms of a loan between a borrower and a lender within the state of California. |

| 2 | It must comply with California's laws and regulations governing loans and credit. |

| 3 | Interest rates on the loan captured in this agreement must not exceed the maximum allowed by California law to prevent it from being considered usurious. |

| 4 | The agreement outlines repayment terms, including the loan amount, interest rate, repayment schedule, and any collateral securing the loan. |

| 5 | It must be signed by both the lender and the borrower to be considered legally binding. |

| 6 | Details of any late fees, prepayment penalties, or default consequences must be clearly stated in the agreement. |

| 7 | In the event of a dispute, the agreement should specify whether arbitration or court proceedings will be used and under which jurisdiction's laws the dispute will be settled. |

| 8 | Amendments to the agreement must be made in writing, and both parties must agree to any changes. |

| 9 | The California Loan Agreement can include clauses for the protection of both lender and borrower, like confidentiality and indemnity clauses. |

| 10 | This agreement serves as a comprehensive record of the loan, helping to protect the interests of both parties and avoid future misunderstandings or legal disputes. |

How to Write California Loan Agreement

Once the decision to extend a loan in California is made, accurately completing the loan agreement form is crucial. This document not only formalizes the terms and conditions of the loan but also serves as a binding agreement that protects both the lender and the borrower. Detail and precision in filling out this form cannot be overstressed, as any inaccuracies or omissions could lead to misunderstandings or legal challenges down the line. The following steps aim to guide both parties through the process of securely completing the loan agreement form, ensuring that all necessary information is provided and that the agreement is legally sound.

- Start by entering the full legal names of both the lender and the borrower at the top of the form. Ensure these are the names as they appear on official documents.

- Specify the loan amount in words and then numbers to make sure there is no confusion about the total amount being borrowed.

- Detail the loan's purpose, defining clearly how the borrowed funds are to be used. This clarity can prevent misuse of the funds and set clear expectations.

- Outline the repayment terms, including the repayment period, frequency of payments (monthly, quarterly, etc.), and the amount of each payment. If applicable, include any interest rate applied to the unpaid balance and how it is calculated.

- Define the collateral, if any, that the borrower is providing as security for the loan. This section should describe the collateral in detail and state its estimated value.

- Include clauses that address late payment penalties, modification procedures, and the actions that will be taken in the event of default. These clauses provide protection to the lender and clarify the consequences of failing to meet the agreement terms for the borrower.

- Specify any legal fees and who is responsible for them in the case that the agreement needs to be enforced through legal action.

- Clearly list any warranties or representations being made by the borrower, such as confirming the truthfulness of the information provided or certifying that they have the legal authority to enter into the agreement.

- Insert a severability clause. This important provision ensures that if one part of the agreement is found to be invalid, the rest of the agreement remains in effect.

- Identify the governing law, which in this case would be the laws of the State of California, to determine any disputes that may arise under the agreement.

- Both the lender and borrower should sign and date the agreement in the presence of a witness or notary public to validate its authenticity. Include the printed names of the parties next to their signatures.

Listed Questions and Answers

What is a California Loan Agreement Form?

A California Loan Agreement Form is a legal document used between two parties — the lender and the borrower — in the state of California. It outlines the terms and conditions under which money is lent. This form specifies the loan amount, interest rate, repayment schedule, and the obligations of both parties. It serves as a binding contract to ensure that both sides understand their responsibilities and the consequences of not adhering to them.

How do I complete a California Loan Agreement Form?

To complete a California Loan Agreement Form, you will need to include several key pieces of information:

- Identify the Parties: Provide the legal names and contact information of both the lender and the borrower.

- Loan Details: Specify the loan amount, interest rate (if applicable), and the loan disbursement method.

- Repayment Terms: Outline the repayment schedule, including due dates and amounts for each installment. Also, clarify if there are any prepayment penalties.

- Signatures: Both parties must sign the agreement to make it legally binding. It is also recommended to have the signatures notarized for additional legal validation.

Be thorough and clear when filling out the form to prevent any misunderstandings or legal issues down the line.

Is a notary required for a California Loan Agreement Form?

While not necessarily required by law, having a notary witness the signing of a California Loan Agreement Form is highly recommended. A notarized document adds a level of authenticity, making it more difficult for either party to dispute the validity of the signatures. Furthermore, in the event of a legal dispute, a notarized agreement can provide stronger evidence in court.

Can a California Loan Agreement be modified after it's signed?

Yes, a California Loan Agreement can be modified after it's signed, but any changes must be agreed upon by both the lender and the borrower. The modification should be made in writing, and a new document, often referred to as an "amendment to the loan agreement," should be created. This document should detail the changes made to the original agreement and be signed and dated by both parties. This ensures that the modifications are legally binding and enforceable.

Common mistakes

In completing the California Loan Agreement form, individuals often make a variety of errors that can affect the validity or clarity of the agreement. Recognizing and avoiding these mistakes ensures the agreement is legally binding and reflects the intentions of all parties involved. Here are eight common mistakes:

- Not specifying the loan terms clearly: It's critical to detail the loan amount, interest rate, repayment schedule, and the loan's duration. Ambiguities can lead to disputes.

- Forgetting to include the full legal names of the parties: Using nicknames or incomplete names might create confusion regarding the agreement's stakeholders.

- Omitting collateral details (if applicable): If the loan is secured, failing to describe the collateral adequately could complicate enforcement of the agreement.

- Ignoring potential penalties for late payments or defaults: Clearly outlining these penalties is necessary to provide enforceable consequences for failing to meet the terms.

- Not detailing the purpose of the loan: While not always mandatory, indicating the loan's purpose can help prevent the misuse of funds.

- Leaving out the governing law clause: Specifying that the agreement is governed by California law is crucial for resolving any legal disputes.

- Failing to include amendment provisions: Without this, altering the agreement would require a new contract, even for minor changes.

- Skipping the signature and date lines: An unsigned agreement or one lacking dates is often considered unenforceable. Ensuring all parties sign and date the document is essential.

Avoiding these mistakes can greatly improve the effectiveness of a loan agreement. It is always recommended to review any legal document thoroughly and, if possible, consult with a legal professional to ensure all aspects of the agreement are correctly addressed and legally compliant.

Documents used along the form

When executing a California Loan Agreement, several ancillary documents and forms often come into play to ensure the transaction is conducted smoothly and is legally binding. These additional documents not only strengthen the agreement but also provide a comprehensive legal framework to protect the interests of all parties involved. Below is a list of commonly used documents alongside the California Loan Agreement form, each serving a unique purpose in the lending process.

- Promissory Note: This document highlights the borrower's promise to repay the loan. It details the loan amount, interest rate, repayment schedule, and consequences of default, making it a cornerstone of the lending process.

- Amortization Schedule: Often attached to the loan agreement or promissory note, this schedule outlines the payments to be made over the term of the loan, including the division between principal and interest, which helps both lender and borrower track the repayment progress.

- Personal Guarantee: Required for some loans, especially for businesses, this legally binding document makes an individual (often a business owner) personally liable for the loan if the borrowing entity fails to repay.

- Security Agreement: This document gives the lender a security interest in a specific asset or property (collateral), which can be claimed in case of default, thereby reducing the lender's risk.

- UCC Financing Statement (Form UCC1): Associated with secured loans, this form is filed with the state to publicly disclose a lender's right to potential interest in the borrower's collateral.

- Mortgage or Deed of Trust: For real estate loans, this document places a lien on the property being financed, which can be foreclosed upon if the loan isn't repaid according to the agreed terms.

- Interest Rate Swap Agreement: Used in some commercial lending scenarios, this agreement allows parties to exchange interest rate payments, often to manage exposure to fluctuations in interest rates.

- Environmental Indemnity Agreement: This agreement requires the borrower to indemnify the lender against any environmental liabilities that may arise from the property used as collateral.

- Loan Modification Agreement: If terms of the loan need to be renegotiated after closing, this document outlines the changes made to the original loan agreement.

- Subordination Agreement: This agreement changes the priority of creditors, allowing a new lender to take a position of seniority in case the borrower's assets are liquidated.

Together, these documents form a comprehensive legal structure around a loan agreement. They serve to clarify the terms, secure the interests of the lender, and provide a clear path to repayment for the borrower. Understanding the function and importance of each can significantly impact the efficacy and security of any lending arrangement.

Similar forms

The California Loan Agreement form shares similarities with the Promissory Note, as both outline the terms under which money is borrowed and must be repaid. The Promissory Note is a straightforward declaration that a debt exists, and similarly details the interest rate, repayment schedule, and consequences of default. Where the Loan Agreement often incorporates broader legal stipulations and protections for both parties, the Promissory Note serves as a clear, unilateral commitment to repay the amount owed.

Similar to a Mortgage Agreement, the California Loan Agreement can also secure loans against property. While the Mortgage Agreement specifically ties the borrowing terms to real estate as collateral, protecting the lender by allowing for foreclosure in the event of non-payment, the Loan Agreement can be more flexible in terms of the acceptable collateral. Both documents delineate the right of the lender to seize and sell the collateral if the borrower fails to fulfill their repayment obligations.

The Personal Guarantee is another document related to the California Loan Agreement, offering a layer of security to the lender. In both documents, a third party agrees to fulfill the debt obligation if the primary borrower fails to do so. However, the Personal Guarantee is an added assurance, often accompanying a Loan Agreement to strengthen the lender's safety net, especially in transactions perceived as riskier.

Businesses often compare the California Loan Agreement with a Business Plan when seeking financing. The Business Plan outlines the company's strategy for success, including financial projections and operational plans, while the Loan Agreement specifies the terms under which the lender will finance the business's endeavors. Both are critical in the lending process, where the Business Plan helps in assessing the viability of the business, and the Loan Agreement formalizes the borrowing details.

Line of Credit Agreements bear resemblance to the California Loan Agreement, as they both involve extending credit under defined terms. The key difference lies in the flexibility of borrowing and repayment; a Line of Credit Agreement allows the borrower to draw upon funds up to a specified limit over time, making it more adaptable than a fixed loan agreement. Nonetheless, both agreements specify interest rates, security, and repayment conditions.

Another document that is often discussed alongside the California Loan Agreement is the Debt Settlement Agreement. This agreement comes into play when negotiating the terms to resolve or reduce a borrower's outstanding debt. Unlike the Loan Agreement, which establishes the initial borrowing terms, the Debt Settlement Agreement focuses on adjusting those terms when the borrower is unable to repay the debt as initially agreed, often including a reduction of the owed amount.

Lastly, the California Loan Agreement is akin to the Lease Agreement, where both involve terms and conditions agreed upon by two parties. While the Lease Agreement pertains to the use of property (such as real estate or equipment) for a specified period in exchange for payment, the Loan Agreement involves borrowing money with the promise to repay. Both types of agreements detail the specifics of the arrangement, including duration, payments, and actions in case of breach of the terms.

Dos and Don'ts

Filling out a California Loan Agreement form is an important process that requires attention to detail. To ensure everything goes smoothly and you avoid common pitfalls, here are some essential dos and don'ts to keep in mind:

Do:Read the entire agreement carefully before you start filling it out. This helps you understand all the requirements and specifications.

Gather all necessary information beforehand, including personal identification, financial details, and any collateral information, to make the process efficient.

Use clear and precise language to avoid any ambiguities or misunderstandings. This is crucial for ensuring all parties have the same understanding of the agreement.

Double-check the interest rate, repayment terms, and any clauses related to late payments or defaulting to ensure they are correct and fair.

Have all parties involved sign the agreement. A loan agreement is only legally binding if all participants officially acknowledge it.

Keep a copy of the completed agreement for your records. Having a record is essential for future reference, should any disputes arise.

Skip reading any sections of the agreement, assuming they are standard or not applicable. Every part of the agreement can have significant implications.

Fill out the agreement in a hurry. Taking your time to ensure accuracy and completeness is key.

Use informal language or slang. The document should be professional and free of any language that could be interpreted in multiple ways.

Forget to specify any special terms that were agreed upon verbally. If it's not written in the agreement, it's challenging to enforce.

Sign the agreement without ensuring that every detail is correct and as agreed upon. Once signed, modifying the agreement can be difficult.

Ignore the importance of consulting with a professional if you have any doubts or questions about the agreement. A small consultation fee can save you from future troubles.

Misconceptions

When it comes to handling loan agreements in California, there are some common misconceptions that can create confusion. Understanding these can help ensure that you navigate these agreements more effectively and with greater confidence. Here’s a look at some of the most prevalent misunderstandings:

- All loan agreements in California must follow a standard template. Many people think that there's a one-size-fits-all template for loan agreements in California, but this isn't the case. While there are certain legal requirements and common clauses, agreements can be customized to fit the specific terms negotiated between the borrower and the lender.

- Verbal agreements are not binding in California. It's a common belief that for a loan agreement to be legally binding in California, it must be in writing. However, while written contracts are strongly recommended for clarity and to ease enforcement, verbal contracts can also be enforceable under California law, though proving the terms of the agreement can be challenging.

- Interest rates can be freely agreed upon. Although parties in a loan agreement have the freedom to negotiate terms, California law imposes restrictions on interest rates. The state’s usury laws cap the amount of interest that can be charged on personal, family, and household loans to prevent predatory lending practices.

- A notary public must sign off on all California loan agreements. While having a loan agreement notarized can add a layer of verification, California law does not require notarization for a loan agreement to be valid or enforceable. The key aspects are the agreement between the parties and the exchange of value (consideration).

- Collateral must always be included in a California loan agreement. The existence of collateral, something of value pledged as security for repayment of the loan, depends on the specific terms agreed upon by the lender and borrower. Not all loan agreements require collateral, especially if the loan is unsecured.

- Default automatically leads to seizure of assets. While defaulting on a loan can have serious consequences, automatic seizure of assets is a misconception. The actions a lender can take in the event of a default are governed by the terms of the loan agreement and California law, which typically involve giving the borrower a chance to cure the default before proceeding with more drastic measures.

Being well-informed can make a significant difference in how you approach and manage loan agreements in California. Misconceptions can lead to unnecessary worry or, conversely, a false sense of security. It’s always best to consult with a legal advisor to ensure you fully understand the specifics of your situation.

Key takeaways

When dealing with the California Loan Agreement form, it is essential for individuals to approach this document with care and understanding. Here are five key takeaways to consider:

- Complete all sections accurately: Ensuring that every requested detail on the California Loan Agreement form is provided accurately is crucial. This includes the names of the borrower and lender, the loan amount, interest rate, and repayment terms. Accurate information helps in avoiding misunderstandings or legal issues later on.

- Understand the terms: Both the borrower and lender must thoroughly understand the terms outlined in the agreement, such as the loan's interest rate, repayment schedule, and any collateral involved. Clarification should be sought for any terms that are not clear to either party.

- Follow state laws: The agreement should comply with California state laws governing loans and interest rates. These laws are in place to protect both the borrower and lender, and failing to comply can result in legal penalties.

- Sign in the presence of a witness or notary: For added legal protection, it is recommended that both parties sign the agreement in the presence of a witness or notary. This step can help in the enforcement of the agreement, should any disputes arise.

- Keep copies of the agreement: After the loan agreement is signed, both the borrower and lender should keep a copy of the document. This ensures that both parties have access to the agreed terms, which can be useful for reference or in case any problems occur during the repayment period.

Create Some Other Templates for California

California All Purpose Acknowledgement - It helps deter fraud by requiring the physical presence of the signer before a notary public.

I Haven't Received My Car Title From Dmv California - State-specific forms may require additional disclosures or information unique to the state's laws regarding trailer sales.