Attorney-Approved California Motor Vehicle Power of Attorney Document

Managing vehicle-related affairs can often require the assistance of someone trusted, especially when circumstances prevent direct personal involvement. The California Motor Vehicle Power of Attorney (POA) form plays a pivotal role under such conditions, empowering a chosen individual to act on someone else's behalf in matters concerning vehicles. This legal instrument is specifically tailored to address a broad spectrum of transactions that can include, but are not limited to, the buying, selling, and registration of motor vehicles within the state of California. Its application is both a practical solution for handling routine vehicle transactions and a critical tool in ensuring that an individual's vehicle-related matters are managed according to their wishes, particularly when they are unable to do so themselves. Whether it’s for a short-term arrangement or something more enduring, understanding the scope, utilization, and specific requirements of the California Motor Vehicle Power of Attorney form is essential for anyone looking to facilitate vehicle transactions through a proxy.

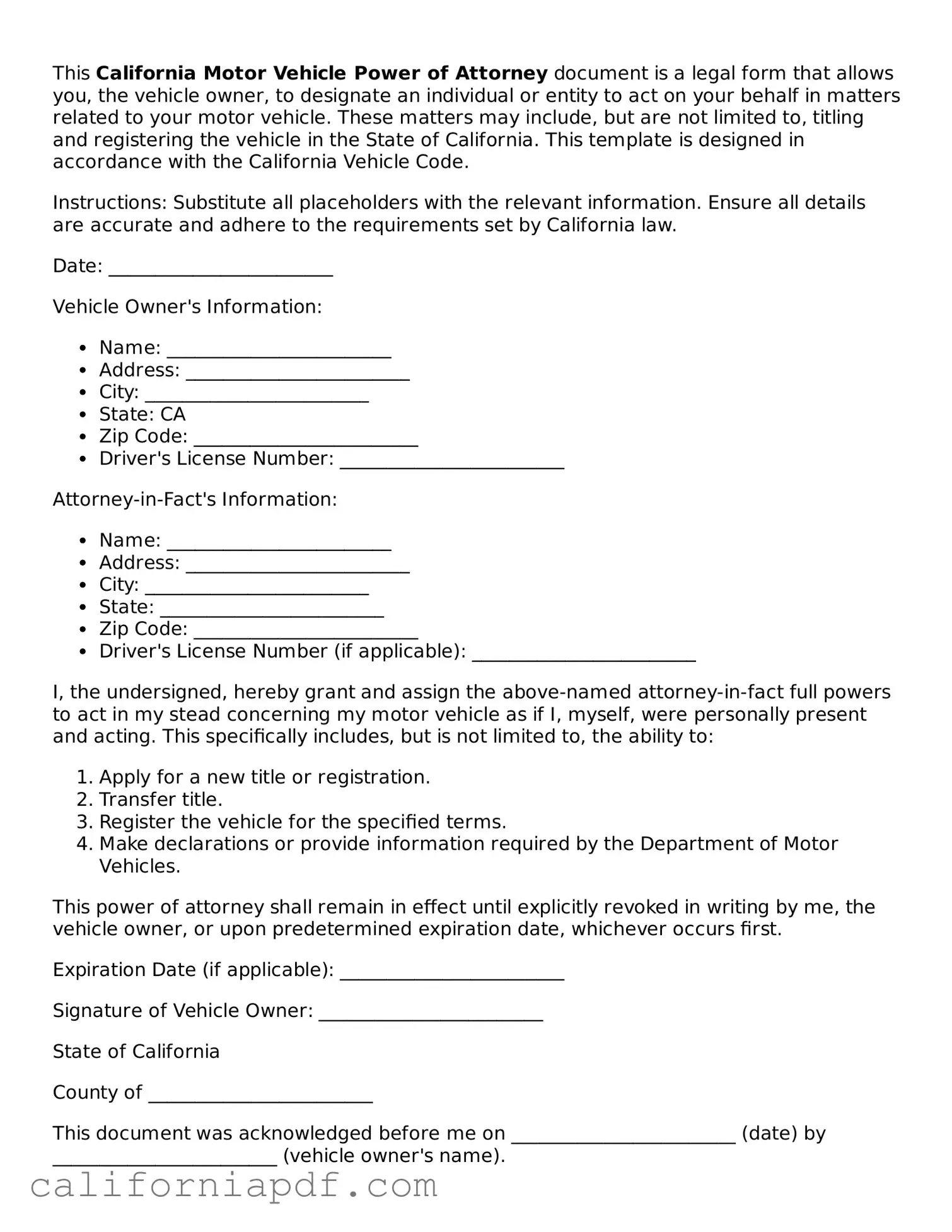

Document Example

This California Motor Vehicle Power of Attorney document is a legal form that allows you, the vehicle owner, to designate an individual or entity to act on your behalf in matters related to your motor vehicle. These matters may include, but are not limited to, titling and registering the vehicle in the State of California. This template is designed in accordance with the California Vehicle Code.

Instructions: Substitute all placeholders with the relevant information. Ensure all details are accurate and adhere to the requirements set by California law.

Date: ________________________

Vehicle Owner's Information:

- Name: ________________________

- Address: ________________________

- City: ________________________

- State: CA

- Zip Code: ________________________

- Driver's License Number: ________________________

Attorney-in-Fact's Information:

- Name: ________________________

- Address: ________________________

- City: ________________________

- State: ________________________

- Zip Code: ________________________

- Driver's License Number (if applicable): ________________________

I, the undersigned, hereby grant and assign the above-named attorney-in-fact full powers to act in my stead concerning my motor vehicle as if I, myself, were personally present and acting. This specifically includes, but is not limited to, the ability to:

- Apply for a new title or registration.

- Transfer title.

- Register the vehicle for the specified terms.

- Make declarations or provide information required by the Department of Motor Vehicles.

This power of attorney shall remain in effect until explicitly revoked in writing by me, the vehicle owner, or upon predetermined expiration date, whichever occurs first.

Expiration Date (if applicable): ________________________

Signature of Vehicle Owner: ________________________

State of California

County of ________________________

This document was acknowledged before me on ________________________ (date) by ________________________ (vehicle owner's name).

Signature of Notary Public: ________________________

(SEAL)

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Purpose | Allows a vehicle owner to grant another person the authority to handle matters related to their vehicle, such as registration or title transactions. |

| Governing Law | The California Vehicle Code is the primary law that governs the use of the Motor Vehicle Power of Attorney in California. |

| Form Designation | In California, the specific form used is often referred to as the "REG 260" form. |

| Who Can Use It | Any vehicle owner in California who wishes to delegate authority related to their vehicle to another person. |

| Requirements for Validity | The form must be properly filled out and signed by the vehicle owner. It may also require notarization, depending on the specific transaction. |

| Limited Scope | The power granted is usually specific to certain tasks, such as registering the vehicle, transferring the title, or obtaining duplicate documents. |

| Expiration | The duration for which the power of attorney is valid can vary. The vehicle owner can specify an expiration date on the form. |

| Revocation | The vehicle owner can revoke the power of attorney at any time, as long as it is done in accordance with California law. |

How to Write California Motor Vehicle Power of Attorney

In California, a Motor Vehicle Power of Attorney (PoA) form is a legal document that allows an individual, known as the principal, to designate another person, known as the agent, to act on their behalf in matters related to the titling and registration of a motor vehicle. This delegation can include signing documents, making decisions, and carrying out tasks related to the vehicle's legal status. Completing this form accurately is essential for ensuring that the designated agent can carry out their duties without legal complications. The following steps are designed to guide individuals through the process of filling out the California Motor Vehicle Power of Attorney form correctly.

- Begin by reading the instructions provided at the top of the form carefully. These instructions offer a general overview of the form's requirements and purpose.

- Identify the document section labeled as the "principal's information." Enter the full legal name of the principal (the person granting the power) as it appears on their identification documents.

- Fill in the principal's address, including the street number, city, state, and ZIP code, in the corresponding fields.

- Proceed to the section designated for the "agent's information." Here, write the full legal name of the agent (the person receiving the power) as it appears on their identification.

- Provide the agent's address, ensuring it includes the street number, city, state, and ZIP code.

- Locate the section concerning the vehicle information. Enter the vehicle's make, model, year, Vehicle Identification Number (VIN), and license plate number. This information must be accurate and correspond to the vehicle's official documents.

- Review the powers being granted to the agent as described in the document. These powers typically include the authority to sign documents related to the titling, registration, and sale of the specified motor vehicle. If necessary, specify any limitations to these powers in the provided space.

- Look for the signature section at the bottom of the form. The principal must sign and date the document in the presence of a notary public. This ensures that the form is notarized, adding a layer of legal authenticity and preventing potential disputes or fraud.

- After the principal's signature, the designated agent will also need to sign and date the form, acknowledging their acceptance of the responsibilities and powers granted to them.

- Finally, deliver the completed and notarized form to the agent, and keep a copy for personal records. The agent may need to present this document when performing tasks on behalf of the principal at the Department of Motor Vehicles (DMV) or other relevant agencies.

With these steps, completing the California Motor Vehicle Power of Attorney form can be achieved efficiently, ensuring that the chosen agent is legally empowered to act on the principal's behalf in vehicle-related matters. It is crucial to ensure that all provided information is accurate and that the form is fully completed to avoid any issues. When in doubt, consulting with a legal professional can provide further clarity and guidance.

Listed Questions and Answers

What is a California Motor Vehicle Power of Attorney Form?

A California Motor Vehicle Power of Attorney (MV POA) form is a document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to act on their behalf in matters related to the California Department of Motor Vehicles (DMV). This could include registering, buying, or selling vehicles, among other transactions.

Who can use the California MV POA form?

Anyone who needs another person to handle their vehicle-related matters with the DMV in California can use this form. This is especially useful for individuals who are unable to personally visit DMV offices due to health issues, travel, or other commitments.

How do I appoint someone as my agent?

To appoint someone as your agent, you'll need to fill out the California MV POA form accurately, stating your name and address as the principal and the name and address of the person you are appointing as your agent. You must then sign and date the form, often in the presence of a notary or a DMV representative, depending on the form's requirements.

Does the agent need to accept the appointment formally?

While the California MV POA form doesn't typically require the agent to formally accept their appointment in writing, it's crucial for the principal to ensure the person they are appointing agrees to take on this responsibility. Verbal acceptance is usually considered sufficient, but having a written acceptance can help clarify roles and prevent misunderstandings.

Is notarization required for a California MV POA form?

Not all California MV POA forms require notarization. However, having the form notarized can add a level of legal assurance and is recommended in most cases. It's important to check the specific requirements of the form or consult with a professional if you're unsure about the necessity of notarization.

What actions can the appointed agent perform?

The agent can perform various vehicle-related transactions on behalf of the principal, such as:

- Registering a new vehicle

- Buying or selling vehicles

- Applying for a title

- Paying fees

- Obtaining license plates

It's essential to specify the powers being granted in the MV POA form to ensure clarity and avoid legal complications.

How long is a California MV POA valid?

The validity of a California MV POA can vary. It may be set for a specific term stated in the document or remain valid until the principal revokes it, becomes incapacitated, or passes away. It's important to refer to the specific terms indicated on your form.

Can I revoke a California MV POA?

Yes, you can revoke a California MV POA at any time by providing written notice to your agent and any relevant third parties, such as the DMV. For complete revocation, it's recommended to retrieve and destroy all copies of the POA document.

Where should I file the completed California MV POA form?

Once completed and (if required) notarized, the MV POA form should be presented to the California DMV along with any other necessary documents for the vehicle-related transaction you're authorizing. It does not need to be filed with any other government office but keeping a copy for your records is recommended.

Common mistakes

Filling out a California Motor Vehicle Power of Attorney form can seem straightforward, but a few common missteps can cause complications or delays. Here's what to watch out for:

Not using the full legal name. It’s crucial to use your complete legal name as it appears on your government-issued ID. Leaving out a middle name or using a nickname can cause confusion or make the document invalid.

Skipping the vehicle identification number (VIN). For the Power of Attorney to be effective, the specific vehicle must be accurately identified; this includes the VIN. A mistake here can render the document ineffective for its intended purpose.

Forgetting to date the document. The date is not just a formality; it establishes when the authorization begins. Without it, the document's validity could be questioned.

Not getting it notarized (if required). While not always mandatory, some transactions may require a notarized document to be accepted. Skipping this step, when necessary, can lead to a frustrating rejection.

Here are additional recommendations to ensure everything goes smoothly:

Double-check the information. Triple-check, if possible. This includes the agent's name, your information, and the vehicle details. Errors can be a significant roadblock.

Know the expiration. Some Power of Attorney forms have an expiration date. Make sure it covers the duration needed for your plans.

Keep a copy. After everything is filled out and submitted, keep a copy for your records. It’ll be handy in case there are any follow-up questions or you need to reference it in the future.

Documents used along the form

When handling endeavors related to motor vehicles in California, the Motor Vehicle Power of Attorney (POA) form is crucial but rarely acts alone. Together with this form, there are several other documents that often play supportive roles in ensuring a smooth transaction or process is achieved. Each document serves a specific purpose, complementing the power and authority granted by the POA form.

- Application for Title or Registration (REG 343): This form is necessary for individuals seeking to title and register a vehicle in California. It captures essential information about the vehicle and its owner.

- Odometer Disclosure Statement (REG 262): Used to document the mileage of a vehicle at the time of sale or transfer of ownership. This document is imperative for maintaining accurate records and preventing odometer fraud.

- Notice of Transfer and Release of Liability (REG 138): When a vehicle's ownership is transferred, this document notifies the California Department of Motor Vehicles (DMV), releasing the previous owner from liability for what occurs with the vehicle after the date of sale.

- Bill of Sale (REG 135): Acts as a record of the transaction between the seller and the buyer, providing details of the vehicle sold, the sale price, and the date of sale. It’s a critical proof of the transaction for both parties.

- Statement of Facts (REG 256): This form is used to provide additional information that may be required for specific transactions at the DMV, such as tax exemptions or vehicle description corrections.

- Vehicle/Vessel Transfer and Reassignment Form (REG 262): A multi-purpose document that also includes the odometer disclosure, needed to complete the transfer and reassignment of a vehicle or vessel.

Together, these forms and documents ensure that all aspects of vehicle transactions, from transfers of ownership to registration and titling, are legally compliant and properly documented. The Motor Vehicle Power of Attorney form allows a designated agent to execute these tasks on behalf of the owner, but the accuracy and legality of the process depend on the proper completion and submission of the supporting documents. Handling them with attention and care is essential for the efficient and lawful management of vehicle-related affairs.

Similar forms

The General Power of Attorney form, much like the California Motor Vehicle Power of Attorney, empowers an individual, known as the agent, to make decisions on behalf of another person, the principal. Where it differs is in its scope; the General Power of Attorney allows the agent to make a wide range of decisions, not just those relating to a motor vehicle, encompassing financial, legal, and personal matters until it is revoked or the principal becomes incapacitated.

Similarly, the Durable Power of Attorney form stands parallel to the California Motor Vehicle Power of Attorney, with the major distinction being its durability. While the Vehicle Power of Attorney focuses on vehicle-related transactions, the Durable Power of Attorney appoints an agent who retains power even if the principal becomes mentally incompetent or physically incapable of making decisions, providing broad or limited control based on the principal's directives.

The Limited Power of Attorney document shares its foundation with the Motor Vehicle Power of Attorney by allowing the principal to grant specific powers to an agent for particular tasks. The likeness lies in the limitation of powers, but while the Motor Vehicle POA is restricted to transactions involving vehicles, a Limited Power of Attorney could cover a range of limited activities, from handling a financial transaction to making medical decisions, based on what the principal specifies.

Health Care Power of Attorney forms, while focused on allowing an agent to make healthcare decisions for the principal, share the element of representation with the Motor Vehicle Power of Attorney. Both documents designate an agent with the authority to act on the principal's behalf, but the Health Care Power of Attorney is specifically tailored towards decisions about medical treatment and health care services in the event the principal cannot make those decisions themselves.

The Real Estate Power of Attorney document parallels the Motor Vehicle Power of Attorney in its function of granting an agent the ability to manage certain affairs for the principal. The difference mainly lies in the type of property under management; while the Motor Vehicle POA pertains to dealings with vehicles, the Real Estate Power of Attorney concerns itself with transactions involving real property, such as buying, selling, or leasing real estate.

Financial Power of Attorney forms mirror the specificity of the Motor Vehicle Power of Attorney, yet they encompass a broader range of financial responsibilities. This document authorizes an agent to handle the principal's financial affairs, including but not limited to, managing bank accounts, paying bills, and investing money. It can be made durable or springing, contingent on the principal's incapacitation.

The Springing Power of Attorney is comparable to the California Motor Vehicle Power of Attorney in its principle of delegating authority to another. However, its distinct feature is activation; it "springs" into effect under specific circumstances defined by the principal, such as a medical diagnosis of incapacity, unlike the typically immediately effective Vehicle Power of Attorney.

The Tax Power of Attorney form, similar to the Motor Vehicle Power of Attorney, narrows its focus to a specific domain, allowing an agent to handle tax matters on behalf of the principal. This includes signing tax returns, obtaining tax information, and dealing with the IRS directly. Though both serve to delegate authority in specific areas, the Tax Power of Attorney is strictly related to tax-related tasks.

Last but not least, the Child Care Power of Attorney provides a way for a parent or legal guardian to grant another individual the authority to make decisions regarding their child's care and welfare, echoing the representation aspect of the Motor Vehicle Power of Attorney. Nevertheless, this form's scope is much more personal, as it pertains exclusively to the well-being and care of minor children, from medical decisions to schooling matters.

Dos and Don'ts

When you're tasked with filling out the California Motor Vehicle Power of Attorney form, it's essential to approach this responsibility with care and precision. This document grants another individual the authority to make decisions regarding your motor vehicle, so ensuring accuracy and compliance with state requirements is crucial. Here's a straightforward guide on what you should and shouldn't do:

- Do read the entire form before beginning to fill it out. Understanding each section can prevent mistakes and ensure you're fully informed about the document's implications.

- Do use black or blue ink for better legibility and to meet standard filing requirements. This makes the document easier to read and photocopy.

- Do verify the vehicle identification number (VIN). Ensuring the VIN matches your vehicle's documentation is crucial for the power of attorney to be applicable.

- Do include all required personal information accurately. Faults in details like your name, address, or the agent's information can invalidate the power of attorney.

- Don't leave any sections blank. If a section doesn't apply, indicate this appropriately (for example, by writing "N/A" for not applicable). Leaving blanks can cause confusion or delays.

- Don't sign without a witness or notary public, if required. The presence of a notary or witness may be necessary for the document to be legally valid.

- Don't use correction fluid or tape. Mistakes should be neatly crossed out and initialed rather than covered up, to maintain the document's integrity.

- Don't forget to check for any specific California Department of Motor Vehicles (DMV) requirements or updates. Requirements can change, and staying informed ensures your document remains compliant.

Taking the time to accurately complete the California Motor Vehicle Power of Attorney form not only streamlines any necessary transactions involving your vehicle but also protects your interests by clarifying the extent of authority granted to your agent. Mindfulness and attention to detail are your allies in this process.

Misconceptions

There are several misconceptions regarding the California Motor Vehicle Power of Attorney (POA) form that individuals often encounter. Understanding these can help in making informed decisions when considering assigning a Power of Attorney for matters related to motor vehicles in California.

It allows the attorney-in-fact to make any decision regarding the owner's vehicles. A common misconception is that the California Motor Vehicle Power of Attorney gives the attorney-in-fact (the person given POA) unrestricted power over all decisions related to the vehicle. In reality, the scope of authority is limited to the specific transactions and matters detailed in the form, such as registering, buying, or selling a vehicle.

The document is valid indefinitely. Many believe once the California Motor Vehicle Power of Attorney form is signed, it remains effective forever. However, it remains valid only until the expiration date stated on the form, if any. Without an expiration date, it continues until it is revoked or upon the death of the grantor.

A notary's signature is always required. Another misconception is that the form must be notarized to be valid. While notarization is highly recommended and may be required for it to be acknowledged by certain institutions, California law doesn't strictly require a notary's signature for the Motor Vehicle POA to be effective.

Any form downloaded from the internet is acceptable. People often believe that any Motor Vehicle Power of Attorney form found online is sufficient for use in California. However, it's essential to use a form that complies with California state laws to ensure it's legally valid. The California Department of Motor Vehicles provides specific forms that should be utilized for this purpose.

Understanding these misconceptions about the California Motor Vehicle Power of Attorney form can help vehicle owners and potential attorneys-in-fact execute their duties more effectively and within the bounds of the law.

Key takeaways

When dealing with the California Motor Vehicle Power of Attorney (MV POA) form, it's important to ensure that the process is handled correctly to authorize someone to act on your behalf concerning your vehicle matters. Here are four key takeaways that can help guide individuals through filling out and using this form efficiently:

- Complete the form accurately: All sections of the MV POA form must be filled out with accurate information. This includes the vehicle identification number (VIN), year, make, model, and the full legal name and address of both the principal (the person granting the power) and the agent (the person receiving the power). Inaccurate or incomplete forms may be rejected.

- Understand the scope: It's crucial to understand that the MV POA grants broad authority to the agent regarding the specified vehicle. This can include buying, selling, and handling registration and titling matters. Knowing the extent of power you're granting is essential for avoiding surprises down the road.

- Notarization may be required: Depending on the specific requirements at the time of use, notarization of the form may be necessary for it to be considered valid and legally binding. Always check the most current requirements or consult with a professional to ensure compliance.

- Keep a record: Once completed and, if applicable, notarized, ensure that copies of the MV POA form are kept in a safe place. Both the principal and the agent should have copies of the document for their records and be prepared to present it when conducting business related to the vehicle.

Create Some Other Templates for California

Are Non Compete Agreements Enforceable in California - Prevents the erosion of a company's market position by limiting the risk of insider knowledge being shared.

Simple Lease Agreement Template - A legal framework outlining the lease dynamics between a property owner and a renter, including financial commitments.

How to Become Power of Attorney for My Mother - A proactive measure for emergency situations, ensuring someone has legal authority to act for the child immediately.