Attorney-Approved California Operating Agreement Document

In the realm of business formation and management in California, the Operating Agreement form occupies a pivotal role, particularly for limited liability companies (LLCs). This document, though not mandated by state law for LLC operation, is highly recommended as it outlines the structural, financial, and operational framework of the entity. It delineates the roles, powers, and responsibilities of the members and managers, stipulates the allocation of profits and losses, and addresses the procedures for adding or removing members, among other governance-related matters. Moreover, it serves as a critical tool for establishing the LLC’s operational legitimacy and can be instrumental in protecting members’ personal assets from the company's liabilities. By custom-tailoring their Operating Agreements, LLC members have the flexibility to structure their business in a way that best suits their specific needs, away from the default provisions set by state law. Thus, the significance of the California Operating Agreement extends beyond mere formal documentation, acting as a cornerstone for clear communication, dispute resolution, and the long-term success of the entity.

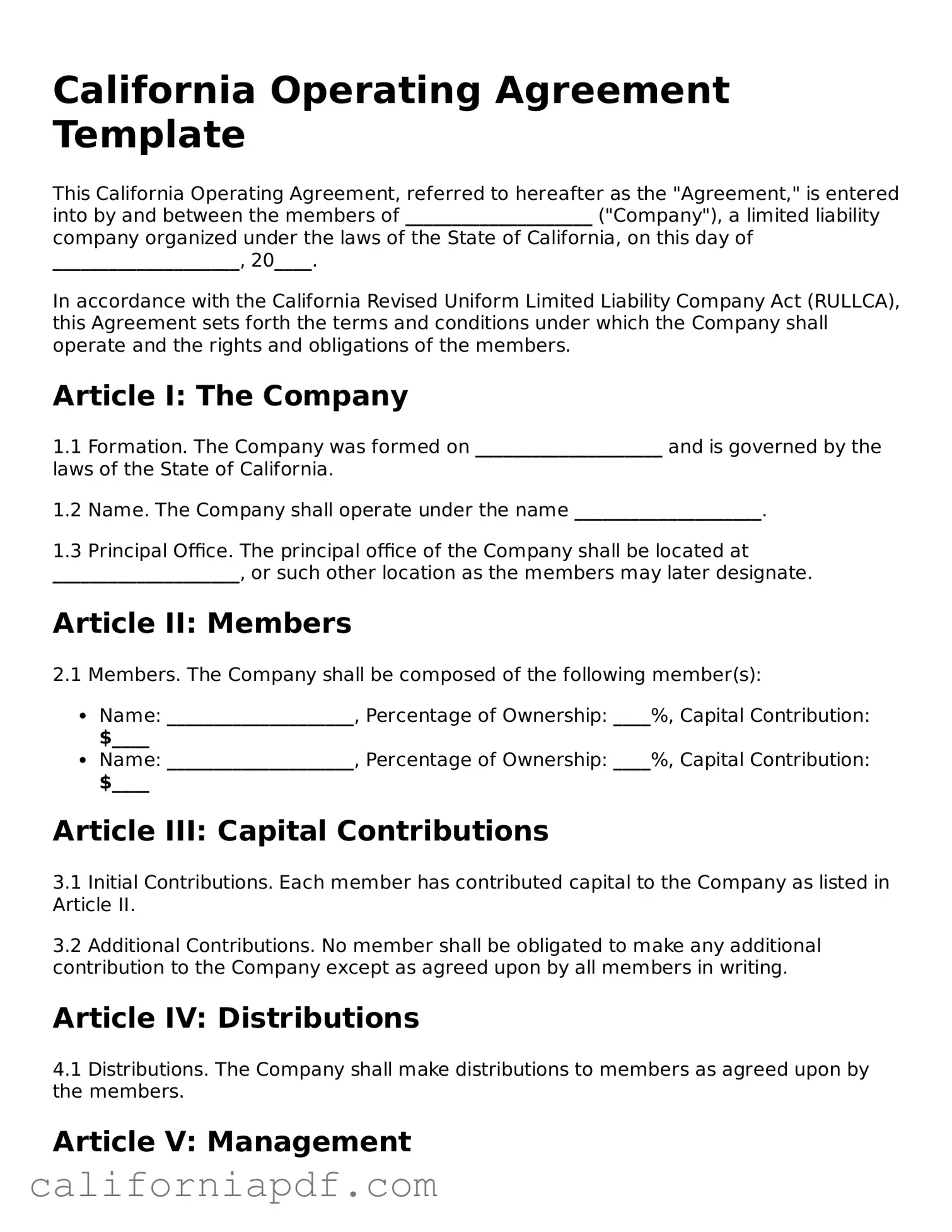

Document Example

California Operating Agreement Template

This California Operating Agreement, referred to hereafter as the "Agreement," is entered into by and between the members of ____________________ ("Company"), a limited liability company organized under the laws of the State of California, on this day of ____________________, 20____.

In accordance with the California Revised Uniform Limited Liability Company Act (RULLCA), this Agreement sets forth the terms and conditions under which the Company shall operate and the rights and obligations of the members.

Article I: The Company

1.1 Formation. The Company was formed on ____________________ and is governed by the laws of the State of California.

1.2 Name. The Company shall operate under the name ____________________.

1.3 Principal Office. The principal office of the Company shall be located at ____________________, or such other location as the members may later designate.

Article II: Members

2.1 Members. The Company shall be composed of the following member(s):

- Name: ____________________, Percentage of Ownership: ____%, Capital Contribution: $____

- Name: ____________________, Percentage of Ownership: ____%, Capital Contribution: $____

Article III: Capital Contributions

3.1 Initial Contributions. Each member has contributed capital to the Company as listed in Article II.

3.2 Additional Contributions. No member shall be obligated to make any additional contribution to the Company except as agreed upon by all members in writing.

Article IV: Distributions

4.1 Distributions. The Company shall make distributions to members as agreed upon by the members.

Article V: Management

5.1 Management of the Company is vested in the members. Decisions shall be made by a vote of the members with each member having a vote proportionate to their percentage of ownership in the Company.

Article VI: Meetings

6.1 Annual Meeting. The Company shall hold an annual meeting of the members at a time and place selected by the members for the purpose of reviewing the company's performance and planning for the future.

Article VII: Amendments

7.1 This Agreement can be amended only by a written agreement signed by all members.

Article VIII: Dissolution

8.1 The Company may be dissolved as agreed upon by the members or as required by the laws of the State of California.

In witness thereof, the undersigned have executed this Agreement as of the effective date first above written.

Member Signature: ____________________ Date: ____________________

Member Signature: ____________________ Date: ____________________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Definition and Purpose | An Operating Agreement is a legal document outlining the governance and operating procedures of a Limited Liability Company (LLC) in California. It details the rights, powers, duties, liabilities, and obligations of the members among themselves and to the LLC. |

| Governing Law | The form and content of the Operating Agreement are governed by the California Revised Uniform Limited Liability Company Act, found in the California Corporations Code starting at Section 17701.01. |

| Flexibility and Customization | While the state provides certain default provisions, the Operating Agreement offers LLC members the flexibility to structure the company according to their own rules and specifications, provided they do not contravene state laws. |

| Not Mandatory, Highly Recommended | Although not legally required in California, creating an Operating Agreement is highly recommended. It helps in the effective management of the LLC, clarifies the financial and managerial organization, and can prevent misunderstandings among members. |

How to Write California Operating Agreement

Starting a business in California means taking several crucial steps to ensure its success and legal compliance. One of these important actions is filling out the California Operating Agreement form for your company. This document outlines the ownership and operating procedures of your LLC (Limited Liability Company), helping to establish clear rules and expectations for all members. It's not just about legality; it also provides a solid foundation for your business operations. Lack of this form doesn't invalidate your company, but having it can avert conflicts and confusion down the line. Here's how to fill it out step by step.

- Start by gathering all necessary information about your LLC, including the company name, principal place of business, and the names and addresses of all members.

- Fill in the name of your LLC exactly as it appears on your Articles of Organization filed with the California Secretary of State.

- Specify the principal place of business where your company will operate. This includes the full address, city, state, and ZIP code.

- List the name(s) and address(es) of each member contributing to the LLC. Detail the contribution of each member, whether it's cash, property, or services, and its value.

- Describe the process for adding or removing members in the future, and how membership interests will be transferred.

- Outline the management structure of your LLC. Indicate whether it will be managed by members or a designated manager/managers.

- Detail how profits and losses will be distributed among members. This is usually proportional to each member's ownership percentage.

- Include any voting rights and responsibilities for each member. This includes how decisions will be made, such as a simple majority or unanimous consent.

- Specify the conditions under which the LLC might be dissolved and the process for winding up its affairs.

- Review the entire document with all members present to ensure accuracy and a mutual understanding of its contents. Each member should sign and date the form.

Once the form is completed and signed by all members, it doesn't need to be filed with the state. However, it should be kept in a safe place where it can be easily accessed when needed. Regularly updating the Operating Agreement as your company grows and changes is also a good practice to maintain clarity and prevent disputes. This document not only serves as a guideline for the operations of your LLC but as a safeguard for the interests of everyone involved.

Listed Questions and Answers

What is a California Operating Agreement?

An Operating Agreement is a key document used by LLCs in California, outlining the business's financial and functional decisions including rules, regulations, and provisions. The purpose is to govern the internal operations of the business in a way that suits the specific needs of its members (owners).

Do I need to file my Operating Agreement with the state of California?

No, you do not need to file your Operating Agreement with any state agency in California. While the document is legally required to be created and should be maintained by the LLC, it is an internal document. This means it should be kept on file by the business owners and presented only when required by a financial institution, for legal proceedings, or as part of tax audits.

What are the key components to include in a California Operating Agreement?

The content of an Operating Agreement can vary, but typically includes the following key components:

- Organization details, including the LLC's name, address, and formation date.

- Member information, specifying who the members are and their ownership percentages.

- Management structure, detailing whether the LLC will be member-managed or manager-managed.

- Contributions of each member, including capital and property.

- Distributions policy, how and when profits and losses will be shared among members.

- Rules for holding meetings and taking votes.

- Procedures for adding or removing members.

- Buyout and buy-sell rules, outlining what happens if a member wants to sell their part of the business, if they become disabled, or if they die.

Can I modify my Operating Agreement?

Yes, the Operating Agreement for your LLC can be modified if necessary. However, the process for making amendments should be outlined in the original Operating Agreement. Typically, amendments require a certain percentage of votes from the members. It's important to ensure all members review and agree with the changes, and that any amendments are documented and kept with the original Operating Agreement.

Is an Operating Agreement necessary for a single-member LLC in California?

Even for a single-member LLC, California highly recommends having an Operating Agreement. While it might seem unnecessary since there are not multiple members to share decision-making, an Operating Agreement can provide clarity and protection for the sole owner’s operational intentions and separate the personal liabilities from the business's liabilities. This document can also add credibility to your business when dealing with banks, lenders, or in legal situations.

Common mistakes

When individuals set out to establish a Limited Liability Company (LLC) in California, the Operating Agreement is a critical document that outlines the management structures, financial agreements, and the operational guidelines of the business. Despite its significance, errors in completing this form are common. These mistakes can lead to misunderstandings, legal vulnerabilities, or even conflicts among members down the line. Here’s an overview of the nine mistakes often made when filling out the California Operating Agreement form:

Not Tailoring the Agreement to the Specific Business - Using a one-size-fits-all approach might overlook specific needs or agreements pertinent to the business at hand.

Skipping Sections Deemed Non-Applicable - Rather than leaving sections blank, it is more prudent to indicate that they are not applicable to avoid any ambiguity.

Incorrect Information - Inputting inaccurate details about the business, such as the official business name, registered office address, or member details, can have legal implications.

Omitting Details about Capital Contributions - Failing to specify the amount and form of each member’s contribution to the company can lead to conflicts or misunderstandings.

Vague Descriptions of Roles and Responsibilities - Without clearly defined duties and responsibilities for each member, operational inefficiencies or disputes may arise.

Not Specifying Dispute Resolution Mechanisms - A lack of outlined procedures for resolving internal disputes can escalate minor disagreements into major conflicts.

Failure to Plan for Future Changes - Neglecting to include protocols for adding or removing members, or for the dissolution of the LLC, can complicate these processes later on.

Ignoring State-Specific Requirements - Each state has unique requirements and failing to adhere to California-specific regulations can result in non-compliance issues.

Not Updating the Agreement - As the business evolves, the Operating Agreement should be revisited and amended to reflect current operations and structures.

Minding these common pitfalls when drafting an Operating Agreement can safeguard an LLC from potential legal challenges and ensure its smooth operation. It's crucial to consider that while templates can provide a foundational structure, the specifics of the agreement should fully encapsulate the unique aspects of the business and the agreement among its members. Consulting with legal professionals can also provide clarity and further personalize the agreement to fit the business’s needs.

Documents used along the form

When creating or managing a Limited Liability Company (LLC) in California, the Operating Agreement is just one crucial document, but it's not the only one you'll need. To smoothly navigate the legal and administrative landscape, there are several other forms and documents often used alongside the Operating Agreement. These documents help in defining the structure of your business, protecting its legal standing, and ensuring compliance with state regulations. Let's look at some of these key documents.

- Articles of Organization: This is the initial document filed with the California Secretary of State to officially form your LLC. It includes basic information such as the LLC name, principal address, purpose, and the name and address of the registered agent.

- Employer Identification Number (EIN) Application: After forming your LLC, you'll need to obtain an EIN from the IRS. This number is essential for tax purposes, hiring employees, and opening a business bank account.

- Statement of Information: California requires LLCs to file a Statement of Information within 90 days of filing the Articles of Organization and every two years thereafter. This document updates the state on vital information about your business, including addresses and management.

- Business Licenses and Permits: Depending on your LLC’s location and industry, you might need various state and local licenses and permits to operate legally. These could range from a general business license to specific permits for regulated industries.

- Operating Agreement Amendments: If there are changes to the membership or structure of your LLC, you may need to amend your Operating Agreement to reflect these changes and keep the document current. Written Action by Consent of the Members or Managers: This document records decisions made by the LLC’s members or managers outside of regular meetings. It ensures that all actions are documented and agreed upon, maintaining clarity and accountability.

Together, these documents form the backbone of your LLC's administrative framework. While the Operating Agreement outlines the operations of your LLC, the other documents facilitate its legal formation, compliance, and daily functioning. Keeping these documents up-to-date and in order ensures that your LLC operates smoothly and remains in good standing with the state of California and other regulatory bodies. Remember, each document serves its unique purpose, contributing to the foundation and success of your business.

Similar forms

The California Operating Agreement shares similarities with a Partnership Agreement. Both documents outline the operational structure, financial arrangements, and responsibilities of the business's owners. They provide a clear guide on how decisions are made, profits are shared, and disputes are resolved. Despite their applicability to different types of business entities—Operating Agreements for LLCs and Partnership Agreements for partnerships—the purpose of defining the internal workings and expectations among the parties is a mutual objective.

Similarly, the Bylaws document of a corporation parallels the California Operating Agreement in its function and intent. Bylaws govern the internal management of a corporation, detailing the roles of directors and officers, meeting protocols, and other corporate governance matters. Like the Operating Agreement, Bylaws serve as a vital document that establishes the rules and procedures the entity will follow, demonstrating how both documents serve to organize the governance of a business entity in a structured manner.

The Shareholder Agreement also bears resemblance to the California Operating Agreement, particularly in its role in specifying the rights and obligations of the shareholders, distribution of profits, and procedures for resolving disputes. Both documents are crucial in closely held companies, as they help prevent conflicts by clearly outlining the terms of engagement and protocols for various scenarios, including the exit or death of a member or shareholder. This ensures a smoother transition during such events.

Lastly, the Buy-Sell Agreement shares a particular similarity with the California Operating Agreement in terms of succession planning. A Buy-Sell Agreement outlines the process for transferring ownership in the event an owner wishes to sell their interest, or in cases of death or disability. The Operating Agreement may also include similar provisions that control the transfer of membership interests, highlighting how both documents address the future of the business’s ownership and provide a roadmap for continuity.

Dos and Don'ts

When filling out the California Operating Agreement form, it's important to approach the process with care and precision. This document outlines the operational framework and financial arrangements of a limited liability company (LLC). To ensure its validity and effectiveness, here are essential do's and don'ts you should follow:

Do's:

- Review the default state laws regarding LLCs in California to understand which provisions of your operating agreement will override or supplement those defaults.

- Include detailed information about each member's contribution to the LLC, whether in the form of capital, assets, or services, to prevent any misunderstandings in the future.

- Clearly outline the process for admitting new members, including any necessary approval from existing members and how their contributions will be valued.

- Specify the allocation of profits and losses among members to ensure there's a clear understanding of financial distribution.

Don'ts:

- Overlook the importance of having a detailed dispute resolution clause. Without it, you might find resolving disagreements among members more challenging.

- Ignore the need for regular updates. As your LLC grows or experiences changes in membership, your Operating Agreement should be revised to reflect these changes.

- Forget to discuss and include details regarding the dissolution of the LLC. This includes the process for dissolving the company and distributing assets among members.

- Use vague language that could lead to multiple interpretations. It's crucial to be as clear and specific as possible to avoid ambiguity and potential conflicts.

Misconceptions

Many people have misconceptions about the California Operating Agreement form, which can lead to confusion and errors in its application. Understanding what these misconceptions are is crucial for anyone involved in formulating such an agreement. Here are some of the common misunderstandings:

It’s mandatory for all businesses to have one. This is not the case; while highly recommended for providing clarity and structure within a limited liability company (LLC), California law doesn’t require every business to have an Operating Agreement. However, it’s particularly beneficial for LLCs to draft one to outline the operational and financial arrangements among its members and manage legal risk.

The form is the same for every LLC. A one-size-fits-all approach doesn't apply here. Each Operating Agreement should be tailored to meet the specific needs and structure of the LLC it pertains to. Copying a standard template without making necessary adjustments can missessential aspects unique to your business or may include irrelevant clauses.

Only multi-member LLCs need an Operating Agreement. Even single-member LLCs can benefit from having an Operating Agreement. It provides a legal document that spells out the business’s management structures and routines, which can be extremely valuable for legal protection and when dealing with lenders or banks.

An Operating Agreement is too complex to create without a lawyer. While having a legal professional help draft or review your Operating Agreement can ensure that all legal bases are covered, it’s also possible for members of an LLC to create one on their own. Many resources and templates are available to guide members through the process. However, for complex arrangements or specific legal advice, consulting a lawyer is advised.

Key takeaways

When starting a business, particularly an LLC (Limited Liability Company) in California, the Operating Agreement is a critical document. It outlines the company's financial and functional decisions, including rules, regulations, and provisions. The purpose is to govern the internal operations of the business in a way that suits the specific needs of the business owners. Here are key takeaways about filling out and using the California Operating Agreement form:

- Customization is Key: Every LLC is unique, and the California Operating Agreement allows for customization to cater to the specific needs of your business. Unlike the one-size-fits-all approach of many other forms and documents, this flexibility ensures that the agreement can align closely with the operations and structure of your LLC.

- Not Legally Required, but Highly Recommended: While the state of California doesn't legally require LLCs to have an Operating Agreement, having one in place is highly advised. It not only provides clarity and structure for the management of the LLC but also ensures that your business operates under your own rules, rather than default state laws.

- Protection for Members: An Operating Agreement can offer substantial protection to the members of an LLC. By clearly defining roles, responsibilities, and processes for conflict resolution, it can safeguard members against personal liability for the actions of the LLC, while also streamlining decision-making processes.

- Distribution and Financial Arrangements: It's vital to specify in the Operating Agreement how profits and losses will be distributed among members. This is typically not dictated by the state, so your agreement should detail any agreements about splits, distributions, and financial contributions from members to avoid future disputes.

- Updating Is Necessary: As your business evolves, so should your Operating Agreement. Regular reviews and updates to the document can ensure it remains relevant and aligned with both the growth of the company and changes in laws. This proactive approach can help in avoiding conflicts and misunderstandings among members in the long run.

Having a well-thought-out Operating Agreement in place is essential for establishing a clear, agreed-upon foundation for the operation and management of your LLC. It not only helps in avoiding potential conflicts but also in ensuring the smooth operation and sustainability of the business. Therefore, taking the time to create and maintain this document can be one of the most important steps in the formation of your LLC.

Create Some Other Templates for California

Mobile Home Title California - This form includes critical information such as the make, model, year, and serial number of the mobile home, along with the sale date and price.

Template for a Will - This important legal document can be revised as life circumstances change, such as after marriage, divorce, the birth of children, or significant changes in financial status, keeping one’s estate plan current and reflective of their wishes.