Attorney-Approved California Power of Attorney Document

In navigating the complexities of managing one’s personal, financial, or health-related decisions during unforeseen circumstances, the California Power of Attorney (POA) form emerges as a crucial tool. This legal document grants one individual, known as the principal, the ability to designate another person, known as the agent or attorney-in-fact, to make decisions on their behalf. Tailored to cater to diverse needs, the form encompasses various types, including those specific to healthcare, financial matters, and the durable POA, which remains in effect even if the principal becomes incapacitated. With its importance underscored by the need for clarity in the delegation of decision-making authority, the form's proper completion and execution are guided by specific legal requirements in California. These stipulations ensure that the document holds validity in the eyes of the law, reinforcing the principal's intentions and providing peace of mind to all parties involved. The significance of this form in ensuring that one’s affairs are managed according to their wishes cannot be overstated, making it an essential component of personal and financial planning.

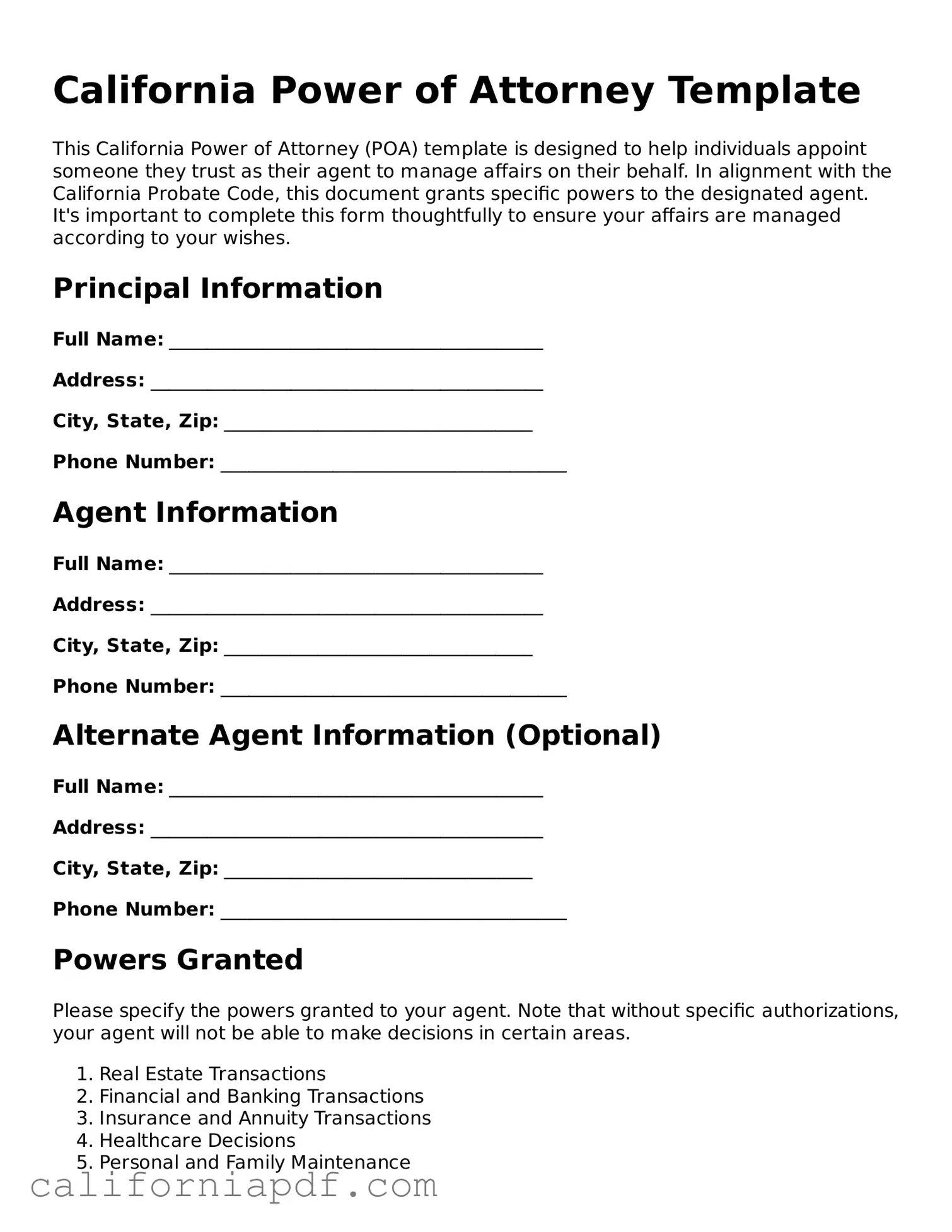

Document Example

California Power of Attorney Template

This California Power of Attorney (POA) template is designed to help individuals appoint someone they trust as their agent to manage affairs on their behalf. In alignment with the California Probate Code, this document grants specific powers to the designated agent. It's important to complete this form thoughtfully to ensure your affairs are managed according to your wishes.

Principal Information

Full Name: ________________________________________

Address: __________________________________________

City, State, Zip: _________________________________

Phone Number: _____________________________________

Agent Information

Full Name: ________________________________________

Address: __________________________________________

City, State, Zip: _________________________________

Phone Number: _____________________________________

Alternate Agent Information (Optional)

Full Name: ________________________________________

Address: __________________________________________

City, State, Zip: _________________________________

Phone Number: _____________________________________

Powers Granted

Please specify the powers granted to your agent. Note that without specific authorizations, your agent will not be able to make decisions in certain areas.

- Real Estate Transactions

- Financial and Banking Transactions

- Insurance and Annuity Transactions

- Healthcare Decisions

- Personal and Family Maintenance

- Tax Matters

- Claims and Litigation

- Government Benefits

- Retirement Plan Transactions

- Other: ________________________________________________

Duration

This Power of Attorney will become effective on ____________________ and will remain in effect:

- Until a specified date: ___________________________ (leave blank if not applicable)

- Until I revoke it in writing.

- Until my death.

- If I become incapacitated, this POA will (choose one):

_____ Become void upon my incapacitation.

_____ Continue to be effective during any period of incapacitation.

Signatures

Principal's Signature: ___________________________ Date: ____________

Agent's Signature: _______________________________ Date: ____________

Alternate Agent's Signature (if applicable): ___________________________ Date: ____________

Witnesses (Optional depending on local requirements)

The signing of this document was witnessed by:

Witness 1's Full Name: ___________________________

Witness 1's Signature: ___________________________ Date: ____________

Witness 2's Full Name: ___________________________

Witness 2's Signature: ___________________________ Date: ____________

By signing, all parties agree to the terms and conditions outlined in this document, ensuring that it adheres to the laws and regulations of the State of California.

PDF Form Characteristics

| Fact | Description |

|---|---|

| 1. Governing Law | The California Power of Attorney form is governed by the California Probate Code, sections 4000 to 4465. |

| 2. Types Available | California allows for both Financial and Healthcare Powers of Attorney forms, catering to different needs. |

| 3. Durability | A Power of Attorney in California can be made durable, meaning it remains in effect even if the principal becomes incapacitated. |

| 4. Document Requirements | For validity, the form must be signed by the principal, in the presence of a notary or two adult witnesses. |

| 5. Witness Restrictions | The witnesses cannot be the agent, the principal's healthcare provider, or the operator of a community care facility. |

| 6. Agent's Authority | An agent can be granted broad or specific authority, including handling financial matters or making health care decisions. |

| 7. Termination | A Power of Attorney terminates upon the principal's death, revocation, or if specified by the document itself. |

| 8. Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent. |

| 9. Requirements for Health Care Decisions | A separate form, the Advance Health Care Directive, is required for medical decisions. |