Attorney-Approved California Prenuptial Agreement Document

Embarking on the journey of marriage symbolizes not just a union of hearts but also of futures, assets, and responsibilities. In California, a state known for its forward-thinking laws and robust legal protections, couples often consider a significant step before saying "I do": entering into a Prenuptial Agreement. This document, far from being a pessimistic view of marriage, represents a practical approach to aligning expectations and safeguarding individual interests before marriage. By clearly outlining the handling of financial assets, debts, and perhaps even spousal support in the event of a divorce, a Prenuptial Agreement in California can pave the way for transparent and honest discussions, setting a strong foundation for the future. It's a tool designed not just to protect one's financial assets but to also foster a spirit of partnership and mutual respect. With the specificity required by California law, the form necessitates careful consideration, including full disclosure of assets, adherence to legal standards, and, often, the advice of experienced legal counsel to ensure that it meets all legal thresholds and truly reflects the wishes of both parties involved.

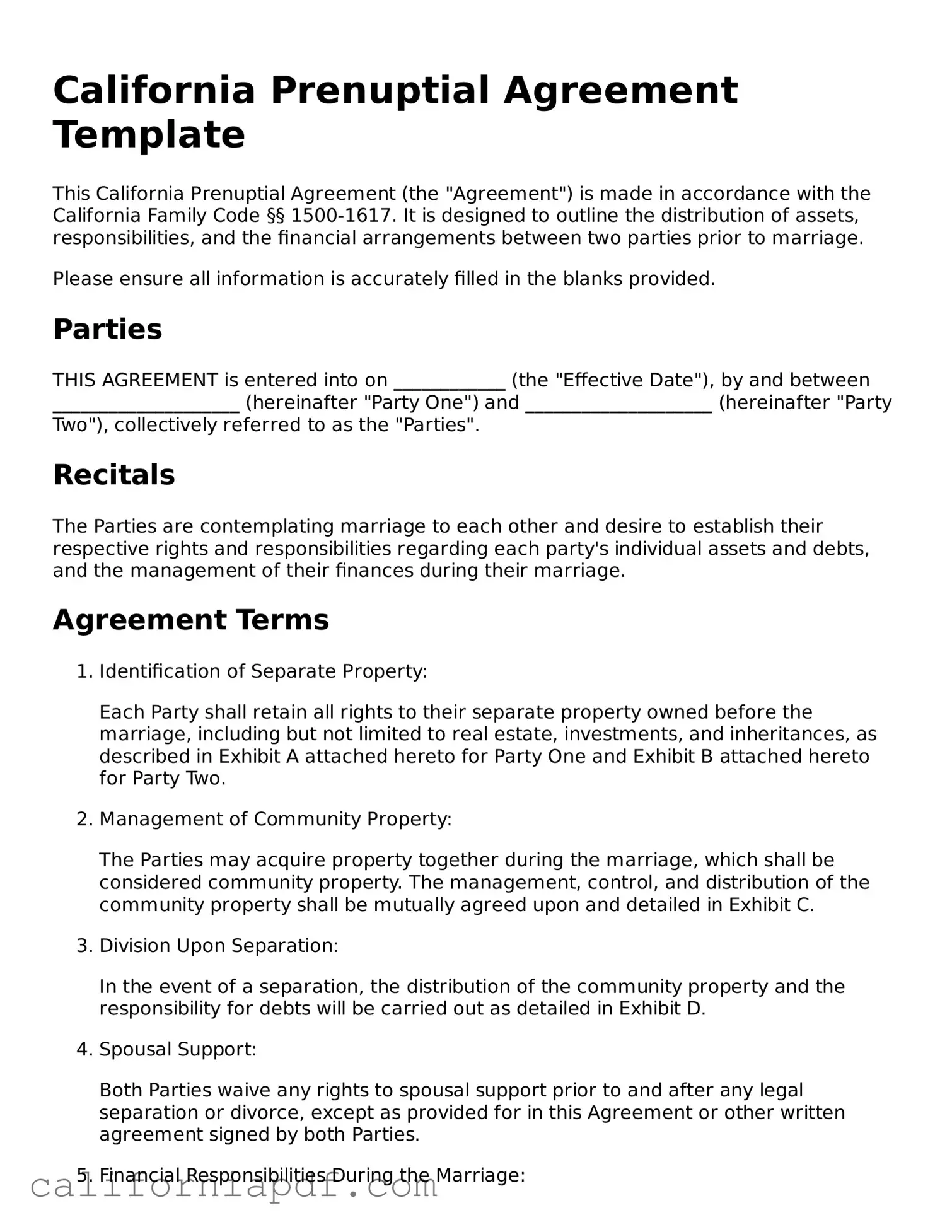

Document Example

California Prenuptial Agreement Template

This California Prenuptial Agreement (the "Agreement") is made in accordance with the California Family Code §§ 1500-1617. It is designed to outline the distribution of assets, responsibilities, and the financial arrangements between two parties prior to marriage.

Please ensure all information is accurately filled in the blanks provided.

Parties

THIS AGREEMENT is entered into on ____________ (the "Effective Date"), by and between ____________________ (hereinafter "Party One") and ____________________ (hereinafter "Party Two"), collectively referred to as the "Parties".

Recitals

The Parties are contemplating marriage to each other and desire to establish their respective rights and responsibilities regarding each party's individual assets and debts, and the management of their finances during their marriage.

Agreement Terms

- Identification of Separate Property:

Each Party shall retain all rights to their separate property owned before the marriage, including but not limited to real estate, investments, and inheritances, as described in Exhibit A attached hereto for Party One and Exhibit B attached hereto for Party Two.

- Management of Community Property:

The Parties may acquire property together during the marriage, which shall be considered community property. The management, control, and distribution of the community property shall be mutually agreed upon and detailed in Exhibit C.

- Division Upon Separation:

In the event of a separation, the distribution of the community property and the responsibility for debts will be carried out as detailed in Exhibit D.

- Spousal Support:

Both Parties waive any rights to spousal support prior to and after any legal separation or divorce, except as provided for in this Agreement or other written agreement signed by both Parties.

- Financial Responsibilities During the Marriage:

The Parties agree to maintain individual financial responsibilities for debts incurred prior to the marriage. Any debts incurred during the marriage will be addressed as outlined in Exhibit E.

- Modification and Revocation:

This Agreement may only be modified or revoked by a written document signed by both Parties and acknowledged by them as an amendment to this Agreement.

- Governing Law:

This Agreement shall be governed by and construed in accordance with the laws of the State of California, without regard to its conflict of laws provisions.

Signatures

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the first date above written.

Party One Signature: ___________________________ Date: _____________

Party Two Signature: ___________________________ Date: _____________

Witness Signature (if required): ___________________________ Date: _____________

PDF Form Characteristics

| Fact Number | Detail |

|---|---|

| 1 | California prenuptial agreements are governed by the California Family Code, specifically Sections 1600-1617. |

| 2 | Both parties must enter into the agreement voluntarily, without any pressure or duress. |

| 3 | Each party must provide a full and fair disclosure of their financial assets and liabilities to the other party before signing the agreement. |

| 4 | Parties have the right to seek independent legal advice before signing the prenuptial agreement. |

| 5 | The agreement cannot make provisions regarding child support or child custody. |

| 6 | If deemed to be unfair or if signed under duress, coercion, or without proper financial disclosure, the agreement may be invalidated by a court. |

| 7 | To modify or revoke the agreement after marriage, both parties must agree to the changes in writing. |

How to Write California Prenuptial Agreement

When a couple decides to marry, they may consider creating a prenuptial agreement. This document can help set clear expectations and protections for both individuals regarding their financial arrangement prior to marriage. In California, filling out a prenuptial agreement form requires careful attention to detail to ensure that it fully captures the intentions of both parties and complies with state laws. The following steps are designed to guide those who wish to establish such an agreement in an organized and respectful manner.

- Gather all necessary financial documents, including but not limited to, bank statements, investment accounts, property deeds, and any other assets or liabilities. This step ensures transparency between the parties.

- Discuss openly with your partner the terms you wish to include in the prenuptial agreement, such as property division, financial responsibilities during the marriage, and any considerations for spousal support in the event of divorce or separation. This conversation should be approached with care and understanding.

- Seek legal advice from an attorney who specializes in family law and prenuptial agreements in California. An attorney can provide valuable guidance on the legal prerequisites and help craft an agreement that meets the specific needs and circumstances of both partners.

- Commence filling out the California Prenuptial Agreement form by entering the full legal names of both parties entering into the agreement.

- Detail the financial assets, liabilities, and any personal property that each person wishes to declare as separate property. Specify how property acquired during the marriage will be handled.

- Include terms regarding the possibility of spousal support, including conditions under which support would be provided, the amount, and the duration.

- Review the agreement together with your partner to ensure that it accurately reflects the understanding and intentions of both parties. It's important to engage in this review with empathy and an open mind to foster mutual agreement and respect.

- Have the agreement reviewed by independent legal counsel for each partner to ensure that it is fair, complies with California law, and that both parties fully understand their rights and obligations.

- Make any necessary revisions to the agreement based on feedback from legal counsel and further discussions with your partner.

- Once the agreement is finalized and both parties are satisfied, sign the document in the presence of a notary public. In California, it is required for the prenuptial agreement to be notarized to be considered legally binding.

After completing these steps, the prenuptial agreement will be a legally binding document that provides a clear framework for the financial aspects of the marriage. By addressing these matters thoughtfully and in advance, couples can focus more fully on building their future together. Remember, a prenuptial agreement is not about anticipating failure but rather about preparing responsibly for a shared life together. Engaging in this process transparently and respectfully can strengthen the foundation of any partnership.

Listed Questions and Answers

What is a California Prenuptial Agreement?

A California Prenuptial Agreement is a legal document that a couple enters into before their marriage. It outlines how assets and financial matters will be handled both during the marriage and in the event of divorce. This agreement aims to provide clarity and protect each person's assets, reducing potential conflicts should the marriage dissolve.

Who should consider a Prenuptial Agreement in California?

Any couple planning to get married in California might consider a Prenuptial Agreement. It is particularly advisable for individuals with significant assets, children from previous relationships, or specific wishes about how their property should be managed. It benefits those who seek to ensure financial clarity and security for both parties, limiting potential disputes over assets in the future.

What types of assets can be protected by a California Prenuptial Agreement?

The types of assets that can be protected by a Prenuptial Agreement in California include:

- Real estate

- Personal property

- Investments

- Inheritances

- Business interests

It's important to accurately disclose and describe all assets in the agreement to ensure they are protected.

How can I ensure my Prenuptial Agreement is legally binding in California?

To ensure your Prenuptial Agreement is legally binding in California, follow these guidelines:

- Both parties must enter into the agreement voluntarily, without any duress or pressure.

- There must be full and fair disclosure of all assets and liabilities by both parties at the time of signing.

- The agreement cannot be unconscionable, meaning it must not heavily favor one party over the other to an extreme extent.

- It is highly recommended that both parties seek independent legal advice to understand their rights and the implications of the agreement fully.

Can a California Prenuptial Agreement dictate child custody or child support?

No, a California Prenuptial Agreement cannot dictate terms regarding child custody or child support. These matters are determined based on the child's best interests at the time of separation or divorce, and a prenuptial agreement cannot predetermine these outcomes.

Is it possible to amend or revoke a Prenuptial Agreement after it's been signed?

Yes, a Prenuptial Agreement in California can be amended or revoked after it has been signed, but this requires the consent of both parties. Any changes or the decision to revoke must be in writing and signed by both individuals, similar to the original agreement process.

What happens to a California Prenuptial Agreement if we move to another state or country?

If you move to another state or country, the enforceability of your California Prenuptial Agreement may vary based on the local laws of your new residence. It is advisable to consult with a legal professional in your new location to understand how your agreement might be affected and whether any modifications are necessary to ensure its continued validity.

Common mistakes

When preparing a California Prenuptial Agreement, individuals often encounter pitfalls that could impact the document's effectiveness and enforceability. Avoiding these mistakes is crucial for ensuring the prenuptial agreement serves its intended purpose and protects both parties' interests. Below are key mistakes to watch out for:

Failing to Provide Full Disclosure: One of the most critical errors is not fully disclosing all assets and liabilities. Transparency is a cornerstone of a valid prenuptial agreement in California. Without complete disclosure, the agreement can be challenged and possibly deemed invalid.

Insufficient Time for Review: Giving one party an inadequate amount of time to review the prenuptial agreement can lead to problems. Both parties should have ample time to consider the terms and seek independent legal advice. Rushing this process can result in an agreement that is not enforceable.

Not Seeking Independent Legal Advice: Each party must have the opportunity to consult with their own attorney. Failing to seek independent legal advice can lead to an imbalance of power and knowledge, making the agreement vulnerable to challenges.

Mistaking Legal Requirements: Every state has its own set of laws governing prenuptial agreements. Misinterpreting or ignoring California's specific requirements can render the agreement invalid. Understanding and adhering to state laws is essential.

Inclusion of Invalid Provisions: Incorporating terms that are not enforceable, such as those dictating personal behavior or child support obligations, can jeopardize the entire agreement. It's important to focus on legally permissible provisions.

Using Ambiguous Language: Clarity and specificity are key in a prenuptial agreement. Ambiguous terms or vague language can lead to disputes and interpretations that were not intended by either party. Precise language helps ensure that the agreement is enforced as intended.

Ignoring Future Changes: Not accounting for future changes in financial situations or considering the potential for children can short-change an agreement's usefulness. Although it's impossible to predict every change, addressing possible future adjustments is essential.

Forgetting to Update the Agreement: Circumstances change, and so should the prenuptial agreement. Failing to review and update the agreement periodically can mean it no longer reflects the parties' wishes or current situation, potentially making it less relevant or enforceable.

Attention to these details can significantly enhance the strength and enforceability of a prenuptial agreement in California. It ensures that the agreement accurately reflects the parties' intentions and complies with legal standards, providing a solid foundation for the future.

Documents used along the form

When couples decide to marry in California, a prenuptial agreement can be a critical tool to protect each person's assets and to outline financial responsibilities during the marriage. Along with this agreement, several other documents are often used to ensure that each party's interests are fully protected and clearly understood. These documents can vary based on the couple's unique circumstances and the complexity of their financial and personal situations.

- Financial Statements: Both parties typically prepare detailed financial statements. These include disclosures of income, assets, debts, and expenses. They are essential for making informed decisions about the terms of the prenuptial agreement.

- Property Deeds: Deeds for any real estate owned by either party can be important, especially if the property is to be kept separate or if the ownership is changing as part of the agreement.

- Business Valuation Reports: If either party owns a business, a valuation report is crucial to establish its worth. This ensures the business is accurately represented in the prenuptial agreement.

- Estate Planning Documents: Wills, trusts, and powers of attorney often complement a prenuptial agreement, especially for individuals entering into a marriage with significant assets or children from previous relationships.

- Insurance Policies: Life, health, and property insurance policies may need to be reviewed and adjusted based on the terms of the prenuptial agreement.

- Postnuptial Agreement: In some cases, a postnuptial agreement might be prepared after the marriage has occurred to address changes in financial situations or to reflect decisions made after the wedding.

- Amendment Documents: Should circumstances or intentions change, amendment documents can modify the original prenuptial agreement, provided both parties agree to the changes.

It's important for couples considering a prenuptial agreement in California to not only focus on the agreement itself but also on these accompanying documents. Together, they provide a comprehensive view of the couple's financial landscape and ensure that both parties' assets and wishes are protected. Consulting with professionals who have expertise in family law can offer guidance and ensure that all documents are correctly prepared and legally binding.

Similar forms

One document similar to the California Prenuptial Agreement form is a Postnuptial Agreement. Much like a prenuptial agreement, a postnuptial agreement is signed after a couple gets married or enters a civil union. The core purpose remains the same: to establish how the couple’s assets and financial matters should be handled in the event of a separation or divorce. However, the timing of when it is signed differentiates them, with the prenuptial agreement being prepared before marriage and the postnuptial afterwards.

Another document akin to the California Prenuptial Agreement is a Cohabitation Agreement. This agreement is used by couples who live together but are not legally married. It serves a similar purpose by setting terms for dividing assets and responsibilities should the relationship end. While a prenuptial agreement anticipates marriage, a cohabitation agreement operates without the expectation of marrying, providing a legal framework for non-married couples to manage their shared life.

A Will or Last Testament also shares similarities with a California Prenuptial Agreement. Both documents involve planning for the future and deciding how assets will be distributed. A will typically comes into play after a person’s death, outlining how to allocate their estate among heirs. In contrast, a prenuptial agreement is effective in the case of a divorce or separation, but like a will, it can include provisions for the distribution of assets upon death, reflecting a proactive approach to asset management.

The Separation Agreement is another document similar to the California Prenuptial Agreement, particularly concerning the division of assets and responsibilities. This type of agreement is usually signed when a couple decides to live apart but is not immediately pursuing a divorce. Like a prenuptial agreement, it outlines financial arrangements and custodial matters but is created at the point of separation rather than before marriage. Its primary role is to create a legally binding agreement that addresses the immediate financial and parental arrangements during a separation.

Lastly, the Financial or Investment Advisory Contract bears resemblance to the financial aspects of a California Prenuptial Agreement. Both documents regulate financial arrangements but for different contexts. An investment advisory contract governs the relationship between an investor and a financial advisor, detailing how assets should be managed. In contrast, a prenuptial agreement outlines how a couple’s assets will be handled, either during their marriage or in the event of a divorce, thus ensuring clarity and reducing potential disputes over financial matters.

Dos and Don'ts

Preparing for marriage is an exciting time, but it's also when important financial decisions are made. A prenuptial agreement in California can safeguard your future, ensuring that both parties enter into marriage with clear financial understanding and expectations. To navigate this process smoothly and effectively, here are some important do's and don'ts when filling out your California prenuptial agreement form:

Do:- Seek independent legal advice. Before signing anything, both parties should consult with their own lawyers who can provide advice tailored to their individual circumstances.

- Be transparent. Include all assets, liabilities, income, and expectations regarding financial arrangements in the agreement.

- Consider future circumstances. Prenuptial agreements can address potential future changes, such as the birth of children, inheritance, or career shifts.

- Understand the terms. Make sure both parties fully understand every clause and condition in the prenuptial agreement.

- Plan ahead. Start the prenuptial agreement process well in advance of the wedding date to ensure there's enough time for negotiation and revisions.

- Rush the process. Rushing can lead to mistakes or oversights that might make the agreement invalid or unfair.

- Hide assets or liabilities. Full disclosure is required for the prenuptial agreement to be valid in California. Concealing information can nullify the agreement and lead to legal consequences.

- Use generic templates without customization. While templates can be a starting point, the agreement should be customized to reflect your specific situation and comply with California law.

- Ignore state laws. California has specific laws governing prenuptial agreements (such as the Uniform Premarital Agreement Act), and the agreement must adhere to these laws to be enforceable.

- Forget to update. Life changes, and so might your financial situation. Consider revisiting and possibly revising your prenuptial agreement to reflect significant changes.

Following these guidelines can help ensure that your prenuptial agreement in California is fair, enforceable, and reflective of both parties' intentions and protections. It's not just a legal formality; it's a practical step towards a secure future together.

Misconceptions

When it comes to planning a marriage, the idea of a California Prenuptial Agreement often brings with it a number of misconceptions. It's essential to clear up these misunderstandings to help partners make informed decisions. Here are seven common misconceptions about California Prenuptial Agreements and the truths behind them:

- Prenuptial agreements are only for the wealthy. Many believe that prenuptial agreements are exclusively beneficial for those with substantial assets. However, these agreements can be valuable for anyone wanting to protect their financial future, manage debts, or delineate personal property from marital property.

- Signing a prenup means you don’t trust your partner. This belief can add tension, but in reality, discussing a prenuptial agreement encourages honest communication about finances and expectations. It’s a step towards understanding and transparency, not an indication of mistrust.

- Prenups cover child support and custody issues. California law dictates that child support and custody are determined based on the child's best interest at the time of the divorce. Thus, these matters cannot be predetermined in a prenuptial agreement.

- If you didn’t sign a prenup, it’s too late. While prenuptial agreements are signed before marriage, couples can opt for a postnuptial agreement if they wish to outline the terms regarding their assets and finances after they have married.

- Prenups make the divorce process easier. While prenuptial agreements can clarify financial matters and property division, they do not necessarily simplify all aspects of a divorce, such as child custody or personal disputes.

- You can include personal obligations in the agreement. While prenuptial agreements primarily deal with financial matters, California laws do not allow the inclusion of personal obligations, such as who is responsible for household chores, in these legal documents.

- Prenuptial agreements are set in stone. Contrary to popular belief, prenuptial agreements can be amended or revoked after they are signed, as long as both parties agree to the changes in a written document.

Understanding these key points can help individuals and couples navigate the complexities of prenuptial agreements in California more confidently. It's important to engage in open discussions and possibly seek legal advice to ensure that any agreement is fair, valid, and reflective of both partners' wishes.

Key takeaways

A California Prenuptial Agreement form is a legal document that couples complete and sign before getting married. It outlines what will happen to their finances and assets should the marriage end in divorce or one of the partners passes away. Here are 10 key takeaways about filling out and using the form:

- Understand the purpose: Prenuptial agreements in California are designed to protect individual assets, outline financial responsibilities, and avoid potential disagreements in case of a divorce.

- Involve legal counsel: Both parties should have independent legal advice to ensure the agreement is fair and binding. This helps in understanding the rights and obligations that come with signing the document.

- Full disclosure: It is crucial that both parties fully disclose their financial situations, including assets, liabilities, income, and expectations of gains. Concealment can render the agreement void.

- Consider the timing: Give yourselves plenty of time to draft, discuss, and sign the agreement. Rushing through it right before the wedding could lead to challenges later on.

- Conform to the law: The agreement must comply with California law, especially regarding property and spousal support, to be enforceable.

- Write clearly: The document should clearly outline all terms, leaving no room for ambiguity. Clarity ensures both parties understand their rights and responsibilities.

- Plan for the future: While it’s difficult to foresee every scenario, try to account for significant future changes, such as the birth of children, career changes, or long-term illness.

- Be fair: The agreement shouldn't be heavily biased in favor of one party. Unfair or one-sided agreements may not be enforceable.

- Regular updates: Consider revisiting and potentially updating the agreement as your marriage progresses and circumstances change.

- Signature requirements: The prenuptial agreement must be signed by both parties and it's recommended to have it notarized for additional legal validation.

By taking these steps, couples can create a California Prenuptial Agreement that reflects their wishes and provides peace of mind as they enter into marriage. Understanding and respecting the legal and emotional significance of this document is imperative for both parties.

Create Some Other Templates for California

California Property Surrender Deed - For homeowners facing financial hardship, this document provides a dignified exit strategy from homeownership without the stigma of foreclosure.

Grant Deed in California - They also serve as a historical record of property transactions, useful for future title searches.