Attorney-Approved California Promissory Note Document

In the sunny state of California, weaving through the labyrinth of financial transactions, the importance of a solid, legally-binding agreement cannot be overstated when it comes to borrowing and lending money. Enter the California Promissory Note form, a crucial document designed to safeguard the interests of both parties in a loan transaction. This form outlines the amount of money borrowed, the interest rate if applicable, repayment schedules, and the consequences of not adhering to these terms. Its versatility allows for customization to fit various lending situations, from personal loans between family members to more complex commercial loans. It stands as a testament to the seriousness of the commitment being made, ensuring that all parties are clear on their obligations and the repercussions of falling short. While it might seem like a mere piece of bureaucracy, this document is imbued with the potential to prevent misunderstandings and disputes, making it a cornerstone of financial transactions in California.

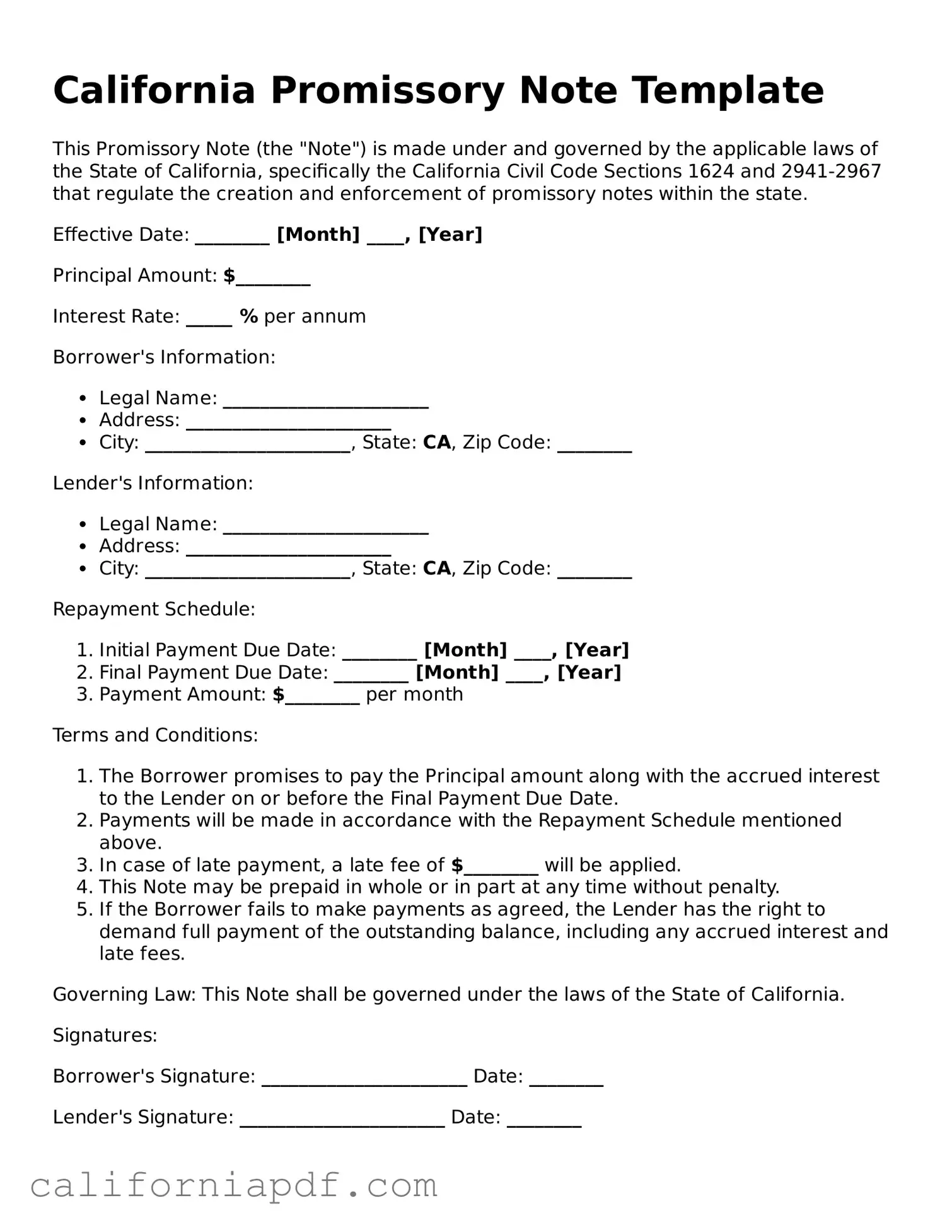

Document Example

California Promissory Note Template

This Promissory Note (the "Note") is made under and governed by the applicable laws of the State of California, specifically the California Civil Code Sections 1624 and 2941-2967 that regulate the creation and enforcement of promissory notes within the state.

Effective Date: ________ [Month] ____, [Year]

Principal Amount: $________

Interest Rate: _____ % per annum

Borrower's Information:

- Legal Name: ______________________

- Address: ______________________

- City: ______________________, State: CA, Zip Code: ________

Lender's Information:

- Legal Name: ______________________

- Address: ______________________

- City: ______________________, State: CA, Zip Code: ________

Repayment Schedule:

- Initial Payment Due Date: ________ [Month] ____, [Year]

- Final Payment Due Date: ________ [Month] ____, [Year]

- Payment Amount: $________ per month

Terms and Conditions:

- The Borrower promises to pay the Principal amount along with the accrued interest to the Lender on or before the Final Payment Due Date.

- Payments will be made in accordance with the Repayment Schedule mentioned above.

- In case of late payment, a late fee of $________ will be applied.

- This Note may be prepaid in whole or in part at any time without penalty.

- If the Borrower fails to make payments as agreed, the Lender has the right to demand full payment of the outstanding balance, including any accrued interest and late fees.

Governing Law: This Note shall be governed under the laws of the State of California.

Signatures:

Borrower's Signature: ______________________ Date: ________

Lender's Signature: ______________________ Date: ________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | California Civil Code governs promissory notes in California. |

| Type of Note | Can be secured or unsecured, depending on whether an asset is used as collateral. |

| Interest Rate Limit | California law caps the maximum interest rate at 10% per annum for personal, family, or household purposes. |

| Late Fees | Must be agreed upon in the note and are subject to California laws on reasonable limits. |

| Usury Exceptions | Some exceptions to the interest rate cap exist, such as for licensed lenders, banks, and similar financial institutions. |

| Prepayment | Borrowers in California may have the right to prepay their loans without penalty, depending on the terms of the note. |

| Default Terms | Must be clearly outlined, including any grace periods and the actions that can be taken in the event of default. |

| Signature Requirement | Both the borrower and the lender must sign the promissory note for it to be legally binding in California. |

How to Write California Promissory Note

Filling out a California Promissory Note form is an essential step in formalizing a loan agreement between two parties. This document ensures there is a legal record of the loan amount, interest rate, repayment schedule, and other pertinent terms. It serves as a binding contract that protects the interests of both the lender and the borrower. By clearly outlining the obligations of each party, the promissory note minimizes potential misunderstandings and conflicts over the loan. The following steps are designed to guide you through the preparation of this important document, ensuring that all necessary information is accurately recorded.

- Begin by entering the date on which the promissary note is being created at the top of the form.

- Write the full legal name of the borrower and the lender on their respective lines, along with their mailing addresses, ensuring that these are the legal addresses under which they can be contacted or served legal documents.

- Specify the principal amount of the loan in U.S. dollars to make it clear how much money is being lent.

- Detail the interest rate per annum that will be applied to the principal balance. This rate must comply with California's usury laws to ensure legality.

- Choose the type of repayment schedule (e.g., monthly, quarterly) and specify the start date of repayment. Clearly define the duration over which the loan will be repaid and the number of payments to be made.

- If there are any provisions for late fees, include the details of these fees. Outline the grace period duration and the specific amount or percentage to be charged after this period ends.

- Discuss and decide on any collateral that will secure the loan, if applicable. Describe the collateral in detail within the form to ensure both parties understand what is at stake.

- Both the borrower and the lender should read through the completed form carefully. This step is vital to ensure that all the information included is accurate and reflects the agreement between the parties.

- Sign and date the form in the presence of a notary public. The notarization of the document, while not always mandatory, adds an additional layer of legal protection and authenticity to the agreement.

- Make copies of the signed document for both the borrower and the lender. It's important for both parties to have a copy of the agreement for their records.

Upon completion, the signed California Promissory Note form serves as a legally binding agreement that outlines the responsibilities and obligations pertaining to the loan. It ensures clarity and accountability for both the lender and the borrower, safeguarding the interests of both parties throughout the duration of the loan. Retaining a copy of the document is crucial for future reference, especially in the event of a dispute or for verification of the terms agreed upon.

Listed Questions and Answers

What is a California Promissory Note form?

A California Promissory Note form is a legal document that records a loan agreement between two parties in the state of California. It outlines the amount of money borrowed, the interest rate applied, and the repayment plan. This document is crucial as it legally binds the borrower to repay the loan to the lender according to the terms agreed upon.

Who needs to use a California Promissory Note form?

Anyone lending or borrowing a sum of money in California should use a Promissory Note form. This includes personal loans between friends or family members, as well as more formal loans from lenders to borrowers. Using this form ensures clarity and legal protection for both parties involved.

What are the key elements that should be included in a California Promissory Note?

- The full names and addresses of the lender and borrower.

- The amount of money being loaned.

- The interest rate, if applicable.

- Repayment schedule including the frequency and amount of payments.

- Any collateral securing the loan, if applicable.

- Signatures of both parties, validating the agreement.

Is a California Promissory Note legally binding?

Yes, a California Promissory Note is legally binding when it contains the signatures of both the lender and borrower. Additionally, it must clearly spell out the loan's terms and conditions. This makes it enforceable in a court of law if necessary.

How can one enforce a California Promissory Note?

To enforce a California Promissory Note, the lender may need to take legal action if the borrower fails to meet the repayment terms. This usually involves filing a lawsuit to recover the owed amount. It is advised to seek legal counsel to navigate this process effectively.

Although notarization is not a requirement for a California Promissory Note to be considered valid and legally binding, it is often recommended. Notarizing the document can add an extra layer of authenticity and may help in the enforcement of the note if there are disputes down the line.

Can a California Promissory Note include penalties for late payments?

Yes, a California Promissory Note can include terms that specify penalties for late payments. These penalties must be clearly outlined in the document and agreed upon by both the lender and borrower. It's important to ensure these terms are fair and comply with California state laws to avoid legal issues.

Common mistakes

Not specifying the loan amount in clear terms: It's crucial to state the exact amount being lent in numbers and words to avoid any ambiguity.

Forgetting to include interest rates: California law requires that promissory notes include the interest rate. Failing to do so can render the note non-compliant and affect enforceability.

Omitting payment details: Detail how payments will be made (monthly, quarterly), including the start date and where payments should be sent. Lack of this information can lead to disputes.

Skipping penalty clauses: If there are penalties for late payments or defaults, they must be clearly outlined in the note. This detail ensures both parties understand the consequences of missed payments.

Ignoring the governing law clause: Including a statement about which state's law will govern the note is vital, especially in California, as it will determine how the note is interpreted and enforced.

Neglecting to mention security: If the loan is secured with collateral, the note should describe the collateral in detail. Failing to do so can jeopardize the lender's ability to claim the collateral in the event of default.

Incomplete or missing signatures: Both the borrower and the lender must sign the promissory note. Missing signatures can invalidate the document or, at the very least, complicate its enforcement.

Ensuring all relevant details are accurately included in a California Promissory Note not only makes the note legally binding but also protects the interests of both the borrower and the lender.

Documents used along the form

When dealing with financial matters, especially those involving loans and repayments, a Promissory Note is a critical document. However, it often does not stand alone. In the context of California, several accompanying forms and documents can strengthen the legal framework of a loan agreement, ensuring clarity and protecting the interests of both the lender and the borrower. Below is a description of up to five forms and documents typically used along with the California Promissory Note form.

- Deed of Trust: This document is used to secure a real estate transaction. It involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee, who holds the property title for the benefit of the lender. If the borrower defaults, the trustee can sell the property to pay the debt.

- Security Agreement: In transactions where personal property is used as collateral to secure the loan, a Security Agreement is essential. It outlines the specific assets pledged by the borrower, granting the lender a security interest in them.

- Guaranty: This form is used when a third party agrees to be responsible for the debt should the original borrower fail to pay. The guaranty assures the lender of repayment by providing an additional layer of financial protection.

- Amortization Schedule: This document provides a detailed breakdown of each payment over the course of a loan's life, showing how much of each payment goes towards the principal and how much goes towards interest. For both the borrower and the lender, it clarifies the repayment structure.

- UCC Financing Statement: When the loan involves securing interests in personal property (as opposed to real estate), a UCC-1 Financing Statement is filed. This public record notifies other creditors about the lender’s interest in the borrower's personal property.

These forms and documents play vital roles in ensuring that all aspects of the loan are clearly understood and legally enforceable. Each one serves a specific purpose, from securing the loan with property to providing a repayment plan, thereby helping to manage risk and protect the rights of all parties involved.

Similar forms

The California Promissory Note form shares similarities with a Loan Agreement, primarily in its function of documenting the terms and conditions of a loan between two parties. Like a promissory note, a Loan Agreement outlines the amount of money borrowed, the interest rate applied, and repayment schedule but tends to be more comprehensive. It might go into greater detail concerning the obligations of each party and include additional clauses regarding the governance of the agreement, such as provisions for default and remedies. Both documents serve to legally bind the borrower to repay the borrowed amount under the stated conditions.

Secondly, an IOU (I Owe You) also resembles a Promissory Note in simplicity and purpose. An IOU is a straightforward acknowledgment of debt, stating that one party owes another a specific sum of money. However, compared to a promissory note, an IOU is less formal and typically does not detail repayment terms or interest rates. While both signify acknowledgment of debt and the intent to repay, a promissory note is more formal and legally binding, offering more protection to the lender.

A Mortgage Agreement is another document related to a California Promissory Note, especially when the promissory note is secured by real estate. The Mortgage Agreement secures the loan by granting the lender a lien on the property, which serves as collateral until the loan is fully repaid. The Promissory Note outlines the debt's terms, while the Mortgage Agreement details the rights and obligations related to the property's use as security. Both documents work in concert in real estate transactions to ensure the lender's interests are protected and that the borrower understands their repayment and collateral obligations.

A Bill of Sale is akin to a Promissory Note in that it represents a transaction between two parties. It is generally used to document the transfer of ownership of personal property, such as vehicles or appliances, from a seller to a buyer. While it doesn't typically involve a loan or credit arrangement, the underlying principle of documenting an agreement between two parties is shared with promissory notes. Both serve as legal evidence of an agreement and can be used to protect the parties' interests in case of a dispute.

Lastly, a Lease Agreement bears resemblance to a California Promissory Note in its structure and purpose of outlining terms between two parties. A Lease Agreement documents the terms under which one party agrees to rent property owned by another party. It specifies the duration of the lease term, payment schedules, and responsibilities of each party, analogous to how a promissory note stipulates repayment terms for a loan. Despite their differing focuses—property use in one case, and loan repayment in the other—both are formal contracts designed to detail and enforce the obligations of each party.