Attorney-Approved California Quitclaim Deed Document

In the landscape of property transfers in California, the Quitclaim Deed stands out as a distinguished form utilized to convey a person's interest in real property to another without any warranty regarding the title's quality. This legal instrument is favored for its simplicity and efficiency, especially in transactions between family members or close acquaintances where there is a mutual trust about the property's condition and ownership. While this form does not guarantee that the grantor holds clear title to the property, it effectively releases whatever interest the grantor may have, thereby altering the ownership record. However, its ease of use does not diminish the necessity for thorough understanding and proper execution, as the implications of transferring property rights can have a lasting impact on legal and financial situations. Whether involved in such a transaction for personal or business reasons, parties should consider the broader context of their actions, including potential tax liabilities and implications for future property disputes. Engaging with the California Quitclaim Deed requires a careful consideration of these factors to ensure that the deed serves the intended purpose without unforeseen complications.

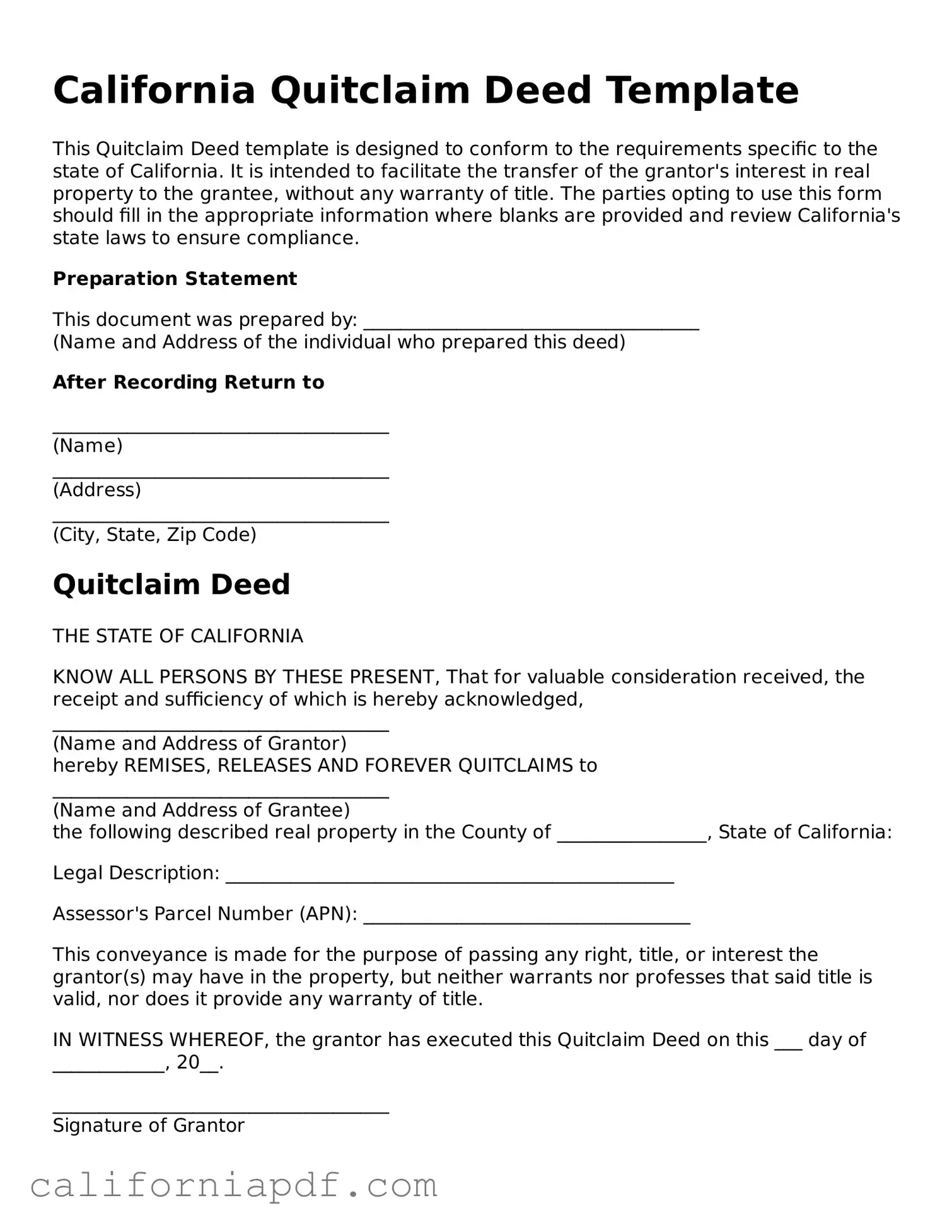

Document Example

California Quitclaim Deed Template

This Quitclaim Deed template is designed to conform to the requirements specific to the state of California. It is intended to facilitate the transfer of the grantor's interest in real property to the grantee, without any warranty of title. The parties opting to use this form should fill in the appropriate information where blanks are provided and review California's state laws to ensure compliance.

Preparation Statement

This document was prepared by: ____________________________________

(Name and Address of the individual who prepared this deed)

After Recording Return to

____________________________________

(Name)

____________________________________

(Address)

____________________________________

(City, State, Zip Code)

Quitclaim Deed

THE STATE OF CALIFORNIA

KNOW ALL PERSONS BY THESE PRESENT, That for valuable consideration received, the receipt and sufficiency of which is hereby acknowledged, ____________________________________

(Name and Address of Grantor)

hereby REMISES, RELEASES AND FOREVER QUITCLAIMS to ____________________________________

(Name and Address of Grantee)

the following described real property in the County of ________________, State of California:

Legal Description: ________________________________________________

Assessor's Parcel Number (APN): ___________________________________

This conveyance is made for the purpose of passing any right, title, or interest the grantor(s) may have in the property, but neither warrants nor professes that said title is valid, nor does it provide any warranty of title.

IN WITNESS WHEREOF, the grantor has executed this Quitclaim Deed on this ___ day of ____________, 20__.

____________________________________

Signature of Grantor

____________________________________

Print Name of Grantor

STATE OF CALIFORNIA

COUNTY OF ________________

On _____ day of ____________, 20__, before me, ____________________________________(Name of Notary), personally appeared ____________________________________(Name(s) of Grantor(s)), proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

____________________________________

Signature of Notary Public

My commission expires: _______________

PDF Form Characteristics

| Fact Number | Description |

|---|---|

| 1 | The California Quitclaim Deed form is commonly used to transfer property without a warranty of title. |

| 2 | It immediately transfers the grantor's interest in the property to the grantee. |

| 3 | Governing laws for California Quitclaim Deed forms are found in the California Civil Code. |

| 4 | This form provides no guarantees about the property's title, unlike warranty deeds. |

| 5 | Typically used among family members, or in divorces, to transfer property quickly. |

| 6 | Recording the deed with the local county is vital for the official transfer of property. |

| 7 | It requires identification of the grantor, grantee, and a legal description of the property. |

| 8 | The grantor's signature must be notarized for the deed to be valid in California. |

How to Write California Quitclaim Deed

When transferring property rights without a traditional sale or exchange, a California Quitclaim Deed form is commonly used. This process is relatively straightforward but requires attention to detail to ensure that the transfer is valid and recognized under California law. The following steps will guide you through filling out the Quitclaim Deed form accurately. It's important to proceed carefully, as this document affects ownership rights and could have implications for future transactions.

- Begin by downloading the latest version of the California Quitclaim Deed form from a reliable source. Make sure it complies with California state requirements.

- Fill in the name(s) of the current property owner(s) as the "grantor(s)." Include all current owners to ensure the deed is legally binding.

- Enter the name(s) of the recipient(s) of the property rights, known as the "grantee(s)." Full legal names should be used to prevent any confusion about the parties involved.

- Provide a complete and accurate description of the property being transferred. This should include the property's physical address, legal description, and parcel number if available. This information can be found on a previous deed or by contacting a local county recorder’s office.

- Decide on the grantee’s vesting, which is how the grantee will hold the property title. Common forms include sole ownership, joint tenancy, or tenancy in common. Understanding the differences is crucial for determining future property rights and responsibilities.

- The grantor(s) must sign the Quitclaim Deed form in front of a notary public. This step officially validates the document, making it a legal instrument for property transfer.

- Ensure all necessary county-specific forms or declarations are completed. Some counties require additional documentation for the Quitclaim Deed to be recorded properly.

- Submit the completed Quitclaim Deed to the county recorder’s office where the property is located. Recording fees must be paid at the time of submission, which vary by county.

- Wait for the county recorder to process and record the deed. Once recorded, you will typically receive a copy of the recorded deed by mail for your records.

By following these steps, the property rights can be successfully transferred through a California Quitclaim Deed. It's essential to keep a copy of the recorded deed, as it serves as proof of the transfer and may be required for future legal or financial transactions involving the property.