Attorney-Approved California Real Estate Purchase Agreement Document

Embarking on the process of buying or selling real estate in California is a significant milestone, fraught with complexities and legal considerations. Central to this process is the California Real Estate Purchase Agreement (REPA), a critical document that outlines the terms and conditions of the property transaction. This meticulously detailed agreement serves as the foundational blueprint upon which the sale is structured, detailing everything from the purchase price to contingencies that must be met before the transaction can be finalized. Its provisions include specifying inspection rights, defining the responsibilities of both the buyer and seller, and setting timelines for each phase of the process. Furthermore, the document addresses financial aspects, such as earnest money deposits and financing terms, and includes clauses on dispute resolution should disagreements arise. The necessity for such an agreement stems from its role in safeguarding the interests of all parties involved, ensuring transparency, and paving the way for a smoother transfer of property ownership. Understanding each aspect of the California Real Estate Purchase Agreement is paramount for anyone involved in a real estate transaction within the state, as it directly influences the success and legality of the sale.

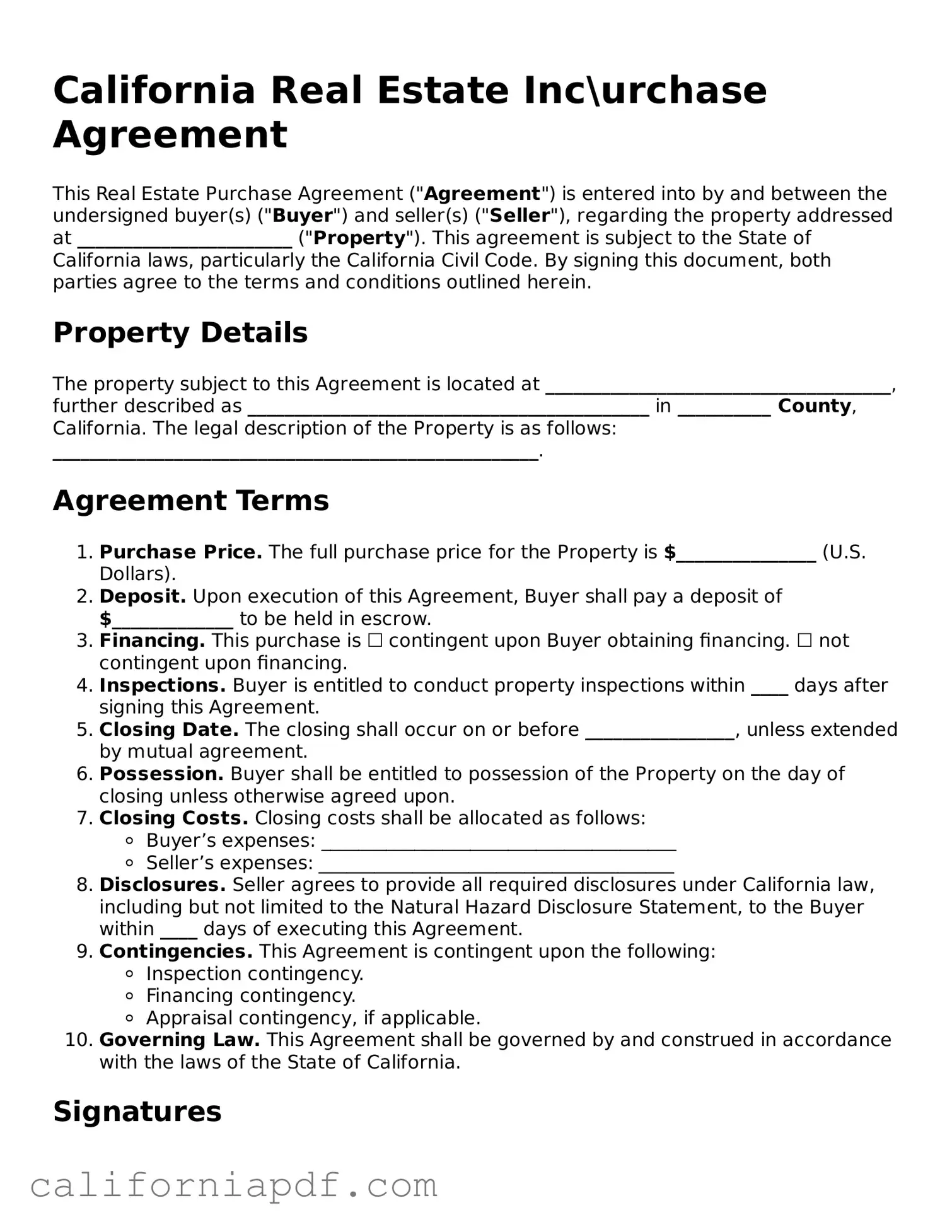

Document Example

California Real Estate Inc\urchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between the undersigned buyer(s) ("Buyer") and seller(s) ("Seller"), regarding the property addressed at _______________________ ("Property"). This agreement is subject to the State of California laws, particularly the California Civil Code. By signing this document, both parties agree to the terms and conditions outlined herein.

Property Details

The property subject to this Agreement is located at _____________________________________, further described as ___________________________________________ in __________ County, California. The legal description of the Property is as follows: ____________________________________________________.

Agreement Terms

- Purchase Price. The full purchase price for the Property is $_______________ (U.S. Dollars).

- Deposit. Upon execution of this Agreement, Buyer shall pay a deposit of $_____________ to be held in escrow.

- Financing. This purchase is ☐ contingent upon Buyer obtaining financing. ☐ not contingent upon financing.

- Inspections. Buyer is entitled to conduct property inspections within ____ days after signing this Agreement.

- Closing Date. The closing shall occur on or before ________________, unless extended by mutual agreement.

- Possession. Buyer shall be entitled to possession of the Property on the day of closing unless otherwise agreed upon.

- Closing Costs. Closing costs shall be allocated as follows:

- Buyer’s expenses: ______________________________________

- Seller’s expenses: ______________________________________

- Disclosures. Seller agrees to provide all required disclosures under California law, including but not limited to the Natural Hazard Disclosure Statement, to the Buyer within ____ days of executing this Agreement.

- Contingencies. This Agreement is contingent upon the following:

- Inspection contingency.

- Financing contingency.

- Appraisal contingency, if applicable.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of California.

Signatures

By signing below, both Buyer and Seller acknowledge and agree to all terms and conditions of this Agreement.

Buyer's Signature: __________________________ Date: ____________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The California Real Estate Purchase Agreement is governed by California's general real estate laws and specific contract codes. |

| Form Purpose | This form is used to outline the terms and conditions under which a property will be sold and purchased in the state of California. |

| Mandatory Disclosures | California law requires sellers to make certain disclosures about the condition of the property, including any known defects and hazards. |

| Contingencies | The agreement may include several contingencies that must be met before the sale can be finalized, such as financing, home inspection, and appraisal. |

| Binding Effect | Once signed by both the buyer and the seller, the agreement becomes a legally binding contract. |

| Modification of Terms | Any changes to the agreement after the initial signing must be made in writing and signed by both parties to be effective. |

| Signature Requirements | All parties involved in the transaction must sign the agreement for it to be valid. |

| Effective Date | The effective date is when the last party signs the agreement, marking the official beginning of the contractual relationship between the buyer and seller. |

| Closing Process | The agreement outlines the steps and timeline for the closing process, including the transfer of title and payment of the purchase price. |

How to Write California Real Estate Purchase Agreement

After you have selected a property to buy and agreed on a price with the seller, the next step in the process of purchasing real estate in California is to complete the Real Estate Purchase Agreement form. This legal document outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies that must be met before the transaction can be finalized. Filling out this form accurately is crucial as it lays the groundwork for a legally binding contract between the buyer and the seller. Here are the steps you need to follow to ensure the form is completed properly:

- Identify the parties involved in the sale. Enter the full legal names of the buyer(s) and the seller(s) in the designated sections.

- Describe the property. Include the full address of the real estate, its legal description, and any applicable parcel number(s).

- Document the purchase price. State the agreed-upon amount in U.S. dollars.

- Outline the terms of the deposit. Specify the amount of the earnest money deposit, including how and when it is to be paid.

- Set a closing date. Choose a specific date by which the sale should be completed and include any provisions for extending this deadline.

- List contingencies. Clearly outline any conditions that must be met for the sale to proceed, such as securing financing or passing a home inspection.

- Detail included items. Specify any fixtures, appliances, or personal property that are included in the sale.

- Address title and closing. Define who will be responsible for paying closing costs and how title to the property will be transferred.

- Specify any additional agreements. Include details of any supplemental agreements or disclosures that are part of the sale.

- Review and sign. Both the buyer(s) and seller(s) must carefully review the entire agreement to ensure all the information is accurate and that they understand their obligations. Then, all parties involved should sign and date the document.

Once the Real Estate Purchase Agreement form is fully completed and signed by both the buyer and the seller, it becomes a legally binding contract. The next steps typically involve fulfilling any contingencies outlined in the agreement, securing financing, and preparing for the closing day when the sale is officially completed. It's essential for both parties to closely follow the terms of the agreement and communicate openly to ensure a smooth transition and successful real estate transaction.

Listed Questions and Answers

What is a California Real Estate Purchase Agreement?

A California Real Estate Purchase Agreement is a document used during the process of buying or selling property in California. This legally binding contract details the terms and conditions agreed upon by both the buyer and seller. It includes important information such as the purchase price, property description, closing date, and any contingencies that must be met before the sale is finalized.

Who needs to sign the California Real Estate Purchase Agreement?

The California Real Estate Purchase Agreement must be signed by all parties involved in the transaction. This typically includes the buyer(s) and the seller(s). In some cases, the real estate agents representing both sides may also sign the agreement, though their signatures are not legally required for the agreement to be valid.

What are some common contingencies included in the agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies included in a California Real Estate Purchase Agreement are:

- Home Inspection Contingency - Allows the buyer to have the property inspected and the option to renegotiate or withdraw if there are major issues found.

- Financing Contingency - Ensures the buyer must secure financing from a bank or other financial institution to purchase the home.

- Appraisal Contingency - Requires that the property must be appraised at a value that is at least equal to the purchase price.

- Sale of Prior Home Contingency - For buyers who need to sell their current home before purchasing a new one.

How can amendments be made to the agreement?

Amendments to the California Real Estate Purchase Agreement can be made if both the buyer and seller agree to the changes. Any amendments should be put in writing and signed by both parties. It is important to clearly document any changes to ensure there is a legal record of the modifications.

What happens if the sale does not go through?

If the sale does not finalize, the outcome depends on the specific terms outlined in the purchase agreement and any contingencies that have not been met. Typically, if the buyer backs out of the agreement due to a failed contingency, such as not being able to secure financing, they may be able to recover their deposit. However, if the buyer or seller breaches the contract without a valid reason, they may face legal consequences, including forfeiting any earnest money or being sued for damages.

Common mistakes

Filling out the California Real Estate Purchase Agreement form is a crucial step in the process of buying or selling property. However, there are common mistakes that can occur during this process. Understanding these errors can help ensure the agreement is executed correctly and efficiently. Here are six typical mistakes:

Not Reviewing the Entire Form: Often, parties to the transaction do not thoroughly review every section of the form. This oversight can lead to misunderstanding the terms, including rights and obligations, which could result in disputes later on.

Incorrect Information: Entering incorrect details about the buyer, seller, or property can lead to significant delays. It is crucial to double-check all entered information, including legal descriptions of the property and personal details.

Omitting Key Terms or Conditions: Sometimes, important terms or conditions specific to the transaction are left out. These may include special contingencies, such as the sale being subject to the buyer obtaining financing or a satisfactory home inspection.

Failing to Specify Fixtures and Chattels: The agreement should clearly state which fixtures and chattels (i.e., personal property) are included or excluded in the sale. Failure to do so can lead to disputes over what was supposed to remain with the property.

Ignoring Closing and Possession Dates: Not specifying or miscommunicating the closing and possession dates can cause scheduling conflicts and may inconvenience both parties. It's important to agree on a realistic timeline and expressly document it in the agreement.

Not Understanding the Binding Nature of the Agreement: Parties sometimes overlook the fact that once signed, the agreement is legally binding. They may not realize the implications of backing out without a valid legal reason or without provisions in the agreement permitting termination under certain conditions.

To avoid these mistakes, both buyers and sellers are advised to read the agreement thoroughly, understand every clause, and verify all the information. Consulting with a real estate professional or an attorney can also provide valuable guidance through the process.

Documents used along the form

When engaging in real estate transactions in California, the Real Estate Purchase Agreement (REPA) form is only a starting point. Alongside this crucial document, a variety of additional forms and documents are often used to ensure the transaction is comprehensive, transparent, and in compliance with all state legal requirements. These additional pieces not only support the purchase agreement but also provide detailed information, disclose conditions, and offer protections that are integral to a smooth real estate transaction. Below is a list of seven such documents that are commonly utilized alongside the California Real Apart from the essential Real Estate Purchase Agreement form.

- Agency Disclosure Form: This document informs the buyer and seller of the real estate transaction about the nature of the agency relationship, specifying whether the agent is acting on behalf of the seller, the buyer, or both parties as a dual agent.

- Natural Hazard Disclosure Statement: California law requires sellers to disclose if the property is located within certain natural hazard areas such as flood zones, fire hazard zones, or earthquake fault zones.

- Preliminary Title Report: This report provides details about the title of the property, including ownership, encumbrances, liens, and any other issues that might affect the title. It's crucial for identifying any potential problems that could impede the transfer of a clean title to the buyer.

- Home Inspection Report: Conducted by a professional home inspector, this report gives an in-depth view of the property's condition, highlighting any existing or potential issues with the structure, systems, and other home components.

- Contingency Removal Form: Often a transaction is subject to certain conditions or 'contingencies' that must be met before closing. This form is used by either the buyer or seller to indicate that a contingency has been successfully satisfied or waived.

- Lead-Based Paint Disclosure: For homes built before 1978, federal law requires sellers to disclose the presence of any known lead-based paint. Along with the disclosure, the pamphlet "Protect Your Family from Lead in Your Home" must be provided to buyers.

- Loan Estimate and Closing Disclosure: Required by federal law for most mortgage loans, these documents detail the buyer's loan terms, closing costs, and other financial details of the mortgage. The Loan Estimate is provided early in the buying process, while the Closing Disclosure is given just before closing.

This ensemble of documents complements the Real Estate Purchase Agreement by offering a holistic view of the transaction, ensuring all parties are well-informed and legally protected throughout the process. For anyone navigating the complexities of buying or selling property in California, understanding these documents is crucial. Each serves a unique purpose, contributing to the transparency and success of the transaction, ultimately guiding both buyers and sellers through the legal landscape of real estate in California.

Similar forms

The Residential Lease Agreement shares similarities with the California Real Estate Purchase Agreement, primarily in detailing the terms of a property transaction. While the Purchase Agreement outlines the conditions for buying and selling real estate, the Lease Agreement specifies the conditions under which a property is rented. Both documents include critical information such as property details, parties involved, financial terms, and obligations to ensure clarity and legality in the arrangement.

Another document similar to the California Real Estate Purchase Agreement is the Bill of Sale. This document is used to transfer ownership of personal property from a seller to a buyer. Like the Real Estate Purchase Agreement, a Bill of Sale provides a legal record of the transaction, lists the item(s) being sold, the price, and the parties' details. While a Bill of Sale can apply to various types of personal property like vehicles or equipment, the Real Estate Purchase Agreement specifically pertains to the sale of real property.

The Loan Agreement also bears resemblance to the Real Estate Purchase Agreement, as it involves detailed financial arrangements. In a Loan Agreement, the terms under which money is borrowed and repaid are laid out, including any interest or collateral. Similarly, the Real Estate Purchase Agreement includes financial terms related to the sale price, down payment, and potentially the financing method. Both documents ensure the financial aspects of the agreement are clearly understood and legally binding.

An Earnest Money Deposit Receipt can be compared to the California Real Estate Purchase Agreement too. This receipt acts as proof of the buyer’s commitment to the property transaction, securing the deal with a deposit. In essence, it's a part of the broader Real Estate Purchase Agreement process, underscoring the buyer's intent and financial stake in proceeding. Both documents facilitate trust and commitment toward finalizing the property sale.

The Property Disclosure Statement, often part of the real estate selling process, is somewhat akin to the California Real Estate Purchase Agreement. This document requires the seller to disclose any known issues or defects with the property that could affect its value or desirability. While the Disclosure Statement focuses on the condition of the property, it complements the Purchase Agreement, which constitutes the formal offer and acceptance including agreed terms and conditions of the sale, ensuring buyers are fully informed.

Last but not least, the Title Insurance Policy is related to the California Real Estate Purchase Agreement in its protective function during a property transaction. Title insurance safeguards against any legal or financial losses resulting from defects in the property title. The insurance policy is typically purchased as part of the closing process outlined in the Real Estate Purchase Agreement, highlighting its role in ensuring a secure and undisputed transfer of property ownership.

Dos and Don'ts

When it comes to filling out the California Real Estate Purchase Agreement form, attention to detail and due diligence are key. This document is a binding contract between the buyer and seller over the sale of real estate, and it's important to get it right. Below are crucial dos and don'ts you should consider to ensure the process goes smoothly.

Do:

- Ensure all parties have a clear understanding of the terms before filling out the form. Misunderstandings can lead to disputes and possibly the cancellation of the sale.

- Use clear and concise language to describe the terms of the sale, including the purchase price, deposit amount, and any contingencies such as financing or inspection requirements.

- Double-check all the information for accuracy. This includes the personal details of both the buyer and seller, the legal description of the property, and any numerical data related to the sale.

- Include all relevant details about the property being sold, such as fixtures and fittings that will stay or go after the sale.

- Have the document reviewed by a professional. A real estate agent or attorney can provide valuable insights and ensure that all legal bases are covered.

- Ensure that any modifications or additions to the contract are clearly noted and agreed upon by all parties in writing. Oral agreements should be avoided to prevent misunderstandings.

- Keep copies of the signed agreement. Each party should have a copy for their records to reference throughout the closing process and for any potential future disputes.

Don't:

- Rush through the process. Take the necessary time to review and understand every part of the agreement before signing.

- Leave any sections blank. If a section doesn't apply, mark it as "N/A" (not applicable) to indicate that it was considered but found to be irrelevant to the current transaction.

- Rely solely on verbal promises or agreements. If it's not written in the contract, it's not enforceable.

- Forget to specify who will pay for certain costs, such as closing costs, inspections, and repairs. Misunderstandings about financial responsibilities can delay or derail the sale.

- Ignore the need for a contingency plan. Life is unpredictable, and the contract should account for the possibility that things won't go as planned.

- Sign anything that you do not fully understand. Seeking clarification now can prevent legal issues later.

- Omit the date of the agreement and the anticipated closing date. These dates are crucial for ensuring that all parties adhere to the timelines set forth in the contract.

Misconceptions

The California Real Estate Purchase Agreement form is pivotal in the process of buying or selling property within the state. However, misunderstandings about its use and implications are common. Addressing these misconceptions can help individuals navigate this important aspect of real estate transactions more confidently and effectively.

It's Just Standard Paperwork: Many believe the California Real Estate Purchase Agreement is merely standard paperwork that doesn't require careful attention. In reality, this legally binding contract outlines the terms and conditions of the sale, including price, contingencies, and closing dates. It's crucial for all parties to thoroughly review and understand these details before signing.

Attorney Review Isn't Necessary: Another misconception is that attorney review of this document isn't needed, assuming it follows a standard template. However, having a legal professional review the agreement can uncover potential issues and ensure that the terms protect the interests of the client, especially in complex transactions.

It's Final and Cannot Be Changed: Some believe that once the California Real Estate Purchase Agreement is signed, it cannot be amended. In fact, parties can negotiate changes up until closing as long as both sides agree. Amendments can cover anything from the sale price to the closing date.

All Contingencies Are the Same: It's often thought that all real estate agreements contain the same contingencies, such as for financing or inspections. However, contingencies can vary widely and need to be explicitly stated in the agreement. It's essential to understand which contingencies apply to a specific transaction.

Verbal Agreements Are Binding: Some people assume that verbal agreements related to the sale are binding. The truth is, for a real estate transaction in California, the agreement must be in writing to be legally enforceable. Verbal promises or agreements should always be documented in the Purchase Agreement.

It Only Covers the Exchange of Property: Lastly, there's a misconception that the Purchase Agreement solely covers the exchange of property. While it does detail the transfer of ownership, it also encompasses other critical aspects, such as terms of possession, disclosures, and any items included or excluded in the sale.

Clearing up these misconceptions can significantly smooth the process of buying or selling real estate in California, ensuring that all parties understand their rights and obligations under the law.

Key takeaways

The California Real Estate Purchase Agreement form is an essential document in the real estate transaction process in California. It outlines the terms and conditions agreed upon by the buyer and the seller for the sale of a property. Understanding the key components and implications of this document is crucial for both parties to ensure a seamless transaction. Here are six important takeaways:

- Accuracy Is Critical: Ensure all the information entered in the agreement is accurate. This includes the names of the parties, the property address, the purchase price, and any other pertinent details. Inaccuracies can lead to disputes or legal issues down the line.

- Legal Descriptions: The agreement must include a legal description of the property. This is more detailed than the street address and helps in identifying the precise boundaries and location of the property being sold.

- Contingencies: Pay special attention to the contingencies listed in the agreement. These conditions must be met for the transaction to proceed. Common contingencies include financing, inspections, and the sale of another property. Removing a contingency should only occur when you are fully satisfied that the condition has been met or waived.

- Disclosure Requirements: In California, sellers are required to disclose specific information about the property's condition and history. Make sure these disclosures are completed and included in the agreement. Failure to properly disclose can result in legal consequences.

- Closing Costs: The agreement should clearly outline who is responsible for paying closing costs, which can include escrow fees, title search fees, and transfer taxes. Understanding these responsibilities can prevent any unexpected financial surprises at closing.

- Signatures: The agreement is only legally binding once it has been signed by both parties. All parties involved should review the agreement in its entirety before signing. Digital signatures are legally accepted in California, but ensure they are executed correctly.

While the California Real Estate Purchase Agreement form plays a vital role in the property buying and selling process, it's just one part of a complex transaction. Consulting with professionals, such as real estate agents and attorneys, can provide guidance and help navigate any challenges that arise. Both buyers and sellers are encouraged to consider their obligations and rights carefully to ensure a fair and successful transaction.

Create Some Other Templates for California

California Employee Handbook - Describes the policy on confidential information, outlining employee responsibilities in safeguarding company secrets and sensitive data.

Verification of Employment - The form typically requires the previous employer to attest to the accuracy of the information provided, sometimes under penalty of perjury.

Bill of Sale Dmv - It can be customized to include specific terms and conditions relevant to the sale of a particular dog.