Attorney-Approved California Release of Liability Document

In California, many activities, transactions, and interactions could pose risks to individuals and entities involved, leading to potential legal liabilities. Against this backdrop, the California Release of Liability form emerges as a critical document designed to mitigate such risks. This form is essentially a legal agreement where parties involved acknowledge the risks of an activity, transaction, or interaction and agree to relinquish the right to hold the other party liable for any resulting injuries, damages, or losses. Commonly utilized in contexts ranging from recreational activities to the sale of property or vehicles, its purpose is to provide a layer of legal protection to the party being released from liability. This form, often succinct yet encompassing, requires careful consideration and understanding of its terms, as it influences the legal rights and obligations of the parties. By effectively executing this form, individuals and entities can navigate through the complexities of liability in California, reinforcing the importance of this document in various legal and business engagements.

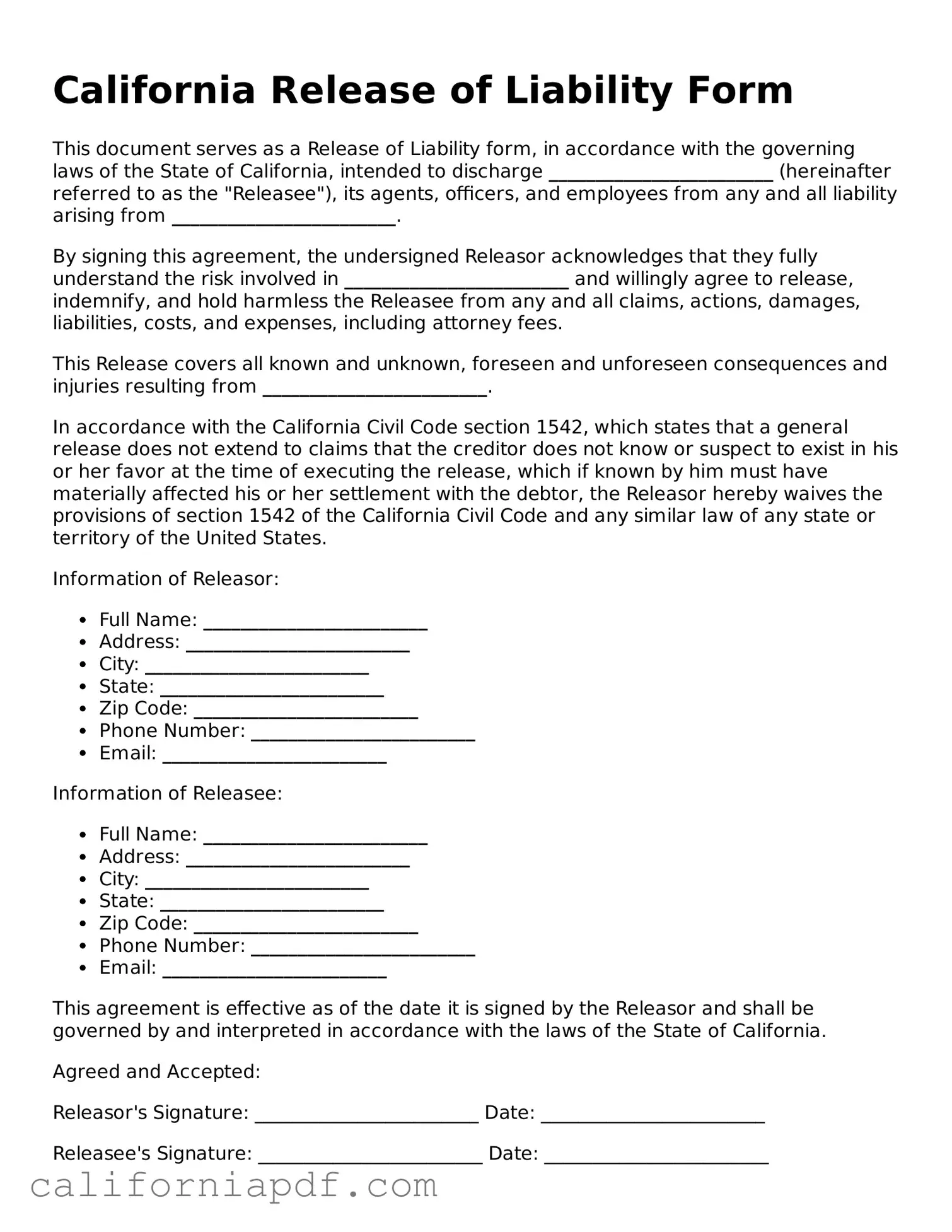

Document Example

California Release of Liability Form

This document serves as a Release of Liability form, in accordance with the governing laws of the State of California, intended to discharge ________________________ (hereinafter referred to as the "Releasee"), its agents, officers, and employees from any and all liability arising from ________________________.

By signing this agreement, the undersigned Releasor acknowledges that they fully understand the risk involved in ________________________ and willingly agree to release, indemnify, and hold harmless the Releasee from any and all claims, actions, damages, liabilities, costs, and expenses, including attorney fees.

This Release covers all known and unknown, foreseen and unforeseen consequences and injuries resulting from ________________________.

In accordance with the California Civil Code section 1542, which states that a general release does not extend to claims that the creditor does not know or suspect to exist in his or her favor at the time of executing the release, which if known by him must have materially affected his or her settlement with the debtor, the Releasor hereby waives the provisions of section 1542 of the California Civil Code and any similar law of any state or territory of the United States.

Information of Releasor:

- Full Name: ________________________

- Address: ________________________

- City: ________________________

- State: ________________________

- Zip Code: ________________________

- Phone Number: ________________________

- Email: ________________________

Information of Releasee:

- Full Name: ________________________

- Address: ________________________

- City: ________________________

- State: ________________________

- Zip Code: ________________________

- Phone Number: ________________________

- Email: ________________________

This agreement is effective as of the date it is signed by the Releasor and shall be governed by and interpreted in accordance with the laws of the State of California.

Agreed and Accepted:

Releasor's Signature: ________________________ Date: ________________________

Releasee's Signature: ________________________ Date: ________________________

Witness's Signature: ________________________ Date: ________________________

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Purpose | It's designed to free a party or entity from liability for bodily injury or property damage that might occur during an activity or event. |

| Governing Law | The form is governed by California Civil Code sections 1541-1542, which dictate the general rules for release and waiver of claims. |

| Applicability | Commonly used in activities that involve a higher risk, such as sporting events, recreational activities, and special events. |

| Limitations | Cannot waive liability for gross negligence, fraudulent acts, or intentional harm as per California law. |

| Signature Requirement | The individual releasing liability, often referred to as the "Releasor", must sign the document for it to be considered valid and enforceable. |

How to Write California Release of Liability

Upon the sale of a vehicle, individuals in California must complete a Release of Liability form. This document serves to officially transfer responsibility from the seller to the buyer, safeguarding the former against future liabilities that may arise from the vehicle’s use after the point of sale. Timely submission of this form is crucial, as it formally documents the change of ownership and shields the seller from potential legal issues. The process for filling out this form is straightforward but requires attention to detail to ensure all provided information is accurate and complete.

- Begin by locating the California Release of Liability form online on the California Department of Motor Vehicles (DMV) website. Download the form for access.

- Gather all necessary information, including the vehicle identification number (VIN), license plate number, and the date of the sale.

- Input the seller’s full name and complete address in the designated sections of the form.

- Fill in the buyer’s full name and complete address accurately to avoid any miscommunication or errors during the transfer process.

- Record the vehicle’s details, including the make, model, year, and color, in the corresponding fields to ensure the DMV can properly identify the vehicle in their records.

- Enter the exact date of the sale to accurately reflect when the responsibility for the vehicle was transferred from the seller to the buyer.

- Verify all entered information for accuracy. Mistakes on the form can lead to delays or complications in the release of liability.

- Once the form is completed, sign and date it to validate the information provided. This step is necessary for the form to be legally binding.

- Submit the completed form to the California DMV. This can be done either online, which is often the most convenient method, or by mailing the form to the address provided by the DMV.

- Keep a copy of the submitted form for your records. It is important to have proof of the submission and the details it contains in case any disputes arise in the future.

Following these steps will ensure a smooth and effective transfer of liability from the seller to the buyer. It is essential for sellers to complete this process promptly to protect themselves after the sale of a vehicle. By meticulously filling out and submitting the California Release of Liability form, sellers can achieve peace of mind in knowing they have taken the necessary legal steps in the sale process.

Listed Questions and Answers

What is a California Release of Liability form?

A California Release of Liability form is a legal document used to release a party from any future legal claims following a transaction. In California, this form is often used in situations such as selling a vehicle, where the seller can protect themselves from future liabilities if any issues arise with the vehicle after the sale. It transfers the responsibility from the seller to the buyer, ensuring that the seller is not held accountable for problems that may occur once the transaction is complete.

When should I use a California Release of Liability form?

You should use a California Release of Liability form whenever you are selling or transferring ownership of a vehicle, or engaging in any other transaction that could potentially expose you to future liabilities related to the item or service in question. This form is crucial in the following scenarios:

- When selling a car, motorcycle, boat, or any other type of vehicle.

- If you are transferring ownership of an item that could cause injury or property damage.

- When you want to have a clear record that the buyer is assuming all future risks associated with the item or service you provided.

How do I file a California Release of Liability form?

Filing a California Release of Liability form involves several steps:

- First, obtain the form from the California Department of Motor Vehicles (DMV) website or a local DMV office. The form is officially known as the Notice of Transfer and Release of Liability (NRL).

- Fill out the form accurately, providing details such as the vehicle identification number (VIN), the date of sale, and information about both the seller and the buyer.

- Submit the form to the DMV. This can be done online, by mail, or in person at a DMV office. Make sure to check the DMV's current recommendations or requirements for submission.

- Keep a copy of the submitted form for your records. This will serve as proof that you completed the process and released your liability in the event of future disputes.

What happens if I don't file a California Release of Liability form?

Not filing a California Release of Liability form can lead to significant legal and financial consequences. If the vehicle is involved in an accident, incurs parking or traffic violations, or is used in a crime, you may be held responsible if the form has not been filed. This is because, in the eyes of the law, the vehicle is still under your ownership until the release of liability is formally processed by the DMV. To avoid such issues, ensure the form is filled out correctly and submitted promptly after the transfer of ownership.

Common mistakes

Filling out the California Release of Liability form is a significant step in transferring vehicle ownership, yet many people, despite their best intentions, make mistakes during this process. These errors can lead to unnecessary complications, delays, and in some cases, legal or financial liabilities. Being aware of these common pitfalls can help individuals navigate the process more smoothly and ensure all legal obligations are met.

Not Filling Out the Form Immediately After the Sale: A major mistake is delaying the completion and submission of the form. The California Department of Motor Vehicles (DMV) advises submitting this form within 5 days after the vehicle sale to help protect the seller from liability for tickets, accidents, or violations that the new owner incurs.

Omitting Essential Information: Skipping sections such as the buyer's full name, address, or the vehicle's odometer reading can invalidate the form. All fields are crucial for the DMV to process the change in vehicle ownership properly.

Incorrect Information: Entering incorrect data, such as the wrong vehicle identification number (VIN) or an inaccurate sale date, can lead to significant problems, including delays in the release of liability or inaccuracies in DMV records.

Not Using the Most Current Form: The DMV updates forms periodically. Using an outdated version can result in the rejection of the document, as it may not include recent legal requirements or sections necessary for current processing.

Forgetting to Notify the Insurance Company: While this step is not part of the form per se, failing to inform one's insurance carrier about the sale can result in continued billing or complications if the vehicle is involved in an incident after the sale.

Failure to Obtain the Buyer’s Signature: The Release of Liability form in California does not require the buyer’s signature, but securing documentation that acknowledges the buyer's receipt of the title and their understanding of the sale is prudent. This can protect the seller if disputes arise later.

Not Keeping a Copy: Not retaining a copy of the completed form for personal records is a critical oversight. Having proof of the form's submission and the details of the transaction is essential for resolving any future disputes or questions about the sale.

Improper Submission: Submitting the form via the wrong method (e.g., mailing it to the incorrect address or failing to use the DMV's online portal when required) can delay the process. It's important to follow the latest DMV guidelines for submission to ensure timely processing.

Avoiding these mistakes requires attention to detail, a thorough understanding of the Release of Liability's requirements, and careful adherence to DMV procedures. By ensuring accurate and prompt submission of this document, both sellers and buyers can protect themselves from future legal and financial problems.

Documents used along the form

When processing a California Release of Liability, it's crucial to recognize that this form doesn't stand alone. It functions within a broader ecosystem of legal and transaction-related documents, ensuring all aspects of a deal, sale, or transfer are adequately covered. The goal is to protect all parties involved and ensure a smooth and transparent transaction. Below, find a detailed list of forms and documents commonly used alongside the California Release of Liability form. Understanding each document will help streamline the process and uphold the legal responsibilities and rights of everyone involved.

- Bill of Sale: This document serves as a formal record of the transaction. It provides proof that ownership of an item, typically a vehicle, has changed hands. The bill of sale outlines the specifics of the deal, including the price, date, and parties involved.

- Title Transfer Form: A title transfer form is necessary when ownership of a vehicle or other significant asset is being transferred. It legally documents the change of ownership and is required to update records with the department of motor vehicles (DMV) or similar agency.

- Accident Claims Form: In situations involving an accident, this form is used to report the incident and any damages or injuries that occurred. It's crucial for insurance claims and legal matters related to the accident.

- Insurance Confirmation Form: This document verifies that insurance coverage is in place. It may be used to confirm the transfer of insurance to a new owner or to provide proof of insurance at the request of a financial institution or other party.

- Maintenance Records: For transactions involving vehicles or machinery, maintenance records provide a history of upkeep and repairs. These documents can influence the terms of a release or the value assigned to the item in a sale.

- Loan Payoff Documents: If there's an outstanding loan on an item being sold, loan payoff documents are needed to prove that the loan has been settled. This ensures the new owner receives the title free of liens.

- Warranty Information: For items still under warranty, providing warranty documents is essential. These outline the conditions of the warranty and what is covered, transferring any remaining warranty to the new owner.

- Inspection Reports: Inspection reports document the condition of an item prior to the sale. They are often required for vehicles and real estate transactions, giving the buyer insight into any potential issues.

- Power of Attorney: This legal document grants someone the authority to sign documents and make decisions on behalf of another person in specific or general matters. It might be necessary if the original owner can't be present to sign the release or other related documents.

Utilizing these documents in conjunction with a California Release of Liability form ensures thoroughness and legal compliance in any transaction. It's not just about transferring ownership; it's about making certain all obligations are met and that both parties are protected. By preparing and understanding these forms, individuals can navigate the complexities of their transactions with confidence and clarity.

Similar forms

The General Liability Waiver is closely related to the California Release of Liability form in its purpose and application. Like its state-specific counterpart, the General Liability Waiver is designed to absolve the party providing a service, hosting an event, or supplying a product from legal responsibility should an injury, damage, or loss occur. Both documents operate on the premise of informed consent, where the signee acknowledges the risks involved in the activity or service in question and agrees not to hold the provider accountable. The primary difference often lies in the broader application of the General Liability Waiver, which is not limited by jurisdiction and may be used in a variety of settings nationwide.

The Medical Release Form shares a similar protective goal with the California Release of Liability, albeit in a healthcare context. This document is typically signed by patients or their guardians before undergoing any medical procedure. It serves to inform the patient of the risks associated with the procedure and to absolve the healthcare provider of liability should complications arise. While the medical release focuses on health-related services, both it and the liability form operate under the principle of informed consent, ensuring individuals are fully aware of the risks they accept.

Another document with a similar function is the Participation Agreement for recreational activities or events. Often utilized by organizations or businesses that host sports events, adventure outings, or workshops, this document requires participants to acknowledge the inherent risks of the activity and release the organizers or facilitators from liability. Though it is focused specifically on participation in activities, like the California Release of Liability form, it serves the vital function of protecting those offering the service from legal ramifications should an accident occur.

The Intellectual Property Release Form, while distinct in its focus on the rights to creative content and ideas, parallels the California Release of Liability in its foundational purpose of relinquishing legal claims. Creators, by signing, give up their rights to legal action related to the use, distribution, or modification of their intellectual property under specified conditions. In both cases, the signing party agrees to not hold the other accountable, whether it be for physical injury in the case of the liability form, or the use of intellectual property with the release form.

Lastly, the Property Damage Release Form resonates with the concepts found in the California Release of Liability by focusing on incidents involving property damage. In scenarios where property is damaged under circumstances that could potentially lead to a dispute, this document acts as a settlement that prevents future legal action. The signee accepts compensation for the damage and in return agrees not to pursue any further claims related to the incident. This mutual agreement to avoid litigation mirrors the preventive legal safeguarding embedded in the California Release of Liability, albeit within the realm of property damage.

Dos and Don'ts

The California Release of Liability form is a critical document that plays a significant role in the transfer of vehicle ownership. Its accurate completion is essential for the protection of both the seller and the buyer. Here are 10 dos and don'ts that individuals should observe when filling out this form.

Do:

- Ensure all the information you provide on the form is accurate and truthful. This includes the vehicle identification number (VIN), sale date, and mileage.

- Complete the form as soon as the sale is finalized. Timeliness is crucial to protect yourself from potential liabilities related to the vehicle you no longer own.

- Retain a copy of the completed form for your records. This document is your proof that the responsibility for the vehicle has been transferred to the new owner.

- Use a black or blue pen for clarity and durability of the information provided.

- Double-check the buyer’s information. Accuracy here is vital for any future correspondence or issues that may arise.

Don't:

- Daily post-submitting the form. Prompt submission to the Department of Motor Vehicles (DMV) is essential for the effective transfer of liability.

- Leave any sections blank. Incomplete forms can lead to processing delays or even rejections, leaving you temporarily liable for the vehicle.

- Forget to notify your insurance company about the sale of the vehicle. This step is as crucial as the form itself for ending your responsibility for it.

- Ignore the need for buyer acknowledgment. It's essential that the buyer is aware of and agrees to the information as it's presented on the form.

- Overlook errors on the form. If errors are made, correct them immediately to prevent legal or administrative complications down the line.

Misconceptions

When dealing with the California Release of Liability form, understanding its purpose and limitations is essential. Common misconceptions often lead to mismanagement and confusion of its application. Here are eight common myths debunked to clarify its use and importance.

Signing Waives All Future Claims: Many believe that once the Release of Liability form is signed, the signer cannot make any future claims. However, this form typically covers specific claims or incidents mentioned in the document, not all possible future disputes.

Only Physical Injuries Are Covered: A common misconception is that the form only relates to physical injuries. In reality, it can cover a range of issues including property damage, personal injury, and other liabilities as stipulated in the agreement.

It's Only for Vehicle Sales: While often associated with vehicle transactions, the Release of Liability form is used in various situations where one party is releasing another from potential legal claims, including sports, employment, and other activities.

It Instantly Transfers Responsibility: Some think that responsibility is transferred to the other party immediately upon signing. This document does initiate the process, but official transfer of liability may require additional steps or documentation, depending on the context.

Not Legally Binding: Another myth is that this form is not legally binding. When properly executed, it is a legally binding document that courts generally respect, making it critical to understand fully before signing.

Can Be Signed Under Duress: The belief that a Release of Liability form signed under pressure or duress is still valid is incorrect. For the document to be legally binding, it must be signed voluntarily and without coercion.

One Size Fits All: Many assume that there is a standard form that applies universally. While there are templates, a Release of Liability should be tailored to the specific circumstances and details of the parties involved.

Doesn’t Need To Be Filed Officially: Some believe that once signed, there's no need to file the form with any state or governmental entity. This is not always the case, as some situations, like releasing liability upon selling a vehicle, require filing with the appropriate state agency.

Understanding these misconceptions about the California Release of Liability form can prevent future legal issues and ensure that individuals are adequately protected when engaging in activities or transactions that could expose them to potential lawsuits.

Key takeaways

When engaging in activities or transactions that could result in potential legal liability in California, understanding how to correctly fill out and use the California Release of Liability form is crucial. Here are 8 key takeaways to consider:

- Identification of Parties: Clearly identify all parties involved in the agreement. This includes the full legal names of the person or entity being released from liability (releasor) and the person or entity who is receiving the release (releasee).

- Details of the Agreement: Specify the date of the agreement and provide a comprehensive description of the event or activity that might potentially give rise to liability. This helps in ensuring that the scope of the release is clearly understood by all parties.

- Voluntary Participation: It’s important to state that the signing of the form by the releasor is voluntary and that they understand the terms and implications of the agreement, including giving up certain legal rights.

- Specificity is Key: Be as specific as possible about the rights being released. The document should explicitly state the types of claims or potential claims that the releasor is agreeing not to bring against the releasee.

- Consideration: The form should mention any consideration (i.e., compensation, goods, or services) that the releasor is receiving in exchange for signing the release. If there is no consideration, this should also be noted.

- Effective Date and Duration: Clearly indicate the effective date of the release and, if applicable, when the release expires. Some releases are intended to be “in perpetuity” (forever), which should be explicitly stated.

- Signatures: Ensure that the form is signed and dated by the releasor. In some cases, a witness or notary public may also be required to sign the form, adding an additional layer of verification to the agreement.

- Legal Advice: Lastly, it's highly recommended to consult with a legal professional before signing a Release of Liability form. A lawyer can help understand the implications of the agreement and ensure that it is in the best interest of the party signing it.

Completing the California Release of Liability form with thoughtful attention can protect individuals and entities from future legal disputes. It formalizes the understanding between parties and sets clear boundaries for the extent of liability coverage. When in doubt, seeking legal counsel can provide peace of mind and assurance that the rights and interests of all parties are being considered and protected.

Create Some Other Templates for California

Bill of Sale for a Car - State laws may require notarization of the Boat Bill of Sale to validate the signature and the document itself for registration purposes.

Durable Power Printable Power of Attorney Form - Effectively grants someone you trust the legal capacity to oversee your finances during periods you cannot.

Do Not Resuscitate Form - It is crucial for patients with terminal illnesses or severe chronic conditions who choose to focus on comfort care rather than emergency interventions.