Fill a Valid Schedule California 540 Form

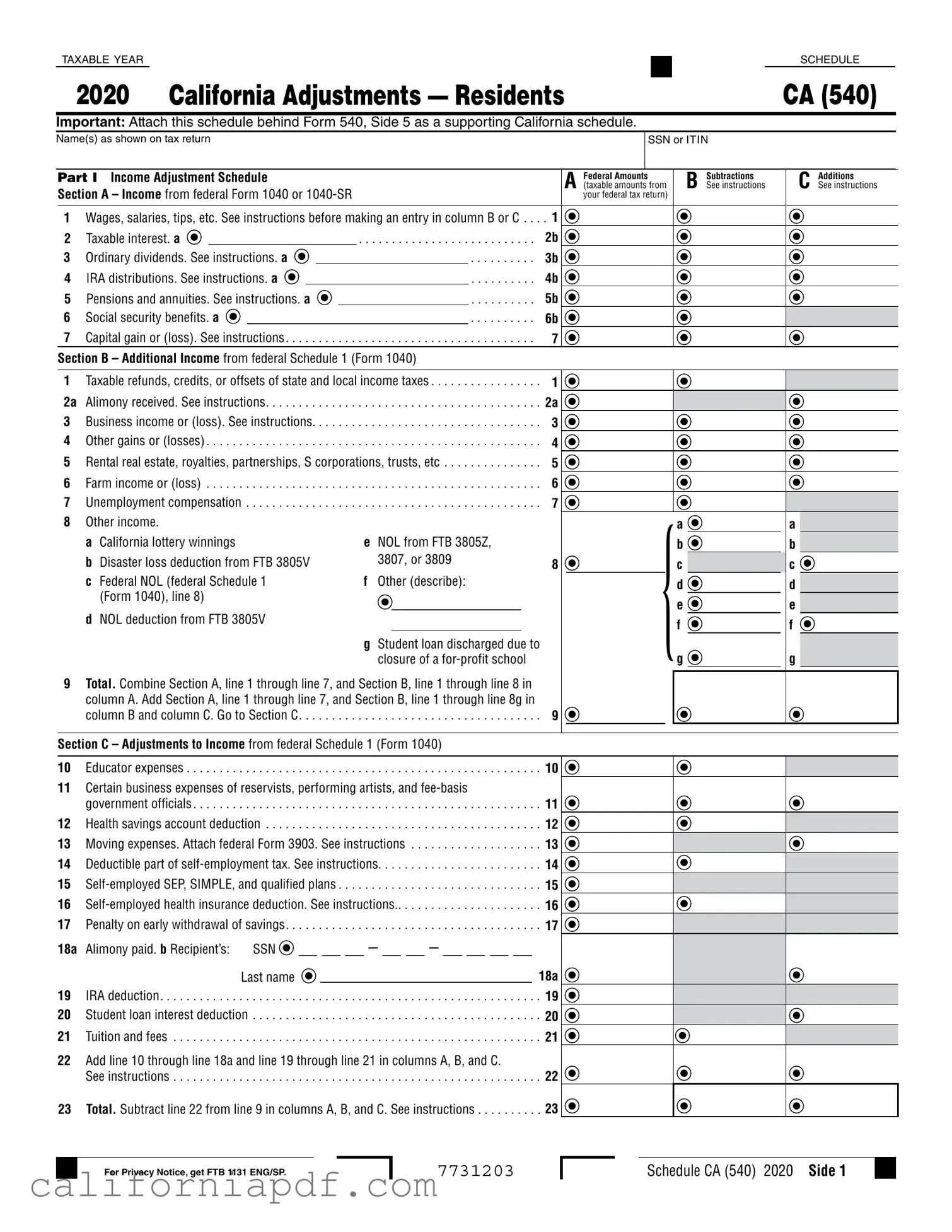

Every year, residents of California navigate the tax season by filling out various forms to comply with state tax laws, one of which is the Schedule California 540 form. This form plays a crucial role, as it outlines the adjustments residents need to make to their income and deductions based on the state's unique tax requirements. Unlike the federal tax return, the Schedule CA (540) meticulously details income types -- from wages and dividends to more specific sources like lottery winnings and disaster loss deductions. It also guides residents on adjusting their federal itemized deductions to align with California's tax laws, covering everything from medical expenses to charitable contributions. Additionally, the form addresses adjustments for itemized deductions, unreimbursed employee expenses, and other noteworthy deductions, making it an essential document for accurately calculating one's state tax liability. Navigating this form requires a careful reading of its sections, each designed to ensure that taxpayers account for California's specific adjustments, ultimately determining their adjusted gross income and deductible expenses in compliance with state regulations.

Document Example

TAXABLE YEAR |

|

|

SCHEDULE |

|

|

|

|

2020 California Adjustments — Residents |

CA (540) |

||

Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule.

Name(s) as shown on tax return

SSN or ITIN

|

Part I |

Income Adjustment Schedule |

|

|

|

|

|

|

A |

Federal Amounts |

B |

Subtractions |

C |

Additions |

|||||||||||

|

Section A – Income from federal Form 1040 or |

|

|

|

|

|

|

(taxable amounts from |

See instructions |

See instructions |

|||||||||||||||

|

|

|

|

|

|

|

|

|

your federal tax return) |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1 |

Wages, salaries, tips, etc. See instructions before making an entry in column B or C . . . |

. 1 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2 |

Taxable interest. a |

|

. . . |

. . |

. . . . . . . . . . . . |

. . . . . . . . |

. . |

2b |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

3 |

Ordinary dividends. See instructions. a |

|

|

|

|

. . . . . . . . |

. . |

3b |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

4 IRA distributions. See instructions. a |

|

|

|

|

|

|

4b |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

. . . . . . . . |

. . |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

5 Pensions and annuities. See instructions. a |

|

|

|

|

. . . . . . . . |

. . |

5b |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

6 |

Social security benefits. a |

|

|

|

|

. . . . . . . . |

. . |

6b |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

7 |

Capital gain or (loss). See instructions |

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

. . . . . . . . . . . . . . |

. . . . . . . . |

. . |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Section B – Additional Income from federal Schedule 1 (Form 1040) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1 |

Taxable refunds, credits, or offsets of state and local income taxes |

1 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2a |

. . . . . . . . . . . . . . . . .Alimony received. See instructions |

. . . . . . . . . . . . . . |

. . . . . . . . |

. . . |

2a |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

3 |

. . . . . . . . . .Business income or (loss). See instructions |

. . . . . . . . . . . . . . |

. . . . . . . . |

. . . |

3 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

4 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Other gains or (losses) |

. . . . . . . . |

. . . |

4 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

5 |

. . . . . . . . . . . . . . .Rental real estate, royalties, partnerships, S corporations, trusts, etc |

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

6 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Farm income or (loss) |

. . . . . . . . |

. . . |

6 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

7 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Unemployment compensation |

. . . . . . . . |

. . . |

7 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

8 |

Other income. |

|

|

|

|

|

|

|

|

|

|

a |

|

|

|

a |

|

|

||||||

|

|

a |

California lottery winnings |

e |

NOL from FTB 3805Z, |

|

|

|

|

|

b |

|

|

|

b |

|

|

||||||||

|

|

b |

Disaster loss deduction from FTB 3805V |

|

3807, or 3809 |

8 |

|

|

|

|

c |

|

|

|

c |

|

|

||||||||

|

|

c |

Federal NOL (federal Schedule 1 |

f |

Other (describe): |

|

|

|

|

|

d |

|

|

|

d |

|

|

||||||||

|

|

|

(Form 1040), line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

e |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

d |

NOL deduction from FTB 3805V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

f |

|

|

f |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g |

Student loan discharged due to |

|

|

|

{g |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

closure of a |

|

|

|

|

|

g |

|

|||||||||

|

9 |

Total. Combine Section A, line 1 through line 7, and Section B, line 1 through line 8 in |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

column A. Add Section A, line 1 through line 7, and Section B, line 1 through line 8g in |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

column B and column C. Go to Section C |

. . . . . . . . . . . . . . |

. . . . . . . . |

. . . |

9 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section C – Adjustments to Income from federal Schedule 1 (Form 1040)

10 Educator expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11Certain business expenses of reservists, performing artists, and

|

government officials |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 11 |

12 |

Health savings account deduction |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 12 |

|

13 |

Moving expenses. Attach federal Form 3903. See instructions . . . |

. . . . . . . . . . . . . . . . . 13 |

||

14 |

Deductible part of |

. . . . . . . . . . . . . . . . . 14 |

||

15 |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 15 |

||

16 |

||||

17 |

Penalty on early withdrawal of savings |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 17 |

|

18a |

Alimony paid. b Recipient’s: |

SSN |

– |

– |

|

|

Last name |

|

18a |

19 |

IRA deduction |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 19 |

20 |

Student loan interest deduction |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 20 |

|

21 |

Tuition and fees |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 21 |

22Add line 10 through line 18a and line 19 through line 21 in columns A, B, and C.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Total. Subtract line 22 from line 9 in columns A, B, and C. See instructions . . . . . . . . . . 23

For Privacy Notice, get FTB 1131 ENG/SP.

7731203

Schedule CA (540) 2020 Side 1

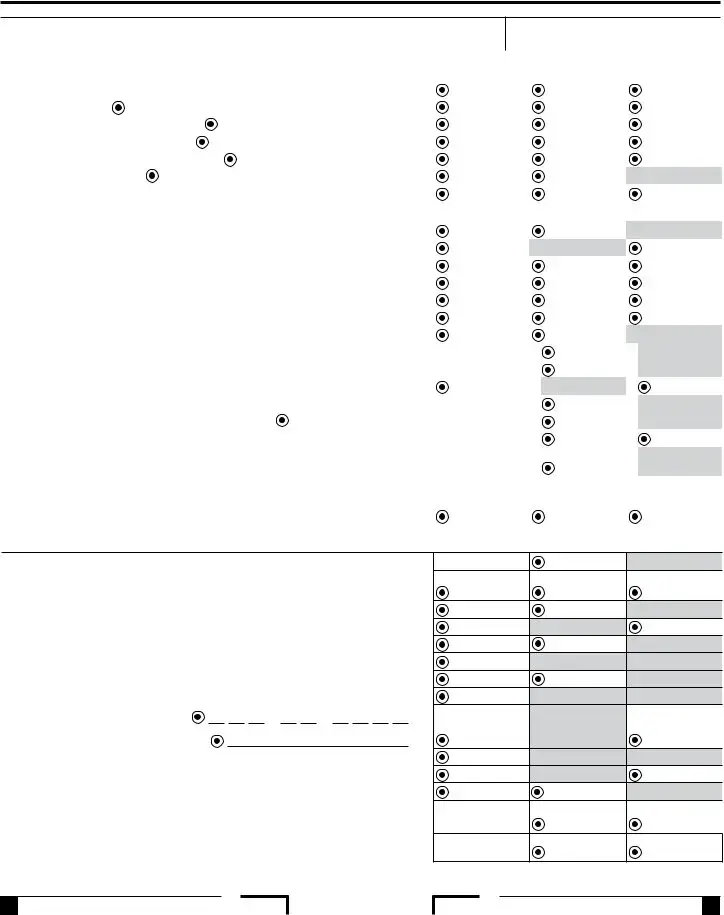

Part II Adjustments to Federal Itemized Deductions

Check the box if you did NOT itemize for federal but will itemize for California . . . . . . . . .

AFederal Amounts (from federal Schedule A (Form 1040)

BSubtractions See instructions

CAdditions

See instructions

Medical and Dental Expenses See instructions.

1 |

Medical and dental expenses |

1 |

2 |

Enter amount from federal Form 1040 or |

2 |

3 Multiply line 2 by 7.5% (0.075) |

3 |

|

4 |

Subtract line 3 from line 1. If line 3 is more than line 1, enter 0 |

. 4 |

Taxes You Paid |

|

|

5a State and local income tax or general sales taxes |

5a |

|

5b |

State and local real estate taxes |

5b |

5c |

State and local personal property taxes |

5c |

5d |

Add line 5a through line 5c |

5d |

5e |

Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) in column A . . |

|

|

Enter the amount from line 5a, column B in line 5e, column B |

|

|

Enter the difference from line 5d and line 5e, column A in line 5e, column C |

5e |

6 |

Other taxes. List type |

6 |

7 |

Add line 5e and line 6 |

7 |

Interest You Paid |

|

|

8a Home mortgage interest and points reported to you on federal Form 1098 . . . . . . . . . . . 8a  8b Home mortgage interest not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . 8b

8b Home mortgage interest not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . 8b  8c Points not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c

8c Points not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c  8d Mortgage insurance premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8d

8d Mortgage insurance premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8d  8e Add line 8a through line 8d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8e

8e Add line 8a through line 8d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8e  9 Investment interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

9 Investment interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9  10 Add line 8e and line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

10 Add line 8e and line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Gifts to Charity

11 Gifts by cash or check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11  12 Other than by cash or check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

12 Other than by cash or check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12  13 Carryover from prior year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

13 Carryover from prior year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13  14 Add line 11 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

14 Add line 11 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Casualty and Theft Losses

15 Casualty or theft loss(es) (other than net qualified disaster losses). Attach federal |

|

Form 4684. See instructions |

15 |

Other Itemized Deductions |

|

16

17 Add lines 4, 7, 10, 14, 15, and 16 in columns A, B, and C . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Total. Combine line 17 column A less column B plus column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  18

18

Side 2 Schedule CA (540) 2020

7732203

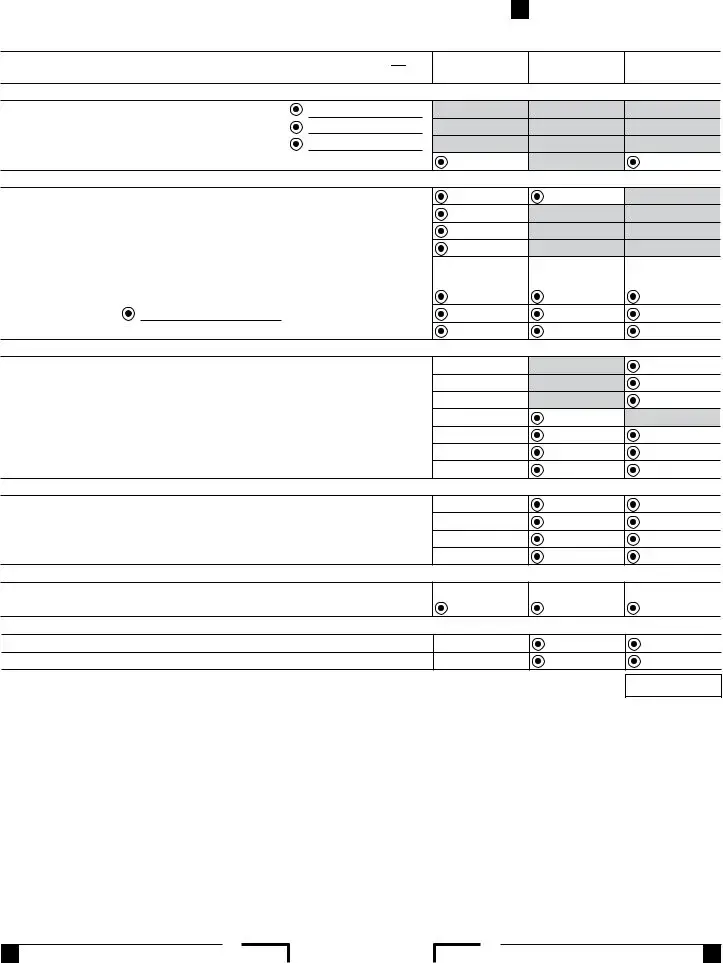

Job Expenses and Certain Miscellaneous Deductions

19Unreimbursed employee expenses - job travel, union dues, job education, etc.

Attach federal Form 2106 if required. See instructions. . . . . . . . . . . . . . . . . . . . . . . .  19

19

20 Tax preparation fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  20

20

21 Other expenses - investment, safe deposit box, etc. List type |

|

21 |

22 Add line 19 through line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

22

23Enter amount from federal Form 1040 or

24 Multiply line 23 by 2% (0.02). If less than zero, enter 0. . . . . . . . . . . . . . . . . . . . . . .  24

24

25 Subtract line 24 from line 22. If line 24 is more than line 22, enter 0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  25

25

26 |

Total Itemized Deductions. Add line 18 and line 25 |

. . . . . . . |

26 |

|

27 |

Other adjustments. See instructions. Specify. |

|

. . . . . . . |

27 |

28 Combine line 26 and line 27. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  28

28

29 Is your federal AGI (Form 540, line 13) more than the amount shown below for your filing status? Single or married/RDP filing separately . . . . . . . . . . . . . . . . . . . . . . . . . . . $203,341 Head of household . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $305,016 Married/RDP filing jointly or qualifying widow(er) . . . . . . . . . . . . . . . . . . . $406,687

No. Transfer the amount on line 28 to line 29.

Yes. Complete the Itemized Deductions Worksheet in the instructions for Schedule CA (540), line 29 . . . . . . . . . . . . . . . . . . . . .  29

29

30 Enter the larger of the amount on line 29 or your standard deduction listed below

Single or married/RDP filing separately. See instructions. . . . . . . . . . . . . . . . $4,601

Married/RDP filing jointly, head of household, or qualifying widow(er) . . . . . $9,202

Transfer the amount on line 30 to Form 540, line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  30

30

This space reserved for 2D barcode

This space reserved for 2D barcode

7733203

Schedule CA (540) 2020 Side 3

Form Breakdown

| Fact Number | Description |

|---|---|

| 1 | The Schedule CA (540) is designed for California residents to make adjustments to their federal income for state tax purposes. |

| 2 | It is essential to attach this schedule behind Form 540, specifically at Side 5, as a supporting document. |

| 3 | Part I focuses on Income Adjustment Schedule including subtractions and additions from federal amount. |

| 4 | Part II details Adjustments to Federal Itemized Deductions, allowing taxpayers who itemize to adjust their deductions for California. |

| 5 | Users must carefully follow the instructions for each line to accurately report their income and deductions. |

| 6 | The form includes sections for adjustments related to various sources of income such as wages, interest, and dividends, among others. |

| 7 | Taxpayers can claim adjustments for educator expenses, health savings account deductions, and other specific expenses. |

| 8 | The governing law for the Schedule CA (540) form falls under the California Revenue and Taxation Code. |

How to Write Schedule California 540

Filling out the Schedule California 540 form is an important step for many residents who need to adjust their federal income for their state taxes. This schedule allows individuals to add or subtract income and deductions that differ from federal amounts, ensuring their tax liability is calculated accurately for the state of California. By carefully following each step and referring to the instructions as needed, filers can accurately complete this form and comply with California tax laws.

- Begin by entering the year for which you are filing at the top of the form, labeled "TAXABLE YEAR."

- Provide your full name(s) and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) as shown on your tax return.

- Under Part I – Income Adjustment Schedule, locate Section A. Fill in the corresponding federal amounts for items such as wages, salaries, tips (line 1), taxable interest (line 2b), and ordinary dividends (line 3b) from your federal Form 1040 or 1040-SR.

- If applicable, make subtractions in column B or additions in column C as per the instructions for specific line items. Some items may not require adjustments, in which case, you would proceed to the next relevant item.

- In Section B – Additional Income from federal Schedule 1, report any additional types of income such as taxable refunds (line 1), alimony received (line 2a), or business income (line 3) following the same approach of entering federal amounts and making necessary adjustments.

- For Section C – Adjustments to Income from federal Schedule 1, include specific deductions like educator expenses (line 10) or student loan interest deduction (line 20), adjusting your income according to California's guidelines.

- Under Part II – Adjustments to Federal Itemized Deductions, check the box if you did not itemize deductions on your federal return but plan to do so for California.

- For medical and dental expenses, taxes paid, interest paid, gifts to charity, casualty and theft losses, other itemized deductions, and miscellaneous deductions, enter the federal amounts from Schedule A (Form 1040) and make any required subtractions or additions for California.

- Review and tot up columns A, B, and C where necessary, especially focusing on the totals for adjusted income and deductions.

- Based on your adjustments, calculate the total itemized deductions and other adjustments to determine your final adjusted gross income for California.

- Finally, confirm if your federal Adjusted Gross Income (AGI) exceeds the threshold for your filing status and complete the Itemized Deductions Worksheet if required. Transfer the relevant amounts to your Form 540, following the instructions provided.

It is paramount to double-check all entries and calculations to avoid errors. Once completed, attach Schedule CA (540) behind Form 540, Side 5, as a supporting document. For detailed guidance on specific lines or situations, refer to the instructions provided by the California Franchise Tax Board. This careful preparation ensures that your state tax obligations are met accurately and efficiently.

Listed Questions and Answers

What is Schedule CA (540)?

Schedule CA (540) is a form used by California residents to adjust their federal adjusted gross income and federal itemized deductions to reflect California's laws. This form complements the main California income tax return, Form 540. It ensures that taxpayers correctly calculate their taxable income according to California state tax rules.

Why do I need to fill out Schedule CA (540)?

The federal government and the state of California have different tax laws. Because of these differences, you may have to add or subtract income and deductions on your state tax return. The Schedule CA (540) form helps reconcile these differences and compute your California taxable income accurately.

How do I know if I need to use Schedule CA (540)?

If you are a California resident and you file a federal tax return, you should complete Schedule CA (540) if any of the following apply to you:

- You have income that is taxed differently by the state and federal government.

- You are claiming deductions or credits that are different on your state return compared to your federal return.

- This includes, but is not limited to, adjustments for IRA distributions, pensions, annuities, Social Security benefits, and itemized deductions.

Where can I find instructions for completing Schedule CA (540)?

Instructions for completing Schedule CA (540) are provided by the California Franchise Tax Board (FTB) on their official website. The instructions can help guide you through each part of the form, explaining how to adjust your income and deductions properly.

Is there an online version of Schedule CA (540) I can use?

Yes, the California Franchise Tax Board offers an online version of Schedule CA (540) and other tax forms through their website. You can also use various tax preparation software programs that will help you fill out your forms correctly.

What are some common adjustments made on Schedule CA (540)?

Common adjustments on Schedule CA (540) include:

- Additions for income that is not taxed federally but is taxed by California.

- Subtractions for income that is taxed federally but not by California.

- Adjustments to federal itemized deductions to conform with California rules.

Can I itemize deductions on Schedule CA (540) if I didn’t itemize on my federal return?

Yes, you can choose to itemize deductions on your California tax return even if you did not itemize on your federal return. You'll need to complete the itemized deductions section on Schedule CA (540) and ensure you meet the federal criteria for itemizing.

What do I do after completing Schedule CA (540)?

After completing Schedule CA (540), you need to attach it to your Form 540, California Resident Income Tax Return. Schedule CA (540) should be placed behind Form 540, Side 5 as part of your supporting documentation.

How does Schedule CA (540) affect my tax return?

Completing Schedule CA (540) can either increase or decrease the amount of taxable income you report on your California tax return, depending on your specific adjustments. This, in turn, can affect the amount of state tax you owe or your refund amount.

Where can I get help with Schedule CA (540)?

For help with Schedule CA (540), you can contact the California Franchise Tax Board directly or seek the assistance of a tax professional. The FTB offers resources and assistance for taxpayers on their website, including FAQs and contact information for customer service.

Common mistakes

Filling out tax forms can be a challenging process, and the Schedule CA (540) for California residents is no exception. Here are nine common mistakes people make when completing this form:

Not attaching Schedule CA (540) behind Form 540, Side 5 as required. This can result in processing delays and potentially missed information.

Incorrectly reporting income amounts in Part I because of not following specific instructions for each line. This can lead to an inaccurate taxable income calculation.

Failing to properly differentiate between federal amounts and adjustments specific to California in columns B (Subtractions) and C (Additions). This mistake can affect the accuracy of the state tax calculation.

Omitting or inaccurately reporting additional income types from federal Schedule 1 on Section B. It's crucial to include all relevant income to ensure compliance and avoid underreporting.

Incorrect calculations within the Adjustments to Income section (Part II), which can lead to a wrong adjusted gross income (AGI) for California. Paying close attention to allowable adjustments is key.

Not correctly adjusting federal itemized deductions in Part II for California-specific rules. For instance, California allows different deductions and credits that might not align with federal rules.

Misreporting deductions related to Medical and Dental Expenses, Taxes You Paid, and Interest You Paid by not applying California-specific rules for these deductions.

Forgetting to add or subtract specific items not included in the federal itemized deductions, like the state income tax refund which is taxable on the federal return but not on the California return.

Either not checking the box for California itemizing even though the taxpayer did not itemize for federal, or vice versa. This could lead to missed deductions or incorrect tax liability.

By carefully navigating these areas and double-checking entries against the provided instructions, taxpayers can avoid these common pitfalls and ensure their Schedule CA (540) is accurately completed.

Documents used along the form

Filing taxes can sometimes feel like assembling a puzzle, where each piece must fit perfectly. For those navigating the complexities of tax season in California, especially when dealing with the Schedule CA (540) form, it's crucial to understand the various other forms and documents that might be necessary to complete the process accurately. These additional documents ensure that every deduction, income adjustment, and tax detail is appropriately accounted for, often responding to specific situations or types of income. Here's a rundown of some important forms and documents that often accompany Schedule CA (540).

- Form 540: This is the main California Resident Income Tax Return form to which the Schedule CA (540) is attached. It captures the overall income, deductions, and credits to calculate the state tax owed.

- W-2 Forms: These show the income earned from employment and taxes withheld by employers. They are essential for accurately reporting wages on your tax return.

- 1099 Forms: Various 1099 forms report income from self-employment, interest, dividends, government payments, and other sources not covered by a W-2.

- Schedule D (540): For reporting California capital gains or losses. This is necessary if you have investments that were sold or exchanged during the tax year.

- Schedule S (540): Required for those who need to report income from sources outside of California, enforcing the state's adjustments to federal itemized deductions.

- FTB 3885A: Depreciation and Amortization Adjustments. If you're using depreciation to reduce taxable income on assets for your business, this form helps detail those amounts for state taxes.

- Form 3506: Child and Dependent Care Expenses Credit. For those claiming expenses related to the care of a child or dependent, this form calculates the state credit.

- Form 3525: Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distribution From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRUs, Insurance Contracts, etc. Use this if you have not received these forms from your employer or administrators.

- Form 540-ES: Estimated Tax for Individuals. For individuals who are self-employed or do not have sufficient taxes withheld from their salaries, this form helps calculate and pay estimated taxes quarterly.

- Form 8453: California e-file Return Authorization for Individuals. If filing electronically, this form authorizes the e-file and provides a space for a paid preparer's signature.

To navigate California's tax landscape, having these documents and forms at your fingertips will simplify the process, ensuring you meet all legal requirements while possibly maximizing your refund or minimizing your liability. Remember, each individual's or family's situation is unique, so not all forms will be necessary for everyone. Always consult with a tax professional if you're unsure about which forms apply to your situation.

Similar forms

The Schedule California 540 form, specifically designed for California residents, bears similarities to several other documents utilized in the calculation and filing of state and federal taxes. These documents, though varied in their application, share commonalities in adjusting gross income, itemizing deductions, or relating to specific financial adjustments, reflecting the nuances of tax law and accounting principles across different jurisdictions. Here, we delve into ten such documents and elucidate on how they parallel the features of the Schedule CA (540).

Firstly, the IRS Form 1040 is akin to the Schedule CA (540) in its fundamental purpose of determining the tax liability of individuals. Form 1040 is the cornerstone of federal tax returns for individuals, capturing all sources of income, adjustments, and credits, much like the CA (540) does for California state taxes. Both forms serve as the primary documents for individual tax filings in their respective domains, highlighting income, deductions, and credits to compute the total tax owed or refund due.

On that note, the IRS Schedule 1 (Form 1040) shares similarities with Schedule CA (540) by providing additional income types and adjustments to income not directly listed on the main form. It includes less common income sources and deductions, such as business income, alimony received, educator expenses, and student loan interest deduction, which are integral to tailoring the tax calculation process to an individual's financial circumstances.

The IRS Schedule A (Form 1040) for itemized deductions mirrors the itemized deductions section of Schedule CA (540), allowing taxpayers to list various types of expenses eligible for deduction. Both schedules allow taxpayers to subtract certain personal expenses, like medical and dental expenses, state and local taxes, mortgage interest, and gifts to charity, from their gross income, reducing their taxable income.

IRS Form 2106, related to employee business expenses, resonates with the unreimbursed employee expenses section of Schedule CA (540). While the tax law changes have limited the deductions for these expenses on the federal level, the similarity lies in the provision for deducting job-related expenses that are not reimbursed by an employer, emphasizing the intersection of employment and taxation.

The Federal Schedule D (Form 1040), concerning capital gains and losses, aligns with the capital gain or loss reporting on Schedule CA (540). These documents reconcile the results of investments, real estate transactions, and other asset dispositions, emphasizing the tax implications of profit and loss in asset management across federal and state lines.

Similarly, Federal Form 4684 for casualties and thefts corresponds to the casualty and theft loss deduction sections in Schedule CA (540), catering to unforeseen financial losses due to disaster or theft. This illustrates the tax system's acknowledgment of personal and financial hardship, providing a mechanism for relief.

IRS Form 3903, which calculates moving expenses, reflects the shifting landscape of tax-deductible expenses, akin to how Schedule CA (540) has provisions for adjustments related to specific expenses, such as those related to jobs or education. Though recent tax law changes have limited the federal deductibility of such expenses, the conceptual parallel lies in recognizing significant life changes in tax calculations.

The IRS Form 1098 is instrumental for mortgage interest deduction, paralleling the interest you paid section in Schedule CA (130). Both forms require taxpayers to report mortgage interest paid during the year, significantly impacting homeowners’ tax liabilities by reducing taxable income.

IRS Form 5329, for additional taxes on IRAs and other tax-favored accounts, shares a common ground with Schedule CA (540) through the lens of addressing specific tax implications of retirement savings distributions and penalties. It highlights the intricate tax considerations surrounding retirement planning and savings.

Last but not least, IRS Form 8839, related to qualified adoption expenses, mirrors the broader principle of targeted tax benefits explored in Schedule CA (540) for specific life events. While Schedule CA (540) doesn't deal directly with adoption expenses, both documents exhibit the tax code's capacity to accommodate diverse aspects of personal finance, underscoring the nuanced approach to individualized tax situations.

In sum, the Schedule CA (540) intersects with various other tax documents, illustrating the complex framework of adjustments, deductions, and credits that define the tax landscape for California residents. Exploring these connections provides valuable insights into the multi-faceted nature of tax preparation and planning, highlighting the importance of detailed record-keeping and awareness of applicable tax laws.

Dos and Don'ts

When preparing to fill out the Schedule CA (540) form, there are important dos and don'ts to consider. To help guide you through the process, here's a list of recommended actions and actions to avoid.

Dos:- Follow the instructions provided for each section carefully to ensure accurate entries.

- Attach the schedule behind Form 540, Side 5, as it is a supporting California schedule.

- Ensure all income amounts are accurately reported from your federal tax return to the relevant sections of the Schedule CA (540).

- Check your calculations thoroughly for subtractions and additions, as mistakes can affect your tax liability.

- Consult the specific instructions for items with unique conditions such as IRA distributions, pensions, and annuities.

- Seek clarification on unclear items, potentially consulting a tax professional if necessary.

- Review the adjustments to income and federal itemized deductions sections closely to claim all eligible adjustments.

- Double-check the totals in Sections A, B, and C to ensure they accurately reflect your income and adjustments.

- Don't rush through the form without carefully reading the instructions for each entry.

- Don't forget to include supporting documentation where required, such as federal forms for certain adjustments.

- Don't overlook the specific exclusions and requirements for California, which may differ from federal rules.

- Don't enter incorrect information from your federal tax return; ensure all transferred amounts are accurate.

- Don't miss adding any additional income not listed on federal Form 1040 or 1040-SR but applicable for California.

- Avoid making assumptions about the taxability of certain income types without checking the instructions.

- Don't forget to check if you need to itemize deductions for California even if you didn't for federal.

- Don't file without reviewing the entire form for completeness and accuracy.

Following these guidelines can help ensure that your Schedule CA (540) form is filled out accurately and completely, potentially avoiding common mistakes and oversights.

Misconceptions

When it comes to tax forms, including the Schedule CA (540) for California residents, there are often several misconceptions that can lead to confusion. Below are four common misunderstandings about this particular form and the truths behind them:

- Only income earned in California needs to be reported. Many believe that the Schedule CA (540) form is solely for reporting income earned within California's borders. However, this form adjusts your federal income for California state taxes, meaning all income reported on your federal return, regardless of where it was earned, needs to be included and then adjusted according to California's laws.

- All federal deductions are allowed on the California return. It's commonly misunderstood that deductions taken on your federal tax return will automatically apply to your California tax return. While many deductions allowed on your federal return are also allowed on the California return, there are exceptions. The Schedule CA (540) is used to document these differences, adding or subtracting from income or deductions per California's tax laws.

- You don't need to fill it out if your federal and California income are the same. Some taxpayers think if their income amounts are the same on both their federal and California returns, there's no need to complete the Schedule CA (540). In reality, this form is necessary for identifying any differences between federal and state taxable income, which can arise even when the gross income figures match.

- California does not tax Social Security benefits, so they should not be included. There's a misconception that because California does not tax Social Security benefits, they should not be reported on Schedule CA (540). Although it's true that California does not tax these benefits, they must still be reported on your federal return and then appropriately subtracted on your Schedule CA (540) to reflect the accurate state-adjusted gross income.

Clearing up these misconceptions helps in properly completing the Schedule CA (540) form, ensuring compliance with California tax laws and potentially avoiding unnecessary adjustments or audits.

Key takeaways

Filling out and using the Schedule CA (540) Form for California Adjustments is a necessary task for residents who need to make adjustments to their federal taxable income for their state tax obligations. Here are six key takeaways to help guide you through this process:

- Attach Behind Form 540: The Schedule CA (540) must be attached behind Form 540, Side 5. This ensures that your adjustments are considered in conjunction with your main state tax return.

- Income Adjustment Schedule: Part I of the schedule allows you to adjust your income. You can subtract or add income items that are treated differently on the federal and state levels. Pay close attention to instructions for each line item to accurately report your adjustments.

- State Specific Adjustments: Some income reported on your federal return may be tax-exempt in California, and vice versa. For instance, California lottery winnings are taxable only at the federal level. Ensure you review the instructions for subtractions and additions thoroughly.

- Itemized Deductions Adjustments: If you itemized deductions on your federal return, you might need to make adjustments for your California return. Part II allows you to adjust federal itemized deductions and should be carefully completed to ensure you claim the correct amount of deductions on your state return.

- Understand Different Sections for Adjustments: The form is divided into sections that address different types of income and deductions. Understanding each section is crucial for accurately completing the form. For instance, sections for income adjustments, adjustments to income from federal Schedule 1, and adjustments to federal itemized deductions each handle different aspects of income and deductions adjustments.

- Documentation and Records: Keep thorough documentation of all the adjustments you make on Schedule CA (540). In case of an audit, this documentation will be vital in justifying the adjustments made to your taxable income and claimed deductions.

Properly filling out the Schedule CA (540) can significantly impact your state tax liability, either by reducing the amount you owe or by increasing your refund. Take the time to review each part of the schedule and consult the instructions or a tax professional if you have specific questions or concerns.

Different PDF Templates

Gun Permit California - The application refuses processing without full payment, highlighting the importance of adhering to the provided fee instructions.

Estate & Trust - Charitable trusts and split-interest trusts have specific sections in the form to detail their distributions for benevolent purposes.