Attorney-Approved California Small Estate Affidavit Document

In the state of California, when a person dies without a will, their estate often must go through a legal process known as probate to distribute the assets to the rightful heirs. This can be a lengthy and costly process, especially for estates that are relatively small in value. Fortunately, California law provides a simplified procedure for the transfer of assets for these smaller estates, utilizing a legal document called the Small Estate Affidavit. This form allows for the distribution of assets without formal probate, provided the total value of the deceased's estate falls below a certain threshold. The Small Estate Affidavit serves as a vital tool for heirs and beneficiaries, enabling them to claim property and assets more quickly and with less expense. Key aspects include eligibility criteria based on the estate's value, the types of assets that can be transferred using this affidavit, and the specific steps required to complete the process. It's a pragmatic solution designed to ease the financial and administrative burden on those dealing with the loss of a loved, streamlining the transfer of assets during a difficult time.

Document Example

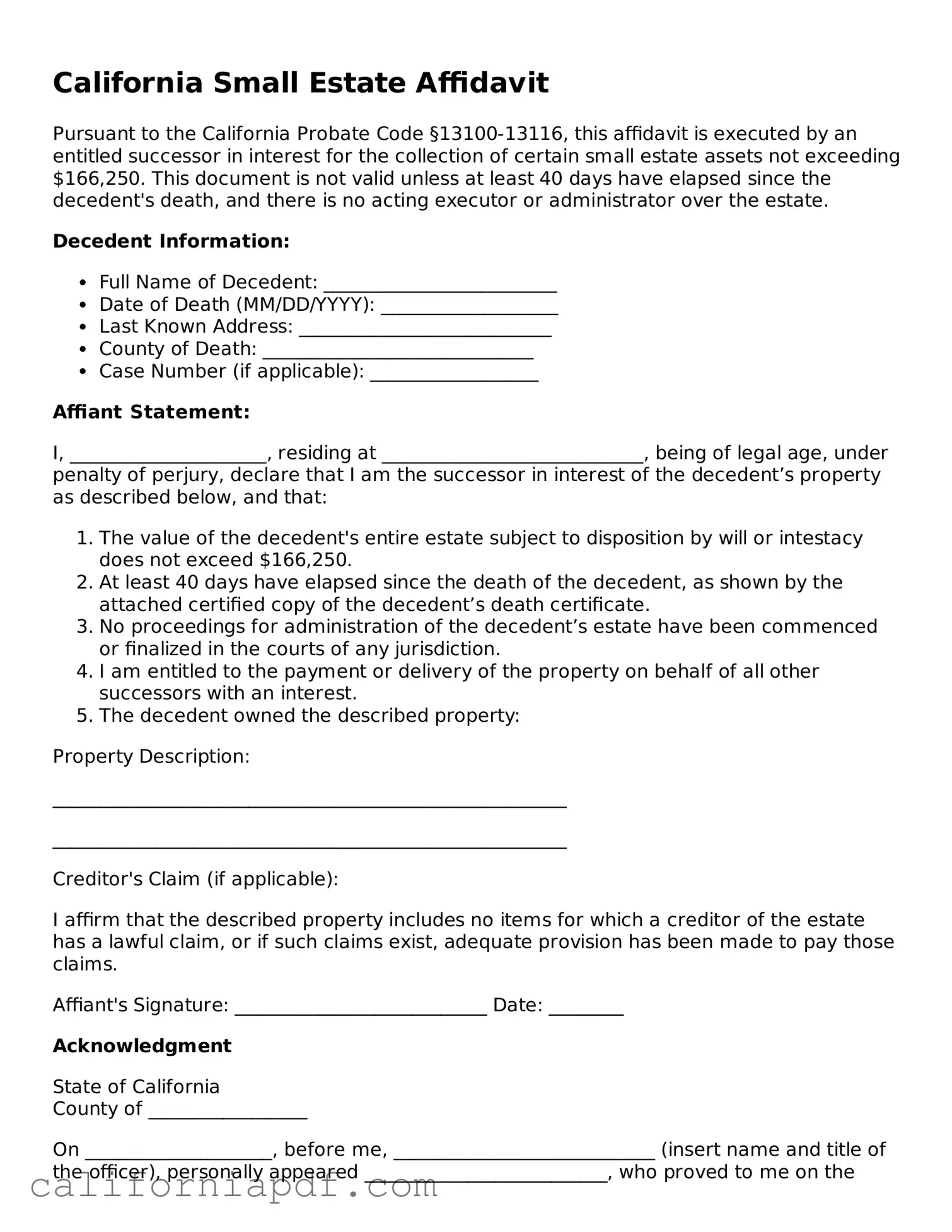

California Small Estate Affidavit

Pursuant to the California Probate Code §13100-13116, this affidavit is executed by an entitled successor in interest for the collection of certain small estate assets not exceeding $166,250. This document is not valid unless at least 40 days have elapsed since the decedent's death, and there is no acting executor or administrator over the estate.

Decedent Information:

- Full Name of Decedent: _________________________

- Date of Death (MM/DD/YYYY): ___________________

- Last Known Address: ___________________________

- County of Death: _____________________________

- Case Number (if applicable): __________________

Affiant Statement:

I, _____________________, residing at ____________________________, being of legal age, under penalty of perjury, declare that I am the successor in interest of the decedent’s property as described below, and that:

- The value of the decedent's entire estate subject to disposition by will or intestacy does not exceed $166,250.

- At least 40 days have elapsed since the death of the decedent, as shown by the attached certified copy of the decedent’s death certificate.

- No proceedings for administration of the decedent’s estate have been commenced or finalized in the courts of any jurisdiction.

- I am entitled to the payment or delivery of the property on behalf of all other successors with an interest.

- The decedent owned the described property:

Property Description:

_______________________________________________________

_______________________________________________________

Creditor's Claim (if applicable):

I affirm that the described property includes no items for which a creditor of the estate has a lawful claim, or if such claims exist, adequate provision has been made to pay those claims.

Affiant's Signature: ___________________________ Date: ________

Acknowledgment

State of California

County of _________________

On ____________________, before me, ____________________________ (insert name and title of the officer), personally appeared __________________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

Signature ________________________(Seal)

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Eligibility Criteria | For estates valued under $166,250, as of 2023, the California Small Estate Affidavit form may be used to manage the distribution of the decedent’s assets without a formal probate process. |

| Waiting Period | The form can be filed 40 days after the death of the decedent, allowing for the use of the affidavit to collect the decedent's personal property. |

| Governing Law | California Probate Code Sections 13000 to 13210 govern the use and requirements of the Small Estate Affidavit in California. |

| Required Information | The affidavit must include detailed information about the decedent, the assets being claimed, the claiming successor’s relationship to the decedent, and a statement that the successor has a rightful claim to the property. |

How to Write California Small Estate Affidavit

Handling the estate of a loved one who has passed away is an emotionally challenging and complex task. One of the tools designed to ease this process in California is the Small Estate Affidavit form. This form allows for the collection of the deceased's property by their successors without the need for a formal probate process, provided the total value of the estate meets certain criteria. It’s important for individuals to carefully complete this document to ensure a smooth transfer of assets. Below, you'll find a step-by-step guide to help you fill out the California Small Estate Affidavit form accurately.

- Gather all required documents, including the death certificate and proof of your right to the property.

- Ensure the total value of the estate's assets qualifies under current California law for the Small Estate procedure.

- Reread the form to familiarize yourself with all sections and any specific instructions it may contain.

- Fill in the date of the deceased’s death at the top of the form.

- Enter the full legal name of the deceased in the designated section.

- List your name and relationship to the deceased, establishing your right to act regarding their estate.

- Provide detailed descriptions of the property you are claiming, including real estate and personal property, with respective values.

- Attach a certified copy of the death certificate to the affidavit.

- Ensure all successors whose names are mentioned in the will (if applicable) have signed the form, agreeing to the distribution of the assets as described.

- Sign and date the form in the presence of a notary public to make it legally binding.

- Present the completed affidavit to the holder of the property, such as the bank or the entity in possession of the decedent’s asset.

Once you have completed and submitted the affidavit with all the necessary attachments, the process of transferring assets can begin. It's crucial to follow up with each entity holding the decedent's assets to ensure they have everything they need to release them to you. Remember, while this form simplifies access to a loved one’s assets, it carries the same legal weight as a formal probate process, demanding accuracy and honesty in every detail provided.

Listed Questions and Answers

What is a California Small Estate Affidavit?

A California Small Estate Affidavit is a legal form used to manage and distribute a deceased person's estate without the need for a formal probate process, provided the total value of the estate does not exceed a certain threshold. This affidavit allows the transfer of property to the rightful heirs or beneficiaries quickly and with less administrative burden.

Who can use a California Small Estate Affidavit?

The Small Estate Affidavit can be used by successors of the deceased, such as family members or beneficiaries named in the will. To qualify, they must meet specific criteria, including the estate's total value being under the legal limit set by California law, which is subject to periodic updates, and sufficient time having passed since the decedent's death.

What is the maximum value limit for using a Small Estate Affidavit in California?

As of the latest update, the total value of the decedent's estate must not exceed $166,250 to qualify for the use of a Small Estate Affidavit in California. It's essential to consult the most current legal limit, as this figure is subject to change.

What types of property can be transferred using this affidavit?

- Personal property, such as bank accounts, stocks, and bonds

- Vehicles

- Real estate holdings, under certain conditions

It is important to verify each type of property's eligibility, as there may be specific rules and exceptions.

What information is needed to complete a California Small Estate Affidavit?

To successfully complete the form, the following information is required:

- The legal name and personal details of the deceased (the decedent)

- The date of the decedent's death

- A thorough description of all assets belonging to the estate

- The estimated value of each asset

- Identification of all successors entitled to the property

Is there a waiting period before filing a Small Estate Affidavit in California?

Yes, there is a statutory waiting period. The Small Estate Affidavit can only be filed 40 days or more after the decedent's death. This timeframe allows for a comprehensive assessment of the estate's value and ensures that all requirements are met before distribution.

Do I need to file the Small Estate Affidavit with a court?

In most cases, filing the Small Estate Affidavit with a court is not required. Instead, the completed form is presented directly to the entity holding the asset, such as a bank or other financial institution. However, for real estate transactions, additional steps and possibly court filing may be necessary.

Can a Small Estate Affidavit be contested?

Yes, like many legal documents, a Small Estate Affidavit can be contested. If someone believes the affidavit was filed improperly, contains inaccuracies, or if there are disputes about the rightful heirs, they may challenge the document. In such cases, legal advice should be sought to address and resolve these issues appropriately.

Common mistakes

When dealing with the transfer of small estate assets in California, many turn to the Small Estate Affidavit as a simplified alternative to a formal probate procedure. However, mistakes in filling out this form can create unnecessary complications and delays. Here are some common errors to avoid:

-

Not Verifying Eligibility Requirements: Individuals often start filling out the form without confirming if the estate actually qualifies under California law's definition of a 'small estate'. This could lead to wasted effort if it turns out probate is required.

-

Failing to Accurately List All Assets: It's crucial to include a complete list of the deceased's assets. Leaving out important details can complicate the transfer process or even challenge the affidavit’s validity.

-

Omitting Debts and Obligations: Similarly, all debts and obligations of the estate must be disclosed. Neglecting to list these can result in financial complications later.

-

Incorrectly Identifying Heirs or Beneficiaries: Precise identification of rightful heirs or beneficiaries is essential. Mistakes here can lead to disputes or contested claims.

-

Skipping Required Signatures: Every required party must sign the affidavit. Missed signatures can invalidate the whole document.

-

Not Using the Most Current Form: The state periodically updates forms. Using an outdated version may mean missing important legal updates or instructions.

-

Overlooking the Notarization Requirement: Many people forget that the form needs to be notarized. This oversight can lead to immediate rejection of the document.

-

Miscalculating the Value of the Estate: Proper assessment of the estate's total value is crucial and must include personal and real property. Under or overestimating can lead to legal issues or the affidavit being challenged.

In conclusion, when handling the California Small Estate Affidavit, careful attention to detail and adherence to state laws are imperative. Common mistakes can often be avoided by thoroughly reviewing all requirements and seeking guidance when necessary. It’s always better to proceed with caution and ensure everything is in order before submitting the affidavit.

Documents used along the form

When dealing with the affairs of a loved one who has passed away, particularly in California, the Small Estate Affidavit form plays a vital role for those estates that qualify as "small" under state law. However, this form does not stand alone in the process. Several other documents are often required or used in conjunction with the Small Estate Affidavit to ensure that all legal and financial aspects of the deceased's estate are properly handled. These documents vary in purpose, from validating the death and proving the inheritor's rights to managing specific assets. Here are some of these crucial documents:

- Death Certificate: This official document serves as proof of death, detailing the date, location, and cause of death. It is often the first document requested when settling an estate.

- Copy of the Will: If the deceased left a will, a copy of it may be required to ascertain the distribution of assets as stated by the deceased.

- Letter of Testamentary: This is a legal document issued by a court that grants authority to the executor named in the will to manage and distribute the estate's assets.

- Bank Statements: Financial institutions often require recent statements to confirm the existence and value of the accounts held by the deceased.

- Stock Certificates: If the deceased owned stocks or bonds, certificates or account statements proving ownership are necessary for transfer or sale.

- Real Estate Deeds: Deeds are crucial to prove ownership of any real estate that may be involved in the small estate.

- Vehicle Registration: To transfer ownership of vehicles, registration documents are required to prove the deceased owned them.

- Life Insurance Policies: Documentation of any life insurance policies is needed to claim the benefits.

- Bill of Sale: If any personal property is sold as part of settling the estate, a bill of sale would document the transaction.

Collectively, these documents assist in the smooth execution of the Small Estate Affidavit process, helping to distribute the deceased's assets according to their wishes or the law. It's important for those handling the estate to understand the purpose of each document and ensure they are correctly prepared and presented to the relevant parties or authorities. Seeking guidance from legal professionals can also provide assurance that the process is followed correctly and efficiently.

Similar forms

The California Small Estate Affidavit form is closely related to the Transfer on Death Deed (TODD). Both documents serve to expedite the transfer of assets upon death, bypassing the lengthy and often costly probate process. The Small Estate Affidavit allows for the distribution of a decedent's estate under a certain value directly to the successors, while the TODD enables an individual to name beneficiaries for their real property, ensuring it passes to them directly upon the individual’s death. Both are designed to simplify the inheritance process, though they apply to different types of assets.

Similarly, the Joint Tenancy with Right of Survivorship (JTWROS) agreement mirrors aspects of the Small Estate Affidavit in terms of property transfer efficiency. JTWROS is an arrangement that allows co-owners of property, often real estate, to automatically inherit the other's share upon their death without the need for probate. While the Small Estate Affidavit covers assets of a deceased individual under a certain value, JTWROS pertains specifically to the seamless transfer of property ownership, showcasing both documents’ aim to avoid probate.

Another document resembling the California Small Estate Affidavit is the Payable on Death (POD) account designation. This banking arrangement allows account holders to designate beneficiaries who can claim the account's balance after the account holder's death, directly and without the need for probate. Like the Small Estate Affidavit, the POD designation simplifies the transfer of assets, albeit focused on financial accounts. Both facilitate a quicker distribution of assets to beneficiaries, streamlining the process for small estates or specific assets.

The Life Insurance Beneficiary Designation forms also share commonalities with the California Small Estate Affidavit, as they both provide mechanisms for assets to bypass probate and go directly to named beneficiaries. While the Small Estate Affidavit allows for the distribution of a decedent's personal property, bank accounts, and other assets under a certain threshold without probate, life insurance beneficiary designations ensure that life insurance proceeds are paid directly to the beneficiaries outside of probate. Both are crucial tools for estate planning, aimed at reducing the administrative burden on survivors and ensuring assets are promptly and efficiently distributed to the intended recipients.

Dos and Don'ts

Filing out the California Small Estate Affidavit form is a procedure that allows the transfer of assets from the deceased to their rightful inheritors without going through probate, under certain conditions. It’s a process intended to simplify and quicken the distribution of assets for estates valued below a specific threshold. The following guidelines aim to ensure that individuals complete this form accurately and effectively.

Do:

- Ensure that you are eligible to file the Small Estate Affidavit under California law. The total value of the estate must meet the criteria set by the state for this streamlined process.

- Read the entire form before you start filling it out to familiarize yourself with the requirements and the type of information needed.

- Gather all necessary documents beforehand, including a certified copy of the death certificate and an appraisal of the estate’s value, to accurately complete the form.

- Use black ink and write legibly throughout the form to avoid any misinterpretation or delays in processing.

- Provide complete and accurate information about the deceased and the assets being transferred. Ensure that details such as names, addresses, and account numbers are correct.

- Consult with a legal advisor if you have any questions or doubts regarding how to fill out the form or about your eligibility. This step can prevent potential legal issues down the line.

- Sign and date the form in the presence of a notary public to authenticate it. Notarisation is crucial for the document's legal standing.

- Make a copy of the completed form and any other documents to be submitted. This back-up can be vital if the original documents are lost or misplaced.

- Submit the form and any accompanying documentation to the appropriate institution, such as a bank or brokerage, where the deceased’s assets are held.

- Contact the county recorder’s office if the estate includes real estate, to inquire about the additional steps required for transferring property.

Don't:

- Attempt to use the Small Estate Affidavit if the total value of the estate exceeds the threshold established by California law. This action could result in legal complications.

- Overlook any sections of the form. Each part is important and requires your attention.

- Guess on details or leave sections blank. If you’re unsure about some information, seek clarification before submitting the form.

- Use correction fluid or tape on the form. Mistakes should be neatly crossed out, and the correct information should be written nearby.

- Ignore the instructions regarding attachments. Certain assets may require additional documentation to be attached to the affidavit.

- Underestimate the importance of having the affidavit notarized. Failing to do so will render the document invalid.

- Assume that submitting the Small Estate Affidavit immediately transfers the property. The process may take some time, and each institution has its own procedures.

- Forget to notify all potential heirs or beneficiaries about the affidavit. Transparency can prevent disputes and misunderstandings.

- Fail to verify that all financial institutions will accept the affidavit. While the document is widely recognized, policies may vary.

- Forego professional legal advice if the estate’s situation is complex. Sometimes professional guidance is necessary to navigate the small estate process successfully.

Misconceptions

Many people believe they fully understand the California Small Estate Affidavit form, but several misconceptions exist. It is essential to highlight and correct these misunderstandings to ensure that individuals can accurately navigate their way through handling a small estate in California.

Anyone can file a Small Estate Affidavit. In reality, the law restricts who can file this affidavit. Only successors of the deceased or a representative authorized by them, such as a family member or a person entitled to the estate by will or intestacy, are eligible to use this form.

It grants immediate access to the deceased's property. While the Small Estate Affidavit can simplify the process of transferring property, it does not grant immediate access. The form must be accepted by the institution holding the assets, which can sometimes take time and additional verification.

A Small Estate Affidavit can transfer any type of property. There are limitations on the types of property that can be transferred using this affidavit. Real estate valued over a certain threshold and some types of personal property may not qualify for transfer via a Small Estate Affidacy.

There's no value limit for using a Small Estate Affidavit. Contrary to this belief, California law sets a maximum value of the estate that can be processed with a Small Estate Affidavit. The estate's total value must not exceed a certain amount, which is subject to occasional adjustments to reflect current values.

Using a Small Estate Affidavit avoids probate completely. While it can simplify the process and avoid a full probate, it does not eliminate the need for probate in all circumstances. Larger estates or those with disputed assets may still require formal probate proceedings.

The form is universally accepted by all institutions. Although designed to be widely accepted, some institutions may require additional documentation or have their own procedures for releasing assets held in the name of the deceased.

The process is completely free. While using a Small Estate Affidavit can be less costly than going through probate, there may still be fees associated with filing the affidavit, notarizing documents, or transferring titles.

All debts of the estate are forgiven. Filing a Small Estate Affidavit does not erase the estate's debts. Claimants may still seek payment from the estate's assets, and certain debts must be satisfied before property can be distributed to heirs or beneficiaries.

Legal advice is not necessary when using a Small Estate Affidavit. While many people successfully use the affidavit without legal assistance, consulting with a legal professional can help navigate complexities and ensure the process is completed correctly, especially in more complicated estates or when disputes arise.

Key takeaways

The California Small Estate Affidavit is a useful document for those managing the estate of a decedent whose total property value does not exceed a specific threshold. Here are some key takeaways to guide you through the filling out and use of this form:

- The total value of the decedent's estate must not exceed $166,250 to use the Small Estate Affidavit in California. This threshold is adjusted over time, so it is important to check for the most current limit.

- Real estate property is not included when determining the total value of the estate for this process. The Small Estate Affidavit is primarily used for personal property such as bank accounts, stocks, or tangible items.

- A waiting period of 40 days is required after the decedent's death before the Small Estate Affidavit can be presented to the institution holding the assets.

- All heirs or beneficiaries must sign the affidavit if there is more than one. In the case of minors, a legal guardian must sign on their behalf.

- The form requires a detailed list of the assets being claimed, including account numbers and descriptions of personal property. Accuracy in this section is crucial to ensure that the process goes smoothly.

- An important part of the affidavit is the declaration under penalty of perjury that the statements within the document are true. This underlines the importance of honesty and accuracy in completing the form.

- Notarization may be required for the affidavit to be considered valid. This process involves signing the document in front of a notary public, who verifies the identity of the signer and their understanding of the document’s contents.

- After completing the affidavit, it should be presented along with a certified copy of the death certificate to the institution holding the assets (bank, brokerage, etc.) to transfer the ownership.

- In some cases, the institution may require additional documentation or have specific forms in addition to the Small Estate Affidavit. It’s a good practice to contact them in advance to confirm their requirements.

Utilizing the California Small Estate Affidavit can streamline the process of asset transfer without the need for a formal probate, saving time and reducing complexity for the heirs or beneficiaries. However, it is important to ensure that all the requirements are met and that the form is filled out with care and accuracy to avoid any potential setbacks.

Create Some Other Templates for California

Bill of Sale for Gun Sale - It offers a standardized way to document the change of ownership, helping to streamline the process for both private parties and firearm dealers.

Durable Power Printable Power of Attorney Form - Allows for continuity in managing your financial affairs by designating an authorized representative.