Attorney-Approved California Tractor Bill of Sale Document

In the bustling agricultural landscapes of California, the transfer of farm machinery, especially tractors, represents a significant transaction that necessitates clear documentation to ensure a seamless exchange between parties. Entering this domain, the California Tractor Bill of Sale form serves as a crucial document, a lynchpin, if you will, facilitating these transactions with the requisite legal backbone to safeguard both buyer and seller. This form not only establishes a written record of the sale, capturing the essential details such as the tractor's description, sale price, and information about the parties involved, but it also plays a key role in fulfilling the legal requirements set forth by the state for the transfer of ownership. Moreover, it offers a tangible piece of evidence to address any future disputes or for use in registration processes, making it more than just a formality but rather a vital step in the agricultural commerce of California. Understanding the multifaceted utility and the step-by-step process of correctly filling out this form can empower stakeholders, ensuring that the transaction is not only legally compliant but also positioned for mutual satisfaction.

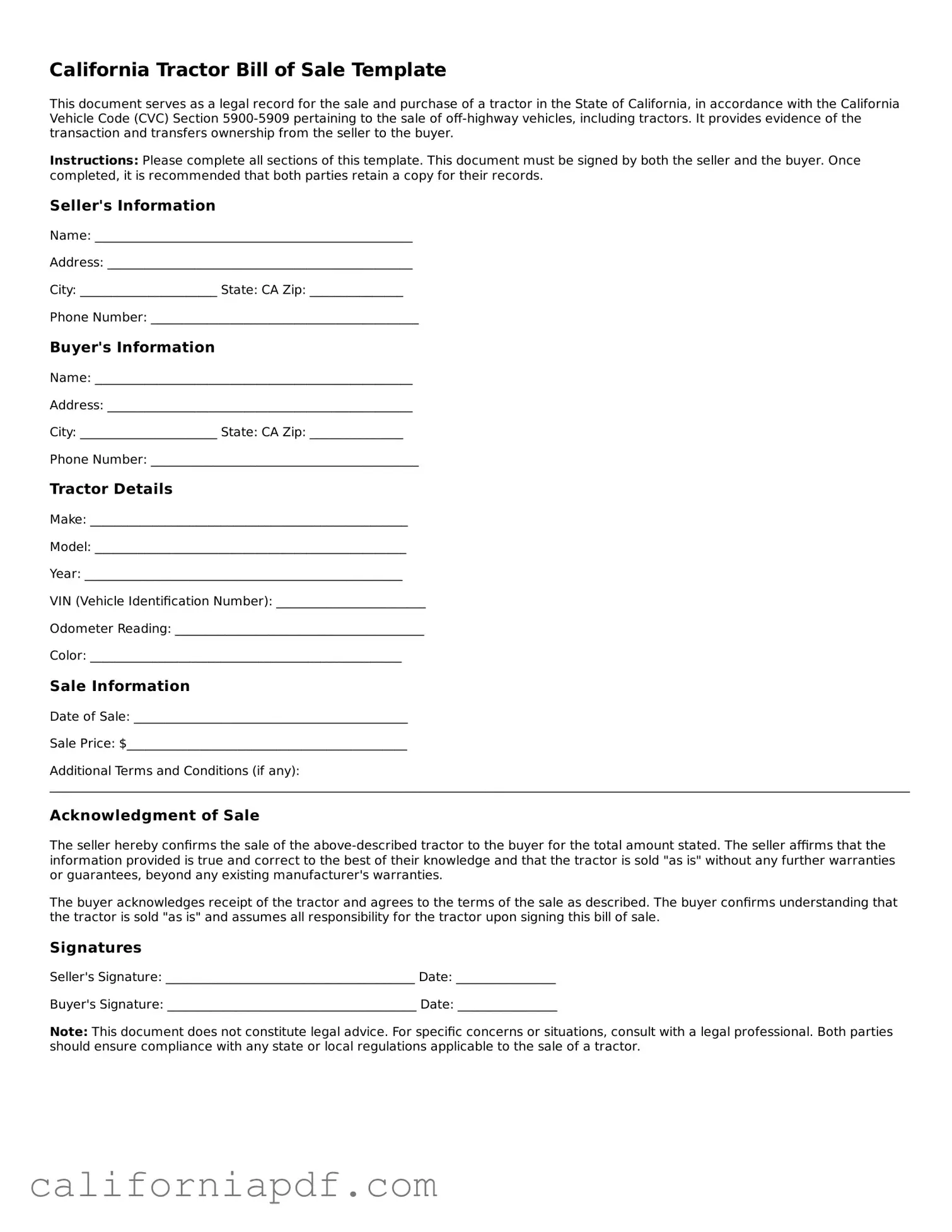

Document Example

California Tractor Bill of Sale Template

This document serves as a legal record for the sale and purchase of a tractor in the State of California, in accordance with the California Vehicle Code (CVC) Section 5900-5909 pertaining to the sale of off-highway vehicles, including tractors. It provides evidence of the transaction and transfers ownership from the seller to the buyer.

Instructions: Please complete all sections of this template. This document must be signed by both the seller and the buyer. Once completed, it is recommended that both parties retain a copy for their records.

Seller's Information

Name: ___________________________________________________

Address: _________________________________________________

City: ______________________ State: CA Zip: _______________

Phone Number: ___________________________________________

Buyer's Information

Name: ___________________________________________________

Address: _________________________________________________

City: ______________________ State: CA Zip: _______________

Phone Number: ___________________________________________

Tractor Details

Make: ___________________________________________________

Model: __________________________________________________

Year: ___________________________________________________

VIN (Vehicle Identification Number): ________________________

Odometer Reading: ________________________________________

Color: __________________________________________________

Sale Information

Date of Sale: ____________________________________________

Sale Price: $_____________________________________________

Additional Terms and Conditions (if any): ______________________________________________________________________________________________________________________________________________________

Acknowledgment of Sale

The seller hereby confirms the sale of the above-described tractor to the buyer for the total amount stated. The seller affirms that the information provided is true and correct to the best of their knowledge and that the tractor is sold "as is" without any further warranties or guarantees, beyond any existing manufacturer's warranties.

The buyer acknowledges receipt of the tractor and agrees to the terms of the sale as described. The buyer confirms understanding that the tractor is sold "as is" and assumes all responsibility for the tractor upon signing this bill of sale.

Signatures

Seller's Signature: ________________________________________ Date: ________________

Buyer's Signature: ________________________________________ Date: ________________

Note: This document does not constitute legal advice. For specific concerns or situations, consult with a legal professional. Both parties should ensure compliance with any state or local regulations applicable to the sale of a tractor.

PDF Form Characteristics

| Fact | Detail |

|---|---|

| 1. Purpose | This form is used to document the sale and transfer of ownership of a tractor from the seller to the buyer. |

| 2. Required by Law | While a Bill of Sale might not be strictly required by California law for private transactions, it provides legal proof of the change in ownership and details of the transaction. |

| 3. Components | The form includes information such as the date of sale, identification details of the tractor (make, model, year, VIN), sale amount, and the names and signatures of the parties involved. |

| 4. Additional Documentation | In addition to the Bill of Sale, California law may require other documents for a complete transfer of ownership, such as a title transfer form or a release of liability form. |

| 5. Notarization | Notarization of the Bill of Sale is not a requirement in California for the sale of a tractor, but it can add an extra level of legal protection and authenticity to the document. |

| 6. Governing Law | This form and the sale it documents are governed by the laws of the State of California, including any specific regulations related to the sale of vehicles or agricultural equipment. |

| 7. Use in Disputes | The Bill of Sale can be used as evidence in legal disputes related to the sale or ownership of the tractor. |

| 8. Public Record | While the Bill of Sale itself is not necessarily filed with any state agency in California, it should be kept by both the buyer and seller as a record of the transaction. |

| 9. Importance | Having a properly filled out Bill of Sale is crucial for both parties as it ensures a clear understanding of the sale terms and helps in future registration or insurance processes. |

How to Write California Tractor Bill of Sale

Completing a Tractor Bill of Sale in California is an essential step in the process of buying or selling a tractor. This document serves as a legal record of the transaction, detailing the agreement between the buyer and the seller. It is vital for ensuring both parties understand their rights and obligations and provides protection in case any disputes arise post-sale. To ensure the process goes smoothly, it's crucial to fill out the form accurately and thoroughly.

- Gather necessary information including the tractor’s make, model, year, and identification number (VIN), as well as the personal contact information of both the buyer and the seller.

- Begin by entering the date of the sale at the top of the form. This establishes when the transaction officially took place.

- Next, fill in the seller’s information, including their full name and address. Ensure this information is accurate for records and potential future contact.

- Proceed to enter the buyer’s information in the designated section, mirroring the format used for the seller's information. Include the full name and address of the buyer.

- Detail the tractor’s information in the specified section. Carefully input the make, model, year, and the vehicle identification number (VIN) to identify the tractor being sold.

- Indicate the sale price of the tractor in the space provided. Write both in numbers and words for clarity and to avoid any misunderstanding.

- If applicable, note any additional terms and conditions of the sale that both parties have agreed upon. This can include payment plans, warranties, or specific responsibilities like transferring the title.

- Both the buyer and the seller must sign the form. These signatures are crucial as they indicate that both parties agree to the terms outlined in the bill of sale and that the information is accurate to the best of their knowledge.

- Finally, it’s a good idea for both parties to keep a copy of the signed document. Having this record on file can be invaluable for registration, tax purposes, or if any legal issues arise.

Completing the California Tractor Bill of Sale form correctly is the first step towards ensuring a legal and smooth transfer of ownership. This document not only serves as a receipt for the transaction but also as a crucial piece of evidence should any questions or disputes arise concerning the sale. Paying attention to detail and ensuring that all the required information is accurately documented will pave the way for a successful sale or purchase.

Listed Questions and Answers

What is a California Tractor Bill of Sale form?

The California Tractor Bill of Sale form is a legal document that records the sale of a tractor from a seller to a buyer within the state of California. This form serves as proof of purchase and verifies the change in ownership of the tractor. It typically includes important information such as the make, model, year, and serial number of the tractor, as well as the names and signatures of the seller and buyer.

Why do I need a Tractor Bill of Sale in California?

In California, a Tractor Bill of Sale is an essential document for several reasons:

- It legally documents the transaction between the buyer and seller.

- It may be required for tax assessment purposes.

- It serves as proof of ownership and can be useful for registration and insurance purposes.

- It helps protect both the seller and the buyer in case of disputes regarding the tractor’s condition or ownership history.

What information should be included in a Tractor Bill of Sale?

A Tractor Bill of Sale should include:

- The date of the sale.

- The complete names and addresses of both the seller and the buyer.

- Details of the tractor (make, model, year, serial number).

- The sale price of the tractor.

- Any warranties or "as-is" condition statements.

- The signatures of both the seller and the buyer.

Is a notarization required for a Tractor Bill of Sale in California?

While notarization of a Tractor Bill of Sale is not a legal requirement in California, it is highly recommended. Notarization can add an extra layer of authenticity to the document and can be helpful in preventing legal disputes in the future.

How do I obtain a California Tractor Bill of Sale form?

A California Tractor Bill of Sale form can be obtained in several ways:

- From the California Department of Motor Vehicles (DMV) website.

- By visiting a local DMV office.

- Through legal form providers online.

- By creating one based on a template found online, ensuring it includes all necessary information.

Can I create my own Tractor Bill of Sale?

Yes, you can create your own Tractor Bill of Sale. However, it is important to make sure that it contains all the relevant information required by California law to ensure its validity. Using a template or consulting with a legal professional can help ensure that all necessary details are included.

What do I do after completing the Tractor Bill of Sale?

After completing the Tractor Bill of Sale, the buyer should:

- Keep a copy for their records.

- Use the document to register the tractor under their name with the California DMV, if applicable.

- Consider notifying their insurance company about the change in ownership.

Does the Tractor Bill of Sale need to be filed with any California state agency?

The Tractor Bill of Sale does not generally need to be filed with any state agency. However, the buyer may need to present it to the California Department of Motor Vehicles (DMX) when registering the tractor. Keeping a copy for personal records is strongly advised for both parties.

What if there are errors in the Tractor Bill of Sale after both parties have signed it?

If errors are discovered in the Tractor Bill of Sale after it has been signed, the best course of action is to create a new document correcting the errors. Both the buyer and the seller should sign the revised document. Previous versions should be discarded to avoid confusion or disputes.

Disputes regarding the tractor after the sale should be addressed based on the conditions outlined in the Bill of Sale. If the tractor was sold "as is," the buyer may have limited recourse. Otherwise, disputes can be resolved through negotiation, mediation, or, as a last resort, legal action. It's advisable to consult with a legal professional to explore the best approach to resolving disputes.

Common mistakes

-

Not Checking for Accuracy in the Details: One of the main errors is providing inaccurate information. Every detail on the form, from the make and model of the tractor to the VIN (Vehicle Identification Number) and the odometer reading (if applicable), needs to be double-checked for accuracy. Incorrect information can cause significant problems, potentially invalidating the bill of sale or causing issues with title transfers and registrations.