Attorney-Approved California Transfer-on-Death Deed Document

Planning for the future is a task filled with complex decisions, especially when it comes to handling one's estate and ensuring loved ones are taken care of after one's demise. In California, a useful tool in this planning process is the Transfer-on-Death (TOD) Deed form, designed to simplify the way real estate property is passed on to beneficiaries. This document allows property owners to name who they want their property to go to upon their passing, without the need for the property to go through probate. The TOD Deed is a revocable document, meaning that the property owner can change their mind at any time as long as they are alive and mentally competent. It's specific to certain types of real estate and has clear requirements to be legally binding, including being properly signed, dated, and recorded before the owner's death. As a relatively recent addition to estate planning tools in California, it paves a straightforward path for transferring ownership, bypassing the often lengthy and costly probate process, therefore, providing peace of mind to property owners who wish their real estate assets to be seamlessly transferred to their designated beneficiaries.

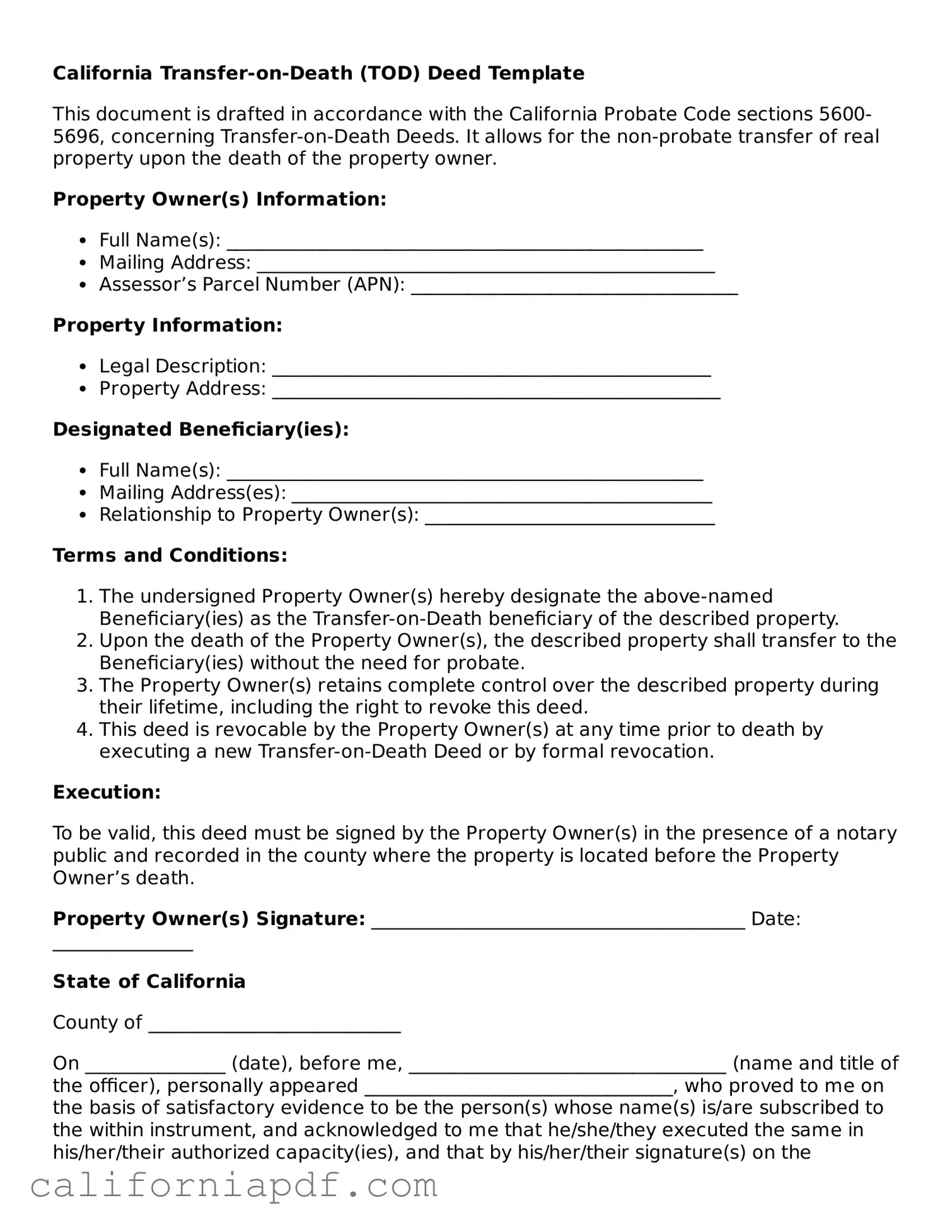

Document Example

California Transfer-on-Death (TOD) Deed Template

This document is drafted in accordance with the California Probate Code sections 5600-5696, concerning Transfer-on-Death Deeds. It allows for the non-probate transfer of real property upon the death of the property owner.

Property Owner(s) Information:

- Full Name(s): ___________________________________________________

- Mailing Address: _________________________________________________

- Assessor’s Parcel Number (APN): ___________________________________

Property Information:

- Legal Description: _______________________________________________

- Property Address: ________________________________________________

Designated Beneficiary(ies):

- Full Name(s): ___________________________________________________

- Mailing Address(es): _____________________________________________

- Relationship to Property Owner(s): _______________________________

Terms and Conditions:

- The undersigned Property Owner(s) hereby designate the above-named Beneficiary(ies) as the Transfer-on-Death beneficiary of the described property.

- Upon the death of the Property Owner(s), the described property shall transfer to the Beneficiary(ies) without the need for probate.

- The Property Owner(s) retains complete control over the described property during their lifetime, including the right to revoke this deed.

- This deed is revocable by the Property Owner(s) at any time prior to death by executing a new Transfer-on-Death Deed or by formal revocation.

Execution:

To be valid, this deed must be signed by the Property Owner(s) in the presence of a notary public and recorded in the county where the property is located before the Property Owner’s death.

Property Owner(s) Signature: ________________________________________ Date: _______________

State of California

County of ___________________________

On _______________ (date), before me, __________________________________ (name and title of the officer), personally appeared _________________________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

Witness my hand and official seal.

______________________________________ (Seal)

Notary Public

PDF Form Characteristics

| Fact Name | Detail |

|---|---|

| Governing Law | The California Transfer-on-Death (TOD) Deed is governed by Sections 5600-5696 of the California Probate Code. |

| Eligible Property | Only real property located in California can be transferred using a Transfer-on-Death (TOD) Deed. |

| Beneficiary Eligibility | Almost anyone can be designated as a beneficiary, including individuals, corporations, or trusts. |

| Revocability | The deed can be revoked by the owner at any time before death without notifying the beneficiary. |

| Witness and Notarization | The deed must be signed by the owner, witnessed by at least two individuals, and notarized to be valid. |

| Effective Date | It becomes effective only upon the death of the property owner, allowing the owner to retain full control over the property during their lifetime. |

How to Write California Transfer-on-Death Deed

Preparing a Transfer-on-Death (TOD) Deed in California is a straightforward process that allows property owners to pass on their real estate to a beneficiary without having to go through probate. This document becomes effective upon death and can be a valuable part of estate planning. It is crucial to fill out the form carefully to ensure your property is transferred according to your wishes after you are gone. Follow these steps to accurately complete the form.

- Locate the current, standardized California Transfer-on-Death Deed form. It can be found online through California’s official government websites or legal document providers.

- Enter the Assessor’s Parcel Number (APN) of the property in the designated space. This number is typically found on your property tax statement.

- Clearly print or type the legal description of the property. This can also be found on your deed or property tax statement. If in doubt, you may need to consult a professional to ensure accuracy.

- List the name(s) and mailing address(es) of the transferor(s). This should match the current deed.

- Specify the name(s) and address(es) of the designated beneficiary(ies). It is vital to list the full legal name and accurate address to avoid any confusion or disputes later.

- Read through the form’s declarations and conditions carefully. These explain the nature of a TOD deed, including its revocability and the fact that it does not take effect until the transferor(s) pass away.

- Sign and date the deed in the presence of a notary public. Notarization is crucial for the deed to be valid.

- Record the deed with the county recorder’s office in the county where the property is located. There may be a recording fee, which varies by county.

Once the form is completed and recorded, it is part of the public record, and the property will transfer to the named beneficiary upon the death of the owner(s). It’s a simple yet powerful tool for estate planning that bypasses the often lengthy and costly probate process. Remember, the Transfer-on-Death Deed can be revoked at any time before the transferor's death should they change their mind, ensuring flexibility in estate planning.

Listed Questions and Answers

What is a Transfer-on-Death Deed in California?

A Transfer-on-Death (TOD) deed in California allows property owners to pass their real estate to a designated beneficiary upon their death without the need for the property to go through probate. This legal document needs to be properly filled out, notarized, and recorded before the property owner's death to be effective.

Who can use a Transfer-on-Death Deed?

Any property owner in California who wishes to transfer their interest in a piece of real estate to a beneficiary upon their death can use a TOD deed. This is applicable to individuals, whether they are sole owners, joint tenants, or tenants in common. However, it's important to understand how ownership is structured to ensure the TOD deed is appropriately utilized.

What properties are eligible for a Transfer-on-Death Deed?

A Transfer-on-Death Deed in California can be used for the following types of residential property:

- A single-family home or condominium unit.

- A single-family residence on agricultural land of 40 acres or less.

- A building with no more than four residential dwelling units.

How does one create a Transfer-on-Death Deed?

Creating a TOD deed requires several steps:

- Completing the TOD deed form, which includes listing the current property owner's name, the legal description of the property, and the designated beneficiary's name.

- Having the document signed by the property owner in the presence of a notary public.

- Recording the signed and notary-sealed document with the county recorder's office where the property is located before the property owner's death.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. Revocation can be done by:

- Filing a formal revocation form with the county recorder's office.

- Creating and recording a new TOD deed that names a different beneficiary which automatically revokes the prior deed.

- Selling or transferring the property to someone else, which cancels the TOD deed automatically.

Is a beneficiary designation on a Transfer-on-Death Deed changeable?

Yes, the beneficiary designation on a TOD deed can be changed as long as the property owner is alive. The change can be made by either revoking the existing deed and creating a new one with the preferred beneficiary or by designating a new beneficiary through a revocation and a new deed concurrently. Similar to creating the original TOD deed, the new deed must be notarized and recorded.

What happens if the beneficiary predeceases the property owner?

If a beneficiary predeceases the property owner, the Transfer-on-Death Deed becomes ineffective. The property will then become part of the property owner's estate and pass according to their will or, if there is no will, by California's laws of intestate succession.

Does a Transfer-on-Death Deed avoid probate?

Yes, one of the primary benefits of a Transfer-on-Death Deed is that it allows the property to bypass the probate process, enabling a smoother and quicker transfer to the beneficiary upon the death of the property owner. However, it's important to note that this applies only to the property specified in the TOD deed and does not affect other assets that may require probate.

Are there any costs associated with creating a Transfer-on-Death Deed?

While creating the deed itself may not have significant costs beyond those for notarization and perhaps legal advice, there are filing fees required by the county recorder’s office to record the deed. These fees vary by county, so it is advisable to check with the specific county recorder’s office where the property is located for exact costs.

How does a Transfer-on-Death Deed affect estate taxes?

The use of a Transfer-on-Death Deed does not inherently save on or increase estate taxes. The value of the property transferred will still be considered part of the estate for tax purposes. It's recommended to consult with a tax advisor or attorney to understand the potential tax implications for your specific situation.

Common mistakes

When completing the California Transfer-on-Death (TOD) Deed form, individuals often look to provide for their loved ones' future in a direct and less burdensome manner. However, a range of common errors can severely impact the effectiveness of the document, disrupting the intended smooth transition of property ownership. Awareness of these potential pitfalls can be crucial in ensuring that assets are passed on as intended, without unneeded stress for beneficiaries. Below are seven common mistakes people make:

-

Not Verifying Eligible Property Types: The TOD deed applies only to certain types of real property. Individuals sometimes mistakenly try to use it for assets other than residential properties, condominiums, or 1-4 unit buildings. It’s important to ensure the property in question is eligible under California law.

-

Failing to Provide Complete and Correct Legal Description of the Property: A complete and accurate legal description is critical. Some individuals only provide the property's address, but the form requires the detailed legal description, which can usually be found on the current deed or by consulting the county recorder’s office.

-

Overlooking Joint Tenant Considerations: The TOD deed cannot be used to transfer property co-owned as joint tenancy unless the last surviving joint tenant is the one filling out the form. This often-overlooked detail can invalidate the deed if not properly addressed.

-

Not Properly Designating Beneficiaries: Designating beneficiaries requires more specificity than merely naming them. It’s vital to specify their full legal names clearly, to avoid any ambiguity that could lead to disputes or legal battles later.

-

Omitting Contingent Beneficiaries: Failing to name a contingent beneficiary can create complications if the primary beneficiary predeceases the property owner. Including contingent beneficiaries ensures that the property still transfers according to the owner’s wishes without reverting to probate.

-

Incorrect or Incomplete Signing Procedure: The document must be signed in the presence of a notary. Sometimes individuals either sign the document without a notary or fail to complete all signing procedures correctly. This mistake can lead to the deed being considered invalid.

-

Forgetting to File the Deed with the County Recorder: For the TOD deed to be effective, it must be recorded with the county recorder’s office before the property owner’s death. A common mistake is successfully completing documents but then neglecting this critical filing step.

By carefully avoiding these errors, property owners can significantly enhance the likelihood that their real estate will be transferred smoothly and according to their wishes. It's advisable for anyone considering a TOD deed to consult with a legal professional to ensure all aspects of the form are correctly managed.

Documents used along the form

In California, the use of a Transfer-on-Death (TOD) Deed form is a relatively straightforward method to transfer property upon the owner's death without going through probate. This document is part of a broader suite of estate planning tools designed to make the management and transition of assets as smooth as possible. Alongside the TOD Deed, individuals should be aware of other forms and documents that play integral roles in comprehensive estate planning. These documents support, complement, or enhance the intentions outlined in the TOD Deed.

- Last Will and Testament: This fundamental document outlines an individual's wishes regarding the distribution of their personal property and the care of any minor children upon their death. It's critical in covering assets not included within the TOD Deed.

- Revocable Living Trust: A flexible tool that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed upon their death. A living trust is a good complement to a TOD Deed, especially for more complex estates.

- Durable Power of Attorney for Finances: This authorizes someone else to manage your financial affairs if you become incapacitated. It ensures that your financial responsibilities are handled, which is vital for the upkeep of real property until its transfer through a TOD Deed.

- Advance Healthcare Directive: Also known as a living will, this outlines your preferences for medical treatment if you're unable to make decisions for yourself. While not related to property transfer, it is an essential part of any comprehensive estate plan.

- Proof of Death Certificate: Not a planning document but a necessary form involved in activating a TOD Deed. The death certificate must be provided to legally transfer the property to the named beneficiary upon the property owner's death.

- Property Tax Change in Ownership Statement: Required by the county assessor to re-evaluate property tax upon the death of the owner when the property is transferred. Filing this form correctly ensures the right tax basis is applied to the new owner.

Together, these documents work in concert to ensure that an individual's assets are protected, managed, and ultimately passed on according to their wishes with minimal legal complication. While each has its distinct purpose, they are part of a collective strategy aimed at ensuring peace of mind and the financial security of beneficiaries. Recognizing and understanding the role of each document within your estate plan will enable a more thorough preparation for the future.

Similar forms

The California Transfer-on-Death (TOD) Deed form shares similarities with a Last Will and Testament in that both enable an individual to outline how their assets should be distributed upon their death. A Last Will and Testament can encompass a broad range of assets and instructions, not limited to real estate, allowing for a more comprehensive estate plan. However, both documents become effective upon the death of the drafter, providing a mechanism for transferring ownership without going through probate court.

Similar to a Living Trust, the California TOD Deed allows for the direct transfer of property to a beneficiary when the owner dies, bypassing the often lengthy and costly probate process. While a Living Trust can cover nearly any asset the grantor owns — from real estate to bank accounts — and can be used to manage the grantor's assets during their lifetime, a TOD Deed is specifically designed for real estate assets and only takes effect after death.

Comparable to Joint Tenancy with Right of Survivorship, the TOD Deed facilitates the transfer of property to another upon death. In Joint Tenancy, the property automatically passes to the surviving owner(s) without going through probate. However, unlike Joint Tenancy, which involves immediate shared ownership, the TOD Deed allows the owner to retain full control over the property during their lifetime, with the transfer only occurring after death.

The Beneficiary Deed, used in some states, is very similar to the California TOD Deed as both designate a beneficiary to receive property upon the death of the owner, without requiring probate. Both deeds are revocable, allowing the property owner to change their mind at any time during their lifetime. The main distinction lies in the jurisdiction and specific legal terminology used, but the core function of bypassing probate remains consistent.

The Payable-on-Death (POD) account, while typically used for bank accounts and other financial assets, shares the principle of avoiding probate like the TOD Deed. With both the POD account and TOD Deed, the designated beneficiary has no rights to the asset during the owner's lifetime. Upon the owner's death, the asset is transferred directly to the beneficiary, sidestepping the need for probate.

The Life Estate Deed is another document with similar objectives to the TOD Deed, in that it allows property owners to transfer their property upon death directly to a beneficiary. However, while a Life Estate Deed grants someone the right to live on the property for the duration of their life, after which the property passes to the remainderman (the designated beneficiary), the TOD Deed preserves the owner’s full control and ownership until death, without creating a present interest in the property for the beneficiary.

Finally, the General Warranty Deed is used to transfer real estate during the owner's lifetime, and it guarantees that the property is free from any liens or encumbrances. Though it serves a different function by facilitating immediate property transfer and providing warranties regarding the title, it is akin to the TOD Deed in the aspect of transferring real property interest. However, the TOD Deed is unique in not taking effect until after the owner's death and does not provide the same title warranties as a General Warranty Deed.

Dos and Don'ts

When filling out the California Transfer-on-Death (TOD) Deed form, it's essential to proceed with caution to ensure the process is done correctly. Below are key dos and don'ts to consider:

Things You Should Do:

Ensure all information is accurate and reflects your current wishes. This includes the correct legal description of the property and the beneficiary's full legal name.

Consult with a real estate attorney to understand the implications of a TOD deed on your estate plan.

Sign the deed in the presence of a notary public to ensure it's legally binding.

Keep a copy of the TOD deed in a safe place where your executor or beneficiary can find it.

Record the deed with the county recorder’s office where the property is located to make it effective.

Things You Shouldn't Do:

Don't fill out the form without first verifying the legal description of your property, which can usually be found on your current deed or property tax bill.

Avoid naming a minor directly as a beneficiary, as this could complicate matters. Instead, consider establishing a trust in their name if you wish to pass property to them.

Don't forget to update the TOD deed if your circumstances change, such as a change in your desired beneficiary.

Do not neglect to tell your chosen beneficiary about the TOD deed. They should be aware of their future responsibilities.

Do not use a TOD deed to try to avoid creditors or legal responsibilities associated with the property.

Misconceptions

When it comes to planning for the future, the California Transfer-on-Death (TOD) deed form is an important document that allows homeowners to pass on their property without going through the complexities of a probate process. However, there are misconceptions surrounding its use and implications. Below is a comprehensive list debunking these common myths.

- It Replaces a Will: Many believe that a TOD deed can replace a will entirely. While it does transfer real estate to a beneficiary upon the owner’s death, it does not cover other assets or estate matters that a will would.

- It's Irrevocable: Some think once a TOD deed is signed, it cannot be changed. This is not true. The property owner can revoke it at any time before their death, allowing for flexibility in estate planning.

- It Avoids Estate Taxes: A common myth is that property transferred through a TOD deed will not be subject to estate taxes. In reality, the property is still part of the estate and could be subject to estate taxes if the estate exceeds federal or state exemption limits.

- Beneficiaries Can't Be Changed: Another misconception is that beneficiaries listed on the TOD deed form are final and cannot be altered. However, owners have the right to change beneficiaries as long as they properly execute and record a new TOD deed.

- It's Expensive: Many people assume that creating a TOD deed is costly. In truth, it’s a relatively affordable way to manage the transfer of real property, especially when compared to the costs associated with probate.

- All Property Types Qualify: It’s often mistakenly thought that TOD deeds can be used for transferring any type of property. In reality, they are primarily used for real estate and cannot be applied to vehicles, bank accounts, or other personal property.

- It Guarantees a Smooth Transfer: While TOD deeds do simplify the transfer of property, they do not automatically resolve all potential issues. For example, debts, liens, or other encumbrances on the property can complicate the process for beneficiaries.

- It Provides Immediate Access: Some people believe beneficiaries can immediately take over the property upon the owner’s death. However, there may be required filings and processes with county records or courts to formalize the transfer.

- Only One Beneficiary Can Be Named: There's a misconception that a TOD deed allows for only a single beneficiary. Owners can actually name multiple beneficiaries, stipulating the exact interest each party will receive.

Understanding the realities behind these misconceptions is crucial for those considering a Transfer-on-Death deed as part of their estate planning. This knowledge ensures property owners make informed decisions that best suit their and their beneficiaries' needs.

Key takeaways

When considering the Transfer-on-Death (TOD) Deed in California, it's important to grasp its benefits and responsibilities fully. This deed allows homeowners to transfer property upon their death without the need for a probate process. Here are seven key takeaways that property owners should consider when filling out and using the California Transfer-on-Death Deed form:

- Eligibility is limited to certain types of property, including single-family homes, condominiums, and no more than a four-unit building. It's crucial to confirm that your property meets these criteria before proceeding.

- The deed must be properly filled out, which includes accurately identifying the property and the beneficiary. Mistakes in this crucial step can lead to disputes or even invalidate the deed.

- Signing the deed requires the presence of a notary. This step reaffirms the seriousness of the document and ensures its validity under California law.

- The deed must be recorded with the county recorder’s office within 60 days of its signature. Failing to meet this deadline can render the deed ineffective.

- Beneficiaries named in the TOD deed will inherit the property only after the owner’s death, and the property does not become part of the beneficiary's estate until the owner passes away. This allows the owner to retain control over the property during their lifetime.

- Owners retain the right to revoke the deed at any time should their wishes change. Revocation procedures must be strictly followed to ensure the previous deed is effectively cancelled.

- It’s essential to consider the impact of the TOD deed on estate planning and potential conflicts it may cause with other estate documents. In some cases, consulting with a legal professional can help to avoid unintended consequences and ensure that the property distribution aligns with the overall estate plan.

Navigating the intricacies of a Transfer-on-Death Deed in California doesn't have to be overwhelming. By paying close attention to these key points, property owners can effectively use the TOD deed to manage their estate planning needs, potentially saving their loved ones time and money by avoiding probate court.

Create Some Other Templates for California

30 Day Notice to Vacate California - The timeframe given in the Notice to Quit for the tenant to act varies by reason for eviction and local laws, but it typically ranges from a few days to a few weeks.

How Much Is a Title Transfer - Offers protection for both buyer and seller by clearly defining the sale terms.