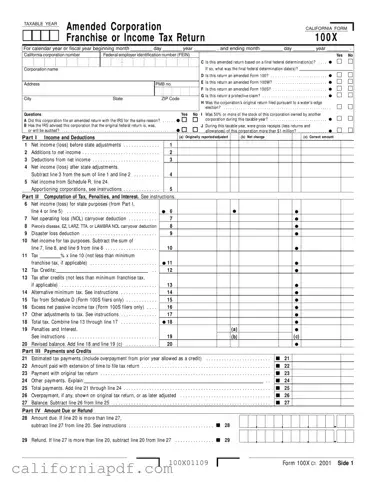

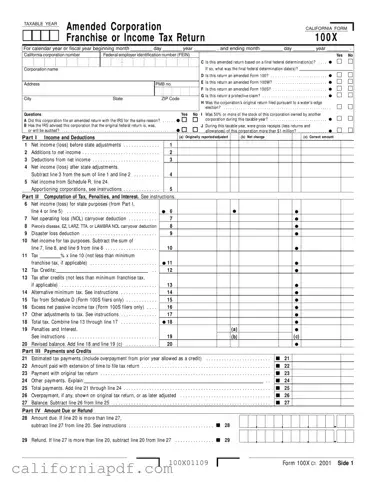

The California 100X form is an important document for corporations in California looking to amend a previously filed Franchise or Income Tax Return. It serves as a critical tool for making corrections or adjustments to an original tax filing, whether...

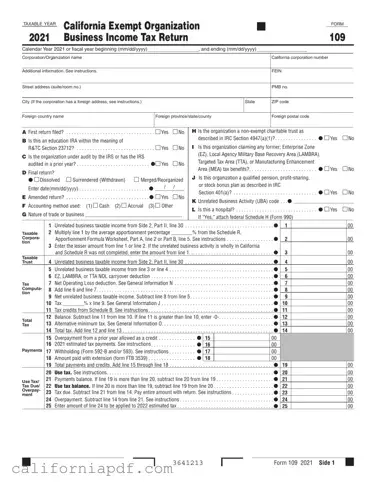

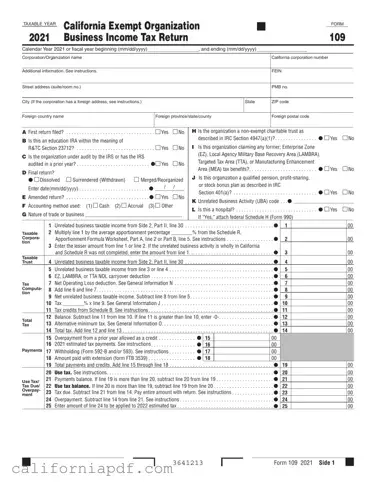

The California Form 109 serves as the Business Income Tax Return for exempt organizations within the state for a specific tax year. It is designed for entities that operate on a calendar year basis or those that have a different...

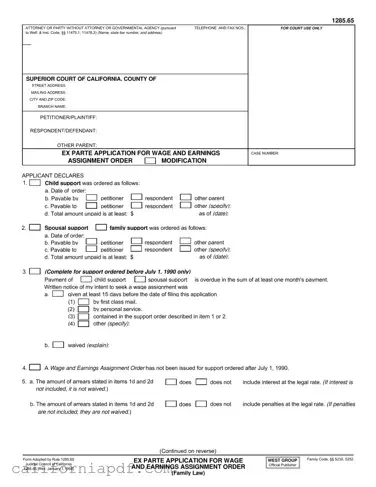

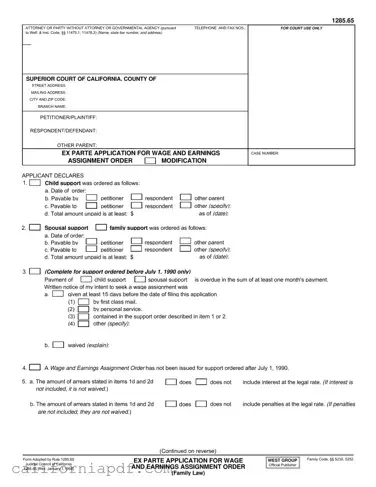

The California 1285.65 form is an essential legal document used to request modifications to a Wage and Earnings Assignment Order, typically in the context of child, spousal, or family support modifications. It is designed to facilitate the process of modifying...

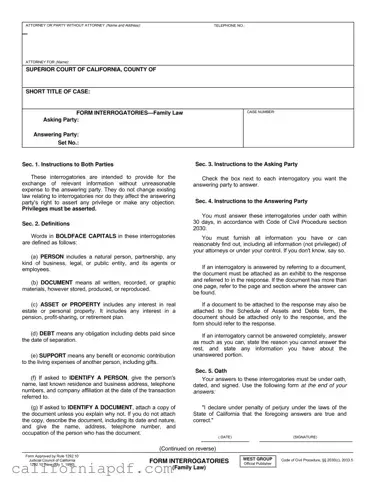

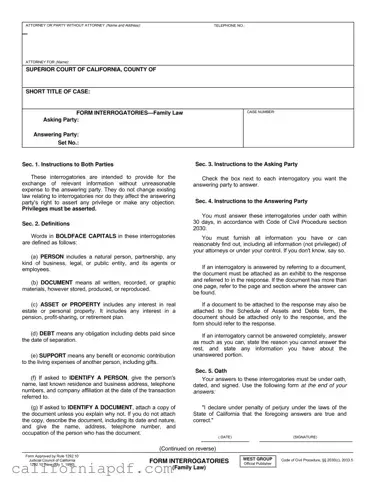

The California 1292 10 form, officially known as the Form Interrogatories—Family Law, serves as a standardized document to facilitate the exchange of relevant information in family law cases without incurring unreasonable expenses for the responding party. It outlines a structured...

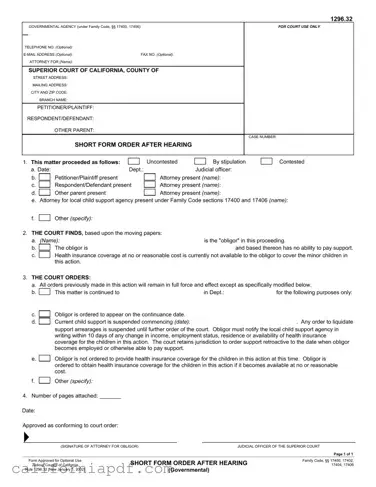

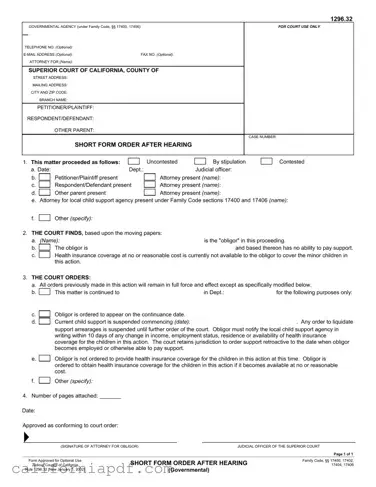

The California 1296 32 form, officially titled as the "Short Form Order After Hearing" under the Family Code sections 17400, 17402, 17404, and 17406, serves a critical function within the state's judicial system. Specifically designed for use by governmental agencies,...

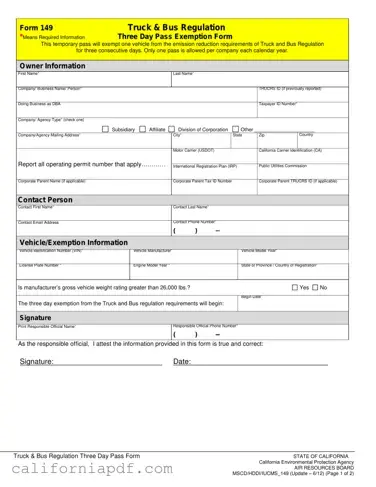

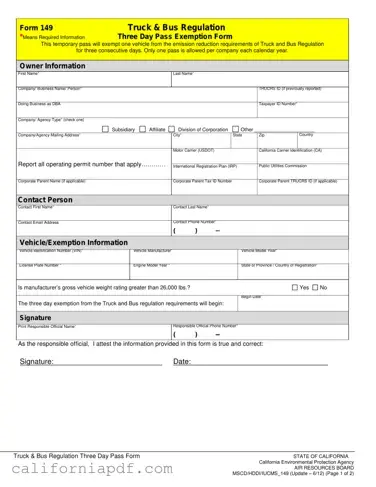

The California 149 form, commonly referred to as the Truck & Bus Regulation Three Day Pass Exemption Form, is a document that provides a temporary exemption from the state's emission reduction requirements. It allows a company to operate one vehicle...

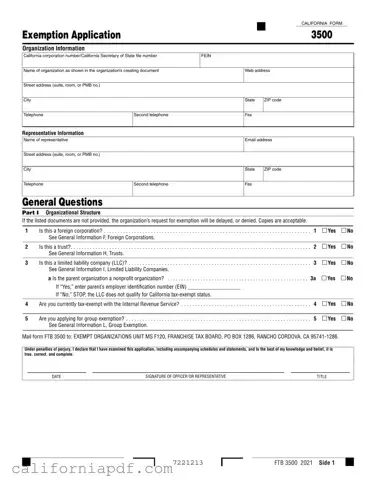

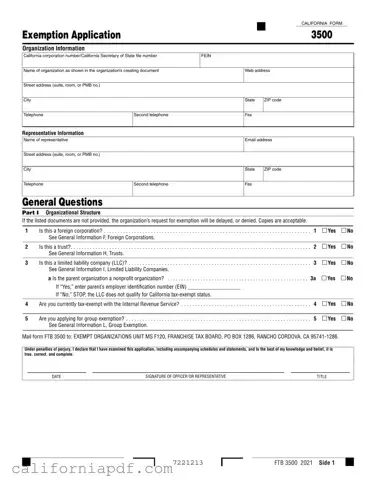

The California 3500 form serves as an Exemption Application for organizations seeking tax-exempt status in the state of California. It requires detailed information about the organization, including organizational structure, representative information, and a narrative of activities. By submitting this comprehensive...

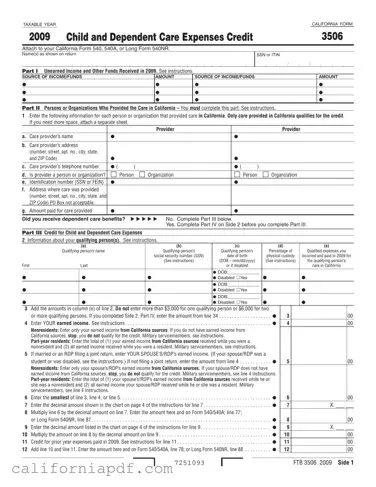

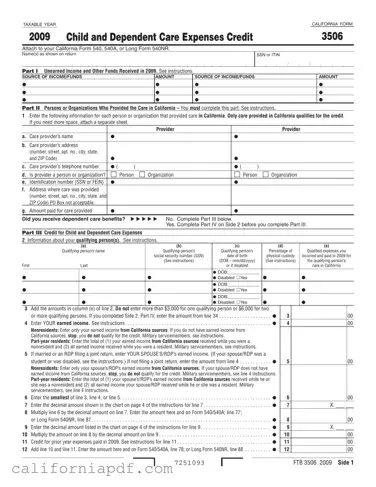

The California Form 3506, known as the Child and Dependent Care Expenses Credit form, is designed for the 2009 tax year. It allows taxpayers to claim a credit for child and dependent care expenses. This form is to be attached...

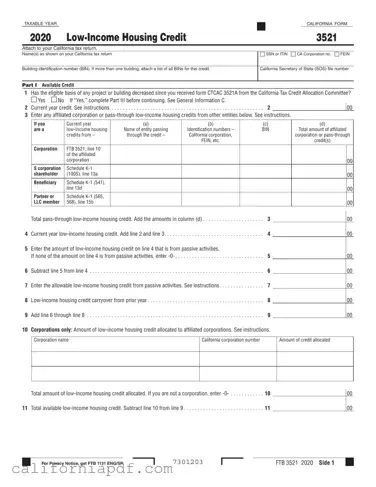

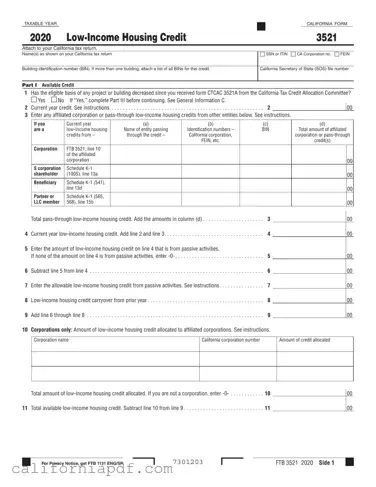

The California Form 3521, also known as the Low-Income Housing Credit form, is an essential document for entities seeking to claim a tax credit for low-income housing developments within the state of California. It is designed to be attached to...

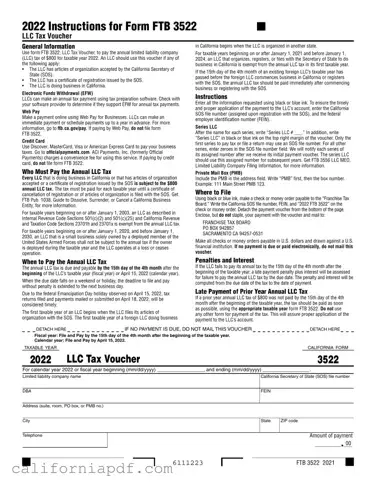

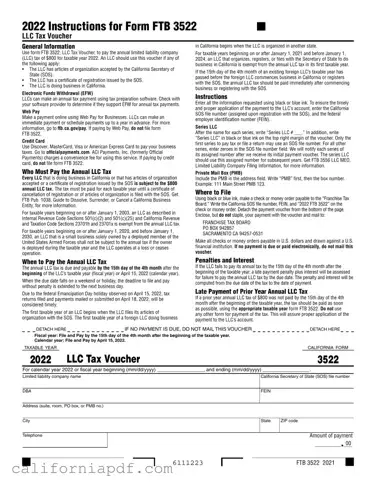

The California Form 3522 serves as the LLC Tax Voucher, which limited liability companies (LLCs) use to pay the annual $800 tax. This payment is mandatory for any LLC operating within California, possessing articles of organization accepted by the California...

The California 3523 Form, known as the Research Credit form, is a document specifically designed for taxpayers who wish to claim tax credits for qualified research expenses incurred within the state of California during a taxable year. It is intricately...

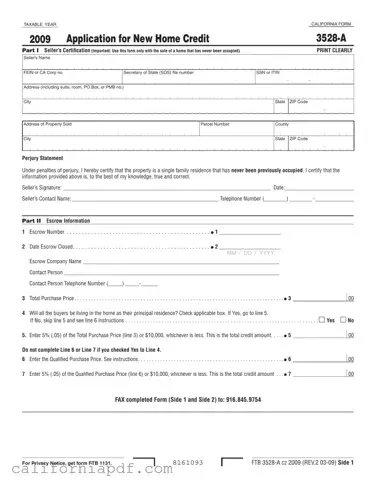

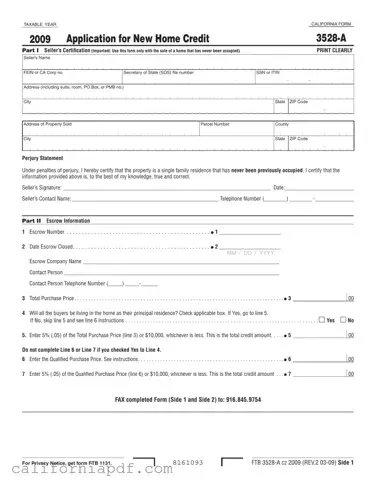

The California 3528 A form, known as the Application for New Home Credit, serves a specific purpose for those involved in the sale and purchase of homes. This form is designed for transactions involving new homes that have never been...