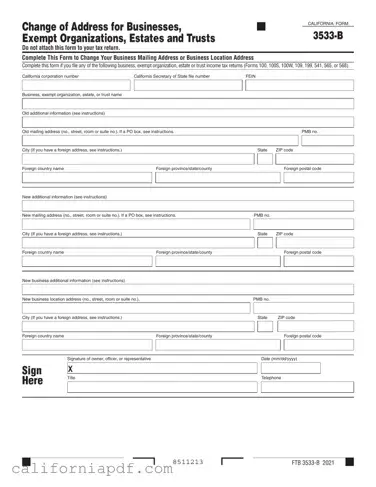

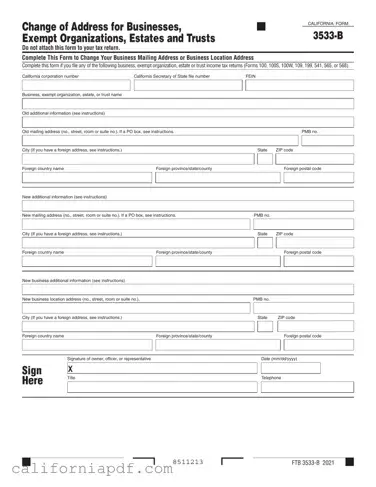

The California 3533 B form is designed for businesses, exempt organizations, estates, and trusts to report a change in their mailing or location address. It ensures that these entities can update their addresses with the state for forms such as...

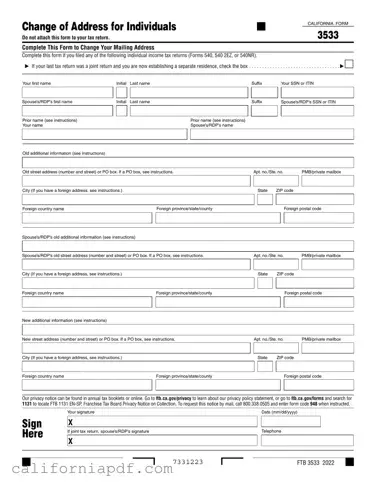

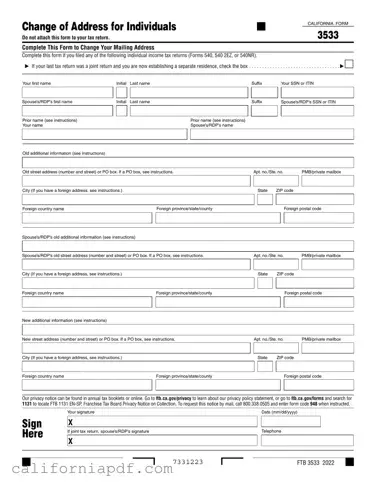

The California 3533 form serves a crucial purpose for residents who need to update their address with the state's tax authority. Specifically designed for individuals, the Change of Address for Individuals form is the official document to submit when any...

The California 3539 form, officially known as the Payment Voucher for Automatic Extension for Corporations and Exempt Organizations, is designed for entities that cannot file their California state tax return by the original due date but owe tax for the...

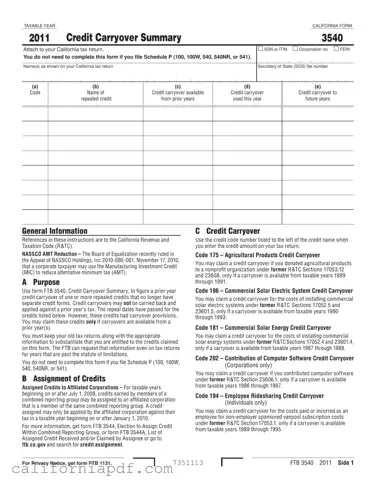

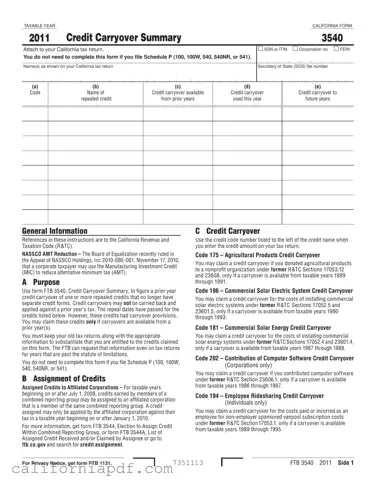

The California Form 3540, known as the Credit Carryover Summary, is designed for taxpayers to report carryovers of specific tax credits that have been repealed but still have available amounts from previous years. These tax credits, which cannot be carried...

The California Form 3541 is designed to report credits related to motion picture and television production within the state. Aimed at stimulating the local entertainment industry, this form allows qualified taxpayers to claim a credit against their California tax liabilities...

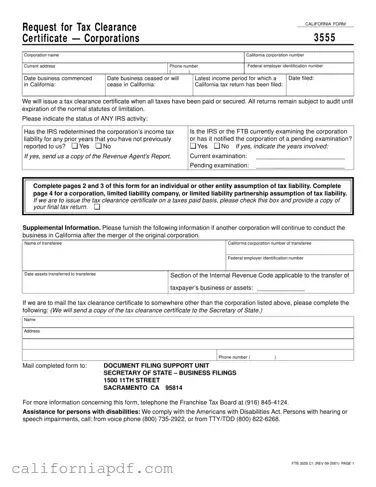

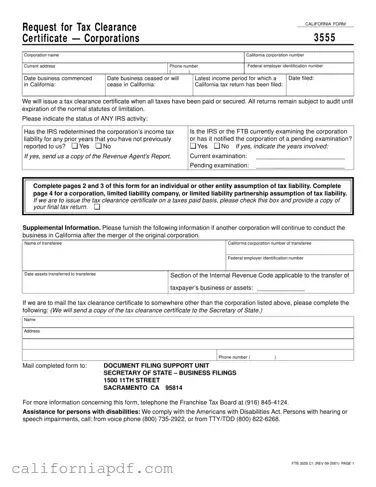

The California Form 3555, or Request for Tax Clearance Certificate, serves as a critical document for corporations in California seeking to validate that all their tax liabilities have been settled or adequately secured. This form is essential when a business...

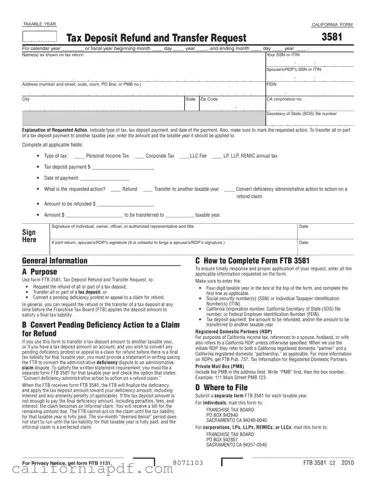

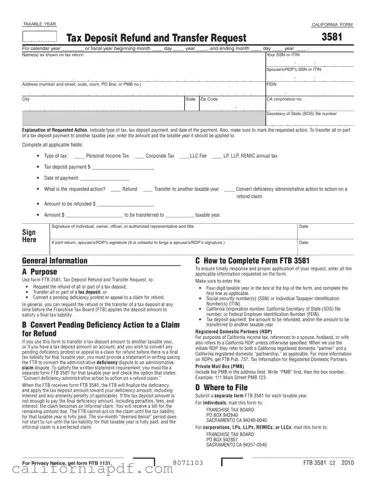

The California Form 3581 serves as a Tax Deposit Refund and Transfer Request tool for individuals and entities. This form plays a crucial role when a taxpayer needs to request a refund of all or part of a tax deposit,...

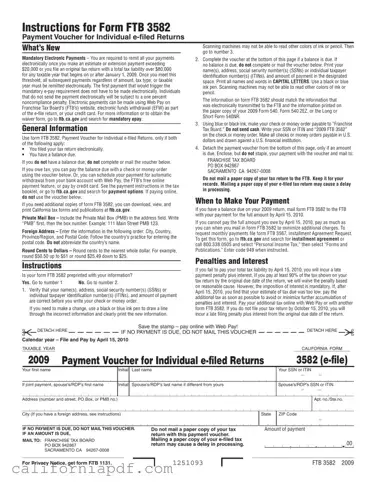

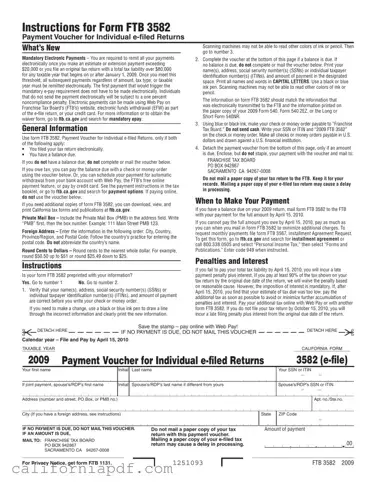

The California Form FTB 3582 serves as a Payment Voucher for Individual e-filed Returns, designed specifically for taxpayers who have filed their tax returns electronically and have a balance due. This form facilitates the payment process, allowing taxpayers to pay...

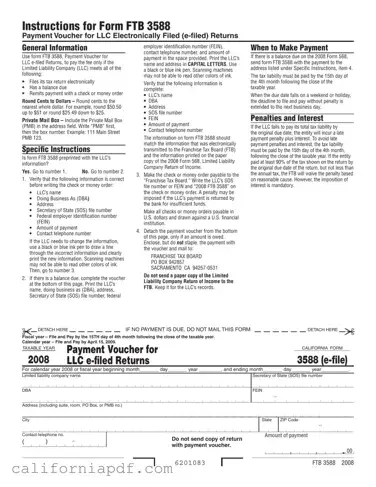

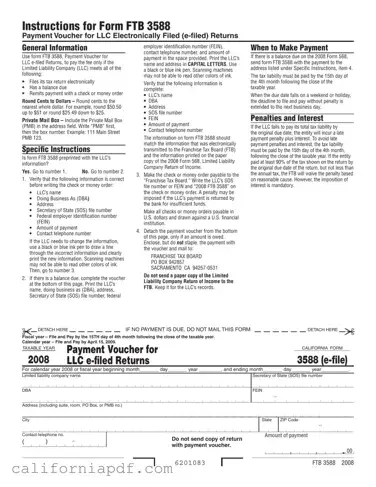

The California Form 3588 (FTB 3588) is specifically designed for Limited Liability Companies (LLCs) that choose to file their tax returns electronically and have a balance due which they wish to settle through check or money order. This form serves...

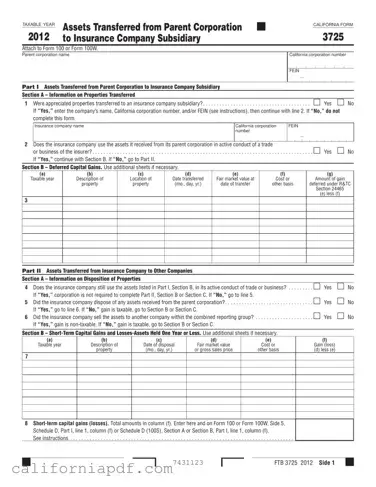

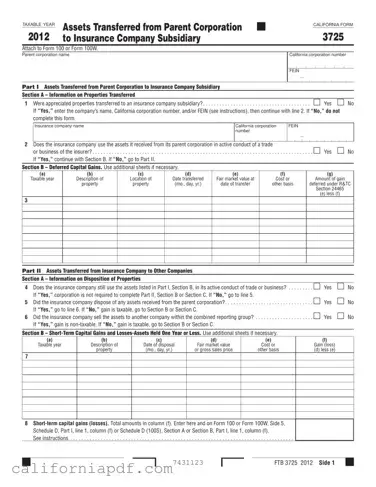

The California Form 3725 is a document used by parent corporations to report the transfer of assets to their insurance company subsidiaries. It's essential for calculating capital gains or losses on these transfers, according to the California Revenue and Taxation...

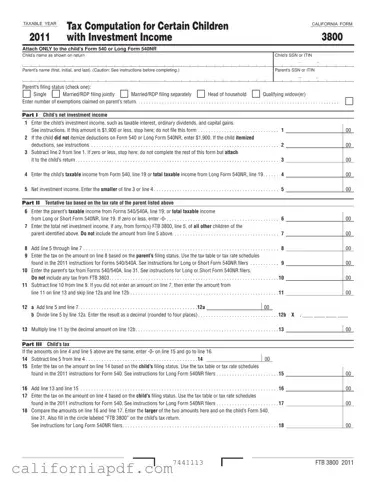

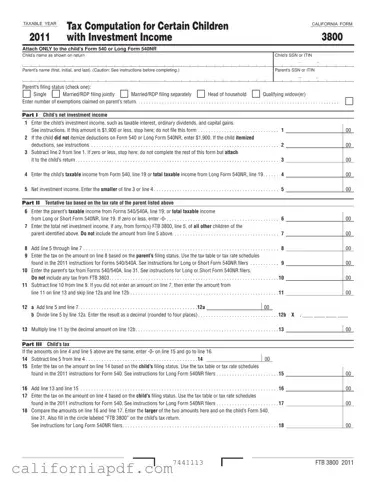

The California Form 3800, titled Tax Computation for Certain Children with Investment Income, is a specialized tax form used to calculate the tax on investment income for children under certain conditions, applying the tax rate of the parent if it...

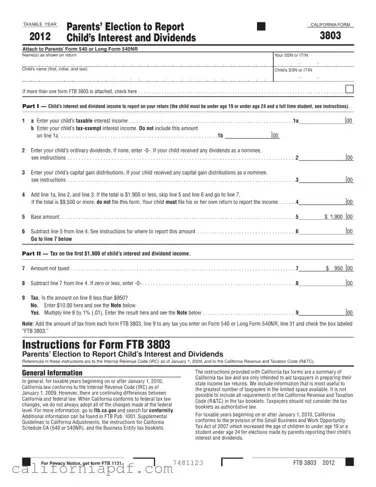

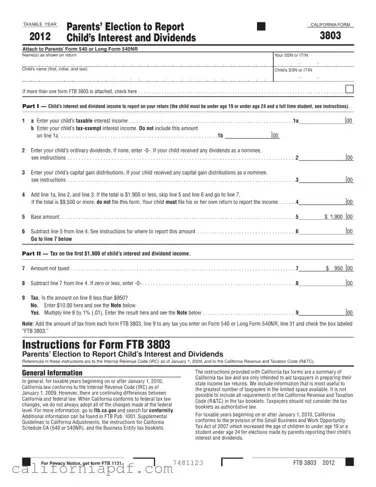

The California Form 3803, Parents’ Election to Report Child’s Interest and Dividends, offers a simplified method for parents to include their child’s interest and dividends on their own tax returns. Designed for parents who meet certain qualifications, this form allows...