The California Form 3805Z, known as the Deduction and Credit Summary for Enterprise Zones, serves as a crucial attachment for taxpayers within the state when filing their returns. Aimed at businesses operating in designated Enterprise Zones, this form allows for...

The California Form 3832 is a crucial document for limited liability companies (LLCs) with nonresident members, delineating the consent of these members for the State of California to tax their distributive shares of LLC income attributable to California sources. Attached...

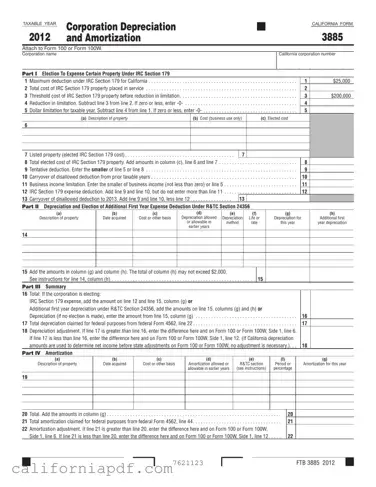

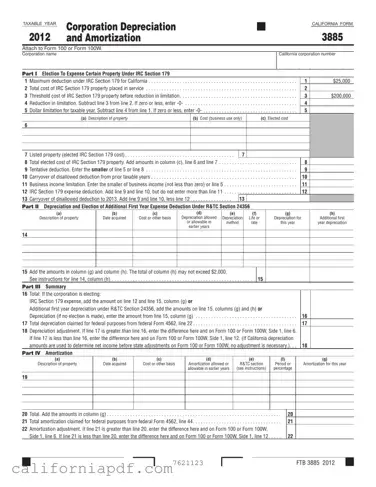

The California Form 3885, referred to as the Corporation Depreciation and Amortization form, is a crucial document for corporations operating within California that need to calculate their depreciation and amortization deductions on tangible and intangible property. It's attached to Form...

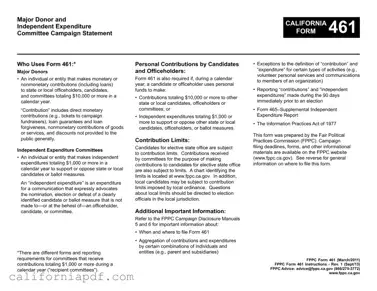

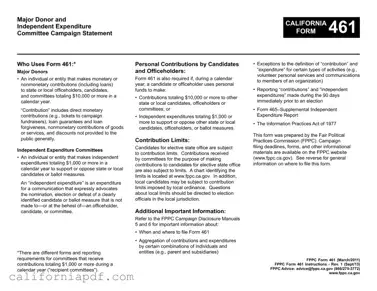

The California Form 461, formally known as the Major Donor and Independent Expenditure Committee Campaign Statement, serves a critical role in the state's political finance transparency. It is utilized by major donors—defined as individuals or entities contributing $10,000 or more...

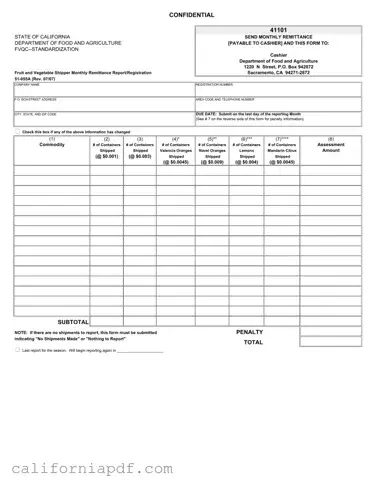

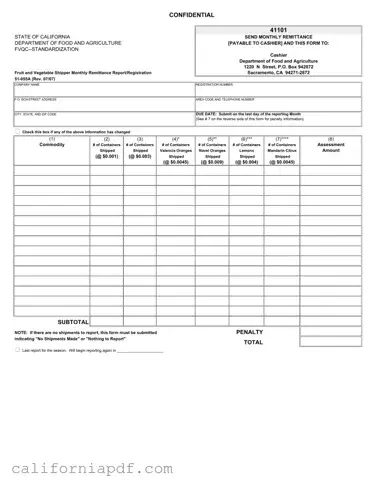

The California 51 055A form is a crucial document for fruit and vegetable shippers in the state, mandated by the Department of Food and Agriculture. It serves as a monthly remittance report and registration, ensuring that all shipments are rightly...

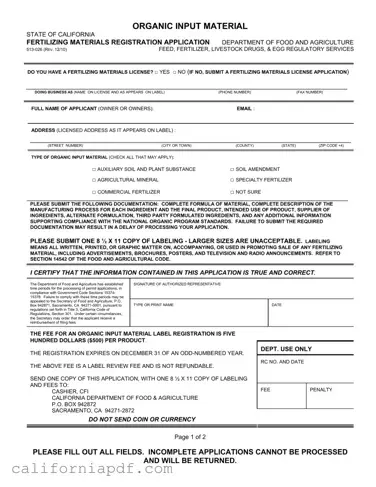

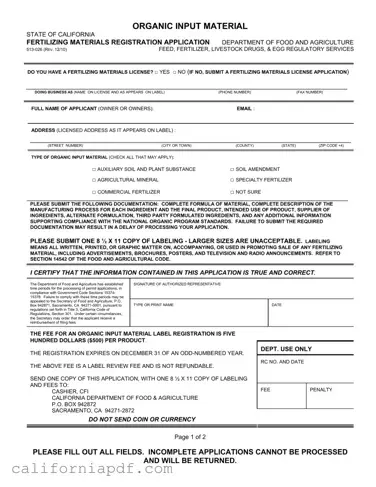

The California 513 026 form serves as an application for registration of organic input material within the State of California, specifically managed by the Department of Food and Agriculture. It’s a crucial document for any business or individual intending to...

The California Form 540 C1 is a comprehensive document designed for residents to file their state income tax return for the year 2012. It encapsulates a wide range of information, including personal details, income, adjustments, exemptions, credits, taxes, payments, and...

The California 540 Schedule P form is a document used to calculate the Alternative Minimum Tax (AMT) and credit limitations for residents of California. It serves as a crucial attachment to Form 540, requiring individuals to adjust their taxable income...

The California Form 540-V, also known as the Return Payment Voucher for Individuals, is designed for taxpayers to submit their payments for state taxes efficiently and accurately. It came into existence as part of the Franchise Tax Board's efforts to...

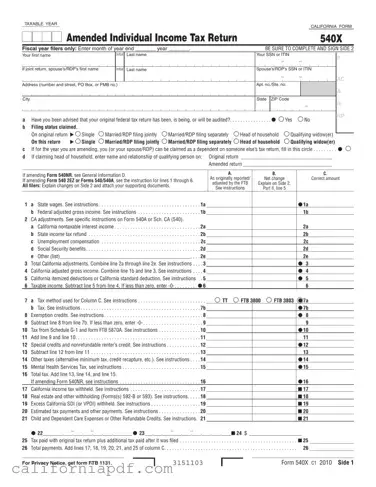

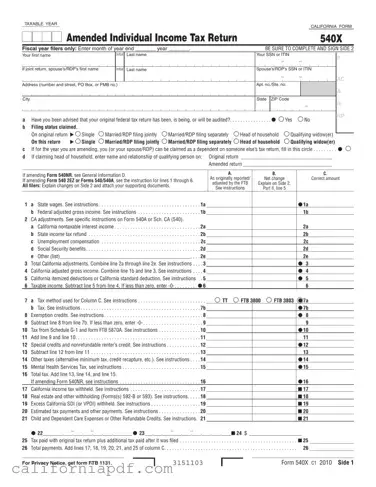

The California Form 540X serves as an Amended Individual Income Tax Return, allowing taxpayers to correct or update their previously filed state tax returns. This form is applicable for taxpayers who need to make adjustments to their taxable income, deductions,...

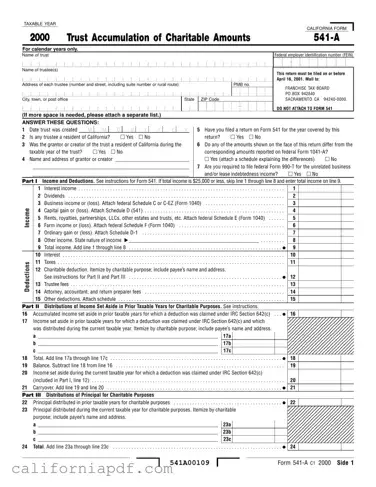

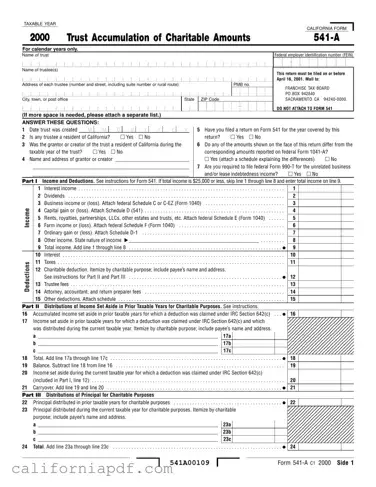

The California Form 541-A, known as the Trust Accumulation of Charitable Amounts form, is a document used for reporting charitable information required by the Revenue and Taxation Code Section 18635 for a given taxable year. It is specifically designed for...

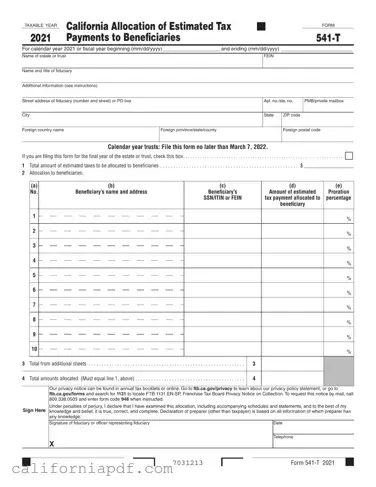

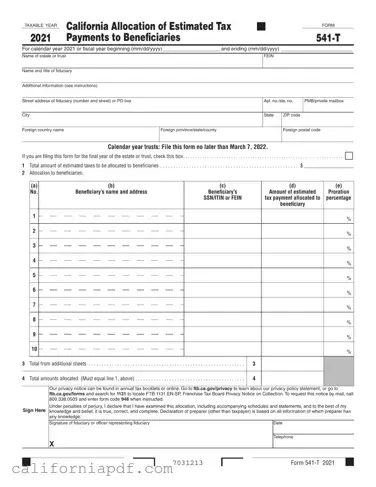

The California 541-T Form, officially titled "Allocation of Estimated Tax Payments to Beneficiaries," is a specialized document filed by trusts or estates for the allocation of estimated tax payments to its beneficiaries. This form comes into play for both calendar...